The government has decided to continue the existing GST (Goods and Services Tax) return filing system for the time being.

In place of launching the new GST return filing system, the government will try to introduce advanced features to the older system. The government will be launching from GSTR 2B for the Input Tax Credit. The form will help the government as well as the assessees in matching the input and output of ITC in forms GSTR 3B, GSTR-1, and GSTR 2A, accordingly.

- About GSTR 2B

- GSTR 2B Features

- Offline Matching Tool

- Comparison B/W GSTR 2A and GSTR 2B

- Download GSTR-2B from GST Portal

- Procedure to View and Download Form GSTR-2B

- GSTR 2B General Queries

Latest Update

- The new advisory relates to ITC, which will continue to auto-populate from GSTR-2B to GSTR-3B without any manual intervention by taxpayers. View more

- The generation date for the draft GSTR-2B of December 2024 has been extended to January 16, 2025. View More

- 55th GST Council Meeting – A recent new update to the CGST Act, 2017 has been introduced on how the GST Invoice Management System (IMS) works. This improves the way invoices are handled under the GST. read more

- The CBIC notification no 202/2024 has mandated using the GSTR-2B for ITC reconciliation in Form GSTR-9, replacing the previous requirement to use GSTR-2A. Read PDF

Free Demo of GSTR 2B Compliance Software

Check Out More About GSTR 2B

The new version of the GSTR 2B return will link the existing return filing forms and will help the government in curbing tax evasion.

The main feature of the new form GSTR 2B return is that it will be generated monthly, just like the other GST return filing forms. A PDF and email feature is also added to the form for the ease of assessee. The form will show whether ITC is available to the assessee or not. The form will summarise the ITC credits attached with GSTR 3B.

The assessee can download the form in PDF or EXCEL file form anytime he wants. The advance search and filter option in the form will also help the assessee to view documents beyond 1,000 records.

Not to Claim GST ITC on Invoice Appearing Twice in GSTR-2B

Some of the assessees (recipients of supply) are advised by GSTN who had notified that they see that invoice twice in GSTR 2B for the months of April and May 2022. GSTN suggested that the assessee not claim the Input tax credit on the identical invoice twice. The council mentioned that a solution would be provided to the problem.

Form GSTR-2B- Form GSTR-2B is a system-generated (auto-populated) statement showing the ITC information. The statement would be auto-generated on the 12th of the succeeding month. Form GSTR-2A gets auto-generated based on the details filed via supplier/ seller/ counterparty.

Top Features of GSTR 2B Form

- GSTR-2B statement features details on the import of goods fetched from the ICEGATE system including details of inward supply of goods from Special Economic Zone units/developers. However, It is not included in the released version of GSTR-2B for the month of July but it will be made available soon

- A summarised statement will indicate whether all the ITC available or not are available under each section. The advisory provided for each section clarifies the action that can be taken by the taxpayers in the particular section under GSTR-3B;

- Document-level details of all invoices, credit and debit notes, etc. with options to view and download

- GSTR-2B for July 2020 Month has been provided on the Common Portal on a trial basis

- Since it is the first time when the statement has been introduced, authorities advised taxpayers to consider GSTR-2B of July 2020 for feedback purposes only

- The official authority directed taxpayers to consider GSTR-2B of July 2020 and after comparing the same with the credit availed by them in July month, respond to any aspect (If any) of GSTR-2B by raising the ticket on the self-Service portal i.e. https://selfservice.gstsystem.in/

- All taxpayers are also advised to refer to the detailed advisory related to GSTR-2B on the common portal before using the statement

- A taxpayer can access the GSTR-2B by navigating to the GST Portal then click on Returns Dashboard then click on Select Return period and then GSTR-2B, after login to the portal

Compare Purchase Register with GSTR 2B Auto-drafted ITC Via Offline Matching Tool

- An offline device has been made available to the taxpayers to level Input Tax Credit (ITC), as auto-populated in their Form GSTR-2B, including their purchase record. This device will assist the assessee to differentiate their ITC as per their Buying record, including the ITC as displayed available in their auto-drafted Form GSTR-2B and therefore support them to pretend correct ITC while filing Form GSTR-3B.

- To practice the Matching Offline Tool, the taxpayer obliges to :

- download and install the Offline tool on their system

- download the Form GSTR-2B JSON file from the GST portal

- prepare purchase register in the template given with an offline tool

- A total number of documents to match should preferably be smaller than 3000 in number.

- Steps to use the utility:

- Download the utility from GST common portal by navigating to Downloads>Offline Tools> Matching Offline Tool

- Start the tool. Then boxes are illustrated on the Offline tool dashboard page:

- GSTR-2B

- Import Purchase Register (PR)

- Matching Result

- Import GSTR-2B JSON file, downloaded from GST portal into the device, by tab ‘Open downloaded JSON file’ and use it to view the same.

- Import the buying register data, reported in the template presented with the offline tool, using Excel or CSV format, from Import Purchase Register (PR) tile.

- Click on the ‘Match’ button to coordinate the above two details (c & d). The utility will match the table-wise details based on the principles for meeting selected.

- Note:

- The ‘Match’ button will be permitted only if the purchase register has been strongly imported into the device

- The matching is performed on the grounds of GSTIN, Document type, Document number, Document date, taxable value, total tax amount and tax amounts head wise.

- After matching, the user will be driven to the ‘Matching Result’ page and the matching result will be compiled as Exact match, Partial match, Probable match or Unmatched.

- Once matching is finished, the taxpayer can:

- Refine matching result

- Outlook summary of the matching result

- Export the matching details to CSV file

- Download the matching result details in excel format from the offline service

- Important points:

- Profile of more than one GSTIN can be added in the offline tool for matching or to see GSTR-2B. The profile can be altered in future if needed.

