The GSTR-8 return form is filed by e-commerce companies each month. E-commerce companies are registered under the GST regime compulsorily and obtain the registration under tax collection source(TCS).

It includes the supplies made by the E-commerce platform to the registered, unregistered customer, tax paid, and tax payable. E-commerce operator files the form detailing the amount of tax collected at source from sellers. The GSTR 8 form is also available in PDF format, download and view here.

- GSTR 8 Form Features

- GSTR 8 Due Date

- GSTR 8 Important Terms

- Interest on Late Payment

- Simple Procedure to File GSTR 8

Latest Update in GSTR 8

- “CBIC new notification no 06/2025 for extending the due date for furnishing FORM GSTR-8 for December 2024”. Read More

- The new GSTR-8 advisory reduces the rate from 1% to 0.5% effective from 10 July 2024. View more

- Central Board of Indirect Taxes and Customs has issued GST notification number 8/2022 related to waive-off interest for form GSTR 8 Non-filing through E-Commerce operators. read more

New Facilities for TCS & Composition Taxpayers Under GSTR 8

Procurement to develop the amendment, multiple times, in Table 4 of Form GSTR-8

- Previously, if no step was exercised on TCS features, auto-populated in TDS/TCS credit form, through the supplier either if the corresponding were refused by them in the said form, the TCS (e-commerce operators) could improve the details individually once.

- Based upon applications collected from stakeholders, the confinement of changing the transaction particulars only once, in table 4 (i.e. amendment table) of Form GSTR-8, has now been eliminated.

- Therefore, features of table 4 (i.e. amendment table) of Form GSTR-8, can now be altered many times, by e-commerce operators likely to accumulate tax at the reference below section 52, while filing their Form GSTR-8

TCS facilities elongated to composition taxpayers

- The taxpayers below the composition policy have allowed delivering supplies through E-Commerce Executives, e.g. Restaurant Services will now be capable to see and initiate important steps in their TDS/TCS credit collected form

- E-commerce executives would presently be able to add GSTIN of such composition suppliers, in their Form GSTR-8 and file the Form

- The volume of tax obtained at the origin, reported by E-Commerce executives in their Form GSTR-8, will soon be populated to ‘TDS /TCS credit received’ form of particular composition taxpayers

- The amount so proclaimed by e-commerce executives will immediately be accessible to individual composition taxpayers, for admitting or refusing the similar one, in their ‘TDS and TCS credit received’ form

- For accepted transactions, the amount will be credited to the cash ledger of composition taxpayers, post successful filing of ‘TDS/ TCS Credit received’ form

- For declined transactions, the amount would be displayed to e-commerce executives for fixing it

Eligibility for E-commerce TCS Deduction Under GST

Central Board of Indirect Taxes and Customs (CBIC) cleared that entities having aggregate turnover lower than INR 20 lakhs (or INR10 lakhs in case of specified special category states) in a particular financial year are exempted from having compulsory registration.

E-commerce Operator Under GST Regime

According to section 43B(d) of the Model GST Law, E-commerce is the platform that allows an online market for different vendors and customers to supply and receive goods and services. To file GSTR-8 electronically through a common portal, an e-commerce operator is needed to be registered under GST.

Salient Features of GSTR-8 Return Form

- GSTR-8 is filed every registered E-commerce operator

- Every E-commerce operator file it before the 10th of the next month of tax period mandatorily

- The details of the GSTR-8 filed by the e-commerce operator is available in part D of GSTR 2A to the concerned taxable persons

- GSTR- 8 has 8 headings. Most of them are auto-populated

- E-commerce platforms deduct the Tax collection at source(TCS) from the supplier of the goods and services and return to the government

- E-commerce operators pay 1% TCS on all the goods and services sold out through their platforms

GSTR-8 Eligibility & Due Dates

- GSTR-8 should be furnished by E-commerce operators every month. The definition under section 43(d) includes the details regarding who should be called E-commerce operators

- e-commerce operator can file the GSTR-8 after the month is completed and the last date to furnish the details is the 10th of the succeeding month of the tax period.

