What is GST Annual Return Form GSTR 9?

Here, SAG Infotech Pvt. Ltd. briefs all the details, rules and regulations for GSTR 9 online filing along with a step-by-step compliance procedure.

The GSTR 9 is a GST annual return form to be filed by the regular taxpayer once a year with all the consolidated details of SGST, CGST and IGST paid during the year.

Get to know all the related information of GST return 9 annual filing procedure, format, eligibility & rules along with proper screenshots and filing guidance at each and every step.

For any query or question, ask our experts and professional chartered accountants who will resolve all your doubts as soon as possible. Eligible taxpayers can download and view the GSTR 9 form in PDF format.

- Latest News/Updates of GSTR 9

- Who is Required to File?

- Different Sorts of Annual GST Returns

- Due Dates Extension & Penalty Norms

- How to File?

- GSTR 9 General Queries

- GSTR 9 Offline Tool

Latest News/Updates of GSTR 9 Form

- The consolidated FAQs for GSTR-9 and GSTR-9C are now available on the GSTN portal. Read PDF

- The GSTN department has released important FAQs for GSTR-9 and GSTR-9C. Read FAQs

- Latest Updates of GSTR 9 Form For FY 2024-25

- Table 6:

- Addition of two fields (6A1 and 6A2) in Table 6, along with label changes for fields 6H, 6J, and 6M

- Removal of the Equality check from Table 6M

- Table 7: Addition of two fields (7A1 and 7A2) in Table 7

- Table 8: Introduction of a new field (8H1) in Table 8 and label changes for Tables 8B, 8H, and 8I

- Table 9: Addition of two columns in Table 9

- Table 10,11,12,13: Label changes done for Tables 10, 11, 12, and 13

- Table 14: Addition of one new column in Table 14

- Table 17: Removal of the differential percent checkbox from Table

- Table 18: Removal of the differential percent checkbox from Table 18

- Table 6:

- CBIC Notification No. 15/2025 relates to the exemption of registered persons with a turnover of up to INR 2 crores. View more

File GSTR 9 Annual Return Via Gen GST Software, Get Demo!

GST Compliance Burden Reduced for Small Businesses for FY 2024-25

| Sales | GSTR 9 | GSTR 9C |

|---|---|---|

| Up to 2 Cr | Exempt (From FY 2024-25 onwards) Read Notification | N/A |

| More than 2Cr. – 5 Cr | Filling is mandatory | Optional (Benefit Given) |

| More than 5Cr | Filling is mandatory | Filling is Mandatory |

Here, we are going to discuss the complete GST Annual Return form under the Goods and Services Tax.

Simplify GSTR 9 Filing by CBIC

- 4B To 4E now be filled net of Credit Notes, Debit Notes and Amendments, Rather than separate reporting in 4I, 4J 4K & 4L;

- Furthermore, Tables 5A to 5F now be inserted with the net of Credit Notes, Debit Notes, and Amendments, Rather than reporting individually in 5H, 5I, 5J & 5KJ;

- If Table 5D, 5E & 5F (exempted, nil rated and Non-GST supply) – A single figure can be filed corresponding to EXEMPTED in 5D;

Table 6 – ITC availed through the FY

- In Table 6B, 6C, 6D & 6E the registered person can report the complete input tax credit below the “inputs” row only;

Table 7 – ITC Reversal

- Parts of table 7A to 7E can be listed under 7H (Other Reversal);

- But, TRAN I & II reversal has to be listed respectively;

Table 8 – Other ITC-related data

- The registered taxpayer can upload the items for the entries in Table 8A to 8D (Reconciliation of GSTR 2A with GSTR 3B) duly signed, in PDF format in Form GSTR-9C (sans the CA certification);

- Table 15, 16, 17 & 18 (HSN summary also) is not mandatory

Meaning of Filing GSTR 9 (GST Annual Return Form)

It is meant for a return form which is required to be filed once a year by the regular taxpayers concerning the GST regime. It is further categorized into IGST, SGST, and CGST. Under the heads, the taxpayers fill in information about supplies made and received in a year separately. It is a consolidated form that comprises the details mentioned in the monthly/quarterly returns in a year.

Who is Required to File GSTR-9 (GST Annual Return Form): Applicability Explained?

All the registered regular taxpayers are required to file a form under the GST regime except below list:

- Taxpayers Opting for Composition Scheme

- Casual Taxable Person

- Non-resident Taxable Persons

- Input Service Distributors

- Persons Paying TDS U/S 51 of CGST

- Person Collecting TCS U/S 52 of CGST

What are the Different Sorts of Annual GST Returns?

Different kinds of annual returns under GST:

- GSTR-9 Annual Return Form: The regular taxpayer who files 1 and 3B forms are required to file the GSTR-9.

- GSTR-9A: The composition scheme holder under GST is required to furnish GSTR-9A.

- GSTR-9B: All the e-commerce operators who have filed GSTR-8 are required. to file GSTR-9B in a financial year.

- GSTR-9C: The taxpayers whose annual turnover cross Rs. 5 crores are required to file GSTR-9C in a financial year. All those taxpayers are needed to obtain the accounts to be audited and furnish a copy of the reconciliation statement of tax already paid, audited annual accounts, and tax payable according to the audited accounts with GSTR-9C.

Due Date for Filing GST Annual GSTR 9 Return Form

The due date of the GSTR 9 annual return form for the financial year 2025-26:

| Financial Year | Due Date |

|---|---|

| Financial Year 2025-26 | 31st December 2026 |

| Financial Year 2024-25 | 31st December 2025 |

Note: “Central Board of Indirect Taxes & Customs (CBIC) notified the amendments regarding the simplification of GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement) which inter-alia allow the taxpayers to not to provide a split of input tax credit availed on inputs, input services, and capital goods and to not to provide HSN level information of outputs or inputs, etc. for the financial year 2017-18 and 2018-19.”

Penalty Norms When You Miss the Due Date of GSTR-9 Filing

As per the penalty provisions for the GSTR-9 annual return form, the taxpayer is required to pay a penalty of Rs. 200 per day, with Rs. 100 being for SGST and Rs. 100 for CGST. For turnover exceeding Rs. 20 crore, the penalty is 0.50% of turnover in the state/UT (0.25% each under the CGST and SGST Acts).

- The taxpayer is required to pay a penalty of Rs. 100 per day, with Rs. 50 for SGST and Rs. 50 for CGST. For turnover exceeding Rs. 5 crore but less than Rs. 20 crore, the penalty is 0.04% of turnover in the state/UT (0.02% each under the CGST and SGST Acts).

- The taxpayer is required to pay a penalty of Rs. 50 per day, with Rs. 25 for SGST and Rs. 25 for CGST. For turnover up to Rs. 5 crore, the penalty is 0.04% of turnover in the state/UT (0.02% each under the CGST and SGST Acts).

- From the financial year 2022-23 onwards, the taxpayer is required to pay a penalty of Rs. 50 per day, with Rs. 25 for SGST and Rs. 25 for CGST, in case of turnover up to Rs. 5 crore. If the turnover exceeds Rs. 5 crore, the late fee will be Rs. 100, consisting of Rs. 50 for SGST and Rs. 50 for CGST.

