GSTR 6 Return form for all the input service distributors who have registered under the Goods and Services Tax (GST). Every Input Service Distributor (ISD) will require to furnish the details of invoices in GSTR- 6 form at the GSTN portal. After correcting, modifying, removing and adding the details of form GSTR-6A, the GSTR 6 is furnished and most of the information is auto-populated. The details of the received credit taken from different invoices are covered under GSTR 6.

- GSTR 6 Features

- Who is Required to File GSTR 6?

- What is the Input Service Distributor?

- How to File GSTR 6 Return?

- General Queries on GSTR 6 Form

Due Date of the GSTR 6 Form

The due date of the GSTR 6 form is 13th March 2026 for February 2026. Form GSTR 6 is now available to fill outfor Input Service Distributors (ISDs) on the GST official portal.

| Period | Last Date of Filing |

|---|---|

| February 2026 | 13th March 2026 |

| January 2026 | 13th February 2026 |

| December 2025 | 13th January 2026 |

| November 2025 | 13th December 2025 |

| October 2025 | 13th November 2025 |

| September 2025 | 13th October 2025 |

| August 2025 | 13th September 2025 |

| July 2025 | 13th August 2025 |

| June 2025 | 13th July 2025 |

| May 2025 | 13th June 2025 |

| April 2025 | 13th May 2025 |

| March 2025 | 13th April 2025 |

| February 2025 | 13th March 2025 |

| January 2025 | 13th February 2025 |

| December 2024 | 15th January 2025 |

Note: Due date for issuing some sort of notice, approval order, notification, furnishing of return, filing of an appeal, forms, sanction order, applications, statements, reports, or any type of documents, As well as the time limit for any type of compliance under laws of GST where the initial time limit is ending in between March 20th, 2020 to June 29th, 2020 will be extended to June 30th, 2020. Read Press Release

Latest Update in Form GSTR 6

- “CBIC new notification for extending the due date for furnishing FORM GSTR-6 for December 2024”. read PDF

- “Extension in dates of various GST Compliances for GST Taxpayers” Read more

- “Delinking of Credit Note/Debit Note from the invoice, while reporting them in Form GSTR 1/GSTR 6 or filing Refund”. Read More

Data in SAVE Stage for Input Service Distributors (ISDs)

- “Changes are being made in the credit utilization criteria in Form GSTR-6, filed by Input Service Distributors (ISDs). These changes are likely to be implemented on the GST portal with effect from 14.04.2020.”

- “During the implementation of this change, any data which is lying in Form GSTR-6 of ISDs, in saved stage, will be lost. Thus, if there is some data, filled up in Form GSTR-6 and is in saved stage (which is not Submitted so far), that data will not be available to ISD, in their Form GSTR 6, for its further use. ISD will be required to fill up this data (which was in the saved stage and now lost due to implementation of change) again in their Form GSTR 6.”

- “All the Input Service Distributors (ISDs) are, therefore, requested to take note of this and take suitable action accordingly.”

Salient Features of GSTR 6 Return Form

- The form GSTR 6 is filled by all the Input Service Distributors who are registered under the Goods and Service Tax (GST)

- It should be filled by the 13th of the succeeding month

- The taxpayer is required to furnish the details of tax invoices on which the credit has been received

Who Should File GSTR 6

All the Input Service Distributors required to file the return excluding:

- Composition Dealers

- Taxpayers liable to collect TCS

- Taxpayers liable to deduct TDS

- Suppliers of OIDAR (Online Information and Database Access or Retrieval)

- Compounding taxable person

- Non-resident Taxable Person

Definition of Input Service Distributor

Input Service Distributor works as an intermediary between the manufacturer businesses or final product producers. According to Rule 2(m) of Cenvat Credit Rules, 2004:

- ISD is the office of the supplier of goods and /or services

- The ISD receives tax invoices towards receipt of input services

- It distributes credit of CGST/SGST/IGST to a supplier of goods/ services having the same PAN from office referred above

- ISD issues documents or invoices for distribution of Credit

In GSTR-6, an ISD requires filling information regarding the distribution of credits. Here are the revised dates to file the GSTR-6 for the months after GST rollout:

- For the Year 2017, ISD needs to file the form until 31st December 2017

- For all the coming month, ISD needs to file the form before or on 13th of the succeeding month of the tax period

The Following Information Is Needed To Be Added To File GSTR 6:

