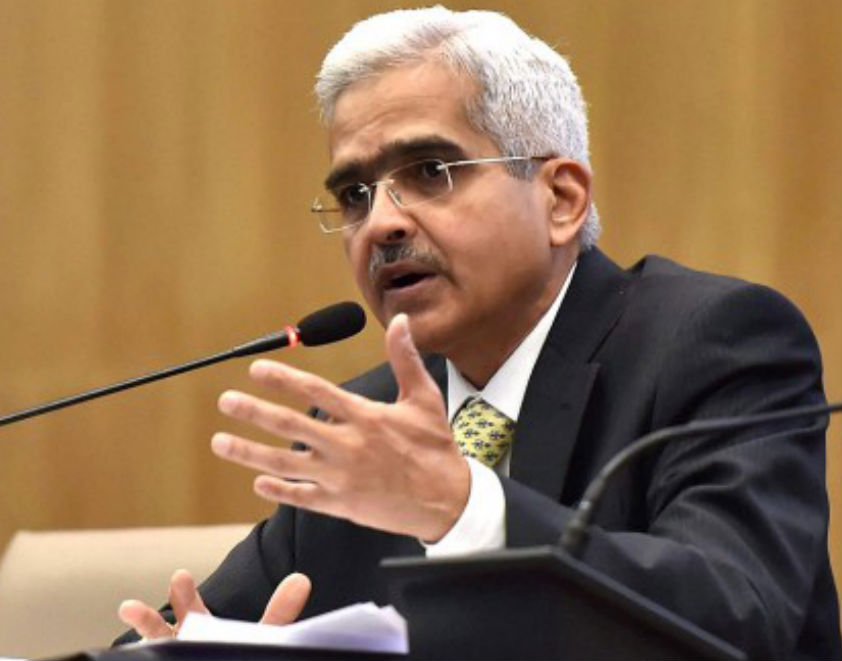

Economic Affairs secretary Shaktikanta das cleared some doubts regarding the impact of GST on the basic nature of economic condition of the country and said that demonetization along with GST has the capabilities to take the tax to GDP ratio to a wider base while doing an overall improvement in the growth of economy in coming two-three years from now.

The government is also hopeful to maintain a stable fiscal balance along with venturing into public investments. Fiscal Responsibility and Budget Management (FRBM) committee report was out and the ministry was responsible for replying towards it, in which Das told that a panel has been formed in order to keep eyes on the government’s policies and assured that the action will be taken before the next budget session. NK Singh-leader committee comes up with a new fiscal structure on the basis of stable government debt which is estimated at 60 percent of current GDP and has mentioned that proper fiscal deficits must be considered by FY23.

Mr. Das said that “In the recent years, compliance (to the fiscal deficit targets) is definitely strong. Now post demonetization and post implementation of GST, the tax base will widen and hopefully tax-to-GDP will also improve, And with the economy expected to show higher growth in next 2-3 years, tax-to-GDP will improve, so overall it should be possible for the government to meet the requirements of public investment and maintain a fiscal deficit.”

The committee hopes of a fiscal deficit up to 2.5 percent of GDP by FY23 while the government of India has announced the review of fiscal structure in the last budget in between the requirement of a more smooth structure which can provide a flexibility space to the center for clearing away economic stress. Mr. Das added that “It (the report) has been made public and time has been given to the stakeholders until May 5 to give their comments. Thereafter, it will be examined and a decision will be taken. They have talked about a new legislation. The government will take a decision this way or that way well before the Budget.”