- Normal/SEZ Developer/SEZ unit/casual taxpayer can follow this device. People must have valid login credentials and valid GSTIN for the period, for which they expect to see and match details of Form GSTR-2B.

Comparison B/W Auto-populated GSTR 2A and GSTR 2B

GSTR 2B form has been recently implemented within the taxpayer community. Know the full comparison between the auto-populated GSTR 2A form and the new GSTR 2B form. The difference table will be having all the necessary points such as statement type, frequency of accessibility.

Also one can see through all the major points within the table as there will be an input tax credit available for the taxpayers on board which will further guide them for a better transnational value.

| Comparison Claws | GSTR-2A | GSTR-2B |

|---|---|---|

| Kind of Statement | Progressive, as this changes from day to day, as and if the supplier uploads the documents. | Remains static or constant, as the GSTR-2B for one month cannot modify based on future operations of the supplier. |

| Accessibility of Frequency | Monthly | Monthly |

| Information Source | GSTR-1, GSTR-5, GSTR-6, GSTR-7, GSTR-8 | GSTR-1, GSTR-5, GSTR-6, ICEGATE system |

| Input Tax Credit on Import of Goods | Does not carry these facts | Accommodates ITC on import of goods as obtained from ICEGATE system (available from GSTR-2B of August 2020 onwards) |

How to View & Download GSTR-2B Data from the GST Portal?

Form GSTR-2B is an auto-generated ITC statement, it will be generated for every recipient as per the data filled by the suppliers in their respective Forms GSTR-1, GSTR-5 and GSTR-6. It will clear that the input tax credit is available or not for every document filed by the supplier. A taxpayer can view and download GSTR-2B from the GST Portal.

