Introduction- The Income Tax Appellate Tribunal (ITAT) Hyderabad in a judgment gives transparency on the applicability of section 115BBDA of the Income Tax Act, 1961 to domestic companies.

The matter, Meenakshi Ventures and Holdings India Private Limited vs. The Income Tax Officer centred on whether the provisions of Section 115BBDA, which assessees additional tax on dividends surpassing 10 lakh rupees, are applicable to domestic companies. It was concluded by the Income Tax Appellate Tribunal that these provisions do not apply to domestic companies, hence deleting the addition made by the Income Tax Officer.

The Case: Meenakshi Ventures and Holdings India Private Limited, the taxpayer, furnished its income return for the AY 2019-20, declaring a loss of Rs. 1,15,455 and on dividends claiming an exemption of Rs. 13,07,650. A notice u/s 143(1) of the Income Tax Act. has been issued by the Assessing Officer (AO), rejecting the claimed exemption and adding the dividend amount to the total income, a consequence of a tax demand of Rs. 3,59,713.

Proceedings and appeals: Dissatisfied with the decision of AO, before the Commissioner of Income Tax (Appeals), National Faceless Appeal Centre (NFAC), Delhi the taxpayer has furnished an appeal.

The CIT(A) granted partial relief, restricting the exemption to Rs. 10,00,000 under Section 115BBDA, and added Rs. 3,07,650 to the total income, resulting in a tax demand of Rs. 92,250. The taxpayer then pleaded to the ITAT Hyderabad.

Arguments and Provisions of Law: A 10% tax on dividends of more than 10 lakh rupees levied by section 115BBDA introduced by the Finance Act 2016 and effective from 1st April 2017 received by specified taxpayers. The term specified assessee was determined to not get included in the domestic companies, specific trusts, and institutions.

The taxpayer claimed that as a domestic company, the same was not covered by the provisions of section 115BBDA at the time of the pertinent assessment year. The revision to section 115BBDA which expanded the definition of the specified assessee to comprise the domestic companies was not subjected to be applicable during the AOs made additions.

The department has argued that the exemption was restricted by the Commissioner of Income Tax (A) under the current provisions of Section 115BBDA.

The decision of ITAT: The ITAT presided over by judicial member Laliet Kumar, analyzed the legislative objective and the particular wording of Section 115BBDA. The tribunal remarked that the provision does not include domestic companies from its purview until the revisions effective from April 1, 2018.

As the taxpayer, a domestic company was not covered beneath the meaning of “specified assessee” for the pertinent assessment year, the AO additions were not sustainable, ITAT carried.

As per that the ITAT has removed the whole addition of Rs 13,07,650 made before the total income of the taxpayer and permitted the petition in favour of Meenakshi Ventures and Holdings India Private Limited.

Conclusions of ITAT

In the matter of Meenakshi Ventures and Holdings India Private Limited vs. The Income Tax Officer, the ruling of ITAT Hyderabad furnishes transparency on the non-applicability of Section 115BBDA to domestic companies for the assessment years before April 1, 2018.

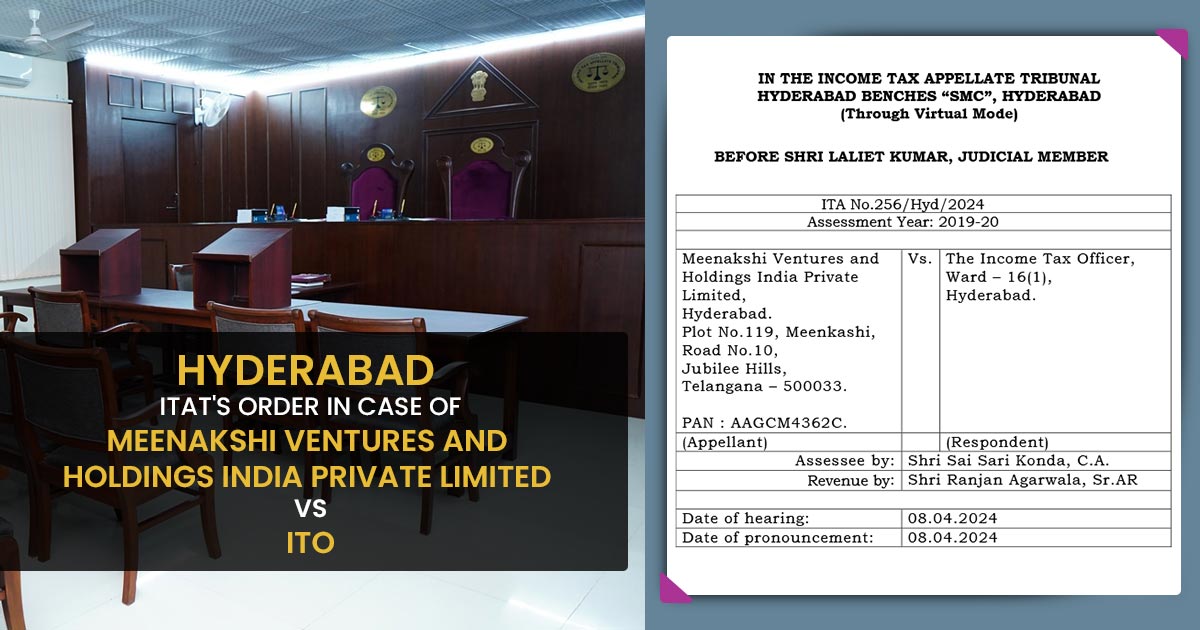

| Case Title | Meenakshi Ventures and Holdings India Private Limited vs ITO |

| Case No.: | ITA No.256/Hyd/2024 |

| Date | 08.04.2024 |

| Counsel For Assessee By: | Shri Sai Sari Konda, C.A. |

| Counsel For Respondent | Shri Ranjan Agarwala, Sr. AR |

| Hyderabad ITAT | Read Order |