The application of registration filed under Section 12A of the Income Tax Act, 1961 has been cancelled by the two-member bench of the Income Tax Appellate Tribunal ( ITAT ) after witnessing that the income made via leasing of trust building is a commercial business activity.

The taxpayer, Golden Charitable Trust entered into a lease agreement with the Muslim Education Welfare Trust dated 03.07.2019. A building has been given on lease by the taxpayer. The lease is for 50 years. Annual Lease is Rs.10 lakhs for the first 5 years. Consequently, the taxpayer has filed an application for registration. However, the application has been dismissed by the CIT(E).

Read Also: Chennai ITAT: Tax Exemption U/S 11 Will Not Be Granted If Activity of Trust Are Commercial Nature

At the time of adjudication Kishor B Phadke, the taxpayer’s counsel furnished that the taxpayer had asked for permission from the Charity Commissioner for the Lease Agreement.

Revenue counsel Keyur Patel supported the lower authorities’ order and claimed that the taxpayer had not registered the lease deed. Consequently, the taxpayer has breached the Registration Act of 1908T, the Maharashtra Public Trust Act, and the Maharashtra Stamp Act.

Consequently, according to section 12AA, since the taxpayer has breached the relevant law, the taxpayer is not qualified for Registration u/s 12A of the Income Tax Act. Additionally, the lease income did not come beneath the object of the taxpayer’s trust.

Related Article: Easy to Register Charitable Trust By Filing 10AB Form

The taxpayer on the perusal of the Income & Expenditure Account has not shown any rental income, however, the taxpayer has entered into a lease agreement in the year 2019. The Objects of the Trust drop in the last limb of Section 2(15) which is General Public Utility(GPU).

It is remarked that the taxpayer has made an income through the lease. As the objects of the taxpayer are General Public Utility, the taxpayer is restricted from doing any business activity. Lease earnings are not incidental to the objects of the taxpayer. Therefore earning a lease is counted under a commercial business activity.

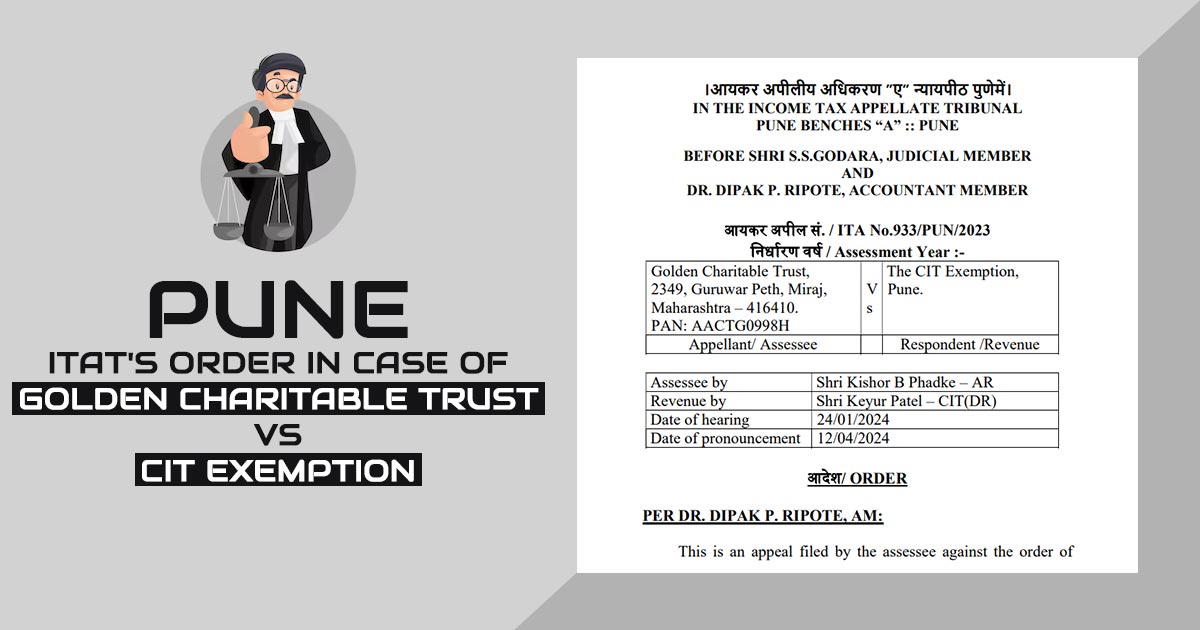

After inspecting the facts the ITAT bench of S.S.Godara (Judicial Member) and Dr. Dipak P. Ripote(Accountant Member) ruled that the taxpayer is not qualified for Registration u/s 12A of the Income Tax Act.

| Case Title | Golden Charitable Trust Vs. The CIT Exemption |

| Citation | ITA No.933/PUN/2023 |

| Date | 12.04.2024 |

| Assessee by | Shri Kishor B Phadke – AR |

| Revenue by | Shri Keyur Patel – CIT(DR) |

| Pune ITAT | Read Order |