Definition of an ITR XML File

The XML format is a file format which allows you to upload information more easily when you convert offline forms into them. Data will be easily uploaded to the ITD’s online repository after the XML file has been uploaded.

Required Legal Documents for the ITR Filing

The first thing you should do is gather all the necessary documents and keep them on hand before you start worrying about generating the ITR XML file. Depending on your tax statement, you might also need updated salary slips, a bank passbook, Form 16 and 26AS, insurance policies, investment proofs, rent receipts and loan papers. To simplify your income tax filing, keep all these proofs convenient.

Basic Meaning of a JSON File

A JSON file is used for importing and downloading the data of your pre-filled return and for creating your income tax return when using the offline utility.

What are the Benefits of Using Genius Software to Import XML/JSON File?

SAG Infotech taxation company designs Genius Software which is most famous in India for tax professionals. The software is useful for chartered accountants and provides a complete income tax + TDS filing package. A number of important features of the software include unlimited filings of income tax returns, AIR/SFT, TDS, Balance Sheet, Profit and Loss Statements etc. with a fully updated taxation process.

Main Features of Genius Software are Described Below:

- You can upload quick ITR with this software

- Easily generate XML and JSON file

- Challans E-payment Options

- Import data options of AIS, TIS, 26AS

- Calculates Interest

- Income Tax Computation

- New PAN card application and correction

- e-Verify income tax return with Aadhaar OTP and DSC Available

- Online e-filing of different Forms like 10B, 29C, 29B, 10CCBC, 10CCBBA, 10CCBD, 56FF and 10CCC.

Steps-by-Step Procedure to Import XML/JSON File By Genius Software

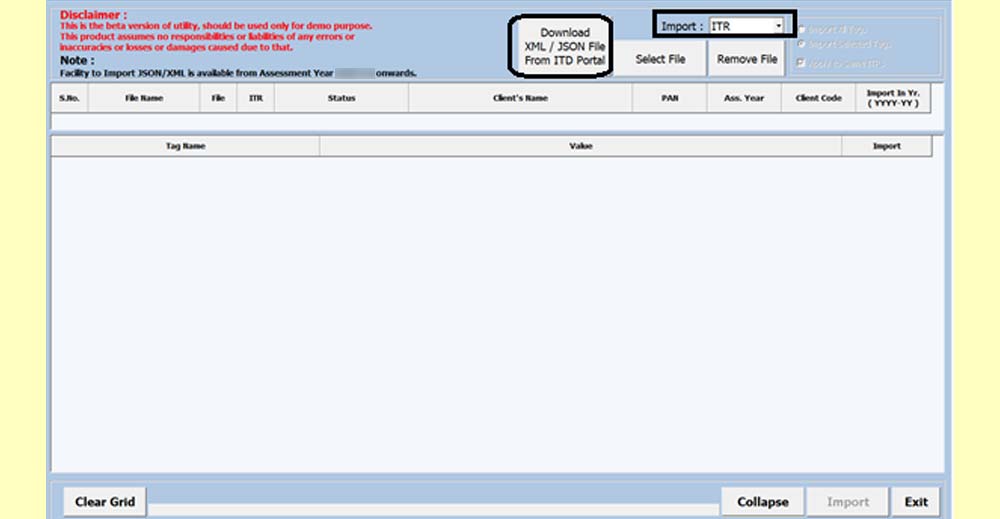

Below is a description of how Genius Return Filing Software imports XML/JSON file:

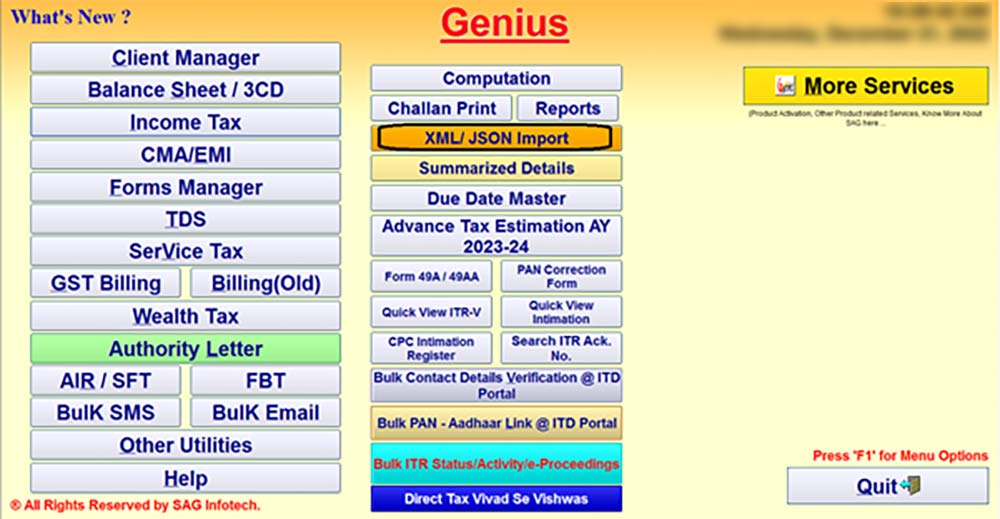

Case 1: XML/JSON Option Through Main Page of Genius

Step 1:- First Install Genius Tax Return Filing Software on your pc and laptop.

Step 2:- After that Open the Software and click ⏩ on XML/JSON Import.

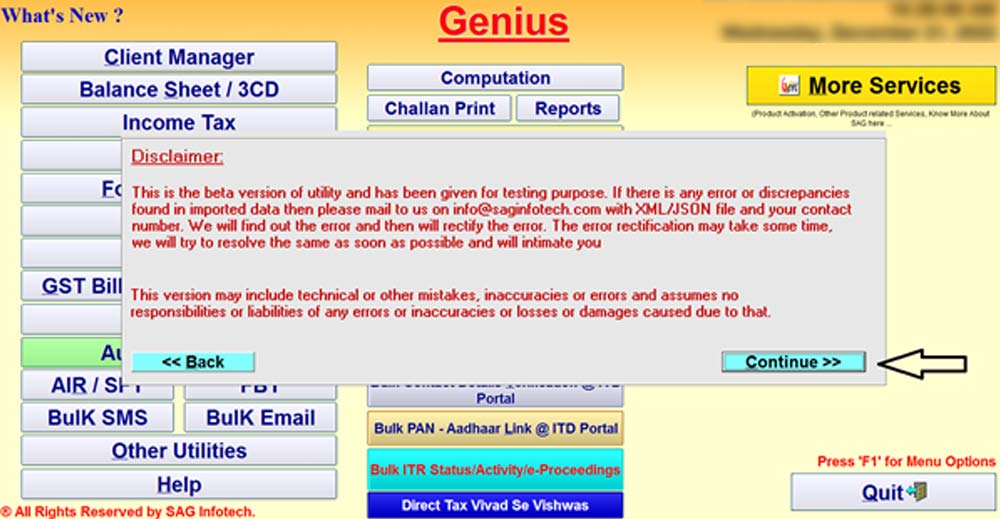

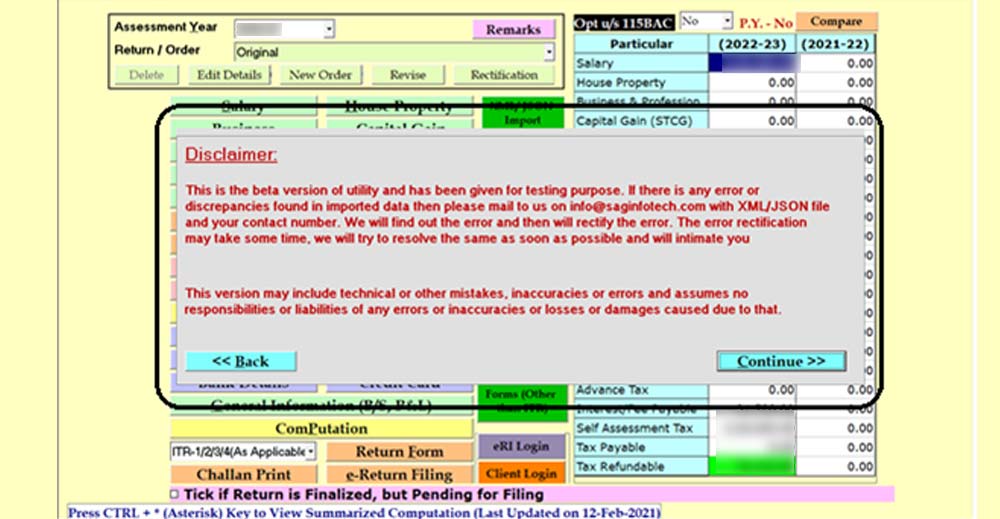

Step 3:- When you click on XML/JSON Import a disclaimer will appear, read the disclaimer and click ⏩ on proceed button.

