GSTR 2B is an alternative form for all the month-wise auto-drafted statements for the taxpayers having regularity. Also to check the QRMP scheme if opted or not.

The GSTR 2B is a validation form to offer the ineligible and eligible input tax credit for every month just like the GSTR 2A form however being similar for a certain time duration.

The GSTR 2B form is for multiple client types like normal, SEZ, and casual taxpayers. The recipients are able to get the form based on GSTR 1, GSTR 5, and GSTR 6.

GSTR 2B Working Process Via Gen GST Software

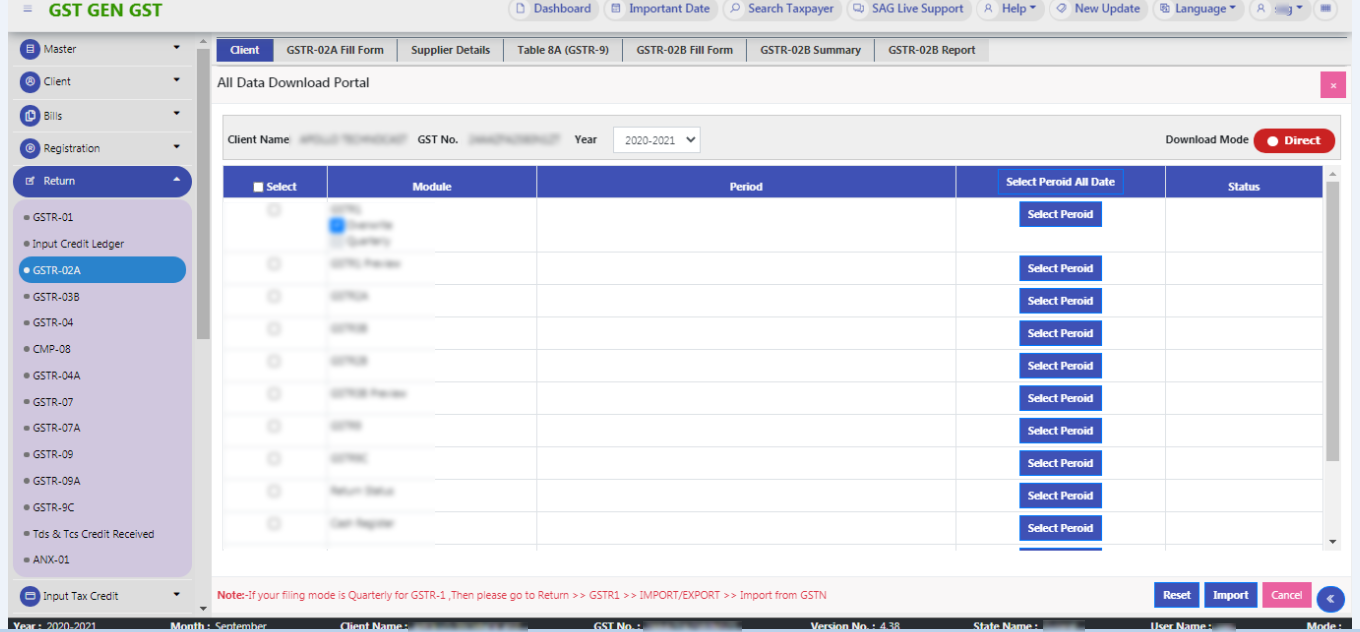

To download GSTR-2B form data please go to the download page as shown in the Figure below:

Step 1: Open the Gen GST Software dashboard

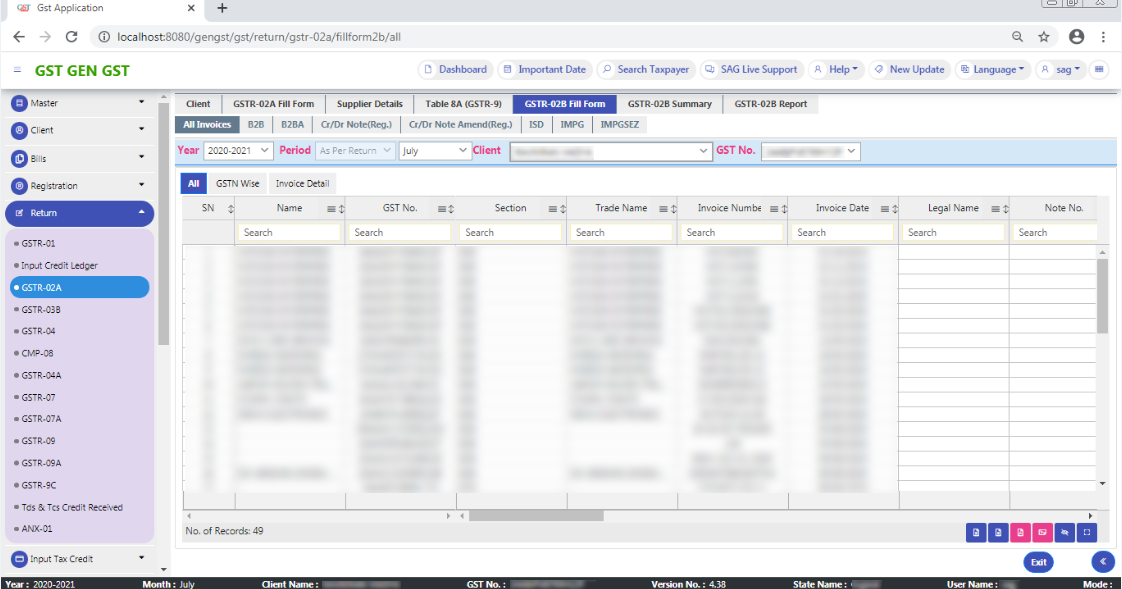

Step 2: We have provided the GSTR-2B section under GSTR-2A.

Step 3: Now select GSTR-2B Return==> Regular==>GSTR-2A==>GSTR-2B fill form. Here comes the page of the GSTR-2B fill out the form