Procedure to View and Download Form GSTR-2B

1. Open a browser or new tab in the browser and head up to https://www.gst.gov.in

2. Website will be opened, log in to the GST Portal using your valid credentials

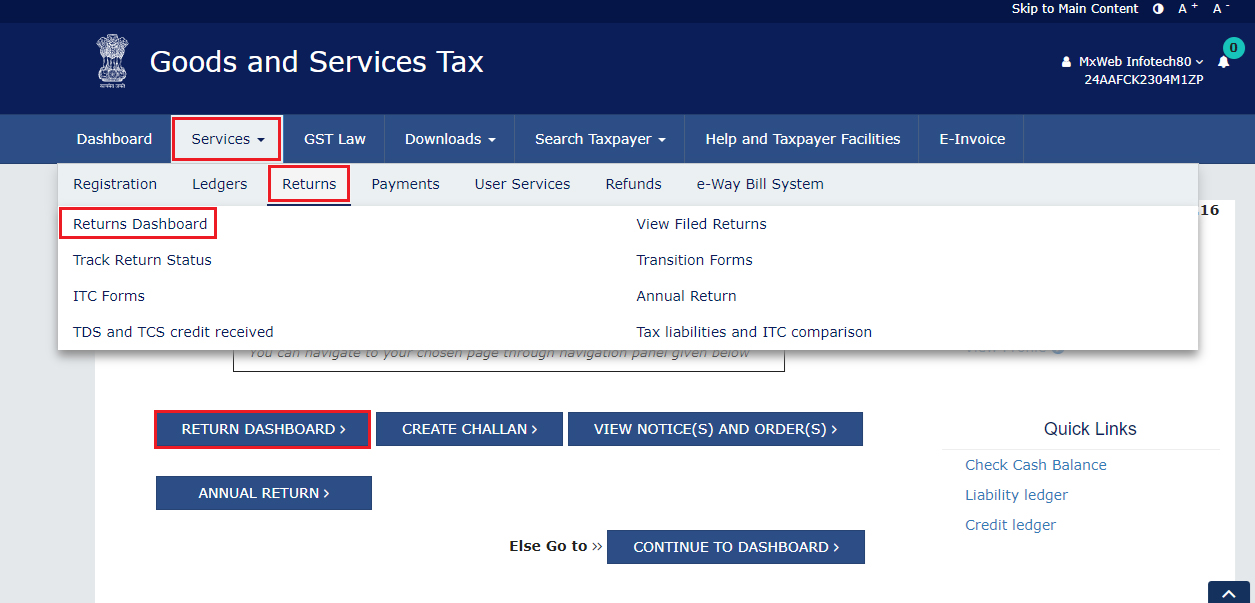

3. From the home page either click on “Return Dashboard” or navigate to Services > Returns > Returns Dashboard

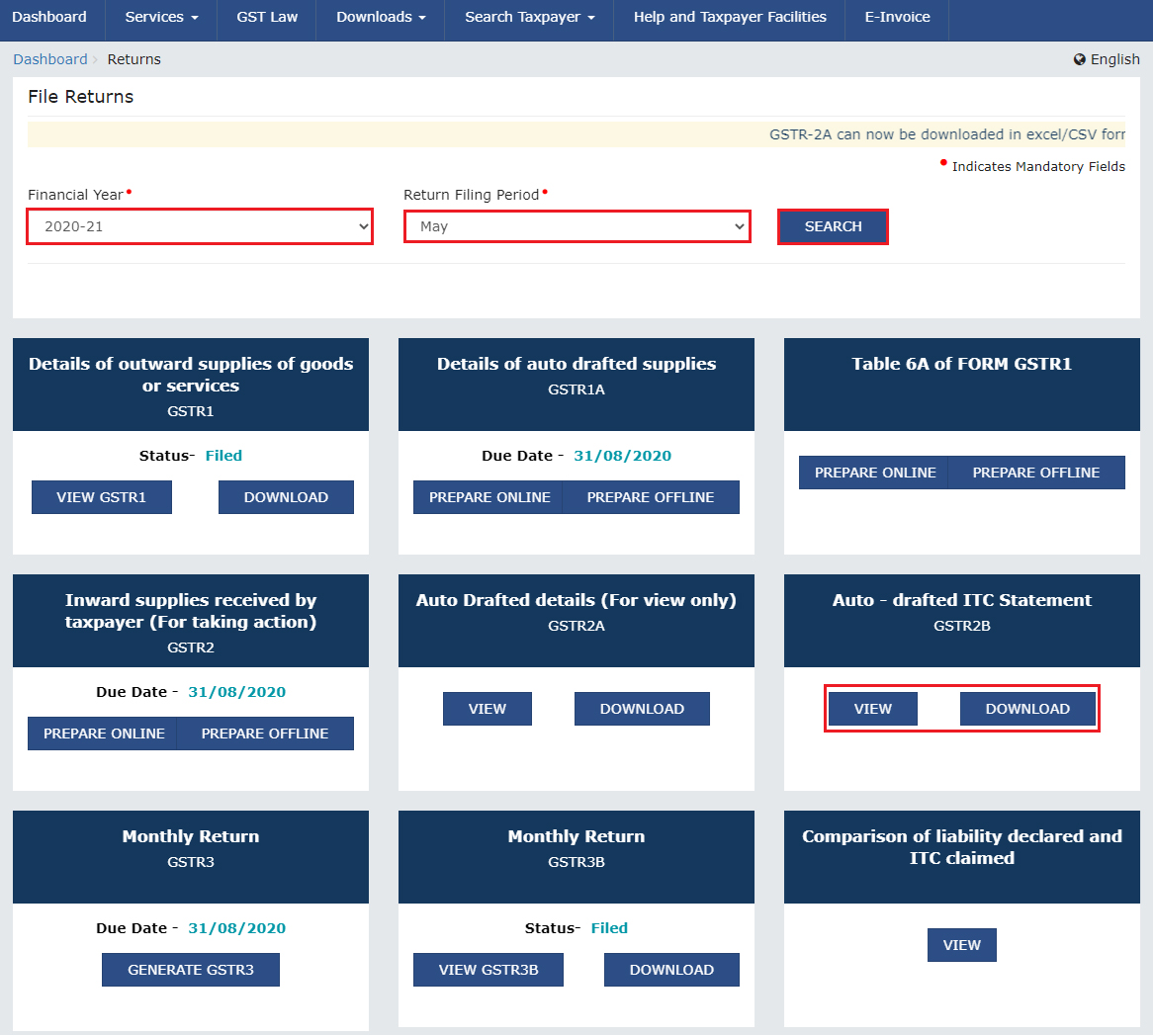

4. File Returns page will appear, here using the drop-down menu select the Financial Year & Return Filing Period (Month) for which you want to view/download Form GSTR-2B

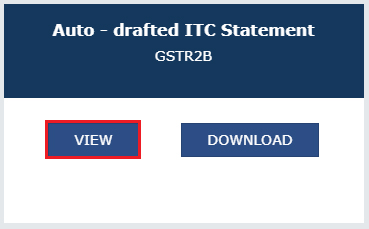

5. Click on the SEARCH button. Form GSTR-2B tile (Auto-drafted ITC Statement GSTR 2B) will be displayed with two options i.e. View and Download

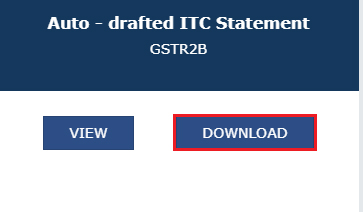

6(a). Download GSTR-2B

- 6.1 If there are more than 1000 documents under all tables of Form GSTR-2B then document details can be downloaded in Excel / JSON format from the download option visible on the page founder the Form GSTR-2B section. Click on the DOWNLOAD button to download the form GSTR-2B

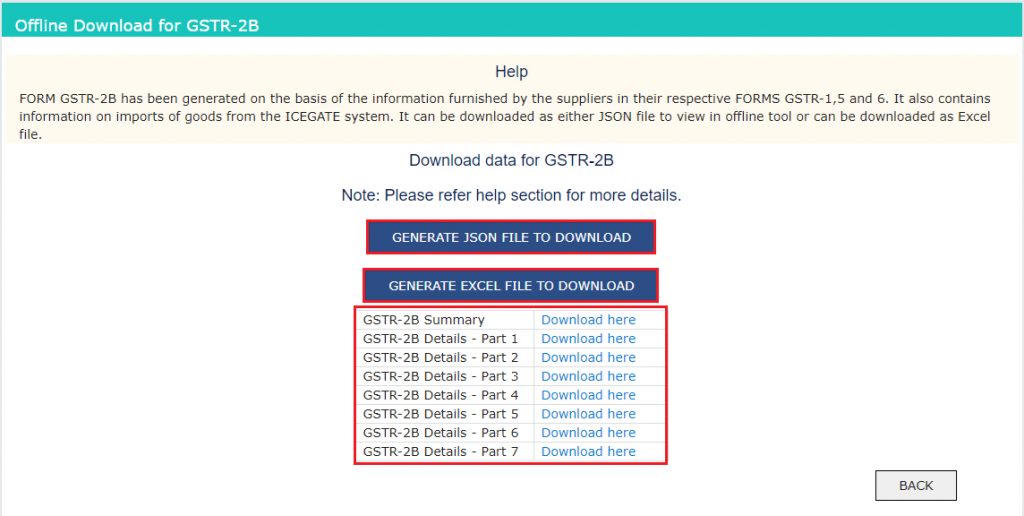

- 6.2 Now, Click on either the GENERATE JSON FILE TO DOWNLOAD button or GENERATE EXCEL FILE TO DOWNLOAD button to download the Form GSTR-2B. The file will be downloaded and stored onto your drive

6(b). View GSTR-2B

- 6.1. To just view the From, Under the Form GSTR-2B tile, click on the VIEW button.

