It is necessary for a large corporate business to the small one to be updated and file the GST returns very carefully because it can lead to errors which can cost a penalty or money hold with electronic cash ledger. It became quite difficult for the businesses to comply with the new indirect tax laws due to the lack of understanding, which is resulting in mistakes while filing GST returns.

There are so many queries originating from different government departments, private departments, and multinational companies about GST return filing to resolve the mistakes they have made while filing the GST returns.

Read Also: Free GST Software Download for Easy GST Return Filing

This article is all about the 8 blunder mistakes, every business needs to ignore to escape from paying unnecessary interest and penalties.

1st Mistake: Wrong Head Filing Such As Mentioning CGST Under IGST:

The most asked queries by taxpayers are that they are confused between the mistakes they have made in mentioning the IGST, CGST, and SGST and eager to know how to resolve such issues.

Here is the example of how the mistake takes places and what are the solutions for the mistakes done under IGST, CGST, and SGST heads.

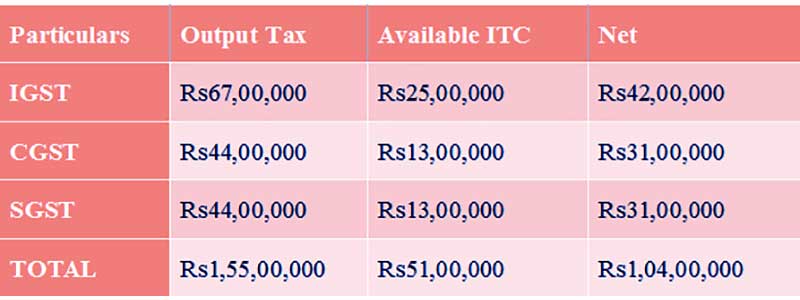

Example 1: A business X has filed the GST returns in IGST, CGST, and SGST for September month and the summary is like this:

This is the ideal situation of how X needs to fill the return under different heads. As filing the returns under the correct head and after that availing the X to file total tax liability is INR 1.55 Crore. The total tax liability divided into the total available tax liability, in this case, is INR 51 lakh, and the net total tax to pay to the government is INR 1.04 Crore.

The Common Mistake, The Businesses Are Making:

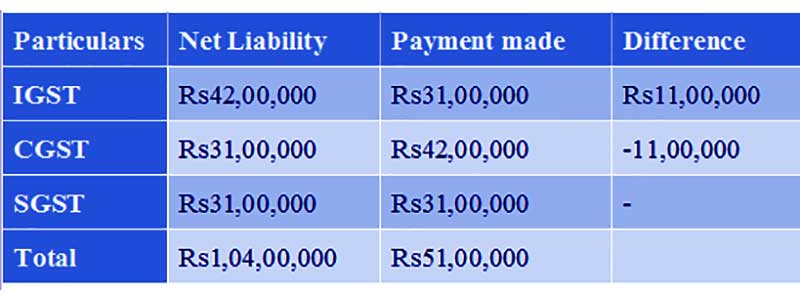

As mentioned above the total tax liability to pay by business X is INR 1.05 Crore in three different heads under GST. While mentioning the CGST, IGST, and SGST, if he does some mistakes and file CGST instead of IGST and reversible

The Solution:

According to GST rules and regulations, the excess balance under any head cannot be utilized in any other heads.

In case of business X, he cannot utilize the excess balance paid under CGST against IGST payment. He can keep the excess balance for future use under CGST or claim the refunds for an excess amount under CGST and need to pay the IGST INR 11 lakh for this particular month separately.

The Loss To The Business X:

in the whole process, the business X has to keep INR 11 lakh with electronic cash ledger and suffer from the shortage of working capital for short time till the refund reflects in an account if he claimed for the refunds.

2nd Mistake: Wrong Entries Under Reverse Charge

This is a big mistake done by any business because it costs the business to pay additional tax under reverse charge mechanism.

Under GST, there is some mechanism where recipient needs to pay GST to the government and the required payment should be done through cash instead against compensating any ITC (Input Tax credit) available.

The Common Mistake Under Reverse Charge Mechanism:

Let’s Assume, business X has made a supply of INR 50 lakh and the tax payable is 18% which is INR 9 lakh. If wrongly taxpayer X made mistake in mentioning the amount of INR 9 lakh, then he needs to pay an additional INR 9 lakh to accommodate the system.

The Solution:

The problem has only one solution and that is taxpayer X will pay an additional tax of INR 9 lakh. As the return cannot be revised for the ITC claim for tax paid because the tax paid under the reverse charge mechanism is not liable to claim under ITC (Input Tax Credit).

Refused the Payment of GST Reverse Charge mechanism (RCM)

- A list of items has been made by the government towards which the recipients are mandated to file RCM. An additional interest payment along with the loss of ITC would be applied if the reverse charge tax would not get filed. ITC could not be used for filing the reverse charge tax.

- Beneath the Reverse Charge mechanism, we could mention that GST is mandated to get filed through the method of challan. A GST enrolled individual is enabled to claim the Input tax credit for the same which could be claimed with the output tax post to the RCM challan payment.