This is subject to a maximum of 0.25% of the taxpayer’s turnover in the relevant state or union territory, as per the Act. However, no late fee has been imposed on IGST so far. get more

How to GSTR 9 Return Offline Tool (v2.1)

The main purpose behind inventing and designing an Excel-based GSTR-9 offline tool is to facilitate the taxpayer in the offline preparation of the GSTR-9 return. To download the utility, there are some system requirements. So, before downloading the same, we must ensure that our system is compatible.

System Requirement

Compatibility ensures the smooth functioning of the tool. Make sure that you have an Operating system – Windows 7 or above and Microsoft Excel 2007 & above, installed in your system.

GSTR 9 Annual Return Form- Complications & Sorting Out Tips

There were many difficulties with Form GSTR 9 and bewilderment with its format, which was released in September 2018. The most difficult problem with this Form is that the information would not get auto-populated in this Form, despite the fact that the same information has been filed previously in the monthly and quarterly akin periodic returns.

To ease and simplify the process of filing an annual return, the GSTN revamped the form and thus sorted out most of the inconveniences. But still, there are some issues that remain unresolved. We are presenting those issues with some suggestions to sort them out.

GSTR 9 requires HSN which was not required while filing GSTR 3B: In the Annual Return Form GSTR- 9, HSN of inward supplies is needed although it was not needed while filing monthly GSTR 3B. The HSN summary is mandatory to be reported only for those HSNs which account for the minimum 10% of the total inward supplies.

Suggestion: The reporting of HSN of inward supplies becomes irksome if not maintained previously. But we have a solution for this, GenGST fills table 18 in the GSTR 9 automatically. Table 18 consists of HSN codes of the inward supplies which get automatically filled from the purchase register by GenGST software.

Details of ITC need to be mentioned as Inputs/Input Services/ Capital Goods: An isolated detail of availed ITC needs to be mentioned as Inputs/Input Services/ Capital Goods in Form GSTR 9.

Suggestion: The division of ITC availed as Inputs/Input Services/ Capital Goods in Form GSTR 9. Will take the assessee back to rework on the accounting entries because of the absence of these details in the periodic returns. Here, Gen GST facilitates the assessee to report this bifurcation with ease in GSTR 9 while filing it.

Reporting of altered transactions: In the Annual Return Form GSTR- 9, we need to report the altered transactions of the FY 2017-18 filed in the current FY returns’ from April to September or till the annual return filing of FY 2017-18 i.e. 31 Dec 2018, whichever is earlier.

Suggestion: Gen GST has a feature of reconciliation and reporting through which it reconciles the altered transactions of FY 2017-18 filed in the current financial year and reports the same in the annual return accordingly.

How to File the GST Form GSTR 9 Annual Return with the Latest Format

The GSTR 9 is divided into six parts and 19 tables and the most important thing as suggested by CBIC that there is no revised facility on the GST Portal.

Here you go:

Part I: Basic Details has the following three sections and four tables:

- 1. Financial Year for which the return is being filed.

- 2. GSTIN of the taxpayer

- 3A Legal Name of the registered person

- 3B Trade Name (if any) of the registered business

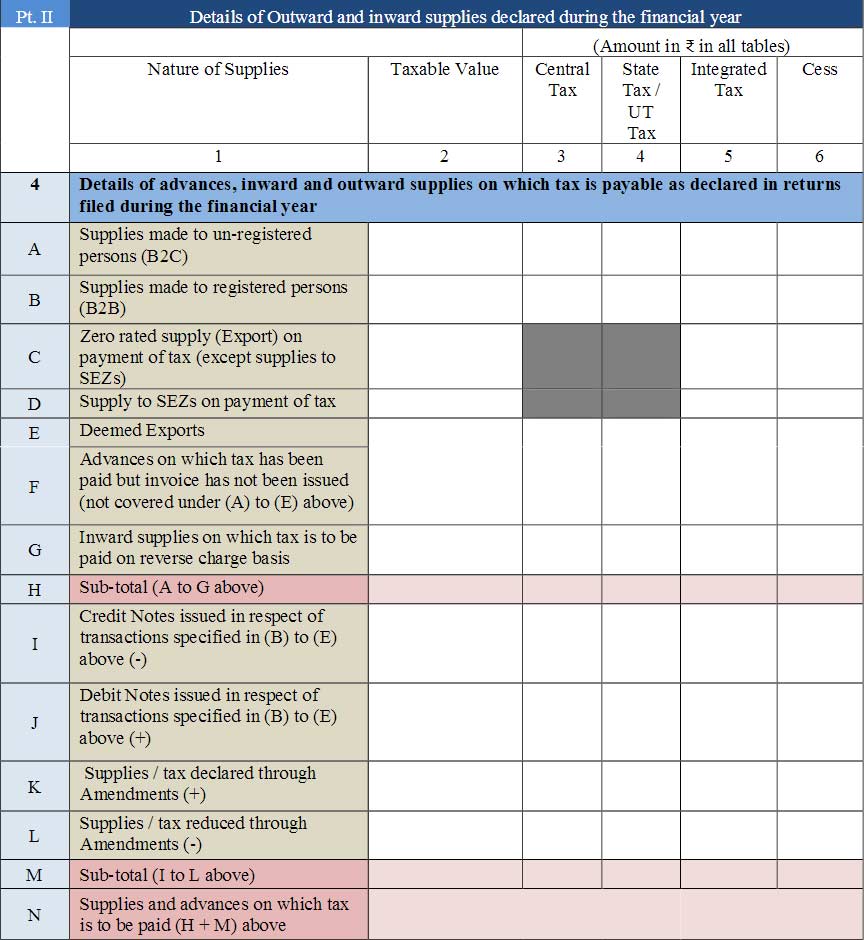

Part II: It consists of details of Inward and Outward supplies made during the particular financial year for which the return is being filed. In short, this part contains consolidated data of all the supplies reported by the taxpayer in all his/her returns filed during that year. It has been divided into the following sections and tables.

- 4. This section will contain the details of advances, inward and outward supplies on which tax is payable as declared in returns filed during the financial year.

- 4A Supplies made to unregistered persons (B2C): The table will contain the aggregate value of supplies made to unregistered persons such as consumers, including the supplies made via e-commerce means, on which the supplier paid tax.” Table 10 of Form GSTR-1 as amended by 114 [Form GSTR-1A] may be used for filling up these details.”

- 4B Supplies made to registered persons (B2B): The table will contain the aggregategstr_9_gen_gst value of supplies made to registered persons, including the supplies made to UINs, on which the supplier paid tax. It will also contain details of the supplies made through e-commerce websites on which tax was paid by the supplier.” Table 4A and Table 4C of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 4C Zero-rated supply (Export) on payment of tax (except supplies to SEZs): This field will contain details of zero-rated supplies such as exports on which tax has already been paid.” FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details”

- 4D Supply to SEZs on payment of tax: The supplier will declare an aggregate value of supplies made to SEZ units on which tax has been paid.