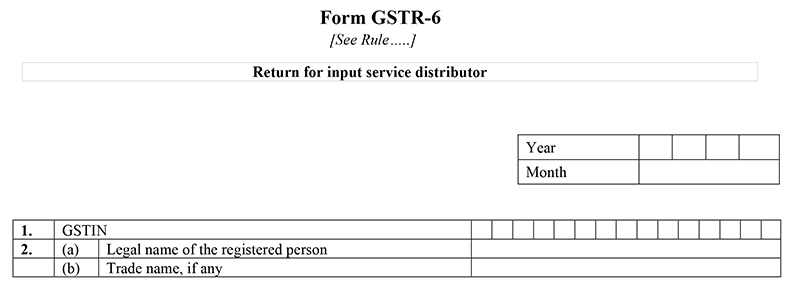

Table 1&2: Details Of The Taxpayer

- GSTIN: GSTIN stands for Goods and Services Taxpayer Identification Number. The GSTIN is a 15-digit number includes 2-digit state code,10-digit permanent account number, and 3-digit includes state, future use, and check-digit. It is auto-populated when we file returns.

- Name of Taxpayer: This is the name of a Non-resident taxpayer owning business outside of India and supplies goods and services. This field is also auto-populated at the time of return filing.

- Month-Year(Period): The taxpayer requires to choose the date from drop down for which month and year for which GSTR-6 is being filed.

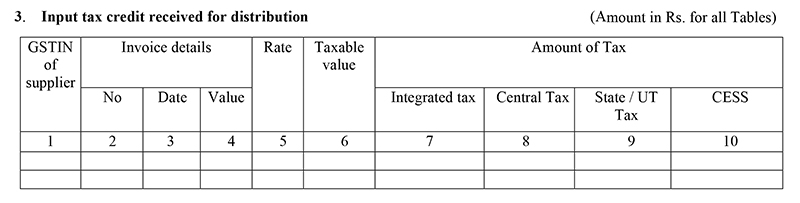

Table 3: Details Of Input Credit Received

- Details Of Inward Supplies From Registered Taxpayer: ISD fills out the details of supplies received and input credit amount from a registered taxpayer. Most of the information especially inward supply details are auto-populated from GSTR-1 and GSTR-5 of the counterparty. The person has to fill all the credit covered under CGST/SGST, and IGST. If the received supplies are in more than one lot, then the taxpayer needs to mention only the last lot information

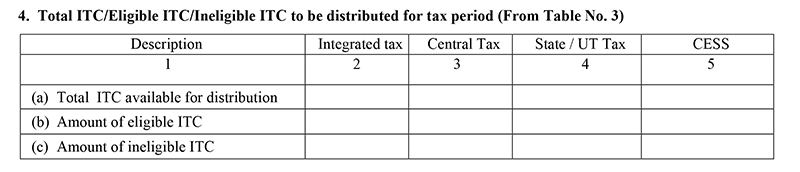

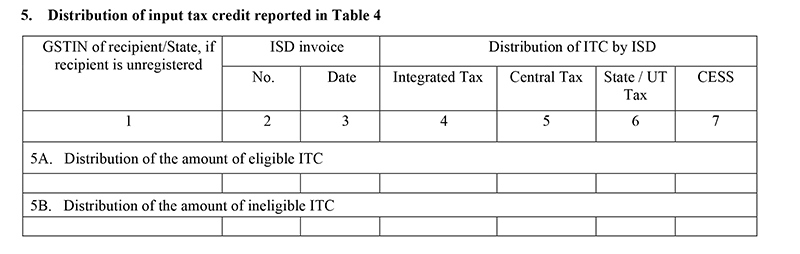

Table 4: For The Given Tax Period Eligible/ Ineligible ITC

- The information is auto-populated by table-3 and fill all the information regarding input tax credit whether it’s eligible or ineligible

Table 5: The Available Credit Under CGST, SGST, And IGST

- This head includes the information regarding the available credit under CGST, SGST, and IGST. the details in this head is of the ITC mentioned in table-4. Here we need to fill the details of the invoices to furnish the fields

Table 6: Any Changes For Table 3

Interest on Late Payment of GST Tax & Missing GST Return Due Date PenaltyModification To Details Of Inward Supplies: Taxpayer provides modified and revised invoices and information along with CGST/SGST and IGST charged if there is any modification or change to the earlier tax period