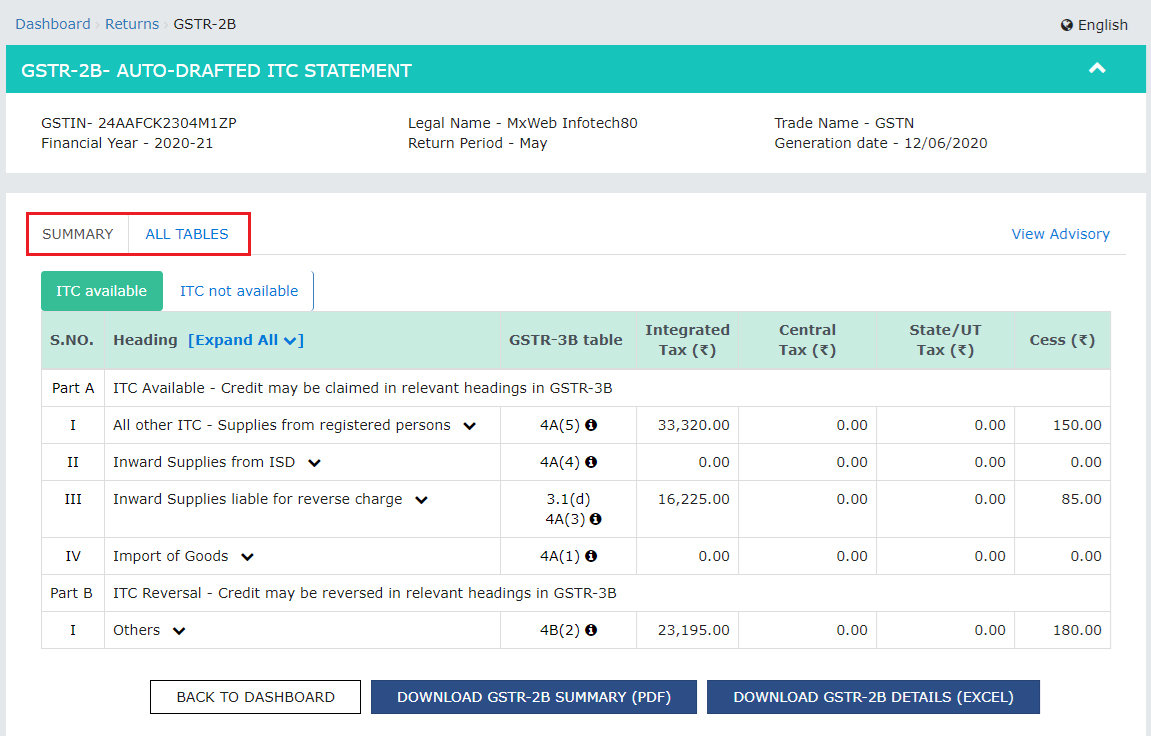

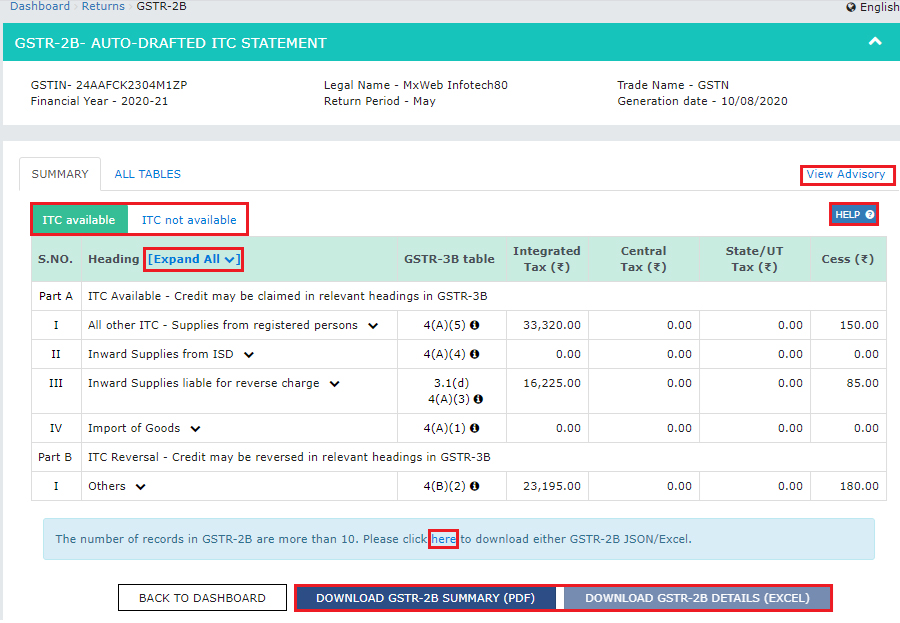

- 6.2. After clicking on the button the Form GSTR-2B – AUTO DRAFTED ITC STATEMENT page will appear. It has two tabs as SUMMARY and ALL TABLES.