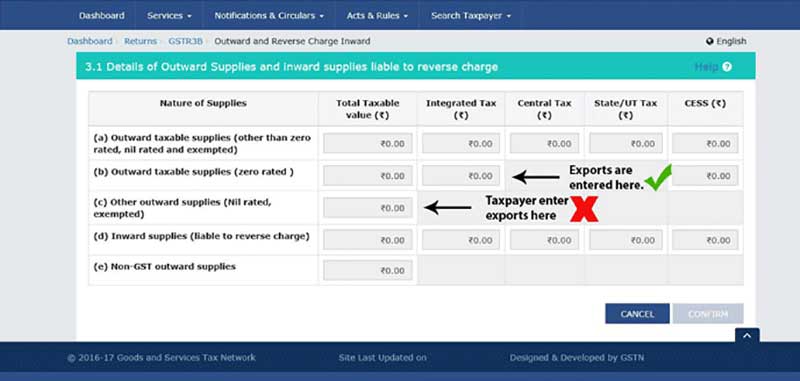

3rd Mistake: Wrong Value Entered By Exporters

Exports fields are very important for exporters because any mistakes made by them in respective fields will lead to mismatch and inability to claim the export benefits.

Under GST, the zero-rated and nil or exempted supplies are treated differently, and any mistakes in understanding the concepts of those can lead to blunder for exporters. As zero-rated exports not similar to nil or exempted taxes, zero-rated exports are treated as no tax on input and no tax on output.

To Understand The Concepts Of Supply Types, Here Is The Explanation:

- Taxable Regular Supplies Under GST: The regular supplies carry a valid invoice with tax liability, which includes all the regular supplies of Goods and Services and mentioned under GSTR-1.

- Nil Or Exempted Supplies Under GST: The supplies which are exempted under GST regime and don’t incur any taxes on the supply of such Goods and Services and ITC cannot be claimed for such exempted taxes are nil or exempted supplies.

- Zero-rated Supplies Under GST: The zero-rated supplies are zero taxed at both input and output ends. The zero-rated supplies include the supplies made to Special Economic Zone(SEZ) and all export supplies.

The Common Mistake Made By Exporters:

As the difference between zero-rated and nil supplies are not known by all and they make the mistake due to this while filing the GST returns under export heads. The exporters generally use the term interchangeably and face the problems in claiming the ITC. The exempted supplies are not liable to claim under ITC refunds and the zero-rated are eligible for the same. So, when the exporters use the replacement of zero-rated with nil supplies, they become ineligible for refunds under ITC and this leads to a big mistake for them.

Solution:

In this case, precaution is a better solution than cure.

4th Mistake: Missing The GST Returns In Case Of No Sale

Under GST regime, it is mandatory for all registered taxpayers to file GST returns irrespective of whether the supplies are made or not in a particular tax month and if the taxpayer misses out the tax return, then he is liable to pay a penalty of 200 Rs. per day after passing the due date.

Maximum Liable Penalty If Taxpayers Misses The Nil Tax Return

In case of missing the GST returns for a year for nil rated or any taxable supplies, the applicable penalty will be 200 Rs. per day.

It will lead to a maximum penalty of INR 10,000 for a month. The total penalty for a year under GST will be [(3 X 12) + (5 X 5)] X 10,000 = INR 4,60,000. So, even a business is not earning a single rupee but forgets to file nil returns will end with INR 4.6 lakh penalty as late fee payment charges.

5th Mistake: Charging the Wrong GST Rate for Taxpayers

After registering under GST every sale would be taxable until it is an export or a GST-free sale. When a higher rate would get levied by the person then he or she might face the issues and penalties regarding it. In the process of assessment imposing a lesser GST rate might give the outcome of cash flow from pocket. The goods or services rates must be checked out on the CBIC website with time.

6th Mistake: Non-claiming of TCS & TDS by GST Taxpayers

- The same would have been seen in various events where the assessee doesn’t about the method to claim for the Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) and on completing GST returns do mistakes beneath the GST needs.

- Central Government, State Governments, Government Agencies, Local Authorities, and notified individuals to deduct 1% TDS beneath the GST scheme when the total value of supply beneath a contract is more than Rs 2.5 lakh, as per invoice not including GST. The same TDS should be placed in the government’s credit account, which the receiver would enable to claim.

- As per GST, an e-commerce operator would be needed to collect 1% of the net value of taxable supplies that have been incurred via its platform through the suppliers in which the e-commerce operator collects the acknowledgement furnished for the same supplies.

- In the government credit account, the TCS should get deposited via which the beneficiary could claim reimbursement.

- In the taxpayer’s electronic cash ledger, the TCS would get displayed which is used to pay the taxpayer’s GST liability along with the debt beneath the Reverse charge mechanism.

7th Mistake: Incomplete Verification of Aadhaar via the GST Registered Person

One of the mistakes in furnishing the GST returns is the incomplete Aadhaar verification of the taxpayer. From 1st January 2022, Rule 10B comes into force that needs assessees to have their Aadhaar verification accomplished for the stipulated purposes:

- For furnishing the application for the revocation of the GST registration cancellation.

- For filling the GST refund application under the form RFD-01

- To claim a refund under rule 96 of the IGST furnished on goods that have been exported outside India.

- If the assessee is unable to complete his/her Aadhaar authentication process then he or she might suffer from the problems like having his GST registration revoked and carrying to apply for revocation of the cancellation.

8th Mistake: Few Additional Small Things Such as GSTIN, Invoice No, HSN

- GSTIN, Invoice No, and HSN/SAC must be included on all the invoices. As per the turnover the number of digits used via firms in their HSN/SAC differs. Including that HSN/SAC the assessee must verify if the GSTIN inserted via the opposite party is correct.

- A tax invoice provided via an enrolled person must have the sequential serial number of not more than sixteen characters, in one or more sequences, composing alphabets, numerals, or special characters-hyphen, dash, and slash symbolized as “-“and” / “respectively, and any combination thereof, typical for a fiscal year.

So, these are the points you should keep in mind while filing GST returns to get ITC credit on time and escape from the issues of late filing or penalty fees.