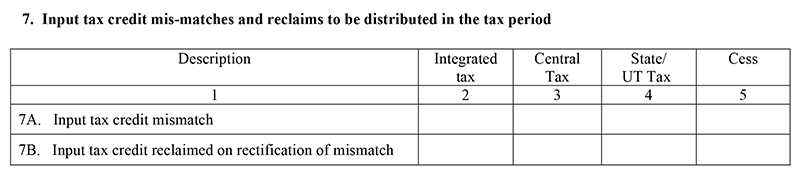

Table 7: Mismatches And Reclaims To The ITC Should Be Cleared Here

- If there is any changes or mismatches or reclaims to be done in input tax credit under CGST, SGST, and IGST, it should be recovered in this head

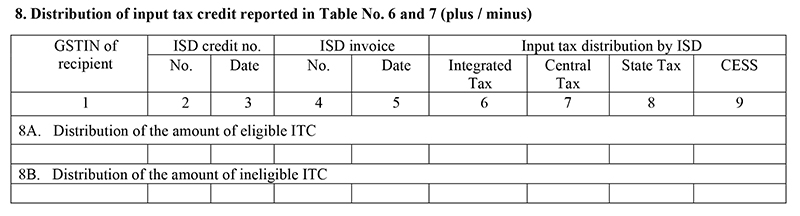

Table 8: Distribution Of The Input Tax Credit Which Is Mentioned In Table 6&7

- The amount distribution for table 6 & 7 under CGST, IGST, and SGST is covered in this head

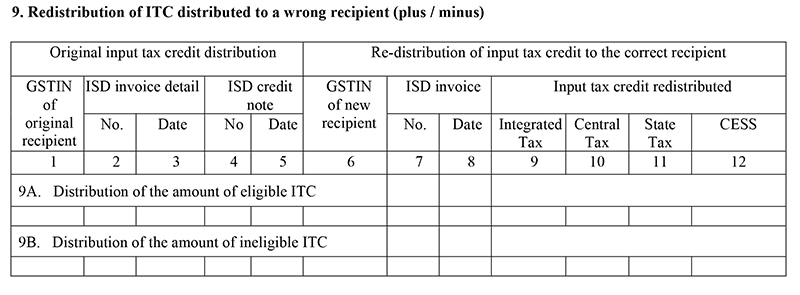

Table 9: Re-distribution If Distribution Is Done Wrong

- If wrongly above mentioned tables are filled by distributed money to the wrong person, the changes and redistribution is possible under this head

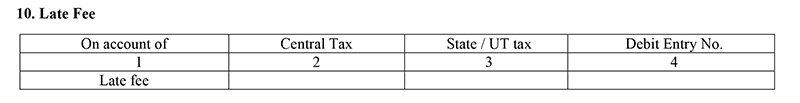

Table 10: Late Fee Payable

- In case of late fee payable or paid, this head is separately mentioned for it. The taxpayer fills the details in it regarding the late fee if applicable

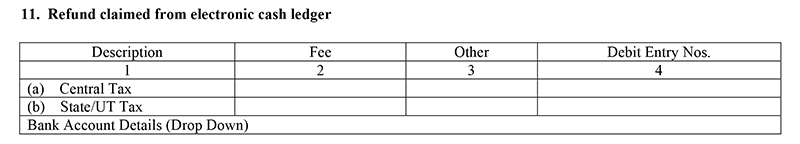

Table 11: Refunds

- As the heading suggests it covers the refund amount and information of the electronic cash ledger

At the end of filing the form, Input Service Distributor needs to sign the form electronically to verify the correctness of the information.

Interest on Late GST Payment & Missing GSTR Due Date Penalty

Among the many rules of GST, there are also rules of penalties and the late fee for the negative aspects of the implementation part, like late payment or taxes or delay in filing returns. The GST rules say that the delay in the payment of GST taxes will lead to an 18 percent annual interest rate, in which a late fee will be charged on each day for the period after the due date of tax payment. Read more details about GST interest mechanism at the URL below.

https://cbec-gst.gov.in/CGST-bill-e.html

Example: As a taxpayer, if you miss the deadline of GST payment for a particular month, you will still be required to pay the tax but will also have to pay additional interest at the rate of 18% or 1000*18/100*1/365= Rs. 4.93 per day approx Where Rs. 1000 is your assumed tax liability. For each day you do not pay tax after the due date, the interest will grow by Rs. 4.93 approx.

