On the recommendations of the 54th GST Council, the Central Government has issued Notification No. 22/2024 – CT dated 08.10.2024 and reported that any registered person against whom any order affirming demand for the incorrect claim of the ITC based on the violation of provisions of sub-section (4) of section 16 of the articulated Act had been issued, but where such ITC is now available under the recently inserted sub-sections (5) and/or (6) of section 16 of the Act, shall now be unable to file an application for rectification of these demand orders.

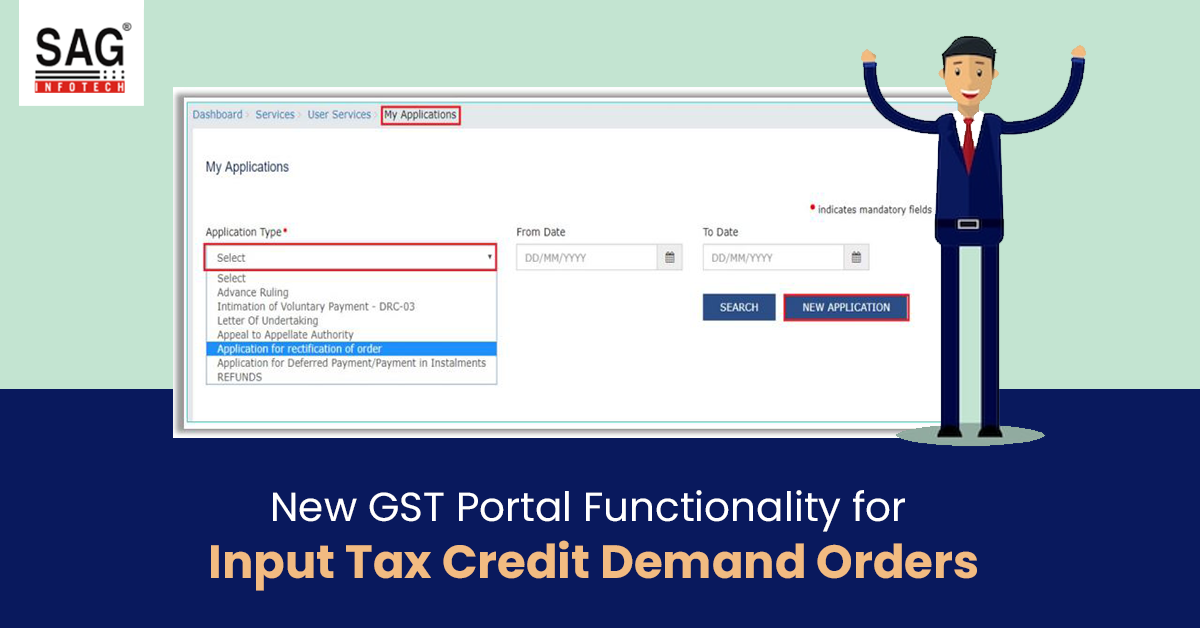

On the Portal, a functionality has now been made available from now for taxpayers to apply for rectification of such orders issued u/s 73/74. After login they can file it, by navigating Services > User Services > My Applications, selecting “Application for rectification of order” in the Application Type field, and tapping on the NEW APPLICATION button.

A hyperlink has been given on the Portal to download the proforma in Annexure A in Word format, directed to be uploaded after entering details of the demand order of the GST Input Tax Credit (ITC) erroneously availed established on the violation of sub-section (4) of section 16 of the CGST Act, now eligible as per sub-section (5) and/or (6) of section 16 of the CGST Act, at the time of applying for rectification.

View a detailed step-by-step process for the filing of the rectification application:

My supplier filed their Gstr1 after due date during the period 2019-20 and deptt pass demand order can we apply for rectification of order