First of all, it should be made clear that GSTR 3A is not a form to file returns, instead, it is a form that is sent by the government of India (GOI) as notice. GSTR 3A refers to the form in which the government sent notice to the taxpayer for not furnishing the GST returns, he needs to.

- What is GSTR 3A Notice

- GSTR-3A Notice for Different Taxpayers

- Duty of Taxpayer After Receiving GSTR-3A Notice

- Penalties/Late Fees GST Return Non-filers

- Interest Applicable for Non-filers of GST Returns

- Returns can be Filed After 15 Days

- GST Payment in Instalments

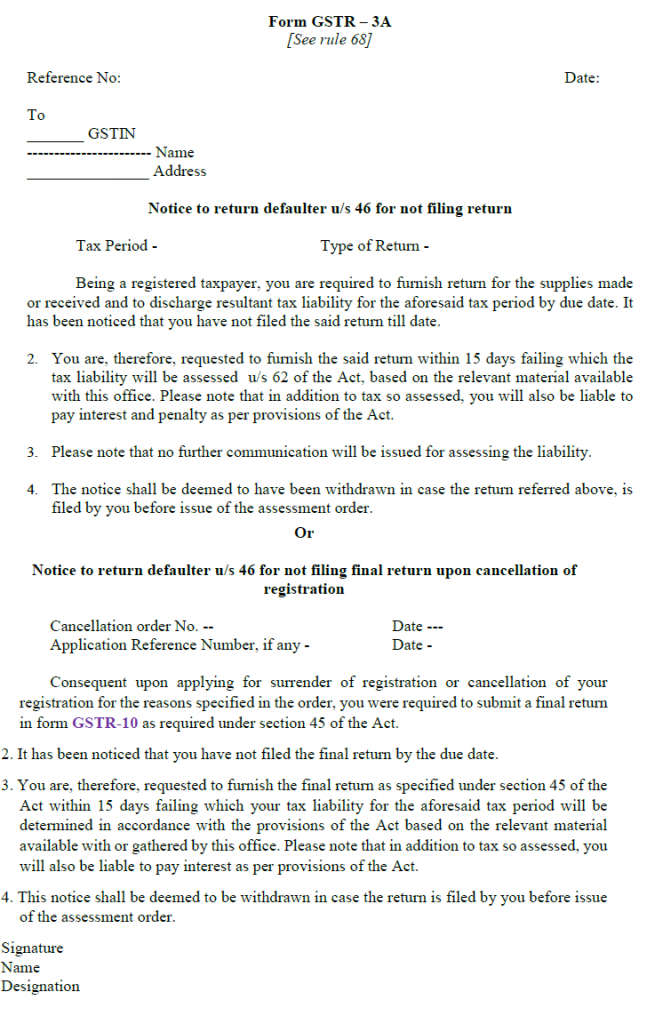

- Form GSTR 3A Notice Format

What is GSTR 3A Notice?

A taxpayer registered under GST has to file his/her GSTRs on a monthly or quarterly basis in addition to one annual return if his turnover surpasses the threshold limit. However, if the taxpayer fails to file the relevant returns, he/she receives a government notice in GSTR 3A. So, we call it GSTR 3A notice.

GSTR-3A Notice for Different Taxpayers

Taxpayers under different categories need to file different GST returns. Let’s have a glance to different returns relevant to be filed by different taxpayers if he/she doesn’t want to receive GSTR-3A notice. Here, we go.

- GSTR-3B for Regular Dealer

- GSTR-4 for Composition Dealer

- GSTR-5 for Non-resident Taxpayers

- GSTR-6 for Input Service Distributor

- GSTR-7 for TDS Deductor

- GSTR-8 for TCS Collector

- GSTR-9 for Annual Return

- GSTR-10 for Final Return

GSTR-3A Notices Sent to Cancelled Composition Taxpayers for Not Filing GSTR-4 (Dated 20.07.2025)

- As per the provisions of Section 39(2) of the CGST Act, 2017, read with Rule 68 of the CGST Rules, 2017, notices in Form GSTR-3A are to be issued in cases where a taxpayer fails to file Form GSTR-4. However, it has come to light that, due to a system-related glitch, these notices have been inadvertently issued in certain cases where they were not applicable. This includes instances involving taxpayers whose registrations had already been cancelled prior to the Financial Year 2024–25, and who were therefore not liable to file GSTR-4 for the said period.