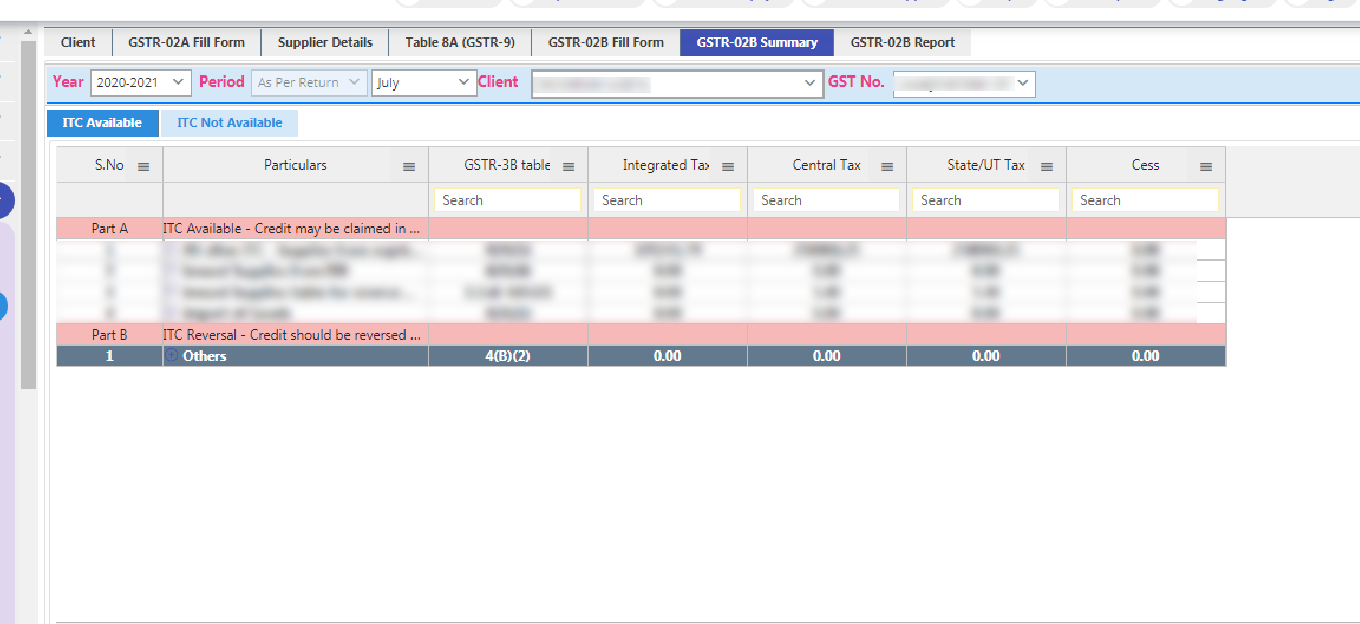

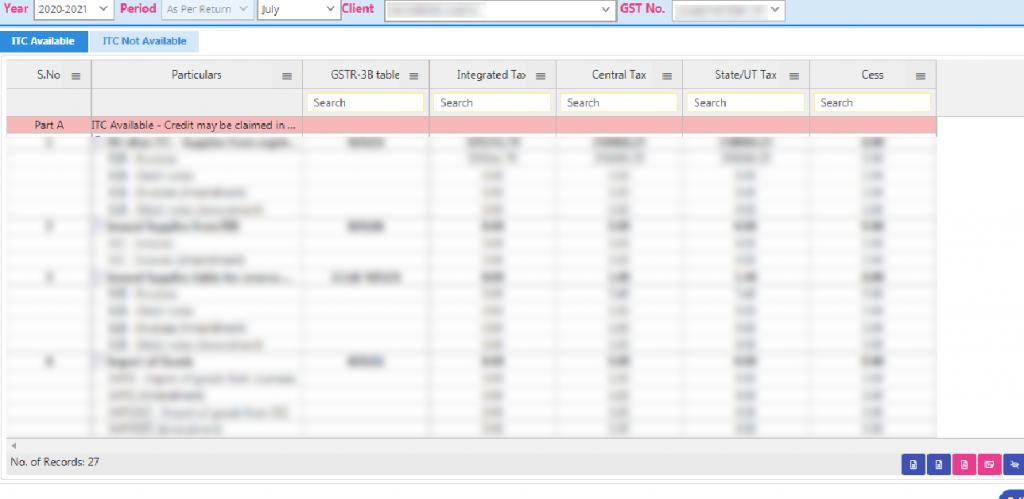

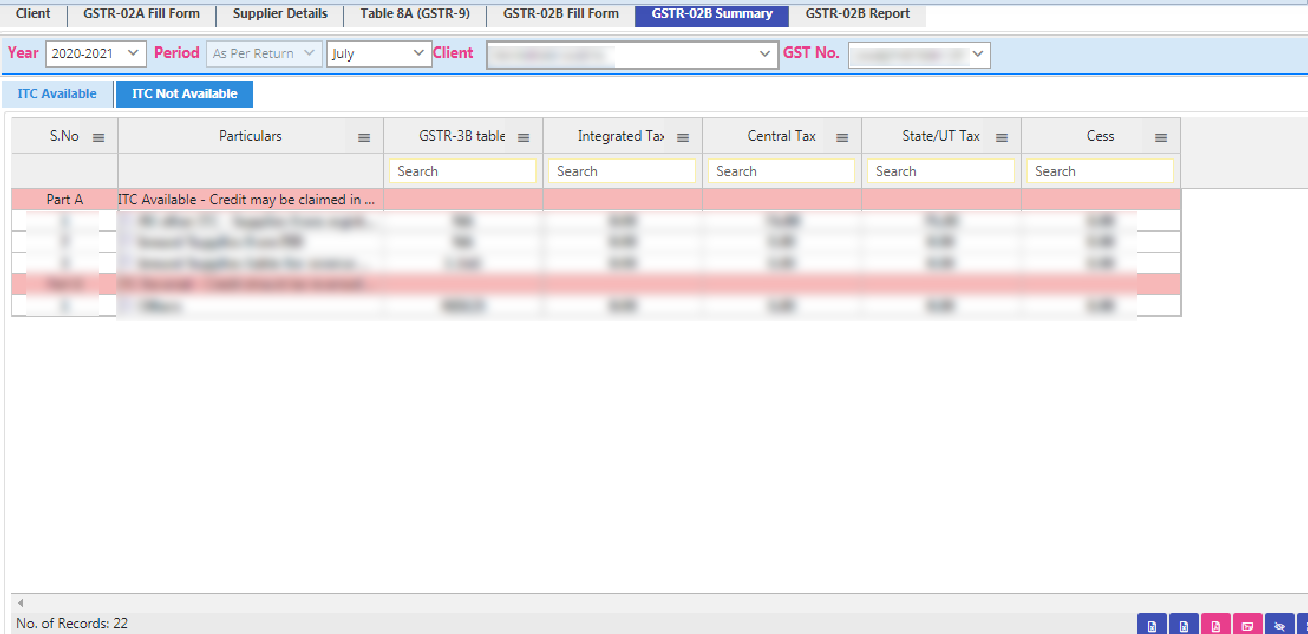

Step 4: Now, the next step is to Go to the GSTR-2B summary, where you have ITC available and ITC not available.

Step 5: On clicking, the ITC available page will be displayed below like this, it consists of Part A which is ITC available and Part B which is related to ITC reversal.

Step 6: By clicking on the + button you will find a detailed amount described from

Step 7: In the same way GST Input Tax Credit, not the available page will be displayed like this, here Import of Goods point is not available.

