The GSTR-7 is the GST return form for filing the returns for the tax deducted at source. The form is to be filed by 10th of the next month for a particular tax period, by all the eligible taxpayers who deduct tax at source. Normal taxpayers have to file the details of outward supplied using GSTR 1 form while the composition scheme taxpayers will use GSTR 4 form to file their quarterly returns and pay taxes.

- GSTR 7 Form Features

- GSTR 7 Eligibility and Due Date

- Who is Required to Deduct TDS?

- Simple Guide to File GSTR 7

- Interest on Late Payment

- GSTR 7 Filing By Gen GST Software

In this article, we will discuss a step-by-step procedure for filing GSTR 7 form for TDS. But before that, you need to know some basic things about the TDS and GSTR 7 Form.

Latest Update in GSTR 7

- The GSTN has issued an advisory on the GST portal regarding the reporting of invoices in the GSTR-7 form. read more

- The GSTN has issued a new advisory related to the implementation of invoice-wise reporting in the GSTR-7 form. View more

- “CBIC new notification for extending the due date for furnishing FORM GSTR-7 for the month of December 2024”. Read PDF

The new advisory mandates sequential filing of GSTR-7 for taxpayers, as per Notification No. 17/2024. View More - Advisory No. 551 pertains to reporting the consolidated amount of TDS by scrap dealers for October 2024. View more

- 53rd GST Council Meeting Update: “The Council recommended that return in form GSTR-7, to be filed by the registered persons who are required to deduct tax at source under section 51 of CGST Act, is to be filed every month irrespective of whether any tax has been deducted during the said month or not. It has also been recommended that no late fee may be payable for delayed filing of Nil form GSTR-7 return. Further, it has been recommended that invoice-wise details may be required to be furnished in the said form GSTR-7 return.”

Features of GSTR 7 Form

- TDS is required to be deducted by certain registered taxpayers while making payments to the supplier. It will be deposited to the government. No TDS will be deducted when the supplier location and place of supply is different from the registration place (State) of the recipient

- The form is to be filed monthly by 10th of the month for an immediately preceding tax period

- The GSTR 7 form is to be filed only by specific taxpayers and not by all registered taxpayers

- It will contain the details of the tax deducted at source

- This return cannot be filed without full payment of previous tax liability

- The details furnished by a TDS receiver in his GSTR-7 form will be available to his/her respective suppliers in Part C of the GSTR-2A Form

- GSTR-7A Form will be issued a TDS certificate to the deductee (from whom tax is deducted) upon the successful filing of this form

- All the amount in the form will be in rupees (INR)

GSTR-7 Eligibility and GST Due Dates

Any registered taxpayer who levies the tax at source under section 37 of the GST Act will have to file a TDS return in Form GSTR-7 at the GST Portal.

The due dates for filing GSTR-7 are as follows:

| Return Monthly | Due date |

|---|---|

| February 2026 | 10th March 2026 |

| January 2026 | 10th February 2026 |

| December 2025 | 10th January 2026 |

| November 2025 | 10th December 2025 |

| October 2025 | 10th November 2025 |

| September 2025 | 10th October 2025 |

| August 2025 | 10th September 2025 |

| July 2025 | 10th August 2025 |

| June 2025 | 10th July 2025 |

| May 2025 | 10th June 2025 |

| April 2025 | 10th May 2025 |

| March 2025 | 10th April 2025 |

| February 2025 | 10th March 2025 |

| January 2025 | 10th February 2025 |

| December 2024 | 12th January 2025 |

Tax-paying Entities Who Require to Deduct TDS Under GST:

- A department or establishment of the Central or State Government, or

- The local authority, or

- Governmental agencies, or

- Persons or category of persons as may be notified, by the Central or a State Government on the recommendations of the Council.

