A crucial update will be implemented on the GST portal by the Goods and Services Tax Network (GSTN). This amendment could permanently block your Input Tax Credit (ITC). Let’s find out how.

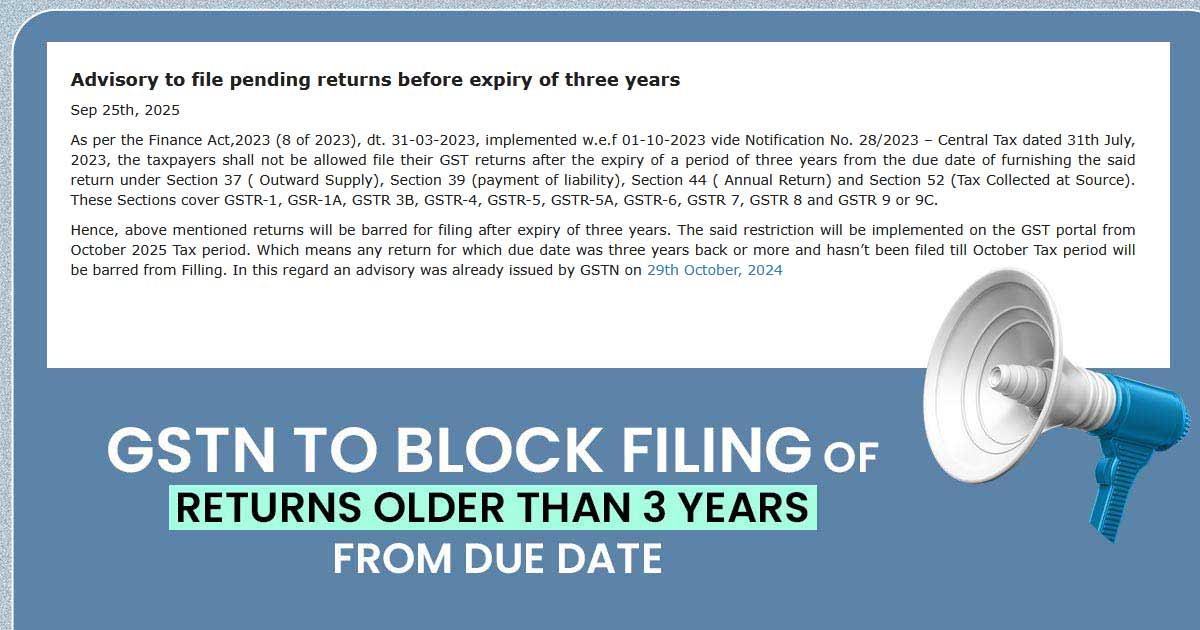

Three years after the due date for filing GST returns, the GSTN declared that taxpayers would be unable to furnish their GST returns.

Taxpayers have not been furnished with any chance to submit their GST returns post 3 years from the due date of return filing u/s 37 (Outward Supply), Section 39 (payment of liability), Section 44 (Annual Return), and Section 52 (Tax Collected at Source), under the Finance Act, 2023.

GSTR-1, GSTR-3B, GSTR-4, GSTR-5, GSTR-5A, GSTR-6, GSTR-7, GSTR-8, and GSTR-9, are covered under these sections.

As of October 2025, the GSTN department will no longer accept the below-mentioned GST returns. Hence, these returns will be barred from filing after the expiry of three years.

| GST Forms | Barred Period (w.e.f. 1st November 2025) |

|---|---|

| GSTR-1/IFF | September-2022 |

| GSTR-1Q | July-Sep 2022 |

| GSTR-3B/M | September-2022 |

| GSTR-3B/Q | July-Sep 2022 |

| GSTR-4 | FY 2021-22 |

| GSTR-5 | September-2022 |

| GSTR-6 | September-2022 |

| GSTR-7 | September-2022 |

| GSTR-8 | September-2022 |

| GSTR-9/9C | FY 2020-21 |

Note: Taxpayers are advised to reconcile their records and file GST returns as soon as possible. View more

In What Way Does the Same Impact Your Input Tax Credit?

When your supplier does not submit the return and does not file the taxes, it is specified that, even if you completed the supply payment, you will not get the ITC on purchases.

Retrospective cancellation of return emerges from not filing the return, which leads to the refusal of the ITC for the customers.

For the default case, no chance for filing an old return will be there with the seller, hence it results in the permanent refusal of input tax credit (ITC). Again, the same impacts genuine buyers.

Positive Judicial Decisions

Even after having the favourable judicial pronouncements, where the courts ruled that the buyers must be furnished ITC for the case of non-compliance by the seller.

In the matter of M/s GARGO TRADERS vs THE JOINT COMMISSIONER, COMMERCIAL TAXES (STATE TAX) & ORS, the Calcutta High Court articulated that Input Tax Credit (ITC) cannot be refused to the buyer only due to the cancellation of GST Registration of the supplier with retrospective effect.

The Delhi High Court in the case of M/S Maurya Industries Vs. The Union of India & Anr has quoted that “Merely because a taxpayer has not filed the returns for some period does not mean that the taxpayer’s registration is required to be cancelled with a retrospective date also covering the period when the returns were filed and the taxpayer was compliant. It is important to note that, according to the respondent, one of the consequences for cancelling a taxpayer’s registration with retrospective effect is that the taxpayer’s customers are denied the input tax credit availed in respect of the supplies made by the taxpayer during such a period.”

Read Also: GSTN Eases GST Refund Filing Process Across Key Categories

The courts normally provide justice to bona fide taxpayers, though one must know that not everyone can afford litigation. The lack of a grievance redressal procedure from the department could make things complicated and lead to litigation.