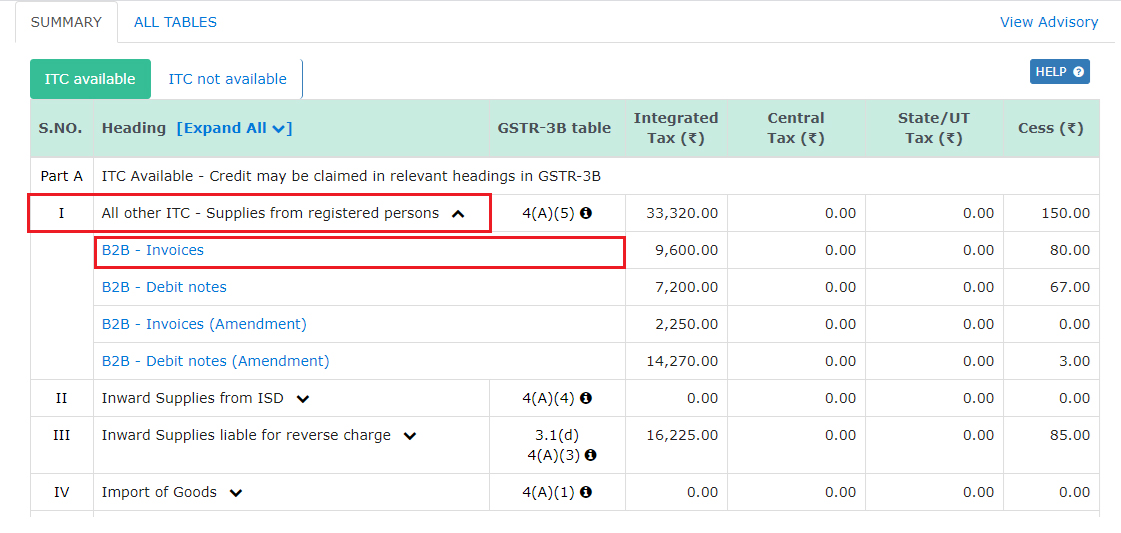

- 6.3 SUMMARY TAB

- 6.3.1 Again the Summary tab will be divided into 2 parts:

- ITC Available: It provides a summary of the inward supply and applicable ITC that can be claimed/ reversed in the relevant headings in Form GSTR-3B

- By default, all sections of the Form GSTR-2B summary are in collapse mode. However, you can expand/collapse all the sections available in the Form GSTR-2B summary by clicking on Expand all

- You can click either the DOWNLOAD GSTR-2B SUMMARY (PDF) button or DOWNLOAD GSTR-2B SUMMARY (EXCEL) button to view the Form GSTR-2B details in PDF or Excel file. The downloaded file will have a Form GSTR-2B summary and all the table details. In the case where the total number of documents under all tables exceeds 1000 then this button will be disabled. You can still download the excel file from Form GSTR-2B download page, a direct link will be given in the message below the summary table

- Help button can provide you with details regarding this particular page/screen

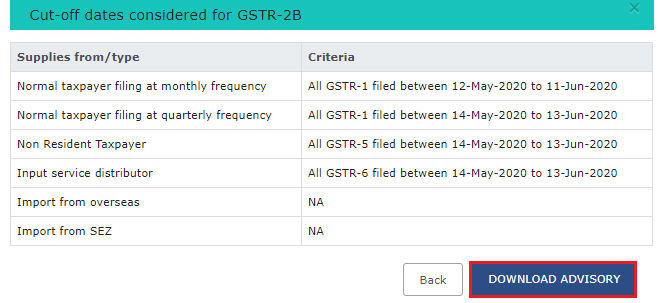

- The link of View Advisory can be also used to view and download the advisory. You can view the cut-off dates held for Form GSTR-2B from the pop-up page

