The Central Board of Indirect Taxes and Customs (CBIC) has introduced an online feature that allows taxpayers to conveniently track the status of their refund applications in real time. This initiative aims to provide a more efficient and transparent process for taxpayers.

To facilitate the tracking of refund applications, different colours have been assigned to represent various stages in the process. The colour Red indicates the current status, Green represents completed stages, and Grey signifies pending stages.

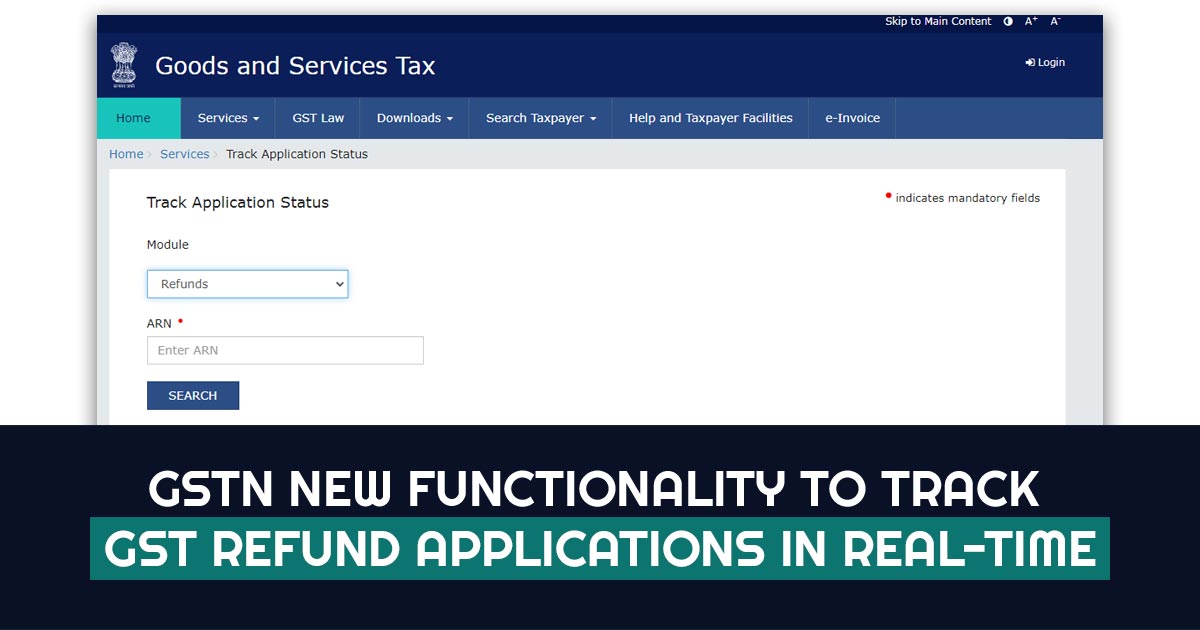

The process for tracking the status of a GST refund application involves a few simple steps.

Step 1: Taxpayers are required to log in to the GST Portal and navigate to the ‘Services Tab’.

Step 2: From there, they can easily ‘Track the Application Status’ by selecting the ‘Refund option‘ and then entering the Application Reference Number (ARN).

Step 3: A quick search will provide them with the desired information.

Under the Goods and Services Tax (GST) system, registered taxpayers have the option to claim a refund if they have paid an excess amount more than their GST liability. To initiate the refund process, taxpayers need to submit a refund application on the GST portal, providing all the necessary details.

Timely refunds play a crucial role in maintaining the cash flow and working capital requirements of manufacturers and exporters. Delays in the refund process can negatively impact their operations.

Hence, one of the key objectives of implementing the GST system is to ensure a smoother refund process, minimising any issues faced by manufacturers and exporters. By expediting the refund process, tax administration becomes more effective and efficient.

To streamline and standardise refund procedures under GST, the regime has specific provisions in place. A standardised form has been developed to facilitate refund claims, allowing taxpayers to complete the required procedures online and within the specified timeframe. This approach aims to simplify the process and enhance the overall experience for taxpayers.