In case if a taxpayer does not file his/her return within the due dates mentioned above, he shall have to pay a late fee of Rs. 50/day i.e. Rs. 25 per day in each CGST and SGST (in case of any tax liability) and Rs. 20/day i.e. Rs. 10/- day in each CGST and SGST (in case of Nil tax liability) subject to a maximum of Rs. 5000/-, from the due date to the date when the returns are actually filed.

General Queries on GSTR 6 Form

Q.1 What is Form GSTR-6?

GSTR-6 form is a monthly return which is required to be filed by all the Input Service Distributor’s (ISD) for the distribution of credit (ITC) among its units.

Q.2 Who is supposed to file Form GSTR-6. Is filing this form mandatory?

GSTR-6 is to be filed by only those taxpayers who are registered as Input Service Distributor (ISD). It is a mandatory return which is required to be filed on a monthly basis. In the case of no business activity, a nil return is required to be filed.

Q.3 What is the last date for filing GSTR-6 form?

We are trying to make you understand the same through an example.

- The ISD return for a month, say M, could be filed on or after the 11th of month M+1 and on or before the 13th of month M+1 or the extended date if any.

Q.4 From where can a taxpayer file the Form GSTR-6?

After logging in to the Returns Dashboard, GSTR-6 form is accessible through the GST Portal. We assist you with the path below. Services>Returns>Returns Dashboard

Q.5 When and where we can see the auto-populated invoices in the Form GSTR 6?

Once the Form GSTR-1/Form GSTR-5 is got successfully saved by the supplier, the auto-populated invoices would reflect in Form GSTR-6A, (Table 3 and 4) and Form GSTR 6 (Tables 3, 6A, 6B, and 6C). An action could be taken on these invoices once GSTR 1/5 form has been submitted by the supplier.

Q.6 Is it required as mandatory to take action on all invoices/CDN which have been auto-populated in Form GSTR-6?

Yes, action on a mandatory basis is required to be taken against all such invoices/CDN which have been auto-populated in your Form GSTR-6. Not doing so, would lead the taxpayer unable filing GSTR-6 Form.

Q.7 What actions could be taken on invoice data which are auto-populated in table 3 & 6 of Form GSTR-6?

The below actions could be taken for invoices or credit/debit notes against the data received in Form GSTR-6, you can take the following actions:

- Accept

- Reject

- Modify

- Keep Pending

Q.8 What all actions could be taken on invoice data auto-populated in table 6A & 6C of Form GSTR-6?

For data received in Form GSTR-6 in the invoices or credit/debit notes, the following actions could be taken:

- Accept

- Reject

- Keep Pending

Q.9 Can one file the ISD return if their counterparties have not filed Form GSTR-1/5?

Yes, one is eligible to file the GSTR-6 return even if their counterparties have not filed their respective Form GSTR-1 or Form GSTR-5. This could be simply done by uploading the missing invoices using the ADD MISSING INVOICE functionality and thus filing the return within the prescribed timeline.

Q.10 What would happen if Form GSTR 6 is filed before Form GSTR-1/5 and then Form GSTR-1 and Form GSTR-5 are filed?

In the case where Form GSTR-1 and Form GSTR-5 did not get filed till 10th of the succeeding month of the tax period by the counterparties, no auto-population of the B2B details would take place in Form GSTR-6A and Form GSTR-6 for that tax period. In such a case, it is the ISD who would add the missing invoices/CDN by using the functionality – ADD MISSING INVOICE DETAILS/ADD CREDIT NOTE/DEBIT NOTE. These details would be available under “Uploaded by supplier” table. Again, the uploaded B2B details would flow directly to the Form GSTR-1/Form GSTR-5 of the suppliers.

Q.11 Is there any Offline Tool for filing Form GSTR-6?

Yes, there is an offline tool available for filing Form GSTR-6.

Q.12 Is there any late fee attached to the system in case of the delayed filing of Form GSTR-6?

Yes, as per the prescribed law there is a late fee which is required to be paid in the case where the form GSTR-6 is filed late.

Q.13 Is there a system for Electronic Credit Ledger available for ISD Registrations?

No, there is no such Electronic Credit Ledger maintained for ISD Registrants. ISD is responsible to distribute credit available during a tax period.

Q.14 Could a taxpayer mark the eligibility of ITC at the invoice-level?

No, the provision is that the eligible Input Tax Credit gets auto-updated in Table no. 4 based on the invoice/CDN uploaded (based on the action taken on the Auto drafted from Form GSTR-1/5) in Table no 3 & 6. The eligibility is required to be taken concern of only at the time of distribution of Credit to units.