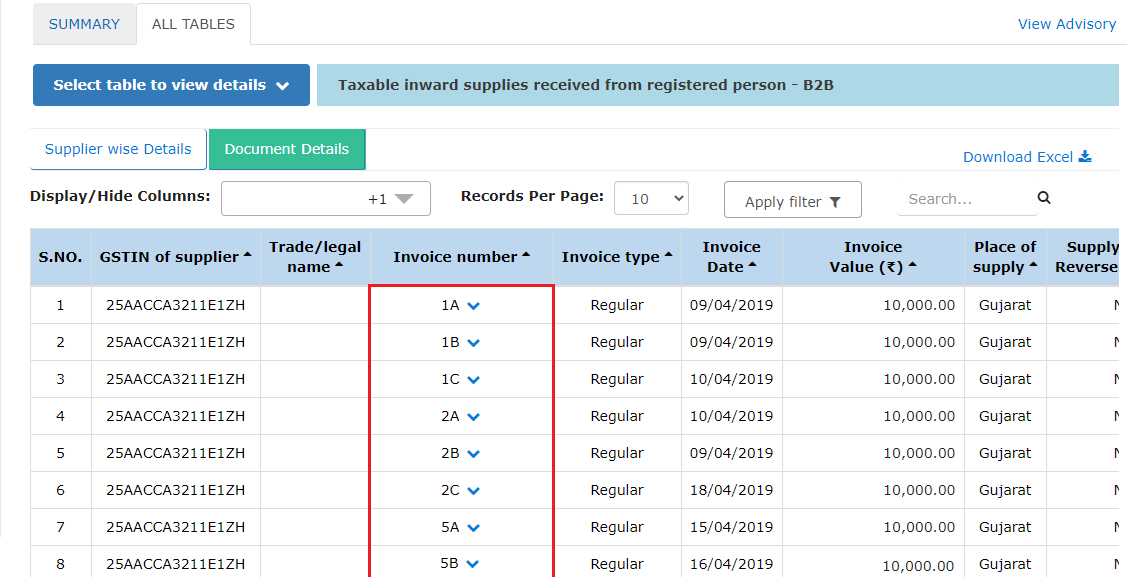

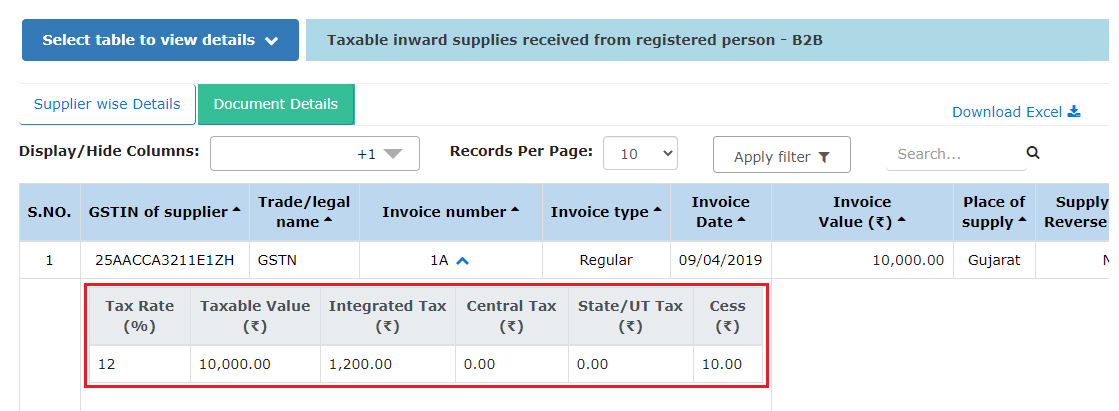

- 6.3.3. By clicking on the hyperlink, you can navigate to Documents Details under ALL TABLES tab for that particular section. You can also view pre-filtered details of inward supplies received from registered persons. You can click on the Invoice number hyperlink to see the tax details

- Download Excel – to download the details in an excel file

- Display/Hide Columns – select columns to hide or show

- Records Per Page – fix the pagination. Define the number of records per page

- Apply Filter – Use the filter option to short auto-drafted documents as per the applied filter

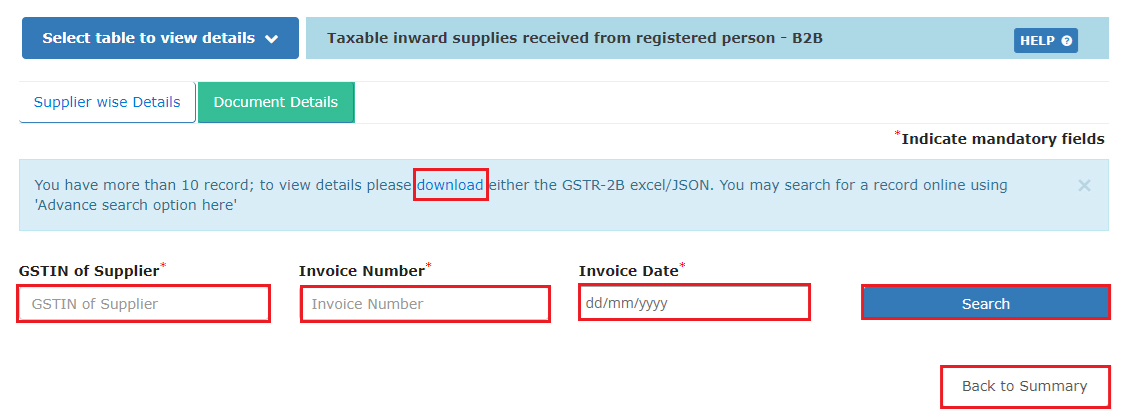

- In the case where the total number of documents under all tables exceeds 1000 then the document details table will not be visible online. However, You can download the GSTR-2B statement in excel or JSON file by clicking on Download link. The link will be available in the message

- You can also use the Advanced search feature to search for any specific document online

- Just in a similar manner, you can view details for other tables

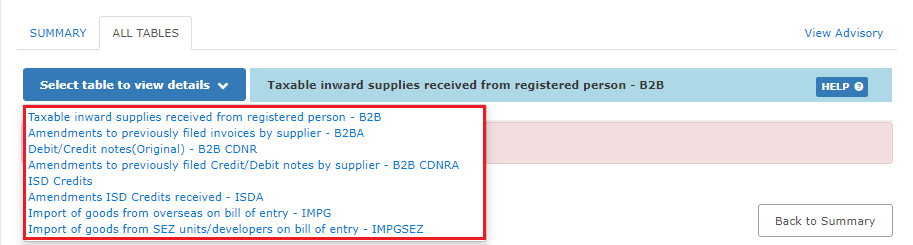

- 6.4 ALL TABLES TAB

- B2B Table of GSTR-2B: To view auto-generated inward supplies received from registered persons including supplies that attract a reverse charge.

- B2BA Table of GSTR-2B: To View auto-drafted details of changes/ amendment to inward supplies received from registered persons including supplies that attract a reverse charge

- B2B CDNR Table of GSTR-2B: To view auto-drafted debit or credit notes received from registered persons.

- B2B CDNRA Table of GSTR-2B: To view auto-drafted modified/ amended debit or credit notes received from registered persons.

