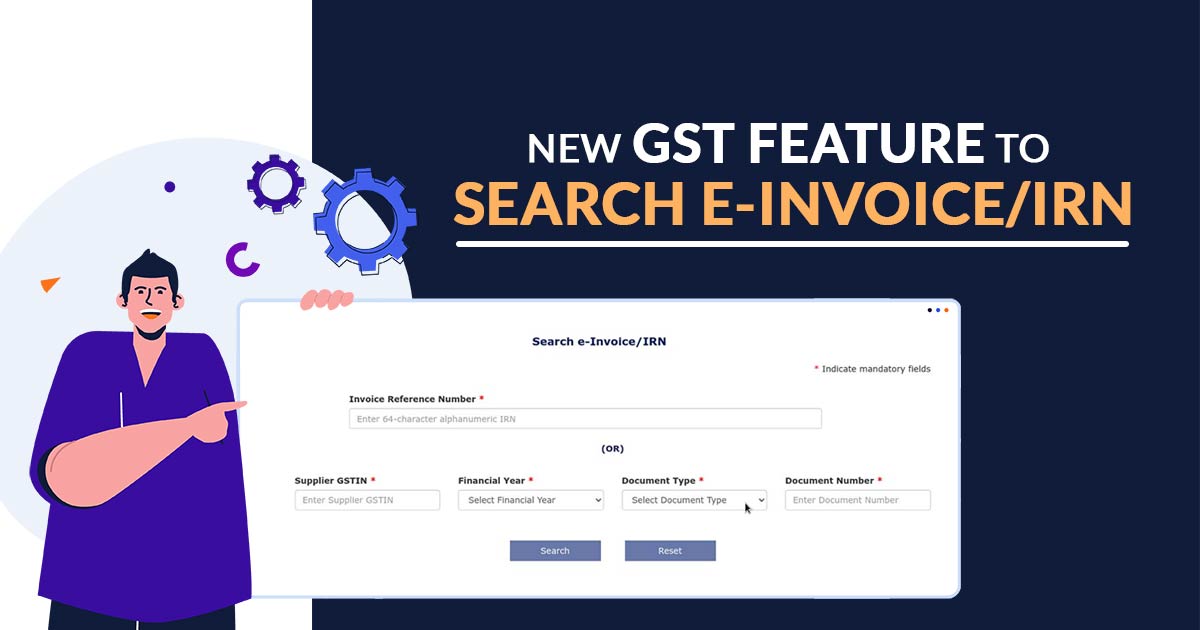

The Goods and Services Tax Network, called GSTN, incorporated a convenient feature that permits the users to recover the Invoice Reference Number (IRN) despite the same was not initially saved for an invoice, credit note, or debit note. If you see that you are in the condition in which you have failed to save the Invoice Reference Number (IRN), then you should not be worried as GSTN has made it enabled you to locate it effortlessly.

Follow these steps in order to access this new functionality, Start by proceeding to the GSTN Dashboard, which can be seen in the given URL: https://einvoice.gst.gov.in/einvoice/dashboard.

After reaching the Dashboard, locate the option to search or enable features. Tap on it to move further. It makes you redirect to the Search IRNs page, which can be alternatively accessed directly via this link: https://einvoice.gst.gov.in/einvoice/search-irn.

Read Also: Step-by-Step Guide to Generate E-invoice Under GST with Benefits

Through the execution of such a user-friendly feature, GSTN has the objective to furnish a perfect experience for individuals who may have mistakenly ignored saving the crucial IRN. Only in a few taps, you can recover the IRN for any document, assuring that you maintain the precise records and follow the GST laws as mentioned.

IRN that computes the hash shall become the IRN (Invoice Reference Number) of the GST e-invoice. It will be unique to every invoice and therefore be the unique identifier for each invoice for the whole fiscal year in the complete GST System for an assessee.

See the official release of the Goods and services tax department for a detailed explanation of the e-invoicing system https://einvoice1.gst.gov.in/Documents/GST_eInvoiceSystemDetailedOverview.pdf

Utilize this useful feature offered by GSTN to easily retrieve any lost Invoice Reference Number using the Document Number.

Access the GSTN Dashboard, navigate to the Search/Enable option, and move to the Search IRNs page for fetching the missing IRN for your invoices, credit notes, or debit notes.