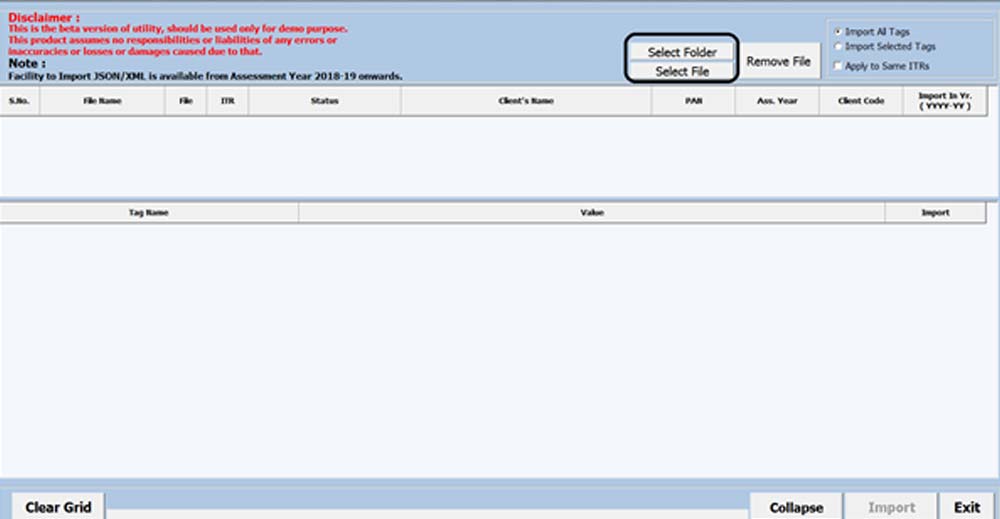

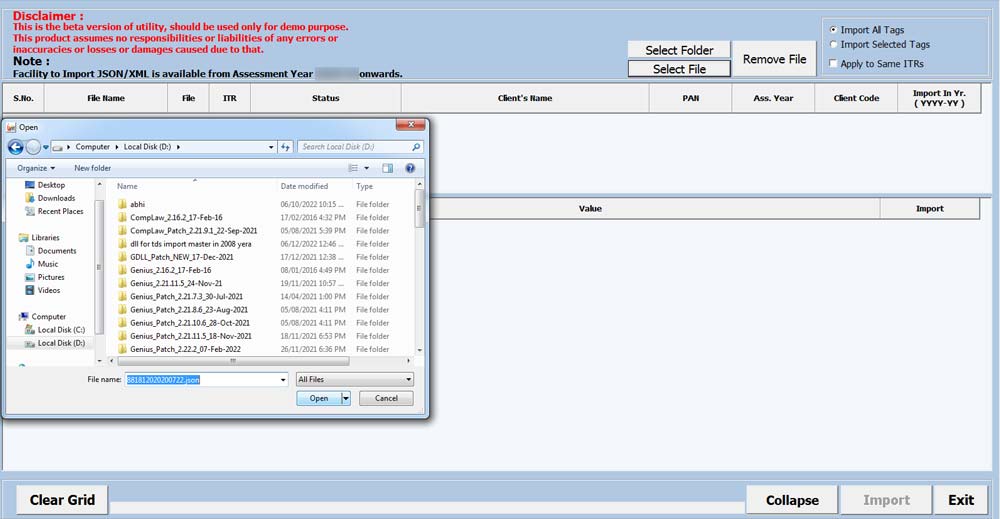

Step 4:- If you want one File of XML/ JSON then select the File and if you want to import more than one file then Click ⏩ on Select Folder to import more than one XMLs/ JSONs.

