After uploading of return in electronic mode, a New functionality of electronic verification code (EVC) of the Income Tax return has been introduced vide Notification No. 2/2015, dated 13/07/2015. This facility can be used as an alternative for the submission of ITR-V to CPC-Bangalore.

What is an Electronic Verification Code Under Income Tax

The Generate Electronic Verification Code (EVC) service is available for the specific person registered using the e-filing portal to generate an EVC. The service permits you to:

- e-Verify an item (Statutory forms, Income Tax Returns, refund reissue request and response against any notice)

- Log in to the e-filing portal

- Reset password

Prerequisites to Claim the Service

- Registered people upon the e-filing portal as the specific assessee with a true user ID and the password.

- Validated and EVC-enabled bank account in the e-filing portal (For Bank Account option)

- Validated and EVC-enabled Demat account in the e-Filing portal (For Demat Account option)

- PAN associated with the bank account (For the Net banking option)

- Valid debit card (For Bank ATM option)

- The corresponding bank account must be associated with a Permanent Account Number (PAN), and this PAN must be registered at e-Filing (For the Bank ATM option)

Full Process to Generate EVC on New Tax Portal

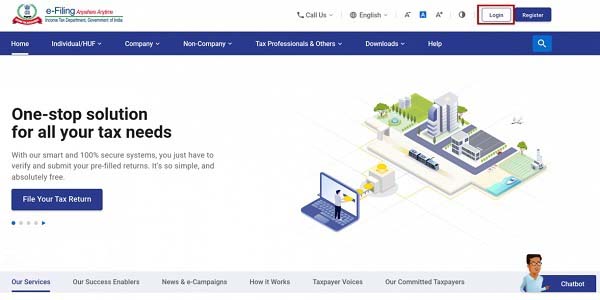

Step 1: Log in to the e-filing portal using your user ID and password.

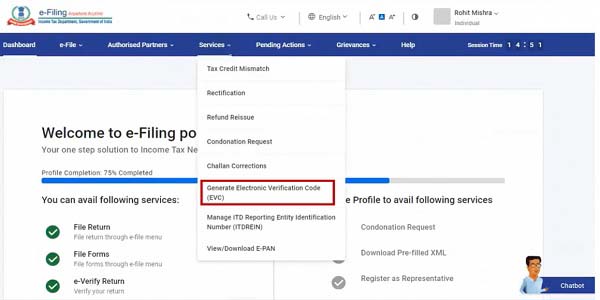

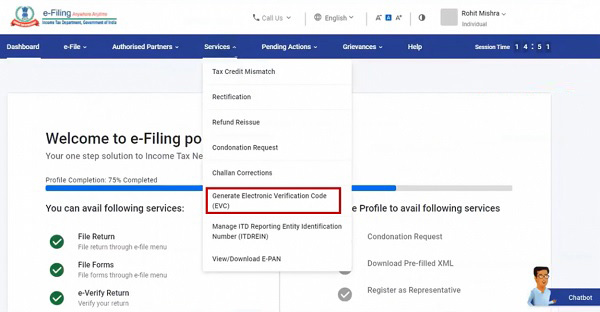

Step 2: On your Dashboard, click Services > Generate EVC.

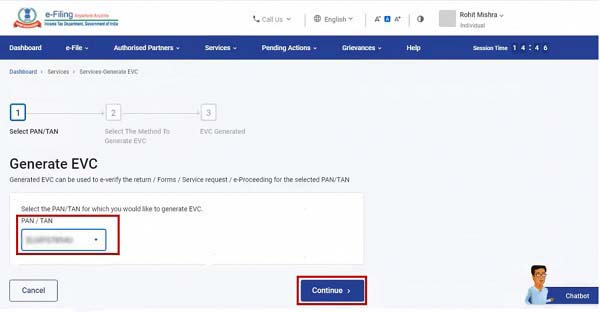

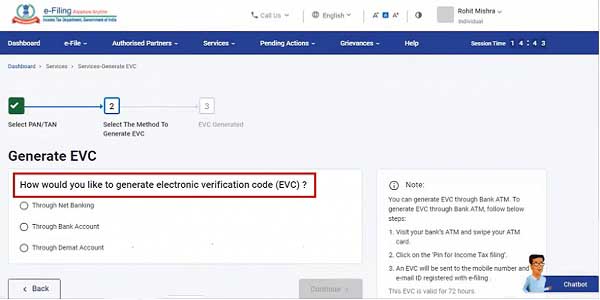

Step 3: On the Generate EVC page, select PAN / TAN and click Continue.

Step 4: On the generate EVC page, choose in what way you would like to generate the electronic verification code (EVC).

You Can Generate EVC via the Mentioned Ways

| Net Banking | Refer to Section 4.1 |

| Bank Account | Refer to Section 4.2 |

| Demat Account | Refer to Section 4.3 |

| Bank ATM | Refer to Section 4.4 |

4.1 Guide to Generating EVC via Net Banking

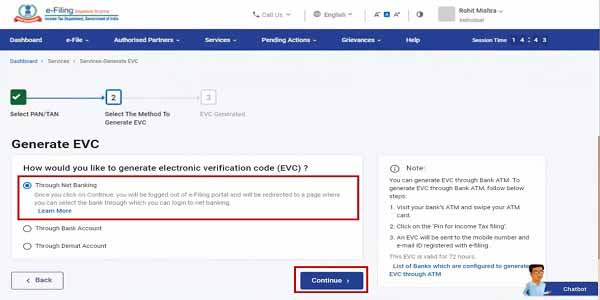

Step 1: On the Generate EVC page, choose Net Banking and tap Continue.

