In the case of Bhagat Dhanadal Corporation the Gujarat Authority of Advance Ruling (AAR) has held a 5% GST subject to be paid on seed mixes manufactured and sold by it. The manufactured products via the same are Mix Mukhwas and Roasted Til with Ajwain.

Both the products particularly consist of sesame seeds and have 60% of ingredients in the first mix and 97% in the second product, the Gujarat AAR bench witnessed.

The steps of cleaning, adding salt and citric acid, roasting, and adding turmeric powder do not revise the product classification as sesame seeds persisted to be the major ingredient.

Read Also: Gujarat AAAR Classifies Various Mix and Instant Flours for Their GST Rate

As per the petitioner, the mixes do not include any element of pan masala, sugar, chocolate, preservatives, or any other artificial flavouring substances. The customers who wish to consume sesame seeds normally as a seed mix these products are bought by them. AAR based on the facts ruled that a 5% GST would be applicable.

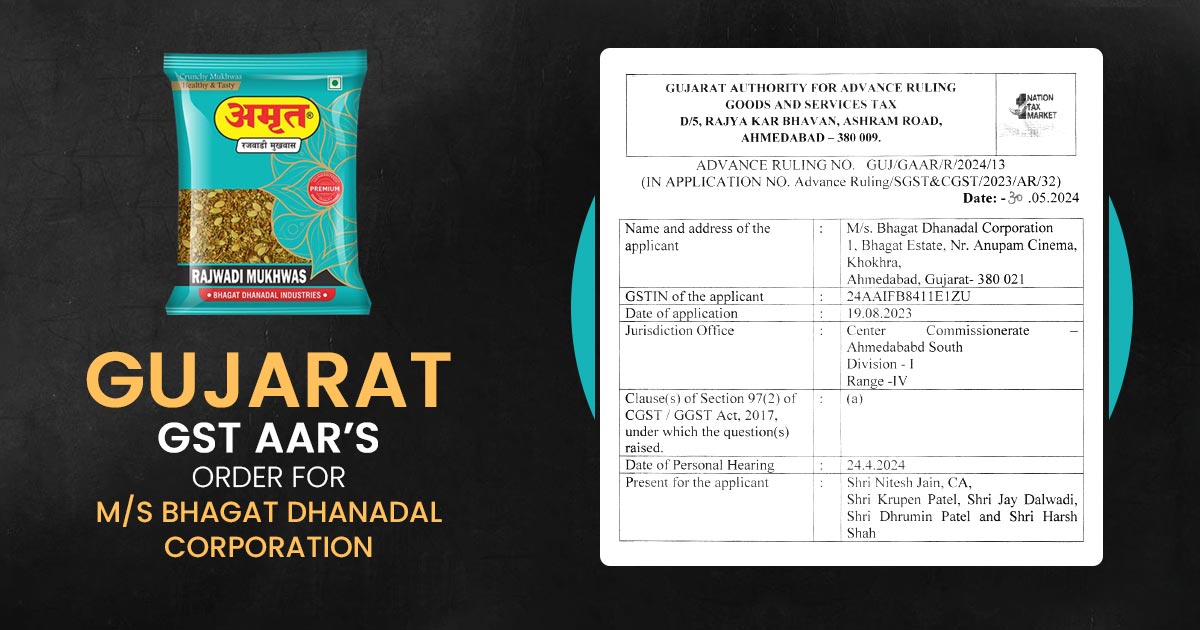

| Name of Applicant | M/s Bhagat Dhanadal Corporation |

| GSTIN | 24AA1FB8411E1ZU |

| Date | 24.04.2024 |

| Present for the Applicant | Shri Nitesh Jain, Shri Krupen Patel, Shri Jay Dalwadi, Shri Dhrumin Patel, Shri Harsh Shah |

| Gujarat AAR | Read Order |