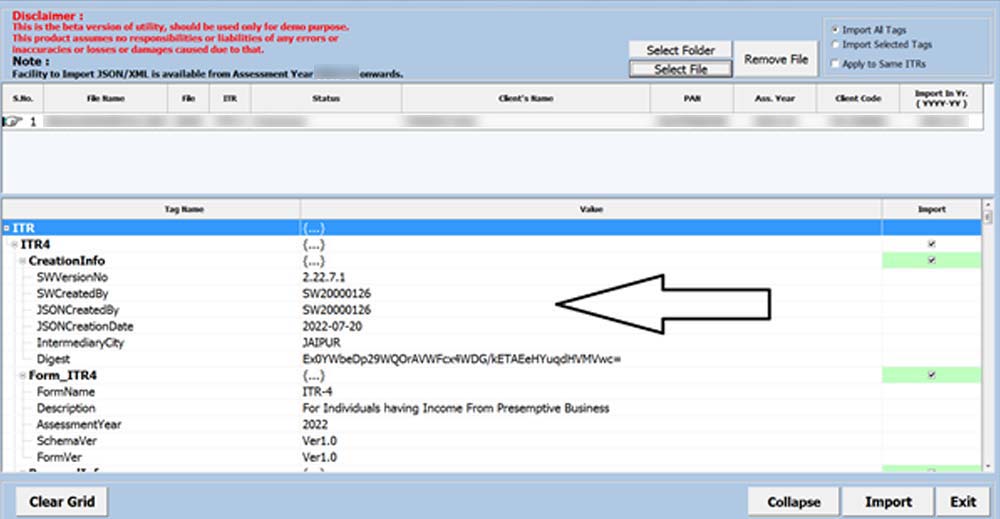

Step 5:- Software will start importing the XML/JSON File.

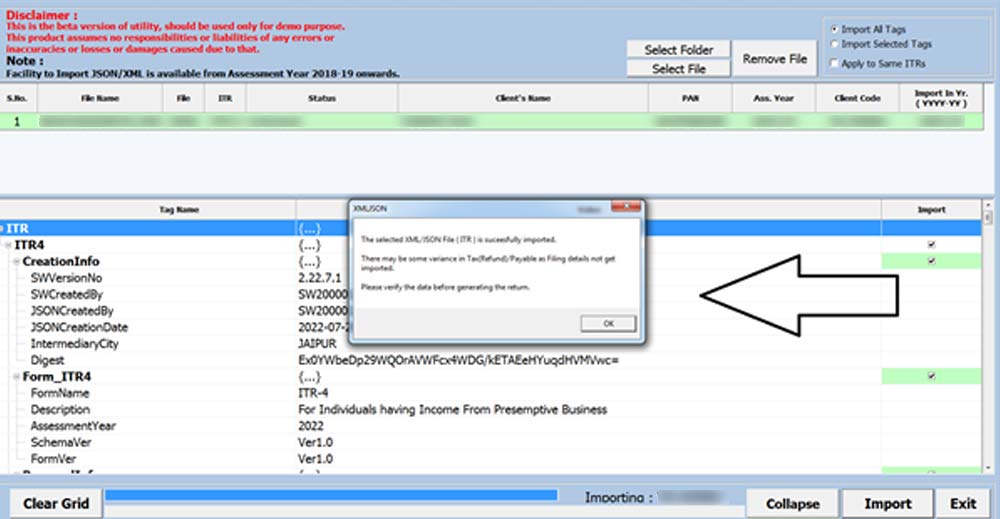

Step 6:- After successfully importing the XML/JSON file message will appear there.

Case 2: XML/JSON Option Through Client Option

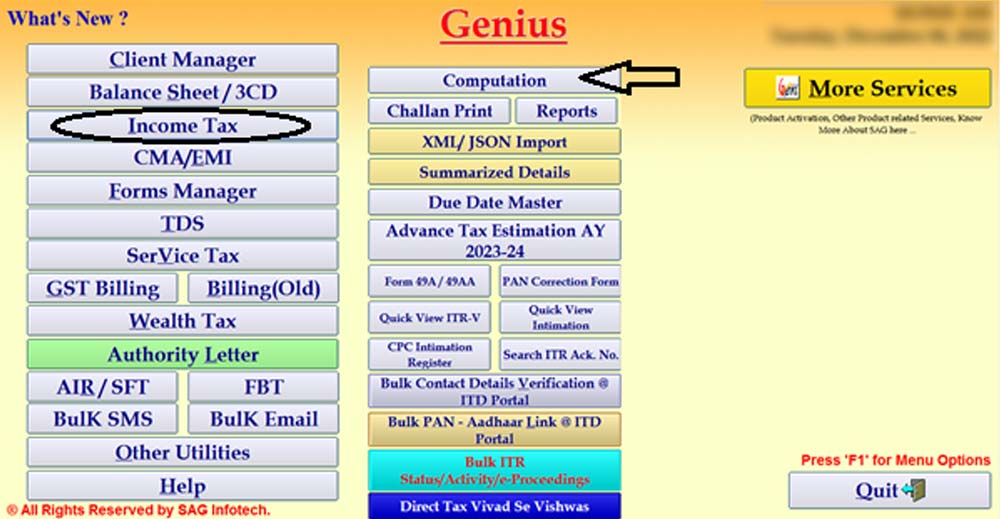

Step 1:- First you have to go to ⏩ Income Tax->Computation Option as shown in the screenshot below.

