GSTR 9C is an annual audit form under goods and services tax which has been released for all the business units having turnover of more than 5 crores annually. The form undertakes the auditing part of such business transactions. Now the government has started to release offline utility for GSTR 9C in excel format on the GST portal.

Quick to File GSTR 9C Audit Form GST Software

Apart from filing the GSTR 9C annual audit form, the taxpayer is also required to fill out the certification of an audit and reconciliation statement. The taxpayer can file the GSTR 9C form till 31st December 2025 for the financial year 2024-25.

Note: Finally the CBIC released the fresh version of the GSTR 9C Version 2.8 offline tool annual return at the portal.

Now the government has released a GSTR 9C offline utility in the form of Excel to help the taxpayers in preparing the GSTR 9C returns offline. In the download link, there is a zip file which contains:

- GSTR_9C_Offline_Utility (Excel Macro)

- Release Notes

Multiple Features in the GSTR 9C Offline Utility

- GSTR 9C JSON file gets available once downloaded from the GST portal

- GSTR 9C JSON error file also available in the excel once downloaded from the GST portal

- Generating GSTR 9C JSON file for upload on the GSTN portal

- The taxpayer can preview the PDF file by generating it and can look on Draft GSTR 9C form

- The sheet will be validated as per the data entered

Steps to Download GSTR 9C Offline Utility in Excel

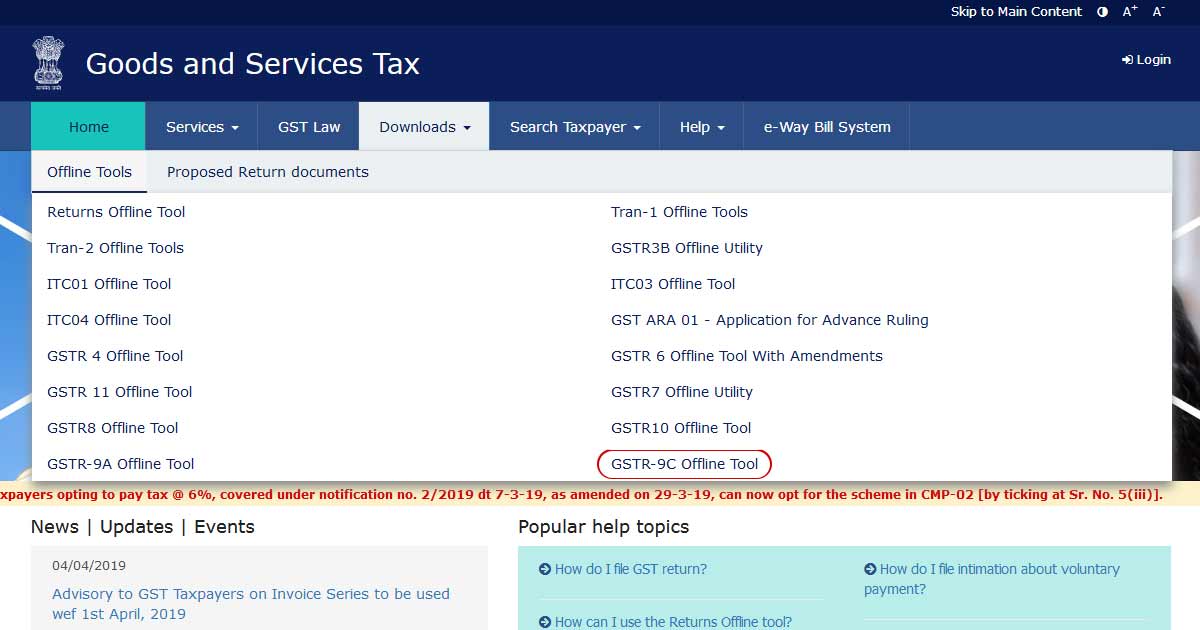

- Go to GST.gov.in

- Click on the download tab on the main menu

- Then opt for offline tools and click on GSTR 9C offline tool from the list

- A new page will open with the download link in the first sentence

- Clicking on it then it will start automatically download the folder in Zip format

- Extract the Zip folder and start working

Important Note:

Make sure that the file is uncorrupted, before extracting the downloaded file. Corrupt files are of no use due to viruses, malware and often premature closure of programs.

How to check that my file is corrupted or uncorrupted? You are on the right click to discover more.

How do I ensure that the downloaded GSTR-9C-Offline-Utility.zip file is uncorrupt?

Compare one of the values given in your downloaded file with the values prescribed below. If there is a precise match between the two, then your file is uncorrupted. In the contrast case, download again.

Where are the values located?

Windows : (Run from windows power shell)

Get-FileHash <<FileUrl>> -Algorithm <<SHA256>>

Eg: Get-FileHash C:\Users\Test\Downloads\GSTR_9C_Offline_Utility.zip -Algorithm SHA256

Your unique values:

SHA256: 1293C6771E04D0320D34597AF2CE361CEF83A9F39AE54CC33D0A29890DED2962

GSTR 9C Offline Utility Information

GSTR 9C Online Filing Guide By Gen GST Software