GSTR-3 is a monthly return we file after GSTR-1 and GSTR-2. Where GSTR-1 contains the information of outward sales, GSTR-2 contains the detailing of inward sales or supplies, GSTR-3 is simply a return based on the information of GSTR-1 and GSTR-2. GSTR-3 has total 15 headings from which most of the information is based on GSTR-1, GSTR-2, and GSTR-3b. To overcome the hurdles, the information will be pre-filled but if there are any discrepancies it can be updated too.

Salient Features of GSTR-3 Return Form

- GSTR-3 is filed by every registered person under GST regime every month

- It deals with detailing of all the inward and outward supplies mentioned in GSTR-1 and GSTR-2

- GSTR-3 has two parts; Part-A and Part-B

- Most of the information is auto-populated in GSTR-3:

- The first part is filled with information of inward supply, outward supply, total tax liabilities, TDS credit, TCS credit information, turn over details and ITC received. This information is auto-populated by GSTR-1 and GSTR-2.

- The second part contains the information regarding tax, interest, late fees, penalty, and refunds. Here the information is auto-populated by GSTR-3b form.

- The information having discrepancies in GSTR-3 from GSTR-3b, Taxpayer can correct them and deposit the applicable taxes later.

- It consists details of various tax under CGST, SGST, and IGST

- Taxpayer can claim the refunds of excess amount in GSTR-3

- GSTR-3 includes the information of ITC ledger, cash ledger, and liability ledger

Who should File GSTR-3 Form?

Every registered person under GST regime is needed to file the GSTR-3 along with all the information of inward and outward supplies. But if the person comes under composition scheme (under the Scheme the person or business files the return for each quarter only) of GST regime, then the person will file the GSTR-3 after 18 days after of each such quarter.

Deadlines for Filing GSTR-3

In normal cases, the deadline for filing GSTR-3 is 20th of the next month for a particular tax period, however, the filing of GSTR-3 has been suspended until March 31, 2018, by the Committee of Officers.

<!–

Filing of Monthly Return under GST for GSTR-3

In the series of GSTR-1 and GSTR-2 return forms, this is GSTR-3 return form filing guide. Every registered person or business needs to file monthly returns by 20th of the next month. The revised due dates for upcoming GSTR 3 return filing are as below.

- For July 2017 – 11th December 2017 (Revised Due Date)

- August 2017 –

–>

Interest on Late GST Payment & Missing GST Return Due Date Penalty

As stated in GST Council norms, if a taxpayer pays the tax after due dates, the system will consider it as a late payment and shall be liable to pay 18 % interest on an annual basis and the total days after the due dates till tax is paid. The detailed information regarding the same is covered under point 50 of chapter 10 and you can access it here: https://cbec-gst.gov.in/CGST-bill-e.html

For example, if a person missed the days after due dates for paying taxes, then the calculations will be like this : Tax amount: 1000 Rs.; Interest rate on late payment= 18%; day delay= 1 day

- 1000*18/100*1/365= 0.49 Rs. for a day delay in paying taxes

In case if a taxpayer does not file his/her return within the due dates mentioned above, he shall have to pay a late fee of Rs. 50/day i.e. Rs. 25 per day in each CGST and SGST (in case of any tax liability) and Rs. 20/day i.e. Rs. 10/- day in each CGST and SGST (in case of Nil tax liability) subject to a maximum of Rs. 5000/-, from the due date to the date when the returns are actually filed.

Let’s Understand the Step by Step Filing Procedure of GSTR 3

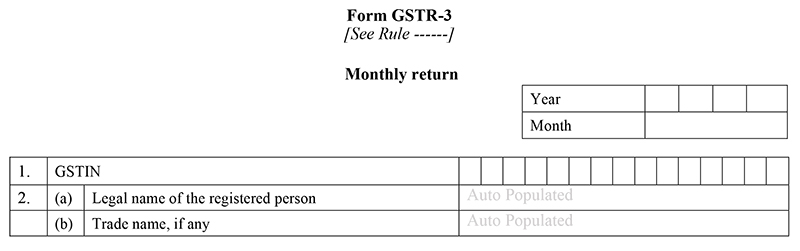

Part 1 to Part 2 – Basic Details of Taxpayer

- GSTIN: GSTIN stands for Goods and Services Taxpayer Identification Number. The GSTIN is a 15-digit number includes 2-digit state code,10-digit permanent account number, and 3-digit includes state, future use, and check-digit. It is auto-populated when we file returns.

