The Bombay High Court said that the credits of Goods and Services Tax (GST) collected by the taxpayers are monitored by the Central Board of Indirect Taxes and Customs (CBIC). The board decides the time limit and way of the utilization of the credits.

The experts said that as the HCs of Haryana, Delhi, Calcutta, Karnataka, Madras, and Himachal Pradesh have removed such restrictions, the matter should be solved by the Supreme Court now. The Bombay High Court’s decision is considered to be a setback for the companies Rajat Bose, partner at Shardul Amarchand Mangaldas, said.

Credit Procedures Up-To Now

“Input tax credit is the tax paid on inputs. Businesses get credit for this to deduct from the tax on the output so as to avoid double taxation and pay tax only on the value-added.” Right from the introduction of Goods and Services Tax (GST) in 2017, the provision for Input Tax Credit (ITC)

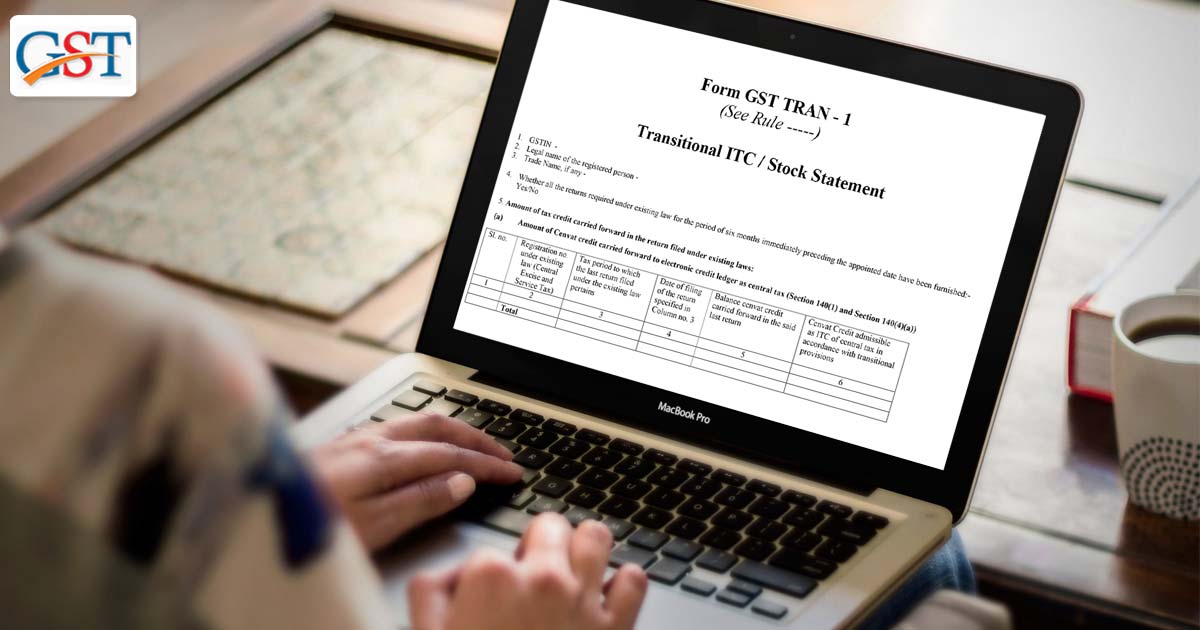

The assessees were required to file Form TRAN-1 up to 27th December 2017 but after many extensions, the last date was extended to 31st March 2020 for the assessees facing credit problems. The CBIC can do so as they have the power under Rule 117 of CGST Rules 2017, but many assessees were unhappy form this rule.

The assessees argued that Rule 117, giving the board the power to set a time limit for filing a form was unethical. They said that it was the right of the assessees, not a rebate provided, but the board can still hold the credit, although it will be carried forward.

The board, in their counter explanation, said that the credit is a kind of exception, not a right and the same has been acknowledged by numerous courts around the country and the department can interfere if there are technical problems in the form.

Bombay High Court’s Version of Treatment of Credit

The Bombay HC agreed to the counter statements of the board and said that they have the power to decide and modify the time period of filing form TRAN-1

The court said, ‘Input tax credit can be regulated through time limits, which are required for the efficient administration of the tax system in the public interest. Transitional provisions would become unworkable if no time limit was prescribed.’

The assessees are now allowed to file the form TRAN-1 up to 31st March 2020 if they faced any technical difficulties earlier. The court said that problems like ‘no internet connectivity’ and ‘no power’ were not to be listed under technical difficulties.

The decision announced by the HC giving powers in the hands of the department, was taken in the case filed by applicant Nelco Ltd. the company said that they were unable to file form TRAN-1 due to some ‘technical difficulties’ and would be losing CENVAT credit is not being allowed to do so but the court said that the reasons stated by the company for the non-compliance in filing the form could not be categorized under ‘technical difficulties’.

The decision taken is projected to impact other such cases too. Cases where the applicant has filed the complaint under ‘technical difficulties’ will be viewed differently by the courts form now on. Anish Tripathi, an independent GST consultant said, ‘In effect, this ruling has shut the door for taxpayers who have been unable to transition the outstanding credit to the new GST regime’.

Budget Amendments

Rajat Bose, Partner, Shardul Amarchand Mangaldas said, ‘Companies adversely affected due to the retrospective amendment can approach the court and challenge the amendment as there are precedents where it has been held that vested rights cannot be taken away by retrospective amendments.’

Bose also said that another HC has ruled, under the same types of cases of CENVAT credit, that the process to refund the credit was a ‘Righ’’ of the assessees which can be put on hold by changing the time limit but the amendments made by the government under Budget 2020 were total neglect of these judgments.

Section 140 of the Central GST Act