- 4E Deemed Exports: Provide the aggregate value of supplies of deemed export nature on which the supplier has paid the tax. ” Table 6C of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 4F Advances on which tax has been paid but the invoice has not been issued (not covered under (A) to (E) above): Mention details of unadjusted advances on which tax has been paid but invoices are not issued in this financial year. “Table 11A of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 4G Inward supplies on which tax is to be paid on a reverse charge basis: It will contain an aggregate value of all input supplies (purchases), including supplies made by registered and unregistered persons and import of services, on which tax is to be paid by the recipient on the reverse charge basis. “This shall also include aggregate value of all import of services. Table 3.1(d) of FORM GSTR-3B may be used for filling up these details”

- 4G1 “Supplies on which the e-commerce operator is required to pay tax as per section 9(5) (including amendments, if any) [E-commerce operator to report]”

- 4H Sub-total (A to G1 above)

- 4I Credit Notes issued in respect of transactions specified in (B) to (E) above (-): the Consolidated value of credit notes issued in respect of transactions mentioned in the above fields (4B to 4E) goes here.”Aggregate value of credit notes issued in respect of B to B supplies (4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E) shall be declared here. Table 9B of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 4J Debit Notes issued in respect of transactions specified in (B) to (E) above (+): the Consolidated value of debit notes issued in respect of transactions mentioned in the above fields (4B to 4E) goes here. “Aggregate value of debit notes issued in respect of B to B supplies (4B), exports (4C), supplies to SEZs (4D) and deemed exports (4E) shall be declared here. Table 9B of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 4K Supplies/tax declared through Amendments (+): Details of tax added through amendments in the above-mentioned details. “Table 9A and Table 9C of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 4L Supplies/tax reduced through Amendments (-): Details of tax reduced through amendments in the above-mentioned details. “Table 9A and Table 9C of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 4M Sub-total (I to L above)

- 4N Supplies and advances on which tax is to be paid: 4H + 4M (above)

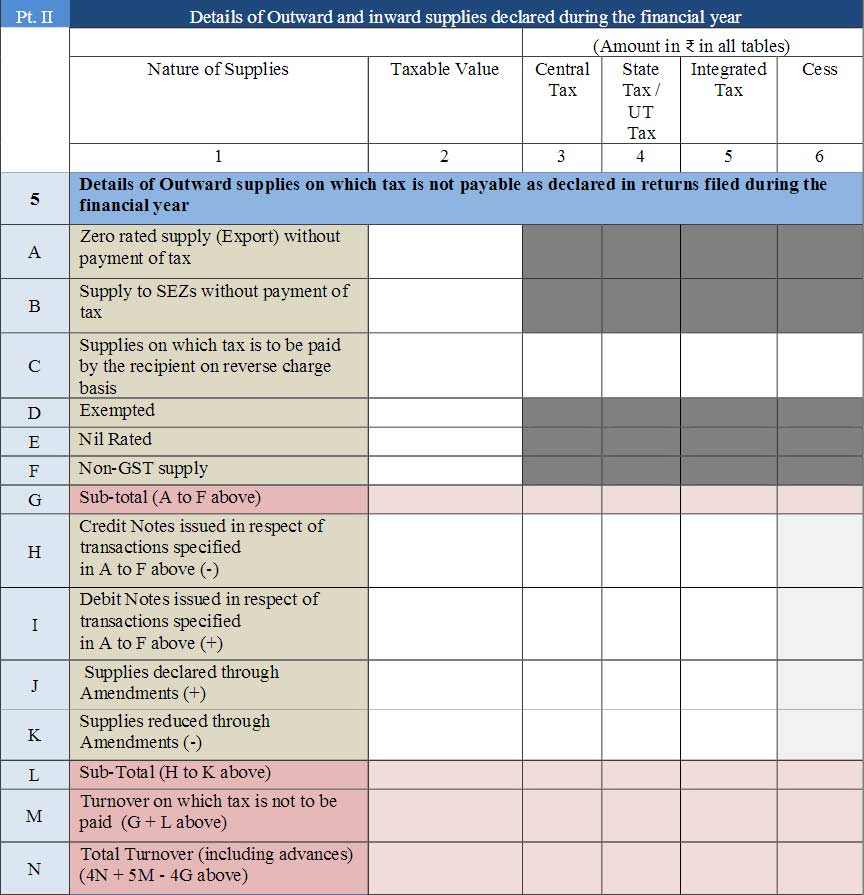

- 5. Details of Outward supplies on which tax is not payable as declared in returns filed during the financial year

- 5A Zero-rated supply (Export) without payment of tax: This field will contain details of zero-rated supplies such as exports on which tax has not been paid. “Table 6A of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 5B Supply to SEZs without payment of tax: Contains details of supplies made to SEZ units on which tax has not been paid.

- 5C Supplies on which tax is to be paid by the recipient on a reverse charge basis: Mention here the total value of supplies made to registered persons on which GST was paid by the recipient on an RCM basis. “Table 4B of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 5C1 ” Supplies on which tax” is to be paid by ecommerce operators as per section 9(5) [Supplier to report]]”

- 5D (Exempted)/ 5E (Nil Rated)/ 5F (Non-GST supply): An aggregate value of exempted, Nil Rated and Non-GST supplies shall be declared here. Table 8 of form GSTR-1 may be used for filling up these details. The value of “no supply” shall also be declared here. “Table 8 of FORM GSTR-1 as amended by 114[FORM GSTR-1A]”

- 5G Sub-total (A to F above)

- 5H Credit Notes issued in respect of transactions specified in A to F above (-): an Aggregate value of credit notes issued in respect of supplies declared in 5A,5B,5C, 5D, 5E and 5F shall be declared here. “Aggregate value of credit notes issued in respect of supplies declared in 5A, 5B, 5C, 5D, 5E and 5F shall be declared here. Table 9B of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 5I Debit Notes issued in respect of transactions specified in A to F above (+): an Aggregate value of debit notes issued in respect of supplies declared in 5A,5B,5C, 5D, 5E and 5F shall be declared here. Table 9B of FORM GSTR-1 may be used for filling up these details. “Aggregate value of debit notes issued in respect of supplies declared in 5A, 5B, 5C, 5D, 5E and 5F shall be declared here. Table 9B of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 5J and 5K Supplies declared through Amendments (+), Supplies reduced through Amendments (-): Details of amendments made to exports (except supplies to SEZs) and supplies to SEZs on which tax has not been paid shall be declared here. Table 9A and 14 Table 9C of FORM GSTR-1 may be used for filling up these details.”Table 9A and Table 9C of FORM GSTR-1 as amended by 114[FORM GSTR-1A] may be used for filling up these details.”

- 5L Sub-Total (H to K above)

- 5M Turnover on which tax is not to be paid (G + L above)

- 5N Total Turnover (including advances) (4N + 5M – 4G above): Total turnover including the sum of all the supplies (with additional supplies and amendments) on which tax is payable and tax is not payable shall be declared here. This shall also include a number of advances on which tax is paid but invoices have not been issued in the current year. However, this shall not include the aggregate value of inward supplies on which tax is paid by the recipient (i.e. by the person filing the annual return) on the reverse charge basis.