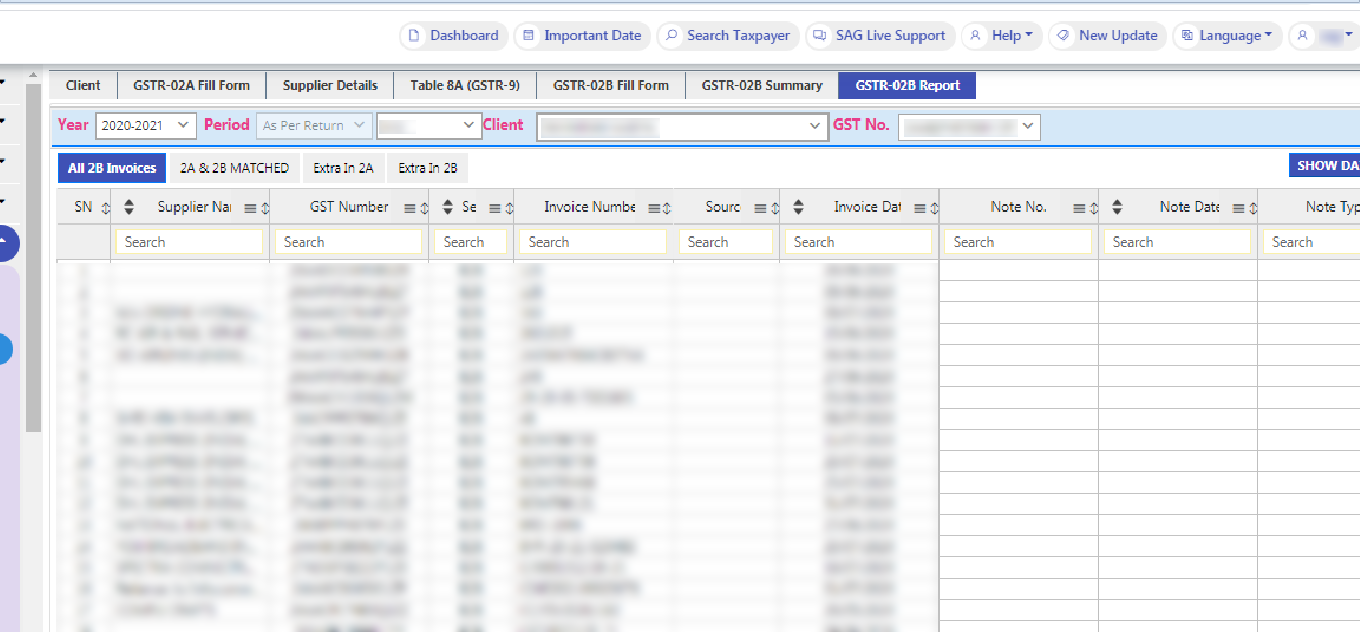

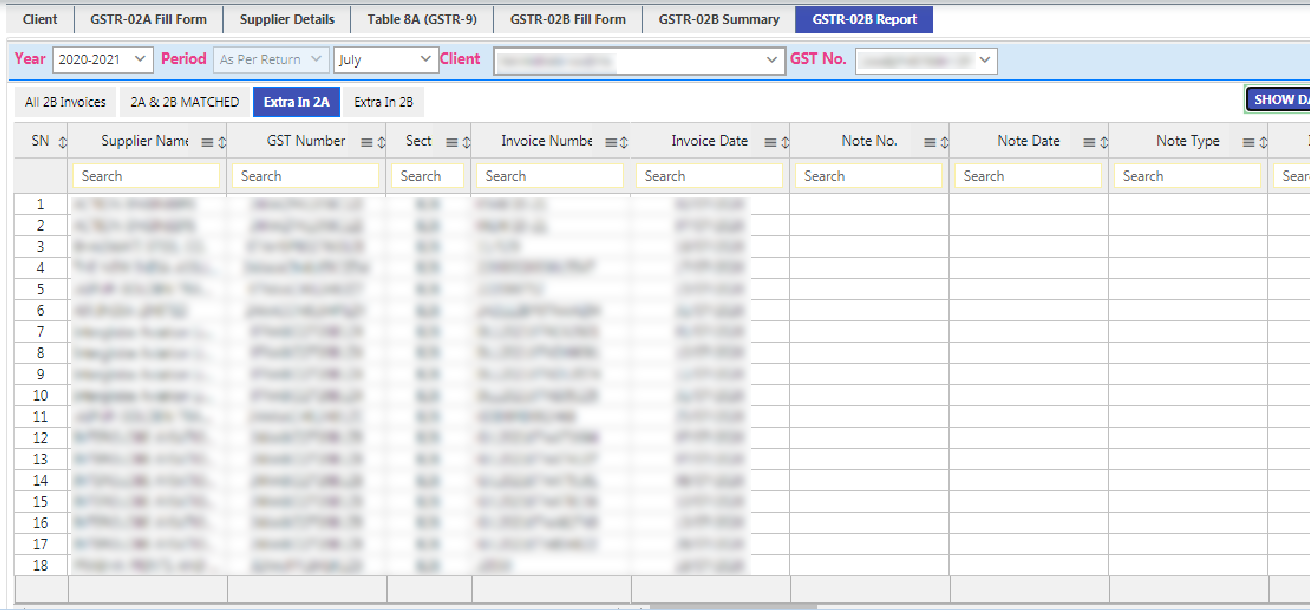

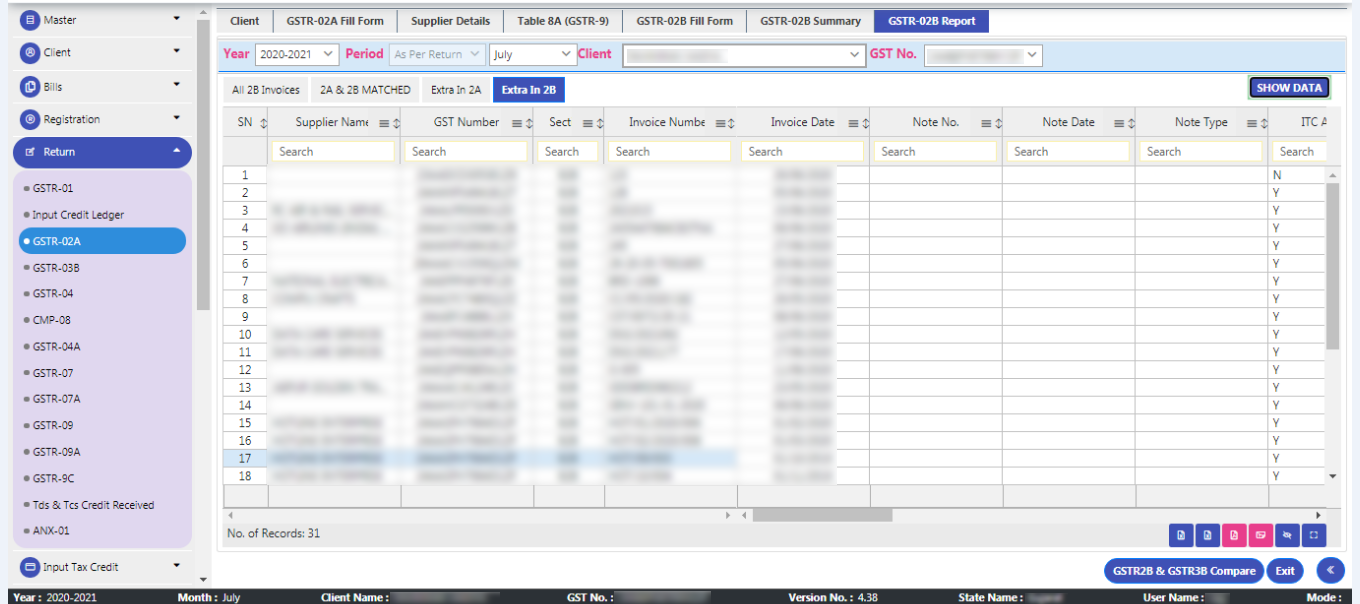

Step 8: The next step is the GSTR 2B report which consists of 1. ALL GSTR -2b invoices, 2. GSTR-2A & 2B Matched, 3. Extra in GSTR-2A, 4. Extra in GSTR-2B.

Step 9: Let’s go to Point No. 1. All GSTR-2B Invoices

Step 10: Here it will show all entries of GSTR -2B, section-wise.After that next is GSTR-2A & 2B Matched.

