It was mentioned by the Gujarat High Court that no blocking of the credit in the electronic credit ledger is there if the available balance is not enough.

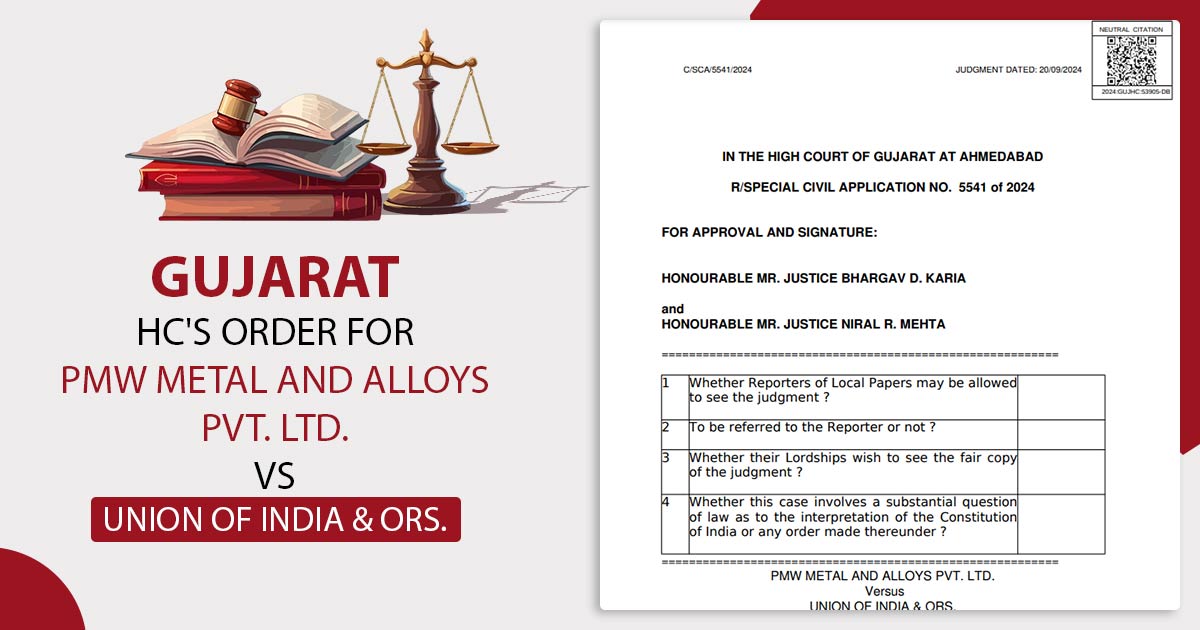

The Division Bench, including Justices Bhargav D. Karia and Niral R. Mehta, was hearing a case where the taxpayer argued that the blocking of Input Tax Credit (ITC) amounting to ₹2,44,05,567 in its electronic credit ledger.

Rule 86A of CGST Rules, 2017 authorizes the Commissioner or authorized officer to restrict debit of wrongly claimed or ineligible Input Tax Credit (ITC) from the electronic credit ledger for the release of liabilities or refund claims, as per the reasons recorded in writing.

Input Tax Credit (ITC) under the Central/Gujarat State Goods and Services Tax Act, 2017 has been availed by the assessee/petitioner. The ITC of the taxpayer of Rs. 2,44,05,567/-, was blocked by the Assistant Commissioner, CGST Una. Consequently this blocking, the GST electronic credit ledger of the taxpayer shows a negative balance.

It was furnished by the taxpayer that the department was unable to acknowledge that the electronic credit ledger balance of the taxpayer was nil when blocking Rs 2,44,05,567 was assessed and hence if there is no availability of ITC in the ledger then the Electronic Credit Ledger blocking under rule 86A of the GST rules and insertion of negative balance in the ledger shall be completely without jurisdiction and illegal.

The bench directed to the case of Samay Alloys India Pvt. Ltd. v. State of Gujarat [(2022) 91 GST338 (Gujarat)] where the Gujarat High Court carried that “……….it is not in dispute that the amount of input tax credit available in the electronic credit ledger as on the date of blocking of the ledger was Nil. If no input tax credit was available in the ledger, the blocking of electronic credit ledger under Rule 86-A of the Rules and insertion of negative balance in the ledger would be wholly without jurisdiction and illegal…………”

Towards the aforesaid case the bench after referring to circular No.4 of 2021 on 24.05.2021 furnished through the office of the Commissioner of State Tax, State Goods & Services Tax Department, Kerala concerning the credit blocking, noted that if there is Nil or insufficient balance in a tax head in the electronic credit ledger, another tax head balance can be blocked merely if the cross-utilization from these head is allowed in law.

However, this cross-utilization between CGST and SGST has not been allowed and hence the SGST credit ledger could not get blocked if adequate credit balance is not there under the CGST head and vice versa, the bench observed in the matter of Samay Alloys India Pvt. Ltd. v. State of Gujarat.

If there is not enough balance available then there could not be any blocking of the credit in the Electronic Credit Ledger, bench concluded.

The bench in the aforesaid permitted the petition and asked the department to withdraw the negative block of the Electronic Credit Ledger.

| Case Title | PMW Metal and Alloys Pvt. Ltd. VS Union of India & Ors. |

| Application No. | 5541 of 2024 |

| Date | 20.09.2024 |

| Counsel For Appellant | Priyank P Lodha (7852) |

| Counsel For Respondent | Mr Siddharth H Dave(5306) |

| Gujarat High Court | Read Order |