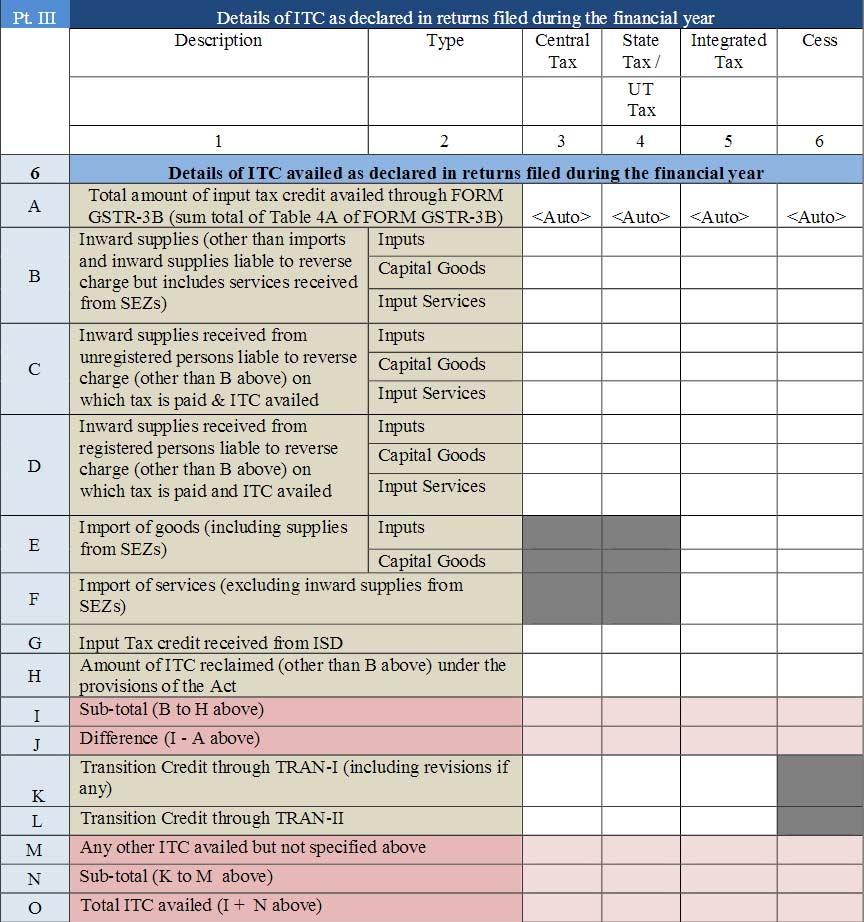

Part III: It consists of details of ITC as declared in returns filed during the financial year

6. This section will contain the details of ITC availed as declared in returns filed during the financial year:

- 6A. Total input tax credit availed in Table 4A of FORM GSTR-3B for the 126[financial year] would be auto-populated here.

- 6A1. ITC in respect of the preceding financial year, but availed through FORM GSTR-3B of April to October of the Financial Year for which annual return is furnished, filed till 30th November of the Financial Year for which annual return is furnished and included in auto populated values in table 6A above, should be declared here. Also, if any ITC which was claimed and reversed (due to rule 37 or rule 37A) in any of the preceding financial year but reclaimed during the financial year for which this return is being filed, shall not be reported here as this will be reported in the Table 6H below. Also, if any ITC which was claimed and reversed (other than due to rule 37 or rule 37A) in preceding financial year but reclaimed during the financial year for which this return is being filed, shall be reported here and this will not be reported in the Table 6H below.]

- 6A2. Net ITC of the financial year =(A-A1)]

- 6B Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs): an Aggregate value of input tax credit availed on all inward supplies except those on which tax is payable on a reverse charge basis but includes the supply of services received from SEZs shall be declared here. It may be noted that the total ITC availed is to be classified as ITC on inputs, capital goods and input services. Table 4(A)(5) of form GSTR-3B may be used for filling up these details. This shall not include ITC which was availed, reversed and then reclaimed in the ITC ledger. This is to be declared separately under 6(H) below.

- 6C Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed: Aggregate value of input tax credit availed on all inward supplies received from unregistered persons (other than the import of services) on which tax is payable on reverse charge basis shall be declared here. It may be noted that the total ITC availed is to be classified as ITC on inputs, capital goods and input services. Table 4(A)(3) of FORM GSTR-3B may be used for filling up these details

- 6D Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed: an Aggregate value of input tax credit availed on all inward supplies received from registered persons on which tax is payable on reverse charge basis shall be declared here. It may be noted that the total ITC availed is to be classified as ITC on inputs, capital goods and input services. Table 4(A)(3) of form GSTR-3B may be used for filling up these details.

- 6E Import of goods (including supplies from SEZs): Details of input tax credit availed on the import of goods including the supply of goods received from SEZs shall be declared here. It may be noted that the total ITC availed is to be classified as ITC on inputs and capital goods. Table 4(A)(1) of FORM GSTR-3B may be used for filling up these details.

- 6F Import of services (excluding inward supplies from SEZs): Details of input tax credit availed on the import of services (excluding inward supplies from SEZs) shall be declared here. Table 4(A)(2) of FORM GSTR- 15 3B may be used for filling up these details.

- 6G Input Tax credit received from ISD: An aggregate value of input tax credit received from the input service distributor shall be declared here. Table 4(A)(4) of FORM GSTR-3B may be used for filling up these details.

- 6H Aggregate value of input tax credit availed, reversed and reclaimed under the provisions of the Act shall be declared here 126[However, for FY 2024-25 onwards, in case of ITC availed, reversed and then reclaimed, ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) which was availed (for the first time) should be declared in Table 6B above. ITC, which was reversed should be declared in the Table 7 and ITC that is reclaimed should only be declared in here. Also, if any ITC which was claimed and reversed (due to rule 37 or rule 37A) in any of the preceding financial year but reclaimed during the financial year for which this return is being filed, shall be reported here. Also, if any ITC which was claimed and reversed (other than rule 37 or rule 37A) in preceding financial year but reclaimed during the financial year for which this return is being filed, shall not be reported here as it is to be reported in the Table 6A1 above.]6I Sub-total (B to H above):

- 6J The difference between the total amount of input tax credit availed through FORM GSTR-3B and input tax credit declared in row B to H shall be declared here. Ideally, this amount should be zero 126[However, for FY 2024-25 onwards, the difference between the total amount of net ITC of the financial year availed through FORM GSTR-3B as per Table 6A2 and input tax credit declared in row B to H shall be auto-populated here. Ideally, this amount should be zero.

- 6K Transition Credit through TRAN-I (including revisions if any): Details of transition credit received in the electronic credit ledger on the filing of form GST TRAN-I, including revision of TRAN-I (whether upwards or downwards), if any shall be declared here.

