If you don’t have access to the necessary technology or tools, invoicing may be quite difficult, whether you run a little business or a large corporation. E-invoicing will be the best option if invoicing has always been a problem for you.

B2B invoices for interchange between buyers and suppliers can be created electronically via e-invoicing software. A firm must manage several transactions, and the need for e-way bills becomes clear when it comes to the delivery of products and transportation.

E-invoicing allows for efficient invoice production, IRN [Invoice Reference Number] generation, and other activities.

How Does E-Invoice Generation Benefit Businesses in Different Ways?

The creation of invoices won’t be a laborious chore any longer if you use e-invoice software. The following benefits make it an urgent necessity:

Seamlessly Integration the Current Billing Techniques

Businesses adhere to a variety of procedures when it comes to invoices. The methods a firm uses range from manually capturing the voices and then accounting for them to using ERP and independent billing tools.

Invoices are also produced when a transaction is completed. Your company’s e-invoicing system will function flawlessly and without any problems. This guarantees a smooth start and continued ease of use for the e-invoicing process.

Limits the Practice of Tax Evasion

All opportunities for tax evasion will be removed with e-invoicing. The IRP portal must receive all invoices before the transaction can be completed. This might put an end to the use of fraudulent GST invoices as well as inaccurate input tax credit claims.

No Doubt It Saves Time

The necessity to manually enter all the transaction information will be gone thanks to electronic invoicing. Time will be saved without a doubt by this. The e-invoicing software will handle the last-minute modifications, including journal entries, pertinent vouchers, and stock item management, once you have generated an invoice.

Additionally, you do not need to print the invoices on your own. As you spend less time reminding your customers to make payments, managing cash flow and collecting payments becomes considerably simpler.

Prevent Accuracy Problems

You may reduce the likelihood of errors or mistakes while producing invoices by using electronic invoicing. Real-time monitoring of all processes will prevent accuracy issues and guarantee greater calculation precision.

Recommended: Step-by-Step Guide to Generate E-invoice Under GST with Benefits

How Does the E-Invoice Process Actually Work?

The e-invoicing system’s procedures are simple to comprehend, but you must also become familiar with the system’s users. The first involves interactions between IRP and suppliers, while the second involves interactions between GST, IRP, and buyers. So, just how does the electronic invoicing system operate? Let’s investigate!

- You must first use the ERP software to create an invoice in JSON format.

- The supplier uploads the JSON to the IRP.

- The invoice is verified by IRP, and an invoice reference number is generated.

- The supplier receives the digitally signed JSON e-invoice together with the QR code and IRN.

- The vendor adds QR codes to the invoices and gives them to the buyers.

- The data on Form GSTR-1 and GSTR-2A would thereafter be auto-populated by the GST.

- On their GSTR-2A, the buyer may check the ITC that is associated with the invoice.

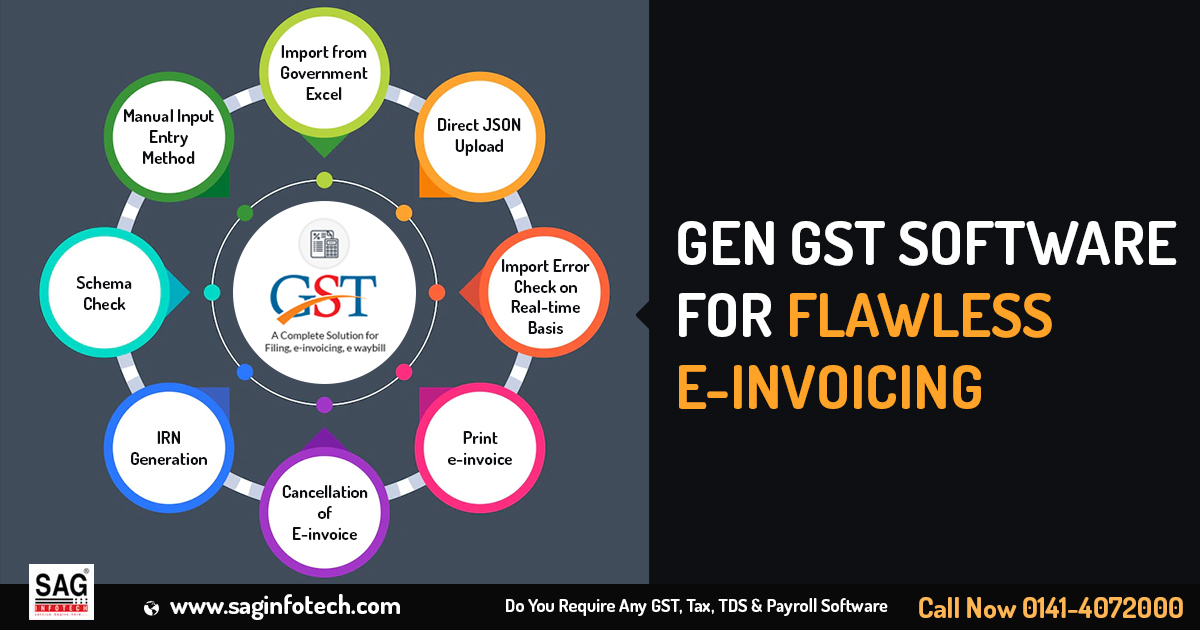

Why is Gen GST Your Best Choice for Seamless e-invoicing?

Gen GST is among the top solutions for e-invoicing, in addition to being an effective business management solution for the following reasons:

Single or Bulk e-Invoice: You can either generate single e-invoices at the time of voucher entry or produce e-invoices in bulk with a single tap.

Fast Invoice Generation: Gen GST provides an easy, one-click method for creating invoices.

E-Invoice Reporting: Every firm must have a picture of the invoices they are producing. The software may be used to acquire e-invoice reports and a thorough overview of all e-invoicing activities.

Obtain Proper Alerts: The alert mechanism will provide you with total control in the event of redundant information or unintentional alteration.

Straightforward Integration with IRP: To quickly create e-invoices, any invoice may be simply submitted to the IRP site.

Digitally Signed Tax Invoices: You may easily add your digital signature to tax invoices, supply bills, and other documents with this software.

Access to Online Details: Creating informative business reports and having access to them from any mobile device while on the road are both possible with this software.

Cancellation of IRN: Sometimes it’s necessary to cancel some of the invoices for which an IRN is generated. With Gen GST, you can directly cancel such invoices and transmit the relevant information to IRP.

GST Filing: The Gen GST Cloud prevention and detection process ensures the accuracy of your GST returns at all times.

GST E-Way bill: With this, you can create E-WayBills through the e-way invoice option, which will save you a tonne of time and work.

Support Service: When you use Gen GST Cloud Software, a complete solution, you may execute e-invoicing offline as well in the event of a brief internet outage or other problems. In such cases, the information may be exported in JSON format and uploaded at your convenience on the IRP.

Conclusion

Generating e-invoices will be as simple as it is now with Gen GST API connections. Utilise the best company management software to handle all of your demands in an efficient manner.