Revision of Table 4(B) & (D) of form GSTR 3B vide notification number 14/2022 and clarification given concerning reporting of the identical vide Circular 170/02/2022, the assessees obligated to visit again their way of recording ITC in their books to ensure true reporting according to the revised form GSTR 3B.

Below is our update we have covered and elaborated on the operational impact of the mentioned revision and clarification:

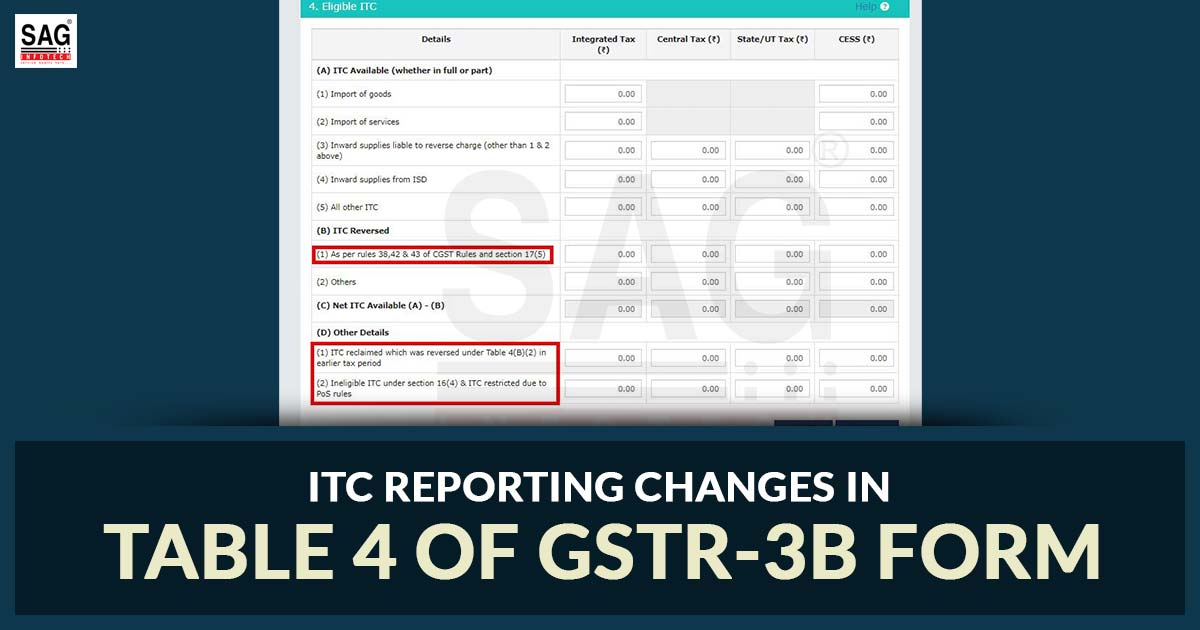

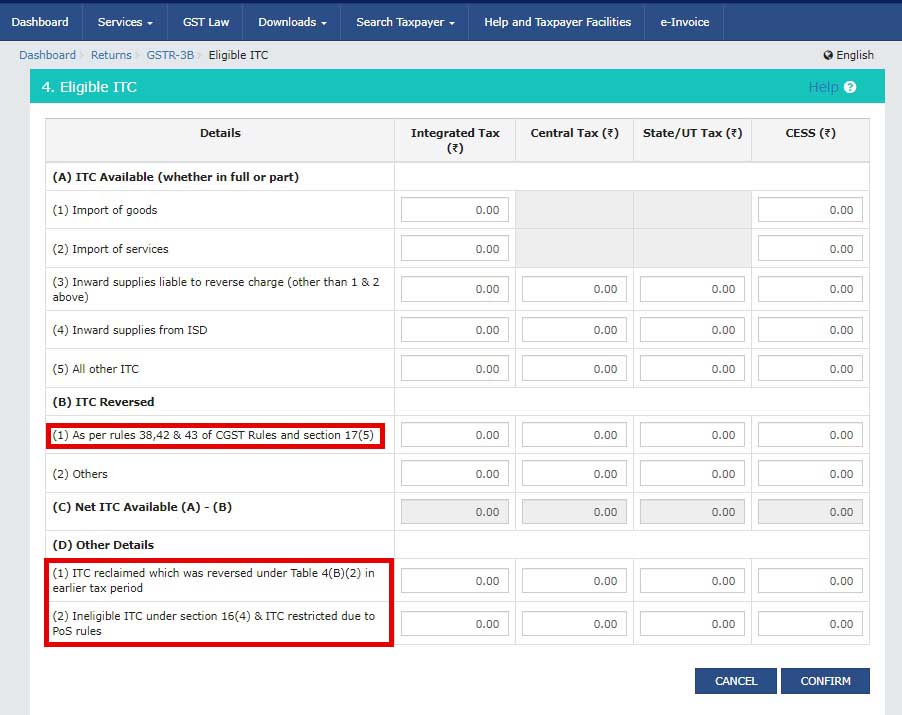

Impact of Revisions in Table Number 4 of GSTR 3B Form

- In the present time, various assessee would record ITC on the qualified inward supply exclusively in their Input Tax Credit GST Guide ledger along with in which ITC is needed to be revered in the specified cases:

- Which ITC is needed to get reversed on the basis of common inward supply utilised for the taxable and exempt outward supply towards Rule 42 & 43

- Reversal and Reclaim of ITC for the case of non-payment of consideration to vendors within 180 days from the date of invoice; or

- Any reversal on account of former incorrect claim and usage of ITC

- Regarding the ITC on inward supplies which comes under 17(5), the assessee is not recording that and transferring these ITCs directly to the P&L account.

- During the time of claiming ITC in GSTR-3B, reconciliation would get executed between the Static ITC statement in Form GSTR 2B vs ITC recorded in books of accounts according to the above-mentioned way.

- Post to these reconciliations and as per the additional provisions of Sections 16 & 17 of the CGST Act read with Rules incurred in it, the credit will be mentioned in the corresponding fields of table 4 of GSTR 3B

- But acknowledging the fact that the ineligible declaration of ITC under section 17(5) in table 4(D)(1) was only instructive in nature along with that the other direct expenses treatment furnished to these credit in the books of account various assessee were not mentioning the amount of the ineligible ITC under Section 17(5) in GSTR – 3B

- Post revision in Table 4(B) of GSTR – 3B, the same would be specified that all ITC as available in GSTR 2B form along with ITC under qualified of section 17(5), Rule 42,43 and 38 and re-availed ITC (earlier reversed due to ineligibility according to section 16(2)(c) & (d) and Rule 37) required to have opted to Table 4(A). Hence, ineligible ITC under the mentioned provisions needs to be separately taken to Table 4(B). Consequently, Net ITC according to the Table 4(C) i.e., [4(A) – 4(B)] will only be credited to the electronic credit ledger.

