GSTR-11 is filed by UIN (Unique Identification Number) holders for purchases they made during the month. Unique Identification Number is a special category under GST that is issued for specialized agencies of the United Nations organization, an organization registered under the United Nations Act, 1947, multilateral financial institutions, and persons notified by commissioners. The privilege is given because forensic missions and embassies are not liable to pay taxes.

The UIN helps the holder to get a refund under GST for the goods and services they have purchased in India. The embassies, consulates, and special agencies can get UIN by registering themselves in Form GST REG-13 through the GST common portal. To get the benefits of UIN, the person is needed to furnish a GSTR-11 return form with the details of taxes paid on inward supplies.

Important Terms Used in GSTR-11

- UIN: Unique Identification Number

- GSTIN: Goods and Services Taxpayer Identification Number

Salient Features of GSTR-11

- GSTR-11 is furnished by UIN holders for inward supply details

- It has an easy structure and has only 4 headings

- It is furnished by every UIN holder every month on the 28th of the succeeding month

- Most of the information is auto-populated

- UIN holder will get to know about their refund amount which is calculated automatically in Table 3

- The supplies made to any UIN holder are considered under B2B supplies and they are liable to mention it in their invoices

Who Should File GSTR-11

Only the UIN cardholders who got the UIN registration under GST REG-13 can claim the refund by GSTR-11 form. UIN holders can be:

- Any agency of the United Nations Organization

- Under the United Nations Act, of 1947, any multilateral financial Institution and Organization

- Embassies of foreign countries

- Consulate

- Any other person notified by the commissioner to obtain UIN status

Deadlines for GSTR-11 Return Filing

Every UIN holder has to furnish the details of all inward supplies in GSTR-11 by the 28th of the next month following the month for which the statement is filed.

Interest on Late Payment of GST Tax & Missing GST Return Due Date Penalty

As per the rules and regulations framed by the GST Council, if the taxpayer missed the last deadline for filing returns, then he would be liable to pay interest at the rate of 18 per cent per annum on the GST tax payable commencing from the due dates till taxes are paid. You can further read the guidelines in detail in Chapter 10 under 50 points.

If the taxpayer missed the last date of filing GST returns, then interest calculations commenced from the due dates and will be calculated based on:- 1000*18/100*1/365 = Rs. 0.49 per day approx.

Figures brief:-

- Rs 1000 is the estimated tax payment

- 18 per cent is the per-annum interest rate

- Per day delayed by the taxpayer

As per the deadlines mentioned by the GST Council and the taxpayer missed those deadlines, then he would be liable to pay a penalty of Rs.100 for CGST and Rs.100 for SGST per day, commencing from the due dates till the returns are filed.

Step-by-Step Processes to File GSTR-11 Form Online

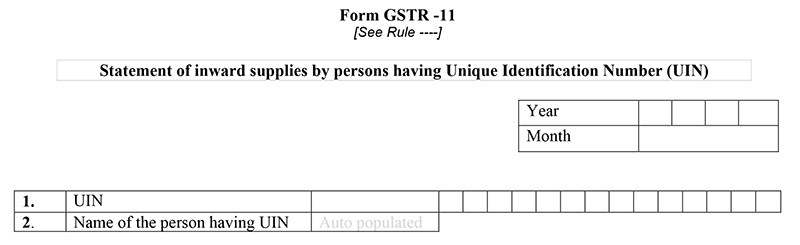

Table 1&2: Details of Taxpayer

- UIN – UIN is the unique number which should be filled in this head

- Name of the taxpayer – The taxpayer’s name will be auto-populated while return filing at the time of logging into the common GST portal

- Month-Year (Period) – The taxpayer is required to choose the date from the drop-down for which month and year the GSTR-11 is being filed

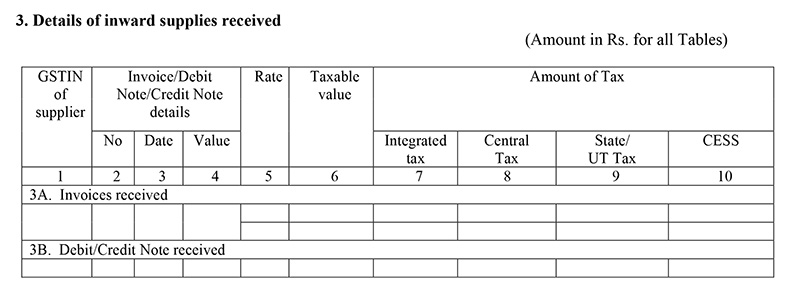

Table 3: Details of Inward Supplies Received

All kinds of inward purchases and supplies are covered under this heading. When the Taxpayer provides his GSTIN number, these details will be auto-populated from the GSTR-1 return form

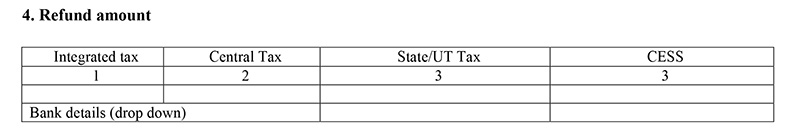

Table 4: Refund amount

- The refund amount is auto-calculated after providing the details in the previous heads

At the end of furnishing all the information, the taxpayer is required to verify the authenticity by signing the form electronically on the common GST portal.