- Name of the taxpayer: It is also auto-populated at the time of return filing.

- Address: The business address of the taxpayer is auto-populated at the time of return filing.

- Month-Year: The taxpayer requires to choose the date from drop down for which month and year GSTR-3 is being filed.

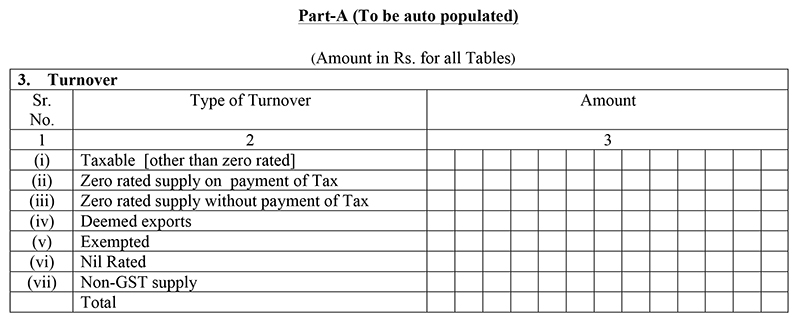

Part-A (To be Auto Populated)

Part 3 – Turnover Details

In this field, you have to provide detail of the turnover whether it’s taxable turnover or export turnover or exempted turnover or Non-GST turnover.

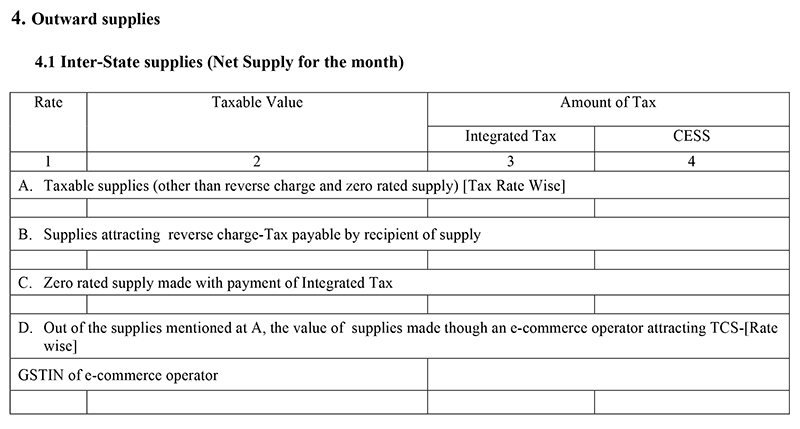

Part 4 – Outward supplies:

This field is auto-populated and it takes the details from GSTR-1 return filing form. The outward supplies will get information from following subheadings in GSTR-1:

Part 4.1 – Inter-state supplies to the registered taxable person

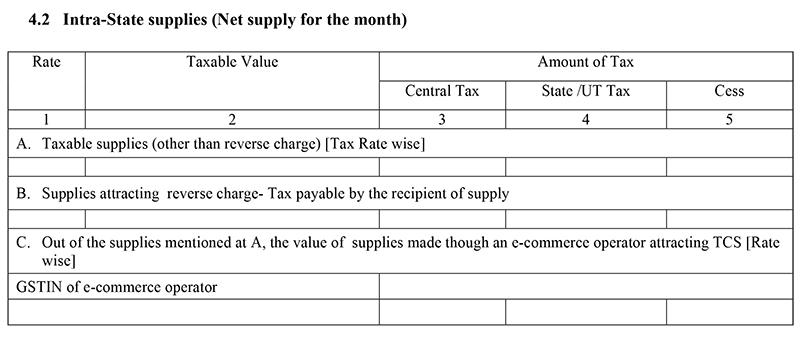

Part 4.2 – Intra-state supplies to registered taxable person

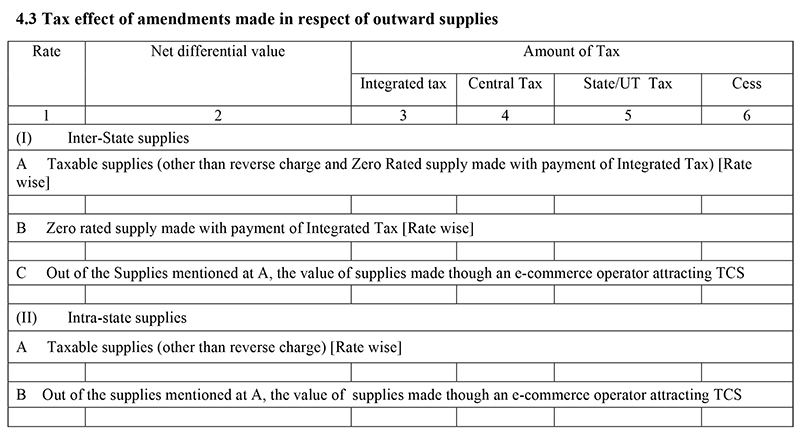

Part 4.3 – Outward Supplies Tax Effects After Amendments

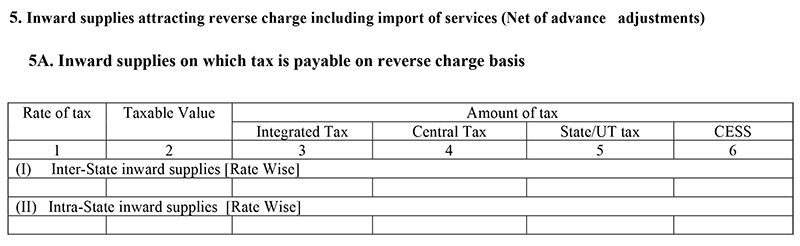

Part 5 – Inward supplies:

- Inward supplies will be auto-populated from GSTR-2 return filing form

Part 5A – Tax is payable on reverse charge basis in Inward supplies

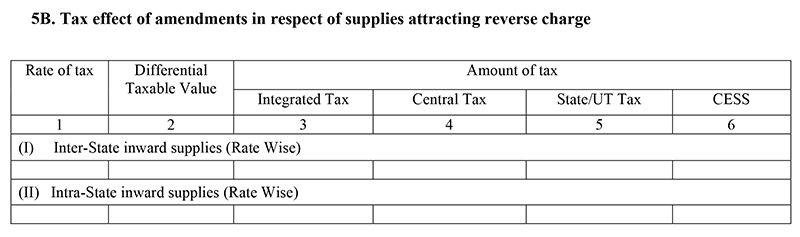

Part 5B – Tax effects after amendment when supplies attracting the reverse charge

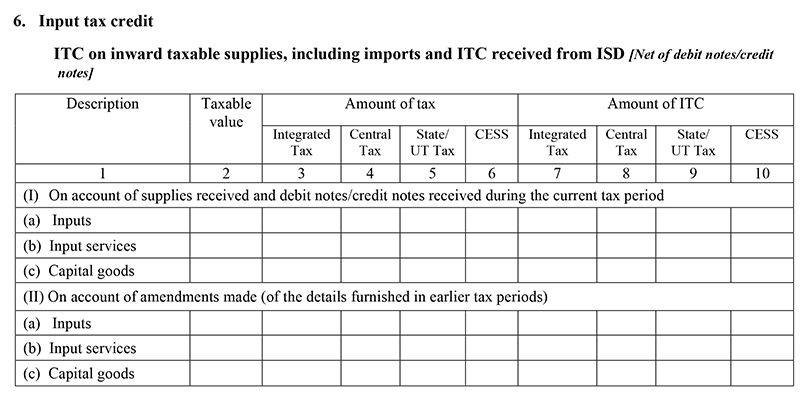

Part 6 – Input Tax Credit Reversal

- Input Tax Credit on inward taxable supplies, having imports and ITC received from ISD [Net of debit notes/credit notes]