- The issue is currently under active review, and the technical team is working diligently to implement the necessary corrective measures to prevent the recurrence of such incidents in the future. In the interim, taxpayers who have either already filed the required GSTR-4 return or whose GST registrations were cancelled prior to the commencement of the Financial Year 2024–25 are advised to disregard the erroneously issued GSTR-3A notices. No further action is required from such taxpayers in these cases, and they will not face any adverse consequences as a result of these inadvertent system-generated communications.

- For any other concerns or issues not covered by the above clarification, taxpayers are encouraged to raise a grievance through the Self-Service Portal available on the official GST Portal. While submitting the grievance, taxpayers should ensure that all relevant details and supporting documents are provided to enable a swift and effective resolution of the matter. This mechanism is in place to assist taxpayers in addressing system-related or procedural difficulties in a timely and efficient manner.

Duty of Taxpayer After Receiving GSTR-3A Notice

When the defaulter or taxpayer receives notice in GSTR-3A from the government, he is allotted 15 days to file the GST Returns and pay the penalty or late fees associated with the date when the notice is issued.

Penalties/Late Fees Imposable for GST Return Non-filers

A taxpayer who fails to file the relevant return before the due date has to pay a penalty along with the return he files. The amount of penalty or late fee applicable differs from a return to return. Let us have a look at them.

Late Fees of GST Annual Return

A late fee of INR 200 per day (INR 100/day under CGST, SGST and IGST) from the day when notice is issued to the taxpayer, is applicable for not filing the annual return.

Maximum Limit of Late Fee Under GST

It should be noted that the maximum limit of the late fee applicable on Annual Returns is 0.25% of the turnover of the taxpayer in the state. This interprets that late fees cannot be more than 0.25% of the taxpayer’s turnover in the state.

Late Fees of Monthly/Quarterly GST Returns

A late fee of INR 50 per day (INR 25 under CGST & INR 25 under SGST) from the day when notice is issued to the taxpayer, is applicable for not filing the monthly or quarterly returns. A late fee of INR 100 is not applicable on IGST for monthly/quarterly returns.

Maximum Limit of Late Fee GSTR 3A Notice

For Monthly/Quarterly Returns, the maximum limit of penalty is INR 5,000.

Interest Applicable for Non-filers of GST Returns

- Interest at the rate of 18% is imposed on the defaulter.

- Interest is calculated on the amount of tax which is outstanding to be paid by the taxpayer.

- Interest is calculated for the time-period from the day next to the due date of GST return filing until the date of payment of tax.

What Happens if a Taxpayer Fails to File his Return within 15 days?

When a taxpayer fails to file his GST returns within 15 days of receiving the GSTR 3A notice, the provisions of Section 62 shall become applicable to him. His tax will be assessed subsequently by an authorised officer appointed for his tax assessment. However, further notice will not be issued until the assessment officer starts the assessment of tax. Such taxpayers will have to pay the penalty of INR 10,000 or 10% of the tax outstanding, whichever is higher.

Returns can be Filed After 15 Days

Returns can be filed after 15 days but that should happen before the issuance of assessment order by the authorised official. In such cases, the notice sent is treated as withdrawn.

GST Payment in Instalments

When the taxpayer is incapable of paying the GST applicable on his business in a lump sum before the due dates, he can opt for the monthly instalment option available under GST. To pay GST under provisions for instalments, the taxpayer needs to submit an application to the Commissioner as a request to allow him to make GST payments in monthly instalments. Besides, the commissioner also needs to give the reasons in writing for the rejection and acceptance of such requests/applications.

Points to Ponder About Monthly GST Payment

- GST is to be paid in instalments every month and on time.

- The maximum number of instalments for GST payment can be of 24. This implies that the time for the payment of GST can not be extended beyond 2 years.

- Interest @18% is payable along with the instalment.

- When an instalment is missed, the instalment cycle shall be discontinued without any notice and also the taxpayer will need to pay the due amount on the same day.

Note: Provision to pay GST in monthly instalments is not available for outstanding taxes under self-assessment. Tax under self-assessment has to be paid in a lump sum. Liabilities computed by tax officials at the time of scrutiny, provisional/final assessments, audit etc. can be paid in monthly instalments.

Form GSTR 3A Notice Format

SAG Infotech has an innovative & imminent GST software solution that complies with the latest norms & notifications of the government. With accounting & taxation software like Gen GST Online software, an assessee can easily file & upload his return forms on the GSTN portal, quickly review his business plans & transactions, and reconcile his accounts.