Also according to the Notification No. 33/2017 Central Tax, 15th September 2017. The listed entities also required to deduct TDS-

- An authority or a board or any other body set up by Parliament or a State Legislature or by a government, with 51% equity ( control) owned by the government

- A society established by the Central or any State Government or a Local Authority and the society is registered under the Societies Registration Act, of 1860

- Public sector undertakings

All the mentioned deductor needs deduct the TDS where the total value of supply under the project surpasses the value of Rs 2.5 Lakhs. While the rate for TDS deduction is 2% (CGST 1% + SGST 1%) in case of intrastate supply and 2 % (IGST) in case of interstate supplies.

Also to note that the TDS is not subject to be deducted when the location of the supplier and place of supply does not match the registration place (State) of the recipient.

Procedure for Filing GSTR-7 Form

The GSTR 7 Form has 8 tables that furnish different details related to the tax deducted at source. Follow the procedure below to understand the filing process.

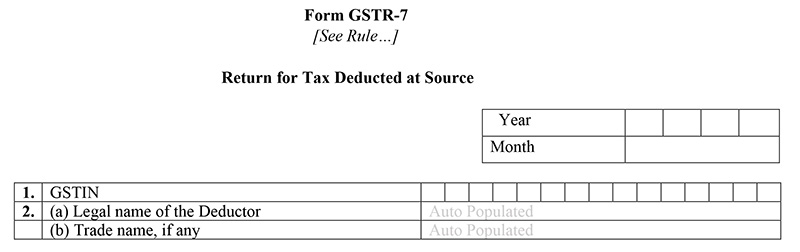

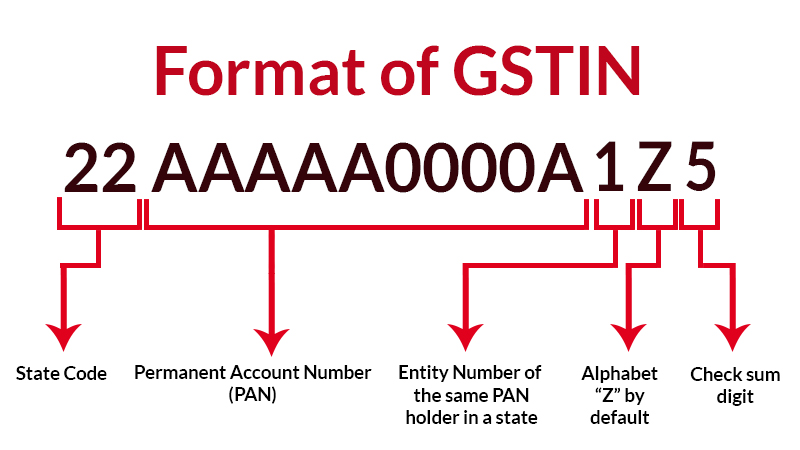

Table 1 and 2: Contain the GSTIN number, legal name and trade name of deductor

- GSTIN: It is the unique GST Identification Number assigned to each registered taxpayer

- Legal name of the Deductor: The name of the registered person who deducts the tax

- Trade Name: Name of the business of the Deductor, if any

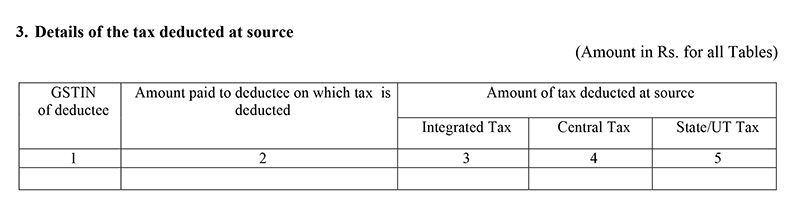

Table 3: Details of the tax deducted at source

- This table is to contain the details of the tax deducted at the source by the eligible Deductor. It will contain the GSTIN of the deductee, total amount and TDS amount (integrated/central/state tax)