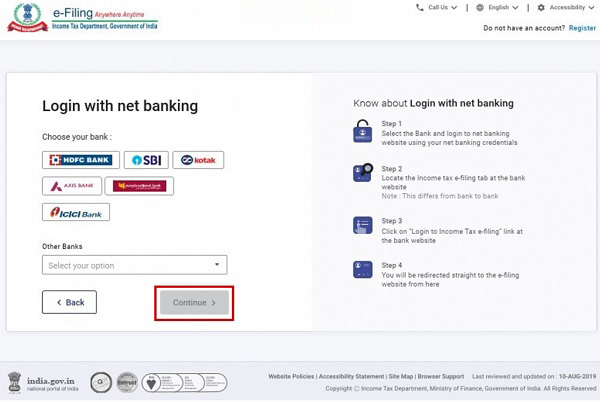

Step 2: At the e-Filing login via the Net Banking page, choose the Bank Name.

Note: You shall be logged out of the e-filing portal when your bank’s net banking login page gets prompted.

Step 3: Insert the username that is given by the bank and the password on your bank’s net banking login page.

Step 4: Tap on the link to log in to the e-filing portal on your net banking website.

Note: One will log out of their net banking website and log in to the e-filing account.

Step 5: On your Dashboard, click Services > Generate EVC.

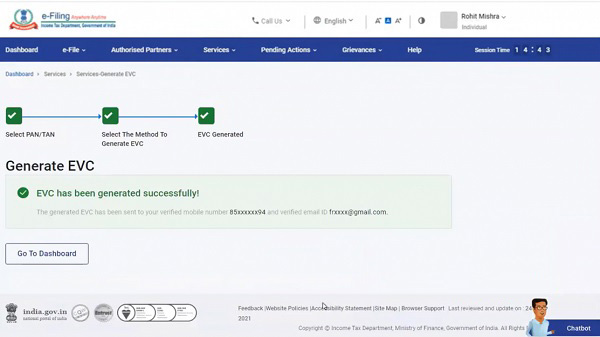

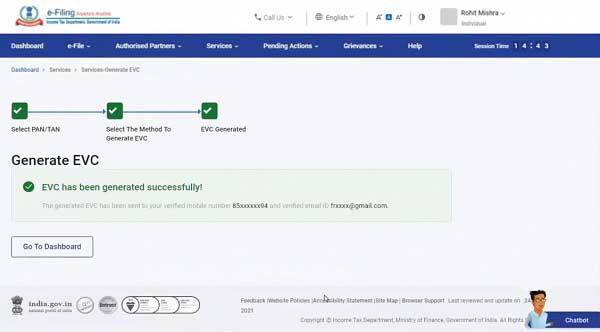

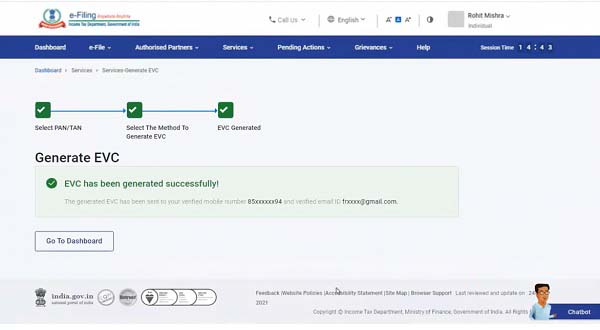

One shall obtain the generated EVC on their mobile number and e-mail ID registered on the e-Filing portal, and a success message will be shown.

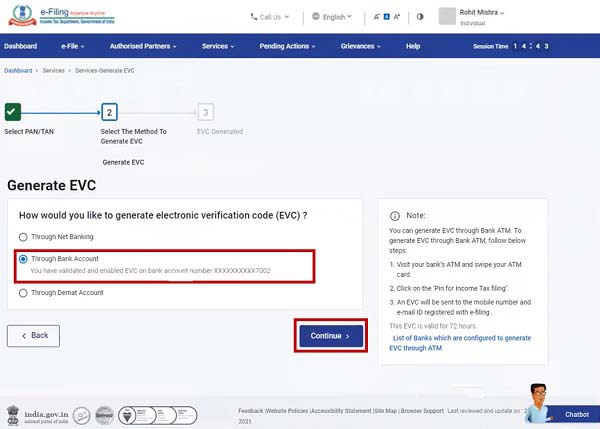

4.2. Guide to Generating Electronic Verification Code by Bank Account

Step 1: On the Generate EVC page, choose via Bank Account and tap Continue.

A message showing success will be displayed, and one shall obtain EVC on their mobile number and email ID verified through the bank.