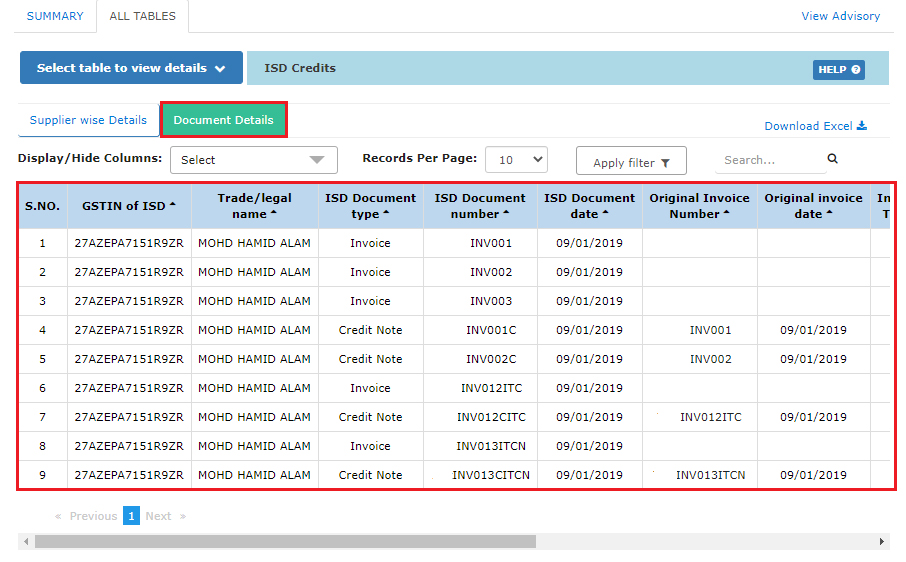

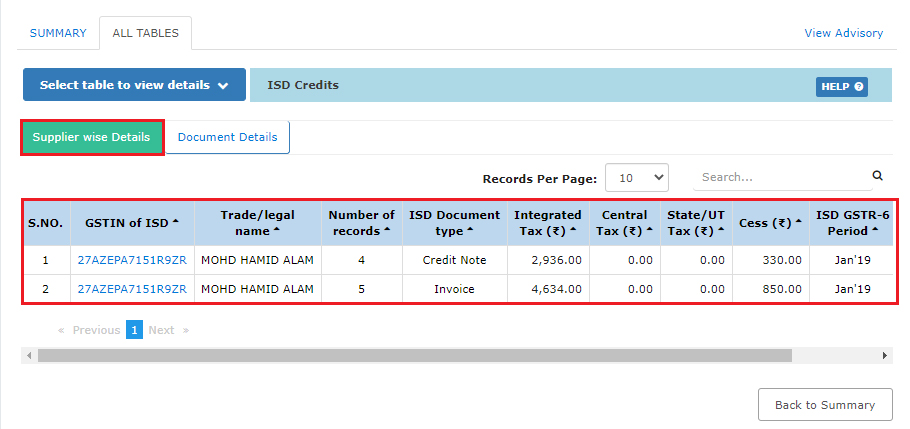

- ISD Table of GSTR-2B: To get auto-drafted details of input tax credit received from input service distributors/ ISD.

- ISDA Table of GSTR-2B: To Check auto-drafted information of the amendment to an input tax credit received from input service distributors/ ISDA.

- IMPG Table of GSTR-2B: To Check fetched (auto-drafted) details of import of goods from abroad (overseas) on bill of entry.

- IMPGSEZ Table of GSTR-2B: To see auto-drafted details of incoming supply received from SEZ units/developers on the bill of entry.

- 6.4.3. You can also select Supplier wise Details tab, to see the supplier wise details of the documents available in the selected table. By Clicking on GSTIN hyperlink, you can go to the Document details tab and explore the documents received from the specific supplier only.

- By using the same process, you can check details for other tables.

- For Import of goods from foreign countries (overseas) on the bill of entry – IMPG table, only document details will be available not the supplier wise details.

- Normal taxpayers

- SEZ taxpayers

- Casual taxpayers

- No credit is availed twice for any document under any circumstances

- Credit is reversed as per the GST Act and Rules in their Form GSTR-3B

- Tax on the reverse charge basis is paid

- ITC Available: A report of ITC available as on the date of its generation and is distributed into a credit that can be availed and credit that is to be reversed (Table 3)

- ITC not Available: A summary of ITC not present and is classified into ITC not available and ITC reversal (Table 4)

- All Other ITC – Supplies from registered persons

- Inward Supplies from Input Service Distributor/ISD

- Inward Supplies liable for reverse charge

- Import of Goods

- B2B – Credit Notes

- B2B – Credit notes (Amendment)

- B2B – Credit Notes (Reverse charge)

- B2B – Credit notes (Reverse charge) (Amendment)

- ISD – Credit notes

- ISD Amendment – Credit notes

- All Other ITC – Supplies from registered persons

- Inward Supplies from Input Service Distributor/ISD

- Inward Supplies liable for reverse charge

- B2B – Credit Notes

- B2B – Credit notes (Amendment)

- B2B – Credit Notes (Reverse charge)

- B2B – Credit notes (Reverse charge) (Amendment)

- ISD – Credit notes

- ISD Amendment – Credit notes

- Invoice or debit note for the supply of goods or services or both where the recipient is not entitled to Input Tax Credit.

- Invoice or debit note where the Supplier (GSTIN) and place of supply are in the same state, while the recipient is in another State.

- GSTIN of supplier / ISD

- Taxable value

- Integrated Tax

- Central Tax

- State Tax

Note:

- Note:

-

Note:

-

Note:

- Note:

Download & View Form GSTR 2B in PDF Format

General Queries on GSTR 2B Form

Q.1 – What is Form GSTR-2B?