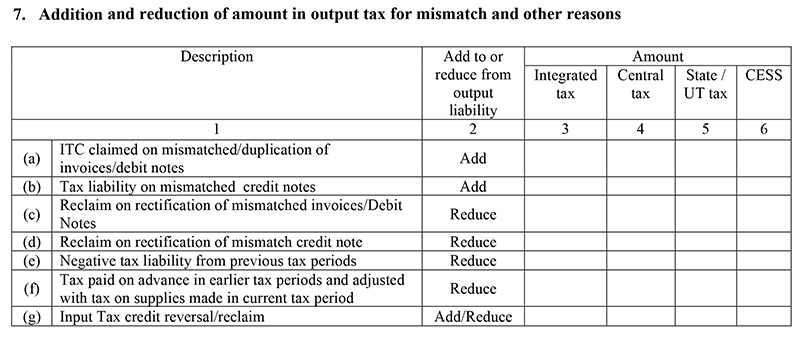

Part 7 – Plus and Minus of an amount in output tax for mismatching and other reasons

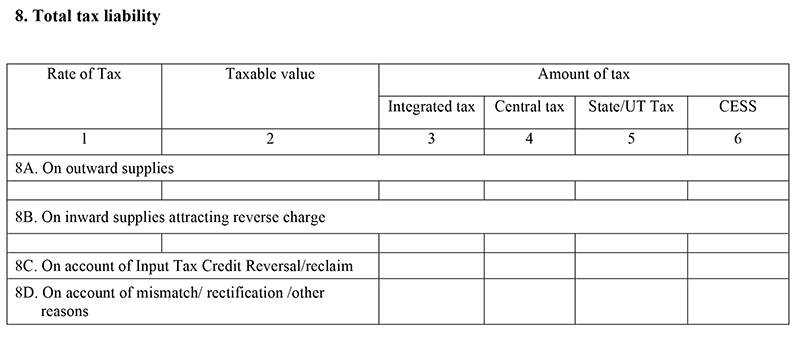

Part 8 – Total tax liability

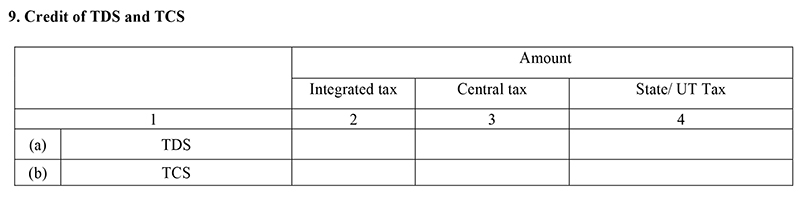

Part 9 – Credit of TDS and TCS

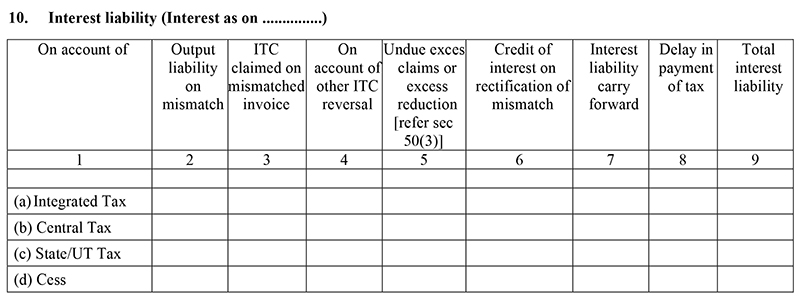

Part 10 – Interest liability (Interest as on ……………)