Note:

- EVC from the bank account option could be generated when the added bank account is verified and enabled with EVC.

- One shall obtain the EVC in your mobile number or your email ID only when it is verified by the bank.

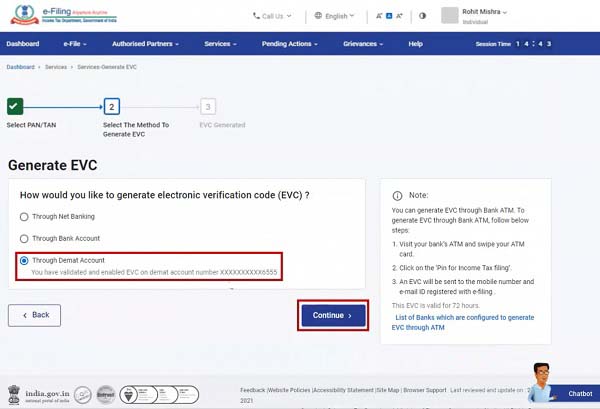

4.3. Easy Guide to Generating EVC by Demat Account

Step 1: Tap continue by selecting the Demat account on the generate EVC page.

A success message gets prompted on your screen, and you shall obtain the EVC on your mobile number and email ID verified by NSDL / CSDL.

Notes:

- EVC via the Demat account option can be created only when the Demat account that is added is verified and enabled with EVC.

- EVC shall be obtained on your mobile number or on your email ID only when they are validated through NSDL or CDSL.

4.4. Generating EVC via Bank ATM option (Offline mode)

Step 1: Go to the nearest bank ATM and swipe your debit card.

Step 2: Insert PIN.

Step 3: Choose the Generate EVC for Income Tax Filing.

An EVC shall be furnished to your mobile number and email ID registered with the e-filing portal.

Note:

- You must have associated the PAN with your corresponding bank account, and that PAN must be registered with the e-Filing portal.

FAQs on Income Tax Electronic Verification Code

Q.1 – What do you mean by EVC?

An Electronic Verification Code (EVC) is a 10-digit alphanumeric code that is sent on your enrolled mobile to validate the item in an electronic way, just log in to the e-filing portal, you can also use the reset password. One can indeed practice the EVC to validate the item in the electronic way (e-Verify statutory forms, e-Verify Income Tax Returns, e-Verify Refund re-issue request, response against any notice), login to e-filing portal, or reset password.

Q.2 – Can I generate EVC for others or can the assessee generate EVC on my behalf?

EVC can be generated by any individual taxpayer towards himself including other PAN (except company) or TAN when the principal contact is the individual himself towards any entity. EVC can be generated by any individual taxpayer for the PAN users even if he is an authorized representative.

Q.3 – With the help of EVC does a firm validate their returns?

No, a firm shall not validate its returns through generating the EVC. they shall need to validate their returns via DSC.

Q.4 – Is it essential to associate my PAN with the account which I used to generate EVC?

Yes, it is essential to link your PAN to whatever account one uses to generate the EVC. Towards the concern that you are creating the EVC through the verified bank account via net banking or Bank ATM, you shall need to link your PAN within the same bank account. For the case in which you are generating the EVC through the Demat account, you shall need to associate your PAN via a similar Demat account.

Q.5 – What is the validity to which the EVC has been generated?

The generated EVC shall be valid for 72 hours since the generation time.

Q.6 – Do I utilize that EVC in 72 hours several times to e-verify various returns?

No one shall not practice that EVC to e-verify distinct returns. You shall need to generate a newer EVC towards each object which you want to e-verify.

Q.7 – I have validated my return through EVC, do I still require to provide the physical ITR V to CPC Bangalore?

No, after you e-verify your returns through EVC then you are not needed to provide the physical copy of ITR V to CPC Bangalore.

Q.8 – Wants to use my bank account to generate an EVC. Can I use any bank account or only the one which is linked with the e-Filing portal?

You can generate EVC with the bank account that is associated and verified within the e-filing portal.

Q.9 – Can I validate my earlier furnished return that is due for verification?

Yes if there is still a time limit left for the verification or the late is refused through the competent income-tax authority.

Q.10 – what is the method to generate EVC via the bank ATM option?

To generate EVC via the bank ATM option one should pose your PAN associated with the corresponding bank account and that PAN must be enrolled through the e-filing portal. Once it gets associated then you can swipe or insert your debit card in the ATM and choose the option with “PIN for Income Tax Filing”. EVC is sent to the mobile number and the email ID registered on the e-filing portal.

Q.11 – Which banks permit me to generate EVC via bank account?

You can create EVC via any of the mentioned banks that are associated and verified through the e-filing portal:

- Allahabad Bank

- Andhra Bank

- Bank of Baroda

- Canara Bank

- Central Bank of India

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Karur Vysya Bank

- Kotak Mahindra Bank

- Oriental Bank of Commerce

- Punjab National Bank

- Saraswat Bank

- South Indian Bank

- State Bank of India

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

Q.12 – Is there a requirement to pre-validate the book account or my Demat account prior to generating EVC through my bank account or Demat account?

Yes, one is needed to pre-validate the bank account or your Demat account prior to generating EVC.