- 6L Transition Credit through TRAN-II: Details of transition credit received in the electronic credit ledger after the filing of FORM GST TRAN-II shall be declared here

- 6M Details of ITC availed through FORM ITC-01, FORM ITC-02 and ITC-02A (i.e. ITC availed through Forms other than GSTR 3B, TRAN-1 and TRAN-II) in the financial year shall be declared here.]

- 6N Sub-total (K to M above)

- 6O Total ITC availed (I + N above)

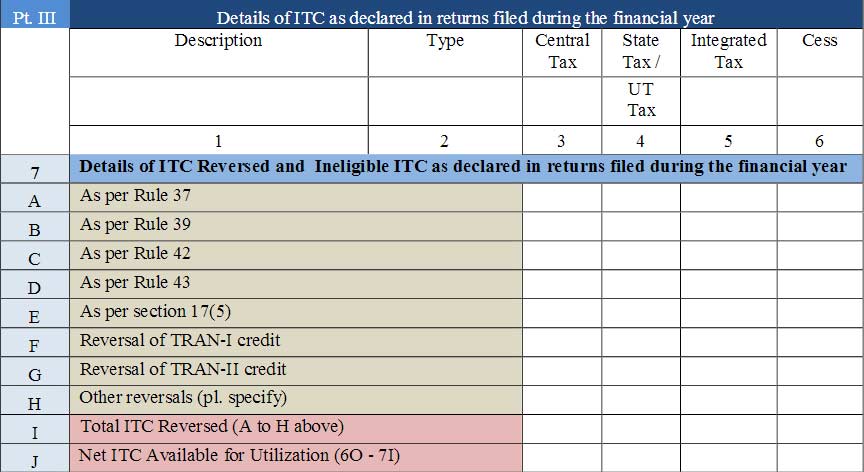

- 7. It consists of details of ITC Reversed and Ineligible ITC as declared in returns filed during the financial year.

- 7A As per Rule 37

- 7A1 As per Rule 37A

- 7A2 As per Rule 38

- 7B As per Rule 39

- 7C As per Rule 42

- 7D As per Rule 43

- 7E As per section 17(5)

- 7F Reversal of TRAN-I credit

- 7G Reversal of TRAN-II credit

- 7H Other reversals (pl. specify)

- 7I Total ITC Reversed (A to H above)

- 7J Net ITC Available for Utilization (6O – 7I)

- 7A As per Rule 37

“Details of input tax credit reversed due to ineligibility or reversals required under rule 37, 39, 42 and 43 of the CGST Rules, 2017 shall be declared here. This column should also contain details of any input tax credit reversed under section 17(5) of the CGST Act, 2017 and details of ineligible transition credit claimed under FORM GST TRAN-I or FORM GST TRAN-II and then subsequently reversed. Table 4(B) of FORM GSTR-3B may be used for filling up these details. Any ITC reversed through FORM ITC -03 shall be declared in 7H. If the amount stated in Table 4D of FORM GSTR-3B was not included in table 4A of FORM GSTR-3B, then no entry should be made in table 7E of FORM GSTR-9. However, if amount mentioned in table 4D of FORM GSTR3B was included in table 4A of FORM GSTR-3B, then entry will come in 7E of FORM GSTR-9. 52[For 53[FY 2017-18, 2018-19, 54[2019-20, 2020-21 and 115[2021-22, 2022-23 and 202324]]], the registered person shall have an option to either fill his information on reversals separately in Table 7A to 7E or report the entire amount of reversal under Table 7H only. However, reversals on account of TRAN-1 credit (Table 7F) and TRAN-2 (Table 7G) are to be mandatorily reported.]

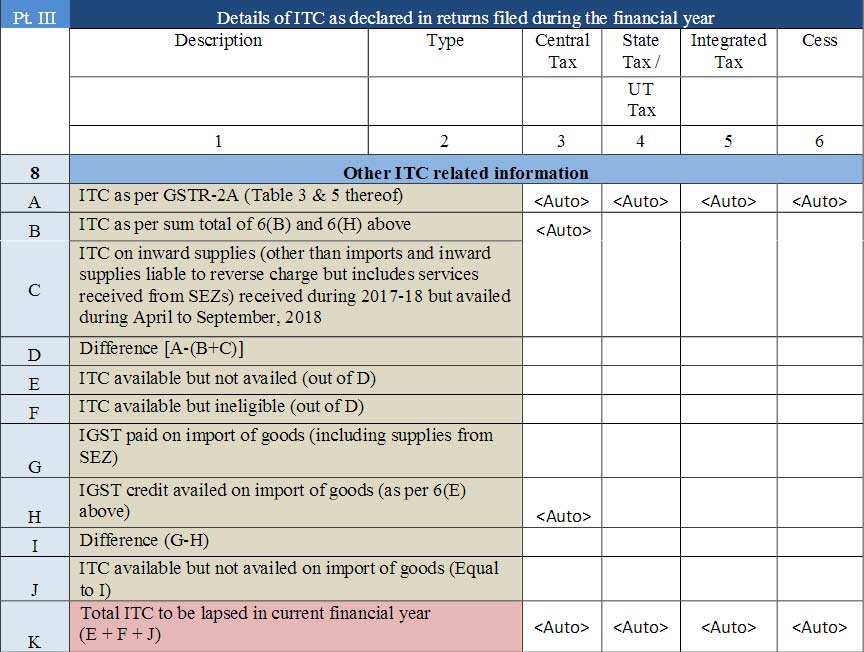

- 8. Other ITC-related information will be provided in this section.

- 8A: ITC as per GSTR-2A (Table 3 & 5 thereof: The total credit available for inwards supplies (other than imports and inwards supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 and reflected in FORM GSTR-2A (table 3 & 5 only) shall be auto-populated in this table. This would be the aggregate of all the input tax credit that has been declared by the corresponding suppliers in their FORM GSTR-I. “[However, for FY 2023-24 onwards, the total credit available for inwards supplies (other than imports andinwards supplies liable to reverse charge but includes services received from SEZs) pertaining to the financial year for which the return is being furnished and reflected in table 3(I) of FORM GSTR-2B shall be auto-populated in this table.]”

- 8B: The input tax credit as declared in Table 6B and 6H shall be auto-populated here. 60[For FY 2017-18 and 2018-19, the registered person shall have an option to upload the details for the entries in Table 8A to 8D duly signed, in PDF format in FORM GSTR-9C ( 126[However, for FY 2024-25 onwards, the input tax credit as declared in Table 6B shall be auto-populated here)

- 8C: ITC on inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) received during 2017-18 but availed during April to September 2018: Aggregate value of input tax credit availed on all inward supplies (except those on which tax is payable on reverse charge basis but includes the supply of services received from SEZs) received during July 2017 to March 2018 but credit on which was availed between April to September 2018 shall be declared here. Table 4(A)(5) of FORM GSTR-3B may be used for filling up these details.

