The GST TRAN 1 is a transition form for the already registered taxpayers in old schemes who are filing the GST TRAN -1 form for availing their previous input tax credit accumulated from earlier purchased stock before the implementation of the GST. A lot of registered entities are under GST in the current time period which stuffed with their old tax credits and benefits, which is a concerned part of the transition. There is a variety of tax paid in the previous tax scheme, ranging from raw materials, semi furnished goods or on the items and material given to the job working process.

Submit Query for Gen GST Software

The business industry awaits this input credit on every 30th July, but this time the Goods and services tax transitions let them wait for the said process. It is one of the sensitive process understanding the value of tax which can be though as capital blockage till realization.

- GSTR TRAN 1 Due Date

- Modify GST Forms TRAN-1 and TRAN 2

- GST TRAN 1 Form Major Issues and Controversies

- GST TRAN 1 Filing Guide

Latest Update

11th November 2022

- The new guideline for transitional credit through GST TRAN-1 and TRAN-2 has been published via circular number 182/14/2022. Read more

23rd October 2022

- Advisory on filing TRAN forms has been issued for taxpayers in Daman and Diu & Ladakh. read more

03rd October 2022

- The GSTN has posted the advisory for filing the TRAN-1/TRAN-2 forms and claiming their transitional ITC. Read PDF

12th September 2022

- According to the Supreme Court order dated 22.07.2022 and 02.09.2022 in Filco Trade Centre vs. Union of India, guidelines for filing or revising TRAN-1 and TRAN-2 forms. Read PDF

05th September 2022

- In Tran 1 and Tran 2, the SC has granted an extension of four weeks to open a common portal. read more

30th March 2022

- The Delhi HC has issued the order for British Motor Car Company (1934) Pvt. Ltd about the manual filing of GST TRAN-1. Read PDF

16th September 2021

- The High court of Bombay released an order related to the allowed claim revision of Transitional Credit in TRAN-1 form. The decision favours the petitioner, Gayatri Agro Agencies.

GST TRAN-1 Form Eligible & Non-Eligible Entities with Due Dates

| Form type | Eligible Entities | Non-Eligible Entities | Revised Due Date of Filing |

|---|---|---|---|

| TRAN-1 | GST Registered Individuals who were part or not of the previous tax scheme | Those registering under GST as composition dealer | 1st October 2022 to 30th November 2022, Read guide |

Now Manually Modify GST Forms TRAN-1 and TRAN 2

Amendment in GST TRAN-1 Form is a bigger job, as there are lots of technical issues and the request towards the amendment/ revision/ modification of TRAN1 Form was not permitted.

Towards those who suffer from the correction of GST TRAN-1 and TRAN-2, the Bombay High court towards Ashoka Buildcon Ltd and others has previously said a judgment permitting a manual furnishing by the assessee. Form TRAN-1 must be furnished by every person who has the ITC on closing the stock and relocated to GST form VAT, Service Tax, or Central Excise. The balance of closing stock ruled by the business as of the date 1st July 2017 needs to be shown in TRAN-1 to avail input tax credit on the former stock in the GST regime.

Form TRAN-2 would be furnished by the dealer or trader who has enrolled for the GST but was unregistered beneath the former regime. Those dealers who do not pose a VAT or excise invoice for the stocks which they held on 30th June 2017, could use the TRAN-2 to avail of the tax credit on the stock with them.

In the mentioned above case, the Bombay High court has permitted 122 applicants to furnish that online, the applicant would furnish the same in a duration of 3 weeks.

GST TRAN 1 Form Major Issues and Controversies

The Form GST TRAN-1 is the issue for the GST transactions from the beginning of the incorporation of the GST. The Transition Form or TRAN-1 is furnished via those people who are entitled to avail the credit upon the tax which has previously paid the Pre GST regime. So to avail of the complete credit amount TRAN-1 is to be furnished. This credit can be filed by the means of the VAT or service tax.

The Trans-1 Notice in Form 603

There will be some problems with the Trans 1 notice in Form 603 because it is sent through the council to everyone and is entitled to be a hurdle for the original assessee. As the notices needed all the before records to be open and pointing towards the tiresome problem for the assessee to give the information again.

The Strict Imposition of the Duration is Not Reasonable to Avail the Transitional Credit

There is no other reason to impose the strict last date which takes towards the loss of these Input Tax Credit for these individuals. No reason is the mandatory consequence of the effective quality that is to be refused in the instant case. Moreover, the ITC loses points on the businesses of the people making them helpless to do the business and will taken off the right towards freedom.

Failure to File Tran-1 Because of Technical Problems on GST Portal

The GST dept will not notice from the orders of the several High court directions to reopen the portal for furnishing the TRAN-1 or to accept the manual TRAN-1. The council is technically glitched to permit the assessee to furnish or revise the TRAN-1.