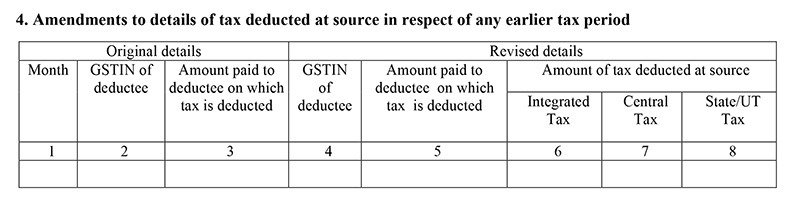

Table 4: Amendments to details of tax deducted at source in respect of any earlier tax period

- It will contain details of the amendments/changes in the previously supplied TDS details for earlier tax months

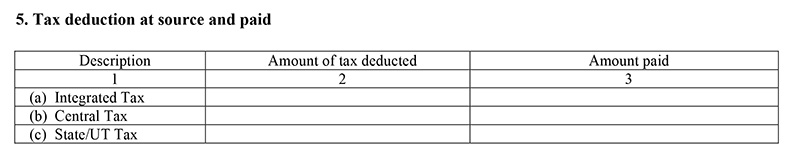

Table 5: Tax deduction at source and paid

- Furnish the details of the tax (integrated/central/state) amount deducted from the deductee and the tax (integrated/central/state) an amount paid to the government

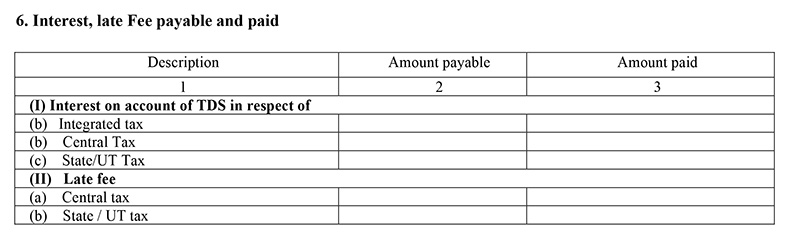

Table 6: Interest, late Fee payable and paid

- If there is any interest and/or late fee liable on the TDS amount, furnish the details of the same in this table along with the details of the amount paid

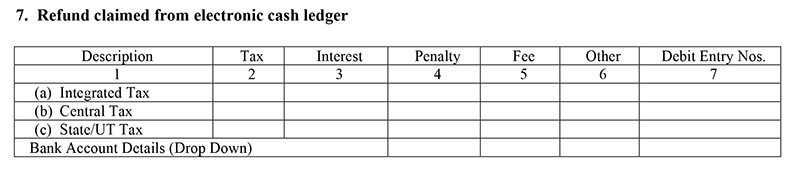

Table 7: Refund claimed from electronic cash ledger

- Provide the details of any refund you may have claimed from your electronic cash ledger on the payment of TDS

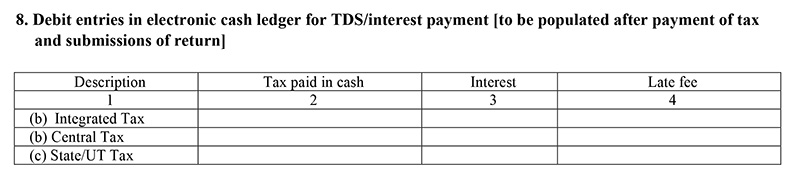

Table 8: Debit entries in electronic cash ledger for TDS/interest payment [to be populated after payment of tax and submissions of return]

Once you finish filing the return and make the payment of the tax deducted at source (TDS + interest) to the government, the details of the same will automatically appear in your electronic cash ledger.

At the bottom, the user needs to provide his/her digital signature to verify the correctness Deductor of the provided information.