- 8D: “Aggregate value of the input tax credit which was available in FORM GSTR2A (table 3 & 5 only) but not availed in FORM GSTR-3B returns shall be computed based on values of 8A, 8B and 8C: However, there may be circumstances where the credit availed in FORM GSTR-3B was greater than the credit available in FORM GSTR-2A. In such cases, the value in row 8D shall be negative. 62[For FY 2017-18 and 2018-19, the registered person shall have an option to upload the details for the entries in Table 8A to Table 8D duly signed, in PDF format in FORM GSTR-9C (without the CA certification). ]”

- 8E & F: “The credit which was available and not availed in FORM GSTR-3B and the credit was not availed in FORM GSTR-3B as the same was ineligible shall be declared here. Ideally, if 8D is positive, the sum of 8E and 8F shall be equal to 8D.”

- 8G: IGST paid on import of goods (including supplies from SEZ): an Aggregate value of IGST paid at the time of imports (including imports from SEZs) during the financial year shall be declared here.

- 8H: The input tax credit 126[availed in the financial year] as declared in Table 6E shall be auto- populated here.

- Out of 8G, the input tax credit on Import of goods which is availed in next financial year shall be declared here.]

- Out of 8G, the input tax credit on Import of goods which is availed in next financial year shall be declared here.]

- 8H1: Out of 8G, the input tax credit on Import of goods which is availed in next financial year shall be declared here.]

- 8I: Difference (G-H-H1)

- 8J: ITC available but not availed on the import of goods (Equal to I)

- 8K: Total ITC to lapse in the current financial year (E + F + J): The total input tax credit which shall lapse for the current financial year shall be computed in this row.

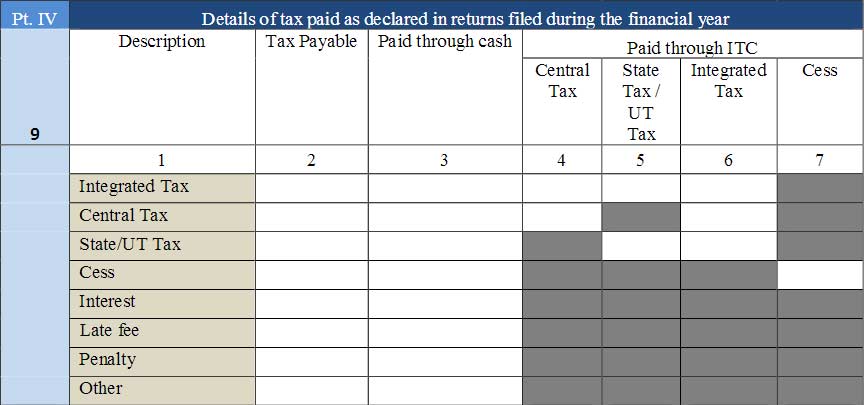

Part IV: Details of tax paid as declared in returns filed during the financial year

- 9. Details of tax paid as declared in returns filed during the financial year

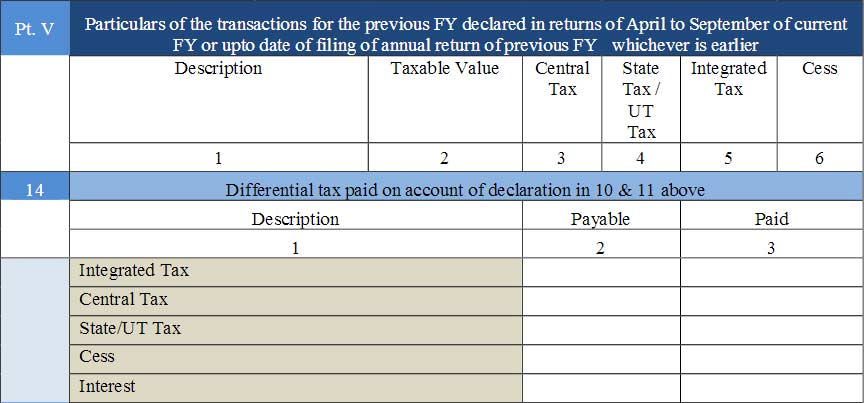

Part V: Part IV is the actual tax paid during the financial year. Payment of tax under Table 6.1 of FORM GSTR3B may be used for filling up these details. 7. 63[For FY 2017-18,] Part V consists of particulars of transactions for the previous financial year but paid in the FORM GSTR-3B 64[between April 2018 to March 2019]. 65[For FY 2018-19, Part V consists of particulars of transactions for the previous financial year but paid in the FORM GSTR-3B between April 2019 to September 2019]. 66[For FY 2019-20, Part V consists of particulars of transactions for the previous financial year but paid in the FORM GSTR-3B between April 2020 to September 2020.] 67[For FY 2020-21, Part V consists of particulars of transactions for the previous financial year but paid in the Form GSTR-3B between April 2021 to September 2021.] 68[For FY 2021-22, Part V consists of particulars of transactions for the previous financial year but paid in Form GSTR-3B 69[of April, 2022 to October, 2022 filed upto 30th November, 2022 114[For FY 2023-24, Part V consists of particulars of transactions for the previous financial year but paid in the FORM GSTR-3B of April, 2024 to October, 2024 filed upto 30th November, 2024 126[From FY 2024-25 onwards, Part V consists of particulars of transactions for the financial year for which annual return is furnished but declared in the FORM GSTR-3B filed for the months of April to October of next financial year, filed upto 30th November of next financial year.]]].] The instructions to fill Part V are as follows:

- 10 &11 [For FY 2017-18, ] Details of additions or amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of FORM GSTR-1 of April 71 [2018 to March 2019] shall be declared here. 72[For FY 2018-19, Details of additions or amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of FORM GSTR-1 of April, 2019 to September, 2019 shall be declared here.] 73[For FY 2019-20, Details of additions or amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of FORM GSTR-1 of April 2020 to September 2020 shall be declared here.] 74[For FY 2020-21, details of additions or amendments to any of the supplies already declared in the returns of previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of Form GSTR-1 of April 2021 to September 2021 shall be declared here.] 75[For FY 2021-22, details of additions or amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of FORM GSTR-1 of 76[April, 2022 to October, 2022 filed upto 30th November, 2022] shall be declared here.] 114[For FY 2023-24, details of additions or amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in Table 9A, Table 9B and Table 9C of FORM GSTR-1 of April, 2024 to October, 2024 filed upto 30th November, 2024 shall be declared here] [From FY 2024-25 onwards, for Table 10, details of supplies or tax increased through invoices or debit note or upward amendment of the same pertaining to the financial year but furnished in FORM GSTR-1 or as amended in FORM GSTR-1A or furnished through invoice furnishing facility of April to October of the next financial year, filed upto 30th November of next financial year shall be declared here. 126[From FY 2024-25 onwards, for Table 11, details of supplies or tax reduced through invoices or credit note pertaining to the financial year but furnished in FORM GSTR-1 or as amended in FORM GSTR-1A or furnished through invoice furnishing facility of April to October of the next financial year, filed upto 30th November of next financial year shall be declared here.]