The due dates for filing GSTR-8 are as follows:

| GST Return | Due Date |

|---|---|

| January 2026 | 10th February 2026 |

| December 2025 | 10th January 2026 |

| November 2025 | 10th December 2025 |

| October 2025 | 10th November 2025 |

| September 2025 | 10th October 2025 |

| August 2025 | 10th September 2025 |

| July 2025 | 10th August 2025 |

| June 2025 | 10th July 2025 |

| May 2025 | 10th June 2025 |

| April 2025 | 10th May 2025 |

| March 2025 | 10th April 2025 |

| February 2025 | 10th March 2025 |

| January 2025 | 10th February 2025 |

| December 2024 | 12th January 2025 |

Important Terms Related To GSTR-8

- GSTIN: Goods and Services Taxpayer Identification Number

- UIN: Unique Identification Number

- UQC: Unit Quantity Code

- HSN: Harmonised System of Nomenclature

- SAC: Services Accounting Code

- POS: Place of Supply of Goods and Services

- B2B: from one registered person to another registered person

- B2C: from registered person to unregistered person

Interest on Late Payment of GST & Penalty of Missing the GST Return Due Date

According to the GST council rules and regulations, each subsequent late payment of taxes will accrue 18 percent interest on the GST tax payable starting from due date till the taxes are paid. You can read detailed interest guides in chapter 10, point 50 here: https://cbec-gst.gov.in/CGST-bill-e.html

For Example: If a taxpayer misses the deadline for GST tax payment then there will be interest calculations commencing from the due date i.e. 1000*18/100*1/365= Rs. 0.49 per day approx.

(Rs. 1000 is the assumed tax payment) (18% per annum is the interest rate) (1 day delayed by the taxpayer)

If taxpayers miss the deadline of GSTR filing according to the due dates stated by the GST council then there is a penalty of Rs. 25 for CGST and Rs. 25 for SGST per day (maximum Rs.5000) starting from the due date till the filing is done.

Step by Step Procedure to File GSTR-8 for TCS Taxpayers

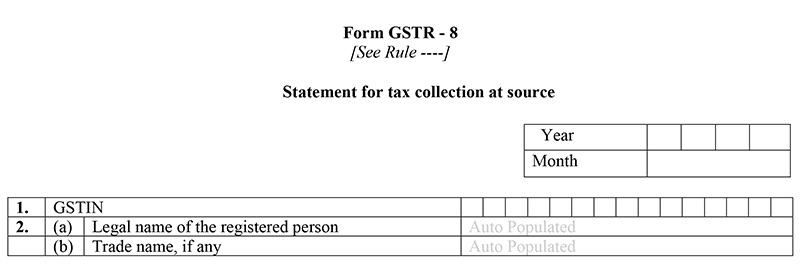

Table 1&2: Details of Taxpayer

- GSTIN: GSTIN stands for Goods and Services Taxpayer Identification Number. The GSTIN is a 15-digit number includes 2-digit state code,10-digit permanent account number, and 3-digit includes state, future use, and check-digit. It is auto-populated when we file returns

- Name of Taxpayer: This is the name of a taxpayer and this field is also auto-populated at the time of return filing. There is separate option to file the Trade Name if applicable

- Month-Year(Period): The taxpayer requires to choose the date from drop down for which month and year for which GSTR-8 is being filed

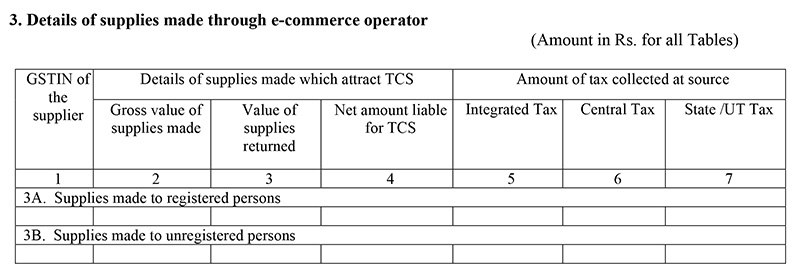

Table 3: Details of supplies

- 3A-Fill the details of supplies made through the E-commerce portal to the registered person

- This field is for supplies made through the portal between B2B. Here taxpayer fills the details of the registered supplier who supplies goods and services to registered customers using the portal. It includes GSTIN of the merchant, the gross value of the supply made, the value of supply returned, and net amount reliable to tax

- 3B-fill the details of supplies made through e-commerce portal to the unregistered person

- The supplies made between the registered seller and unregistered taxpayer are to be furnished here. It includes all the same field as B2B transaction like GSTIN, the gross value of supply made, the value of returned supply, and other taxes