Terms Used in GSTR-7 Form

- GSTIN: Goods and Services Tax Identification Number

- TDS: Tax Deducted at Source

- Deductor: the person who deducts the tax

- Deductee: the person from whom the tax is deducted

Interest on Late GST Payment & Missing GSTR Due Date Penalty

GST Council has introduced rules and regulations for filing the late return or missing the tax payment due dates to unify the system flawlessly. According to the Act, each late payment is liable to attract 18 percent interest per annum on the payable tax from the due date to the date of paying the tax.

The detailed information regarding the same is covered under point 50 of chapter 10 here: https://cbec-gst.gov.in/CGST-bill-e.htmlDeductor

The simplified example of understanding the late payment fee and penalty: Suppose, a taxpayer whose taxable amount is 1000 Rs. missed out the due date for tax payment in a particular month and wants to pay off the dues after 1 day. In that case, the calculation will be like this: 1000*18/100*1/365= Rs. 0.49 per day (here, 18% is the interest accrued on taxable amount)

If he missed out for more than one days then the calculation will be multiple of 4.93 Rs.

Instead of missing the due dates of tax payment, if the taxpayer misses the return filing dates, they are liable to pay Rs. 25 for CGST and Rs.25 for SGST per day till the filling is done. Here, the maximum cap for the penalty is Rs. 5,000 till the taxpayer file the returns.

FAQs on GSTR 7 Form for TDS Deductor

Q.1 – What are the steps to download GSTR 7?

Steps to download GSTR 7 from the GST Portal:

Login to the Portal by entering your credential > Click on TDS Certificate > fill in the details as asked (financial year, GSTIN) > select search > Download.

Q.2 – What is the significance of GSTR 7?

Form GSTR 7 has to be filed by the person deducting TDS mentioning every information related to the income and TDS deduction. The final Tax Deduction Certificate is achieved by the deductee based on the information entered in GSTR 7.

Q.3 – What is the penalty for delay in filing GSTR 7?

Rs. 200 per day is charged from the taxpayer until the delay by him continues. 100 is deducted under CGST and Rs. 100 under SGST.

Q.4 – Is it possible to revise the filed Form GSTR 7?

There is no way to revise Form GSTR 7 once it is filed. Any discrepancy, mismatch or error can be sorted in the returns filed for the consecutive month.

Q.5 – Why is GSTR 7 filed by the TDS deductor?

ITC benefits on the TDS can be claimed by the deductee based on Form GSTR 7 and the same can be used as payment of other tax liabilities. The amount of TDS deducted is even mentioned in deductee’s GSTR 2A (purchase-related return) which is filed post the filing of GSTR 7. It is even mandatory to provide the certificate of TDS deduction to the deductee in his/her form GSTR 7A for the information filed in GSTR 7.

Q.6 – What is the prescribed deadline for filing GSTR 7?

As directed by the legal administration, the last date for filing GSTR 7 is the 10th of the succeeding month.

Q.7 – I am a TDS deductor. How can I file my GSTR 7 form online?

You can get access to form GSTR 7 from the official GST Portal by entering valid credentials. Once you are logged in the portal go to ‘Returns Dashboard’.

Services > Returns > Returns Dashboard.

Q.8 – Can I use any offline utility for filing GSTR 7?

Yes, you can opt for the offline utility as well for filing GSTR 7 returns.

Q.9 – Is it possible to extend the deadline for filing GSTR 7?

Yes, it is possible that the date of filing GSTR 7 is extended only when it is confirmed by the Government through official notice.

Q.10 – Are there any prerequisites for filing GSTR 7?

Below are the prerequisites for filing Form GSTR-7:

- The person deducting the tax should be a registered Tax Deductor and also have a valid GSTIN

- Tax Deductor should log in with his own valid credentials on the GST portal

- The Tax Deductor should own a digital signature and should authorize the form by entering his non-expired and valid signature in case he is filing the form online

- Tax Deductor has made the payment or credited the amount to the supplier’s account

Q.11 – I want to discharge my TDS liability. Can I do so?

Yes, the deductee can discharge his tax liabilities by debiting an Electronic Cash Ledger at the time of filing the returns.