- 12 [For FY 2017-18,] Aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April 78[2018 to March 2019] shall be declared here. Table 4(B) of FORM GSTR-3B may be used for filling up these details. 79[For FY 2018-19, Aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April 2019 to September 2019 shall be declared here. Table 4(B) of FORM GSTR-3B may be used for filling up these details. 80[For FY 2019-20, Aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April, 2020 to September, 2020 shall be declared here. Table 4(B) of FORM GSTR-3B may be used for filling up these details. For FY 2019-20, the registered person shall have an option to not fill this table.] 81[For FY 2020-21, aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April 2021 to September 2021 shall be declared here. Table 4(B) of FORM GSTR-3B may be used for filling up these details.] 82[For FY 2021-22, aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of 83[April, 2022 to October, 2022 upto 30th November, 2022] shall be declared here. Table 4(B) of FORM GSTR-3B may be used for filling up these details.] For 84[FY 2017-18, 2018-19, 85[2019-20, 2020-21 and 2021-22]]126[ For FY 2024-25 onwards, aggregate value of reversed ITC of the financial year which has been reversed through the return filed in next financial year filed upto 30th November, shall be declared here (This will not be part of Table 7). Table 4(B) of FORM GSTR-3B of next financial year may be used for filling up these details.], the registered person shall have an option to not fill this table.] 114[For FY 2023-24, aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April, 2024 to October, 2024 filed upto 30th November, 2024 shall be declared here. Table 4(B) of FORM GSTR-3B may be used for filling up these details]

- 13 [For FY 2017-18,] details of ITC for goods or services received in the previous financial year but ITC for the same was availed in returns filed for the months of April 87[2018 to March 2019] shall be declared here. Table 4(A) of FORM GSTR-3B may be used for filling up these details. However, any ITC which was reversed in the FY 2017-18 as per second proviso to sub- section (2) of section 16 but was reclaimed However, any ITC which was reversed in the FY 2018-19 as per second proviso to sub-section (2) of section 16 but was reclaimed in FY 2019-20, the details of such ITC reclaimed shall be furnished in the annual return for FY 2019-20. 89[For FY 2019-20, Details of ITC for goods or services received in the previous financial year but ITC for the same was availed in returns filed for the months of April, 2020 to September, 2020 shall be declared here. Table 4(A) of FORM GSTR-3B may be used for filling up these details. However, any ITC which was reversed in the FY 2019-20 as per second proviso to sub-section (2) of section 16 but was reclaimed in FY 2020-21, the details of such ITC reclaimed shall be furnished in the annual return for FY 2020-21.] 90[For FY 2020-21, details of ITC for goods or services received in the previous financial year but ITC for the same was availed in the returns filed for the month of April 2021 to September 2021 shall be declared here. Table 4(A) of FORM GSTR-3B may be used for filling up these details. However, any ITC which was reversed in the FY 2020-21 as per second proviso to sub-section (2) of section 16 but was reclaimed in FY 2021-22, details of such ITC reclaimed shall be furnished in the annual return for FY 2021-22.] 91[For FY 2021-22, details of ITC for goods or services received in the previous financial year but ITC for the same was availed in returns filed for the months of 92[April, 2022 to October, 2022 upto 30th November, 2022] shall be declared here. Table 4(A) of FORM GSTR-3B may be used for filling up these details. However, any ITC which was reversed in the FY 202122 as per second proviso to sub-section (2) of section 16 but was reclaimed in FY 2022-23, the details of such ITC reclaimed shall be furnished in the annual return for FY 2022-23.] For 93[FY 2017-18, 2018-19, 94[2019-20, 2020-21 and 115[2021-22, 2022-23 and 2023-24]]], the registered person shall have an option to not fill this table.] 114[For FY 2023-24, details of ITC for goods or services received in the previous financial year but ITC for the same was availed in returns filed for the months of April, 2024 to October, 2024 filed upto 30th November, 2024 shall be declared here. Table 4(A) of FORM GSTR3B may be used for filling up these details. However, any ITC which was reversed in the FY 2023-24 as per second proviso to subsection (2) of section 16 but was reclaimed in FY 2024- 25, the details of such ITC reclaimed shall be furnished in the annual return for FY 2024-25]

- 14 Differential tax paid on account of declaration in 10 & 11 above

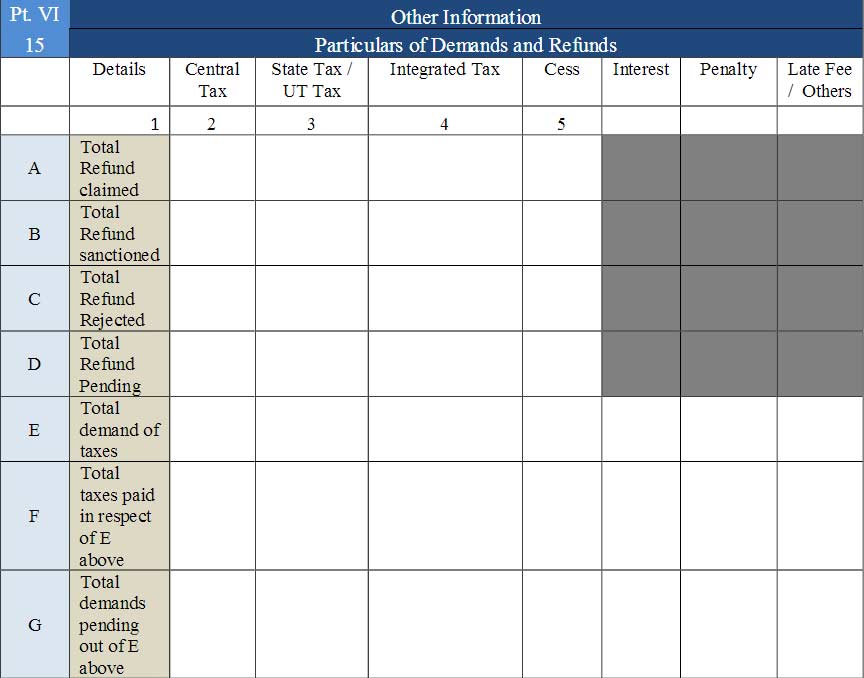

Part VI: Other Information

- 15A, 15B, 15C, and 15D: Particulars of Demands and Refunds: An aggregate value of refunds claimed, sanctioned, rejected and pending for processing shall be declared here. Refund claimed will be the aggregate value of all the refund claims filed in the financial year and will include refunds which have been sanctioned, rejected or are pending processing. Refund sanctioned means the aggregate value of all refund sanction orders. Refund pending will be the aggregate amount in all refund applications for which acknowledgement has been received and will exclude provisional refunds received. These will not include details of non-GST refund claims.

- 15E, 15F, and 15G: Total demand of taxes, Total taxes paid in respect of above, Total demands pending out of E above: An Aggregate value of demands of taxes for which an order confirming the demand has been issued by the adjudicating authority shall be declared here. The aggregate value of taxes paid out of the total value of confirmed demand as declared in 15E above shall be declared here. The aggregate value of demands pending recovery out of 15E above shall be declared here.