Form GSTR-2B is an auto-drafted ITC declaration that will be created for all enrolled persons on the grounds of the information provided by his/her suppliers in their respective Form GSTR-1 & Form GSTR-5 and ITC obtained through Form GSTR-6. The statement will show the availability of Input Tax Credit to the enrolled person upon every document filed by his/her suppliers and the Input Service Distributor (ISD). Form GSTR-2B also holds information on the import of goods from the ICEGATE system including inward supplies of goods collected from SEZ Units / Developers

Q.2 – What is the use of Form GSTR-2B?

Form GSTR-2B should be practised by taxpayers to get the right input tax credit in particular segments of Form GSTR-3B.

Q.3 – Do I as a taxpayer have to file Form GSTR-2B?

No, one should not file Form GSTR-2B. It is only a read-only static auto-drafted ITC statement which shows the availability of Input Tax Credit upon specific documents filed by the suppliers and ITC received through ISD

Q.4 – When will Form GSTR-2B generate?

Form GSTR-2B will be created for each month on the 12th day of the following month. For example, for the month of July 2020, the statement will be created and produced available to the enrolled person on 12th August 2020. Example: Form GSTR-2B consists of all certificates filed by suppliers/ISD in their Form GSTR-1, 5 & 6, between 00:00 hours on 12th day of preceding month to 23:59 hours, on 11th day of the current month. Thus, the statement made on the 12th of August will include data from 00:00 hours of 12th July to 23:59 hours of 11th August

Q.5 – By when details filed in Form GSTR-1 and Form GSTR-6 would reflect in Form GSTR-2B?

The information filed in Form GSTR-1 & 5 (by supplier) & Form GSTR-6 (by ISD) will display in the succeeding open Form GSTR-2B of the beneficiary regardless of supplier’s/ISD’s date of filing. For e.g., if a supplier files a document INV-1 dt. 15.07.2020 on 11th August, this will show in GSTR-2B of July (generated on 12th August). However, the document is filed on 12th August 2020 the document will be displayed in Form GSTR-2B of August (generated on 12th September)

Q.6 – Can GSTR-2B be edited by the taxpayer for performing the changes to add a document in my Form GSTR-2B to rectify the omissions and errors in the applications filed by the supplier?

No, one cannot edit or add a document to the Form GSTR-2B, as it is a read-only static ITC statement.

Q.7 – Which taxpayer can view Form GSTR-2B?

Form GSTR-2B is available for the following taxpayers:

Q.8 – How to view and download Form GSTR-2B statement for the Tax period?

Navigate to Services> Returns > Returns Dashboard > File Returns > GSTR 2B Tile to view and download Form GSTR-2B statement of a tax period.

Note: Form GSTR-2B statement for a specific tax period is present to display and download after the Form GSTR-2B gets made for the particular tax period

Q.9 – Can I as a taxpayer download and keep the xerox of Form GSTR-2B for future testimony?

Yes, Form GSTR-2B for a particular provided tax period will be present to view or download (in Excel and/or JSON formats) in after login mode on the GST portal

Q.10 – Can I download individual table-wise details in Form GSTR-2B

Yes, one can download separate table-wise information in Form GSTR-2B by clicking the Download Excel link available in document details. This link will be accessible only if the total number of documents beyond all tables is up to 1000 documents. For more than 1000 records, one can use the advance search option or download the complete file

Q.11 – Should I reconcile my account with the information generated in Form GSTR-2B?

Taxpayers are guided to verify that the information created in Form GSTR-2B is reconciled with their own records and books of accounts. Taxpayers will have to see that

Q.12 – What information is present in summary of the Form GSTR-2B?

Form GSTR-2B summary is bifurcated as:

Q.13 – What information is available in PART-A of ITC available?

The PART-A of ITC Available includes aspects of inward supplies (invoices, debit notes and amendments related to invoices and debit notes) and import of goods received from suppliers, as follows:

Q.14 – What description is available in PART-B of ITC reversal?

The PART-B of ITC Reversal contains details of credit notes and amendments thereof issued by the suppliers or ISD, in the following manner:

Q.15 – What details are available in PART-A of ITC not available?

The PART-A of ITC Not Available contains details of inward supplies (invoices, debit notes and amendments related to invoices and debit notes) received from suppliers, in the following manner:

Q.16 – What information are available in PART-B of ITC not available?

he PART-B of ITC Not Available contains details of credit notes and amendments thereof issued by the suppliers or ISD, in the following manner:

Q.17 – How are amendments taken into the accounts for the summary tables?

Summary wise details of all amendment tables in Form GSTR-2B displays the differential tax amount (Amended – Original), i.e., the delta value. However, the document information has to bel display revised details with a source to the original document.

Q.18 – Whether taxpayers are eligible to take credit/ITC on all the supplies auto-drafted in Form GSTR-2B?

Taxpayer is liable to avail the input tax credit on the basis of ITC shown in Form GSTR-2B as per the availability and eligibility of ITC. input tax credit may not be present to the taxpayers and it is not generated in the system for Form GSTR-2B. The self assessment and reverse or taking credit in Form GSTR-3B has been advised to the taxpayers.

Q.19 – What are the different scenarios where ITC is not available?

Only in the following scenarios, ITC availability is shown as No in Form GSTR-2B:-

Q.20 – Which are the columns as a taxpayer I can hide and show?

Form GSTR-2B summary is bifurcated as:

Q.21 – When will the advance search option be enabled?

If the number of records across all tables of Form GSTR-2B is more than 1000 documents, then the advance search option will be enabled. By using this option, taxpayers can view a particular document

Q.22 – Where can a taxpayer view the cut-off dates in Form GSTR-2B?

View cut off dates for the taxpayers in Form GSTR-2B page in the View Advisory.