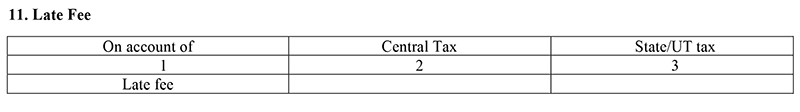

Part 11 – Late Fee

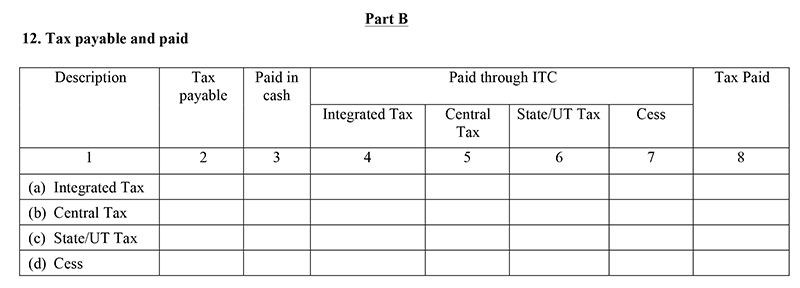

Part B

Part 12 – Paid and further Tax payable

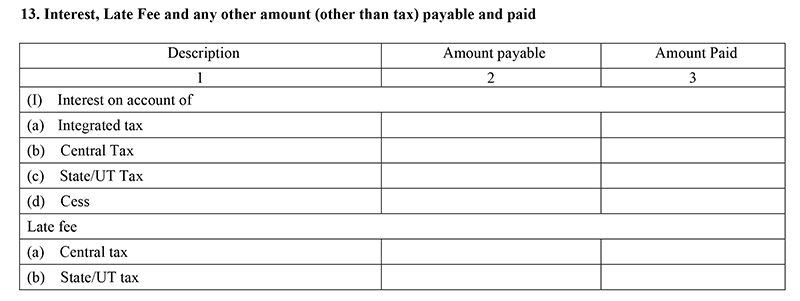

Part 13 – Late Fee, Interest and other amounts (other than tax) payable and paid

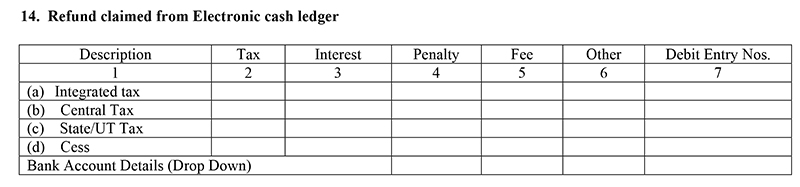

Part 14 – Electronic cash ledger for the refund claim

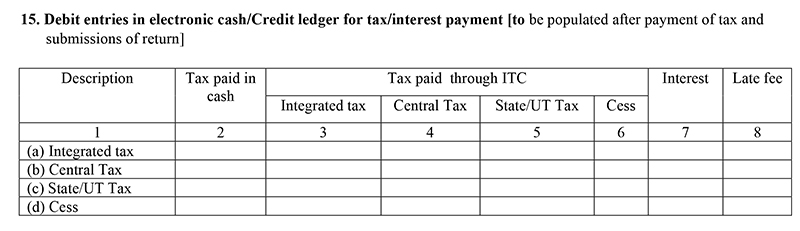

Part 15 – Electronic cash/Credit ledger debit entries for interest/tax payment [to be populated after payment of tax and submissions of return]

when due date GSTR 3?

The GSTR 3 is still not released by the department but the GSTR 3B Due date for the month of April 2018 has been extended 22/05/2018.

Sir, Need more information on software and training.

Dear Sir, Did u provide accounting, inventory and GST combine software? if yes, then what will be the price?

We will send the email with GST software features.

very good file

FROM WHERE DO WE GET THIS GSTR 3 FORM

As no utility for GSTR-3 is released by the department, you have to wait.

sir, which person gst return fill the company actually digital signature asking to last submit return form so any other person do not gst return …………………why ?

please clarify your question.

late fee penalty clarification

Very nicly expained the GSTR-3….simple and helpful…well done