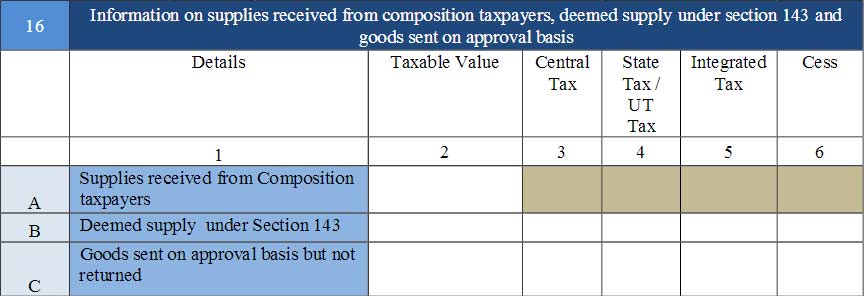

- 16. Information on supplies received from composition taxpayers, deemed supply under section 143 and goods sent on the approval basis

- 16A Supplies received from Composition taxpayers: An aggregate value of supplies received from composition taxpayers shall be declared here. Table 5 of FORM GSTR-3B may be used for filling up these details.

- 16B Deemed supply under Section 143: an Aggregate value of all deemed supplies from the principal to the job-worker in terms of sub-section (3) and sub-section (4) of Section 143 of the CGST Act shall be declared here.

- 16C Goods sent on an approval basis but not returned: an Aggregate value of all deemed supplies for goods which were sent on an approval basis but were not returned to the principal supplier within one eighty days of such supply shall be declared here.

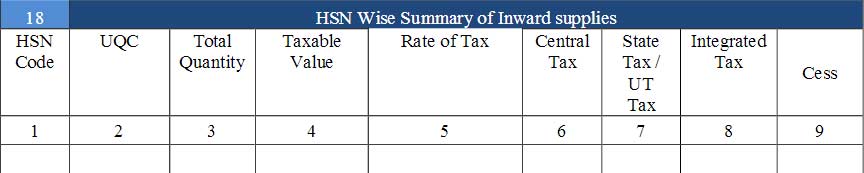

- 17. HSN Wise Summary of outward supplies and 18. HSN Wise Summary of Inward Supplies: Summary of supplies effected and received against a particular HSN code to be reported only in this table. It will be optional for taxpayers having annual turnover upto ₹ 1.50 Cr. It will be mandatory to report HSN code at two digits level for taxpayers having annual turnover in the preceding year above ₹ 1.50 Cr but upto ₹ 5.00 Cr and at four digits‘ level for taxpayers having annual turnover above ₹ 5.00 Cr. 110 [From FY 2021-22 onwards, it shall be mandatory to report HSN code at six digits level for taxpayers having annual turnover in the preceding year above ₹ 5.00 Cr and at four digits level for all B2B supplies for taxpayers having annual turnover in the preceding year upto ₹ 5.00 Cr.] UQC details to be furnished only for supply of goods. Quantity is to be reported net of returns. Table 12 of FORM GSTR1 114[as amended by FORM GSTR-1A] may be used for filling up details in Table 17. It may be noted that this summary details are required to be declared only for those inward supplies which in value independently account for 10 % or more of the total value of inward supplies. 111 [For 112 [FY 2017-18, 113 [2018-19, 2019-20 and 115[2021-22, 127[2022-23, 2023-24 and 2024-25,]]]], the registered person shall have an option to not fill this table.] 114[For FY 2021-22, the registered person shall have an option to not fill Table 18.]

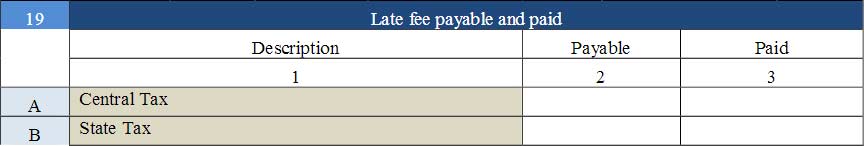

- 19. Late fee payable and paid: Late fee will be payable if the annual return is filed after the due date. “Towards the end of the return, taxpayers shall be given the option to pay any additional liability declared in this form, through FORM DRC-03. Taxpayers shall select “Annual Return” in the drop-down provided in FORM DRC-03. It may be noted that such liability can be paid through electronic cash ledger only.]”

General Queries on GSTR 9 Form

Q.1 What are the rules and regulations for filing GST Annual Return?

The rules and regulations for filing the annual GST return which is referred to as GSTR-9 are controlled by the CGST Act u/s 35(5) and 44(1). According to Section 44(1) of the CGST Act, with Rule 80 (1) of CGST rules indicates to every registered person excluding.

- Taxpayers opting for composition scheme

- Casual Taxable Person

- Non-resident taxable persons

- Persons paying TDS

- Input service distributors

Q.2 What is the last date for filing the GST Annual Return?

The person who is registered under the GST must submit the GST annual return digitally in form GSTR-9 on or before 31 December after the end of every fiscal year.

Q.3 Who can apply for the GST Tax Audit?

All the rules about the Tax audit are discussed u/s 35(5) of the CGST Act. Every person registered under GST with a turnover during the fiscal year above the threshold limit i.e. Rs 2 crore must-

- Get his/her fiscal statements audited by a cost accountant or a chartered accountant

- Submit a copy of the annual GST audit report

- The reconciliation statement u/s 44(2)

- Other documents like this can be determined

Q.4 In the case of a tax audit, how will the annual GST return be filed?

Pre-requisites for the filing of Form GSTR-9A are:

- Through Form GSTR 9C, the annual return must be filed in case of the tax audit which is also known as the annual audit form

Q.5 What is the Reconciliation statement in the GST Audit?

With the annual audit form GSTR 9C, the taxpayer must also submit a reconciliation statement along with the GST audit certification. The reconciliation statement is the extra details given with GSTR 9C, which confirms the reconciliation of data according to the GST annual return as per the accounts book and data.

Q.6 Who should file GSTR-9?

Every person who has registered under the GST has to file the GSTR-9 according to Section 44(1) of the CGST Act 2017. Therefore, despite Annual Turnover, all the registered individuals under the GST must complete the procedure of the annual GST Return Filing.

Q.7 Who should not file GSTR-9?

As per Section 44(1) of CGST Act-2017 taxpayers that should not file the GSTR-9 are-

- Input Service Distributor

- TDS deductor u/s 51 (TDS)

- TCS collector u/s 52 (TCS)

- Casual taxable person

- NRI Taxpayer

Q.8 Can GSTR-9 be filed even in the case of Nil Turnover?

Yes, all registered individuals will have to file GSTR-9 as per their turnover. But, during the Nil turnover, the GSTR-9 can be submitted with one click.

Q.9 – Matching input GST with 2A before filing GSTR 9 is mandatory?

Yes, GSTR-2A for FY 2017-18 to FY 2022-23 & GSTR 2B for FY 2023-24 onwards data with the input tax credit accounted in your books of accounts data before filing GSTR-9 need to be reconciled.

How to File GSTR 9 in Hindi By Gen GST Software