Note: – Input Tax Credit (ITC) for distribution should be available only against those inward supplies where the Place of Supply (POS) and the State where ISD is registered is the same.

Q.15 Is an ISD liable to pay tax on a reverse charge basis? OR Is reverse charge mechanism applicable to ISDs?

Reverse charge liability is not applicable for an ISD.

Q.16 How could one allocate credit to his/her other units in GSTR 6 Form?

With the help of Table 5 and Table 8 of the Form GSTR-6, both eligible and ineligible ITC could be conveniently distributed to the units.

Q.17 Could Amendment be made to the credit allocated to the units in Form GSTR 6 of earlier tax periods? If yes, how?

Yes, the credit allocated to a unit in a previous tax period could be redistribute using Table 9 of the Form GSTR-6.

Q.18 Can the date of filing of Form GSTR-6 be extended?

Yes. The date of filing of Form GSTR-6 could be extended by the Government through a notification.

Q.19 What are the pre-conditions for filing GSTR-6 returns?

Pre-conditions for the filing of Form GSTR-6 are:

- The recipient should have been Registered as ISD and must be retaining an active GSTIN

- The Recipient should be having valid login credentials (i.e., User ID and password)

- It is required that the Recipient should have a valid and non-expired/ unrevoked Digital Signature Certificate (DSC which is mandatory for companies, LLPs and FLLPs)

- It is required that the Recipient should an active mobile number which is mentioned in his registration details at the GST Portal at the time of enrolment/ registration or amendment thereof for authentication through EVC

- The recipient would be given an option to file Form GSTR-6 for a canceled GSTINs for the period in which it was active

Q.20 What happens after Form GSTR-6 is filed?

Let us look broadly for what happens after the Form GSTR-6 is filed:

- On successfully filing of the Form GSTR-6 Return an ARN is generated.

- An SMS and an email for acknowledgment sent to the applicant on his registered mobile and email id.

- In case, if there is any modification or addition made in Form GSTR-6, these modified details are auto-populated in Form GSTR-1//5 of counterparty supplier.

Q.21 What are the modes of signing Form GSTR-6?

Form GSTR-6 could be filed using DSC, or EVC.

- Digital Signature Certificate (DSC)

- Digital Signature Certificates (DSC) are the digitized forms of physical or paper certificates. A Digital certificate presented electronically could prove one’s identity. It is also used to access the information or services available on the internet and to sign certain documents digitally.

- It is important to know that in India, Digital Signature Certificates (DSCs) are issued by authorized Certifying Authorities.

- The GST Portal is designed such that it accepts only PAN-based Class II and III DSC.

- Electronic Verification Code (EVC)

- The Electronic Verification Code (EVC) is aided to authenticate the identity of the user at the GST Portal. EVC does this by generating an OTP. The OTP is sent to the registered mobile phone number of the Authorized Signatory filled in part A of the Registration Application.

Q.22 Could the Form GSTR-6 be previewed before submission?

Yes, we can preview the Form GSTR-6 before submitting it on the GST Portal.

The late fee for late filing you have mentioned will be Rs 20/ day in case of NIL returns. But this late fee is for GSTR 3B as per Notification No. 76/2018-Central Tax. The late fee for GSTR 6 regardless of Nil or Non-Nil Return is Rs 50/ day as per Notification No. 7/2018 – Central Tax.

Please correct me if I am wrong.

Hello subodh kamawat, i have a doubt in gst tax, is gstr-1, gstr-2a, gstr-3b enough to calculate tax for the given month or there is any other details which includes in monthly tax, how to find tax amount for given month?

To find out actual tax liability, you should match your GSTR-1 & GSTR-3B first then find ITC from GSTR-2A And in GSTR 3B pay the tax on Net tax liability i.e. Outward tax -Inward tax

is tax payable amount depends on profit/loss for the month, what if profit/loss? give me reply

How to Delete Bills in offline utility for GSTR-6

The option is provided to delete bills in offline utility, if not then contact to GSTN helpdesk.

what about offline filing for gstr-6

It can be filed on GSTN portal by downloading offline utility

Please provide us steps to be followed for the filing of GSTR-6 return by using offline tool facilities provided by the GSTIN.

Still GSTR 6 not available on site for July 17.

Contact to GSTN helpdesk