- Hence same is essential to record all the ineligible ITCs and even when the same would be absolute in nature and not reclaimable e.g., ineligible ITC beneath Rule 38 or Section 17(5), and others.

- As per that, we think that the assessee needed to incur the amendments in their way of accounting for the recording ITC through classifying that as per distinct applicable provisions beneath the GST law. We would have made a list of those types for ease of reference.

- Ineligible ITC in terms of Section 17(5)

- Ineligible and eligible to reclaim ITC towards Rule 37 (non-payment of consideration within 180 days)

- Ineligible ITC towards Rule 38 (reversal of credit by a banking company or a financial institution)

- Ineligible ITC for Rule 42 (common credit on inward supply of inputs or input services utilized for outward supply of taxable including the exempted supply)

- Ineligible ITC for Rule 43 (common credit on inward supply of capital goods utilised for the outward supply of taxable and exempted supply)

- Ineligible ITC because of the distinction in place of supply.

- Ineligible input tax credit on invoices which has a time limit in terms of Section 16(4)

- Ineligible ITC in the duration of the present tax because of the non-fulfilment of the conditions of section 16 e.g., receipt of invoice in the current month but supply obtained in the subsequent month.

- Ineligible ITC utilised only or party for the purpose of business.

- All additional eligible ITC.

- Form GSTR 2B indeed auto-categorizes ITC into ineligible ITC in the subsequent two cases:

- Ineligible ITC, intra-State supply, the distinct location of the recipient, then the place of supply

- Ineligible ITC on invoices which has a time limit in terms of Section 16(4)

- Acknowledging the amendments in reporting ITC in tables 4(B) & (D) of GSTR – 3B, every assessee would be obligated to again visit their present way of ITC recording in books of accounts and develop the precise amendments to ensure the true data availability for the reconciliation with ITC in GSTR – 2B and smooth reporting in Form GSTR – 3B.

- Comparative illustration, ITC reversal reporting prior to and post to the revision of the GSTR-3B would be given in the subsequent slide for effective knowledge.