Q.12 – Being a deductor, the TDS credit entered by me is final or the deductee can act upon the data filed by me?

Data is filed by the deductor but it is in the hands of the deductee to accept/reject the TDS and TCS credit details auto-populated in his/her returns. The approval of the deductee is mandatory for crediting the TDS to cash ledger.

Q.13 – When will the TDS credit amount be received by the deductor in his ECL?

he deductee will receive the TDS amount in his Electronic Cash Ledger once he accepts that the TDS and TCS credit information auto-populated in his returns is true and files his return forms.

Q.14 – What are the consequences of the rejection of TDS credit entry by the deductee?

The entries rejected by the deductee will be auto-populated in Table 4 of GSTR 7 and is required to be revised by the deductor in his next GSTR filing. Once the details are revised in GSTR 7, the data will be redirected to the deductee for finally accepting or rejecting it. The process goes on until the details are thoroughly confirmed by the deductee.

Q.15 – Is it mandatory to file GSTR 7 for the tax period when TDS is not deducted?

There is no obligation on filing a nil return if you haven’t deducted the TDS for a particular tax period.

Q.16 – How can I digitally sign Form GSTR 7?

- One can easily sign the digital GSTR 7 form by either using DSC or EVC

- DSC or Digital Signature Certificate is an electronic certificate used as proof while authenticating any digital documents. The certificate is issued only by the Legally Authorised Bodies

- The GST Portal accepts only PAN based Class II and III DSC

Please Note: For obtaining a DSC one can put an application on http://www.cca.gov.in/cca/?q=licensed_ca.html

- EVC or The Electronic Verification Code authenticates the unique identity of the form filer on GST Portal by generating an OTP

- The OTP is directed to the registered mobile phone of Authorized Signatory filled in part-A of the Registration Application

Q.17 – Can I take a preview of GSTR 7 before finally submitting it?

Yes, there is a feature for reviewing the form. One can review the form and make amendments (if any) before finally submitting it. The form can be reviewed by clicking on the ‘Preview Draft’ option on the GST portal.

Q.18 – How do I come to know that Form GSTR 7 is successfully filed?

the filer comes to know the status of his Form GSTR 7 when,ARN is generated against successfully his/her filed compliance. The intimation is granted by tax authorities regarding the successful filing of GSTR 7 either by email or via SMS sent to the registered ID or mobile number of the applicant.

government department purchase stationery, in that stationery bill can be deduction of GST OR not, if deduction how much deduction pls inform.

DEAR SIR.

1) GSTR 7 FILE KARNE KE BAD 7A AUTO GENERATE THAY ????

2) AND HAM GSTR 7 NILL FILE KARE TO HAME 7A GENARATE KARNA PADTA HE??

Does a Party filing GSTR 7 need to file GSTR 3B?

No

Hi expert,

My query is a government entity that has regular taxpayer GST Number he deducted TDS to suppliers. whether obtain a new GST number ?????

Dear Sir, Which amount we will fill in Table 3 & 4. Then Details of the tax deducted at sources in this column, which amount I have filled

The amount on which tax deducted at source

i already filed GSTR 7 in april 30,2020 some bills received for provision how can file GST TDS ammended details with GSTR 7 June 2020

You can file the same in Next tax period

Sir, we have filed GSTR-7 for the month of jun-30 one of the party’s TDS amount is correct but taxable value amount instead of INR 2730448 we have entered INR 1730448 but the deductee has taken the action and filed…. how to correct our taxable value in GSTR-7 for the month of Jun-20

It can be amended in the next period return only

WHEN FILING TDS RETURN GSTR 7, IF TDS MADE OF PARTY BUT HAS NO GSTN THEN HOW TO FILE GSTR 7

What is the easy way of filling the GSTR 7 to a deductee? please share with us.

With the help of our software you can file GSTR-7 in an easy way