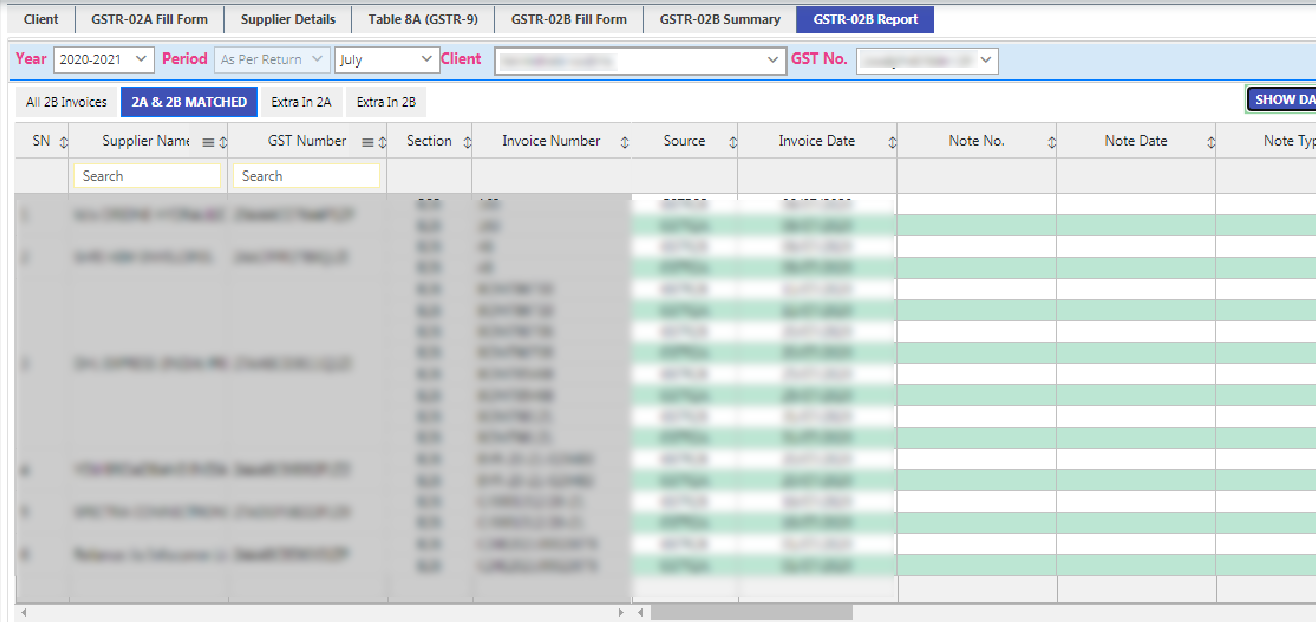

Step 11: It will show only those invoices which are common in GSTR-2A & GSTR-2B, you have to press the Show Data button first to view the detail

Step 12: The next one is Extra in GSTR-2A.

Step 13: It contains the data after the cut-off date i.e. 11th of next month.

Step 14: And the last one is Extra in GSTR-2B

Step 15: It will contain the data of Previous periods which were filed within the duration of the Current Month. For e.g., if a supplier files a document INV-1 dt. 15.07.2020 on 11th August, it will get reflected in GSTR-2B of July (generated on 12th August). If the document is filed on 12th August 2020 the document will be reflected in Form GSTR-2B of August (generated on 12th September).

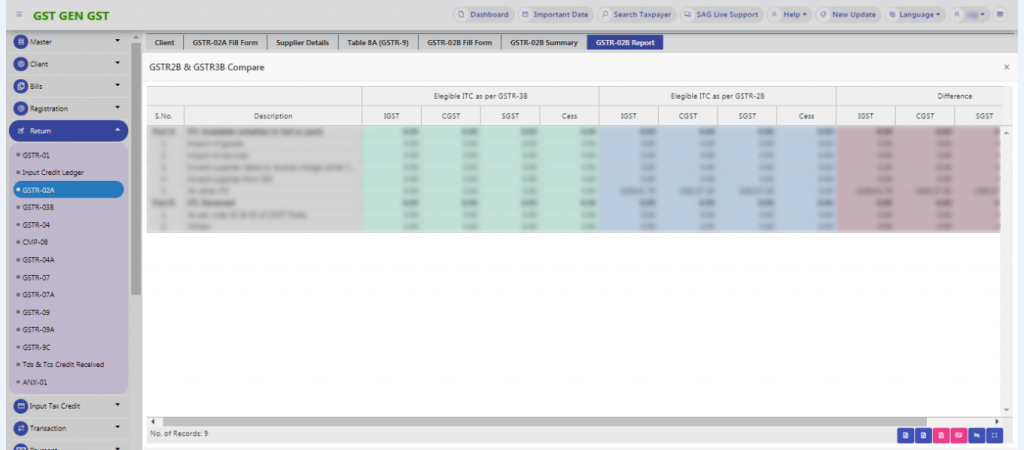

Step 16: And at the bottom, you will find the GSTR 2B & GSTR 3B comparison report

Step 17: It will show you ITC-related data that you have filed in your GSTR-3B And ITC data which will be reflected in GSTR-2B