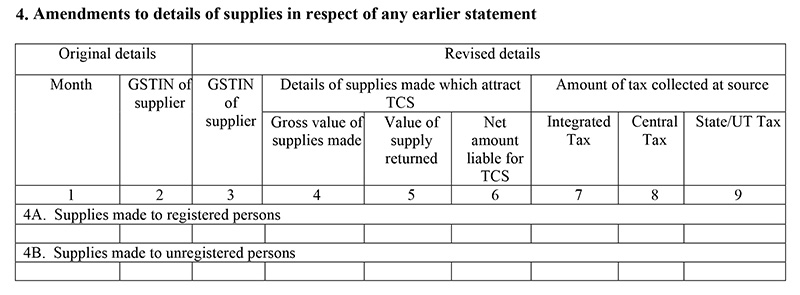

Table 4: Any amendments to supplies made through e-commerce operator to registered or unregistered person

- 4A- amendments in table 3A of GSTR-8

- If there is any modification under in B2B transaction supplies made through the e-commerce portal during the previous month, the taxpayer can edit the details using the e-commerce portal under Section 4A of the GSTR-8

- 4B- amendments in table 3B of GSTR-8

- If there is any modification under in B2C transaction supplies made through e-commerce portal during the previous month, it can be edited under section 4B of GSTR-8

- Amount of tax collected at source

- The e-commerce operators furnish this head with detailing of an amount of tax collected at source by B2B and B2C transactions. This is the important heading to be furnished by merchant based on supplies made during the month. It includes integrated tax, central tax, and state/UT tax

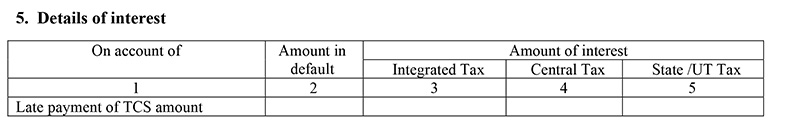

Table 5: Details of Interest

- This field is auto-populated by the above headings and calculate the Tax collected at source, interest on delayed payment of TCS, and the fee for late filing

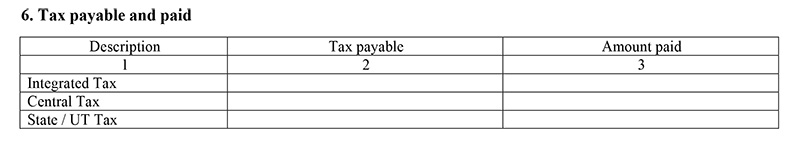

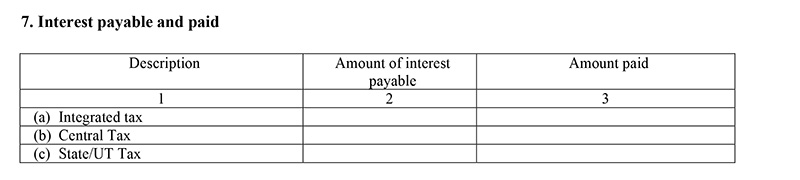

Table 6&7: Interest/Tax payable and paid

- This field is auto-populated after filling the above details and shows the details about the tax, Interest, and fees paid or payable to the state and central government

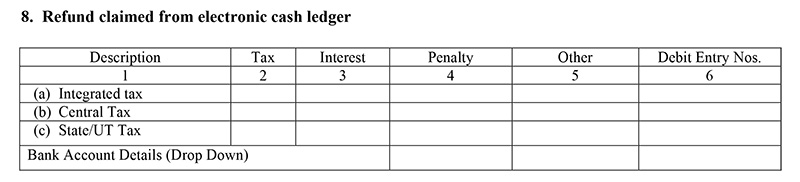

Table 8: Refunds claimed from electronic cash ledger

- This head is furnished with the refund details claimed from electronic cash ledger and bank account details. This is auto-populated from the previous headings

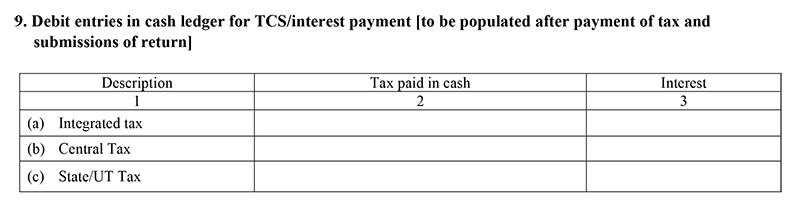

Table 9: Debit entries in cash ledger for TCS/interest payment (to be populated after payment of tax and submission of return)

- This field is auto-populated after the payment of returns. It includes tax paid in cash and interest payment to the taxpayers

After furnishing all the information, the taxpayers need to sign electronically to authentic the details filled.