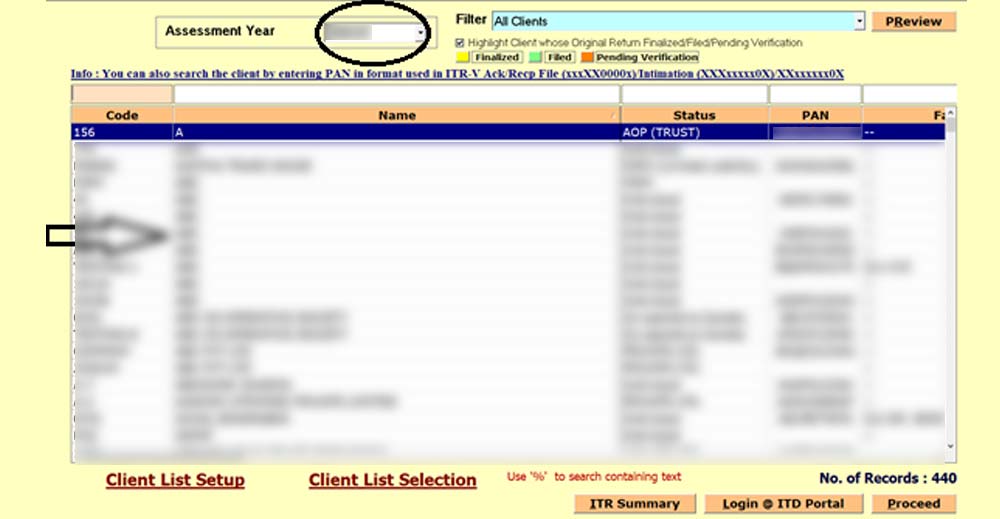

Step 2:- After that Select the Client and the Assessment Year for which you want to import the XML/JSON.

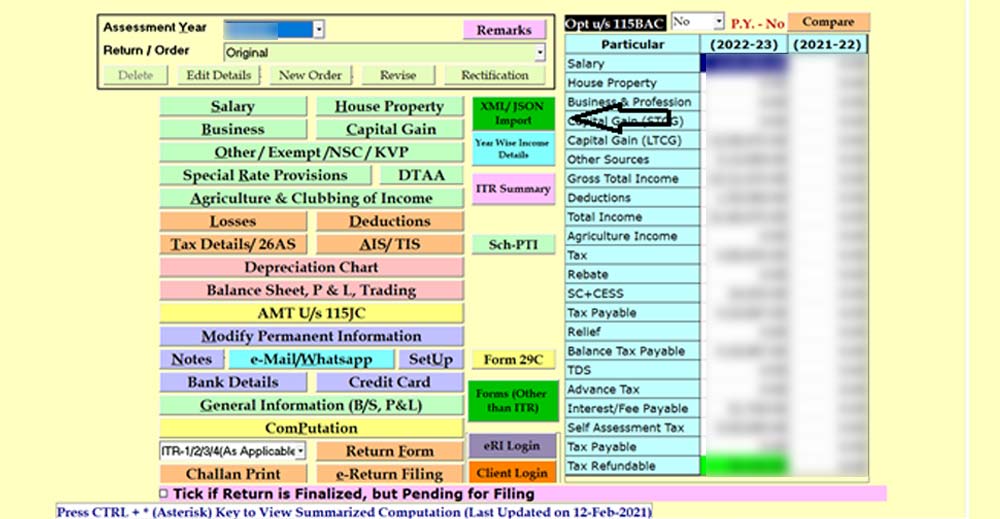

Step 3:- Now Click ⏩ on the XML/JSON Import Button.

Step 4:- When you click ⏩ on XML/JSON Import a disclaimer will appear, read the disclaimer and click on proceed button.

Step 5:- Select The Client – XML/JSON Import – Select Drop Down Whether ITR Or Pre-Filled – Click On Download