Here is the Step by Step Guide for Filing GST TRAN-1 Form Online

We have consolidated the steps for filing the TRAN-1 form online to ease the complete nature of GST forms for the taxpayers. We have included break-down PDF parts to elaborate each point for discarding any silly mistakes done by registered entities.

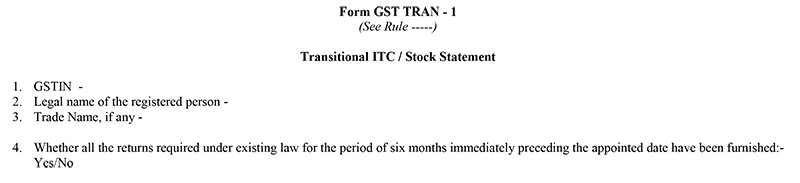

Step 1 to Step 4: Basic Details to be Filled before Starting the Form Procedure

- After logging, choose services then choose returns and click on the transition form ( services > Returns > transition forms)

- The tabs of transition forms TRAN 1/TRAN 2/ TRAN 3 can be seen in the topmost band. By default, the tiles of Form TRAN-1 and TRAN-3 are visible

- Click the option ‘yes’ or ‘no’ for further choice, whether all the returns required under relevant earlier laws for the period of six months immediately preceding the appointed date have been furnished. Relevant tables can be seen in form GST TRAN 1, according to the option selected

- Input any required details in each tile and press save button at the bottom. The system will conclude the entries and if there is any validation error, the system will show status as processed with an error. Clicking the edit button against that entry the nature of validation error can be seen in the topmost area of the screen.

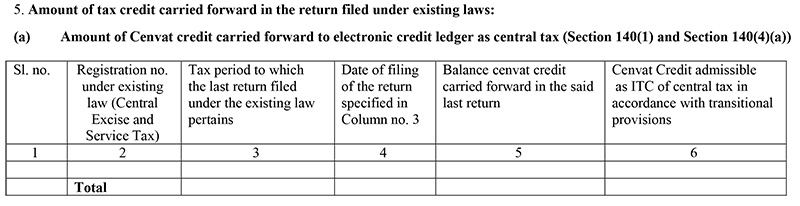

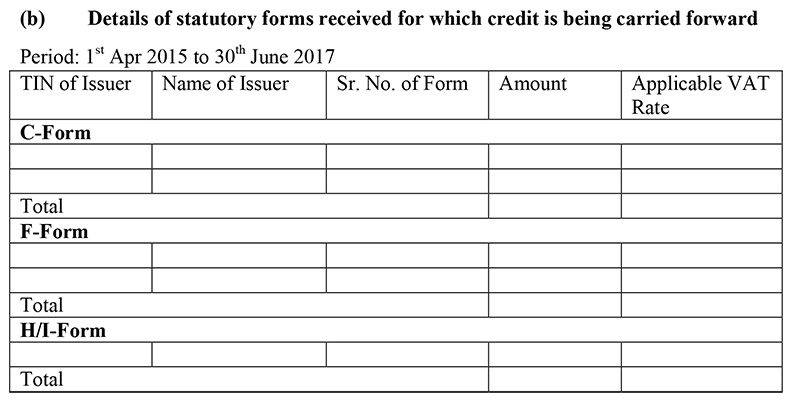

Step 5: Carried Forward Tax Credit in the Return Filed under Current Law System

5. Declare the details of the amount of tax credit carried forward in the returns filed under relevant earlier laws and admissible as GST credits, by clicking on the tile 5(a), 5(b), 5(c).

- A – The registration numbers under earlier laws mentioned in the below table in another table of TRAN 1 needs to be same as declared by the taxpayer in registration form otherwise system will display validation error

- B – If the taxpayer has failed to furnish any registration number of earlier laws, he may use the non-core registration amendment facility declared it in the registration details and subsequently file TRAN 1

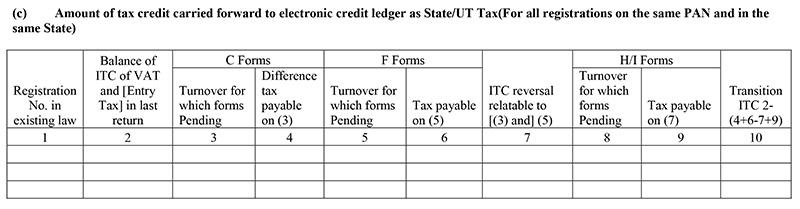

- C – Tax credit amount brought forward to the electronic credit ledger as State tax/UT Tax (Registrations for all on the same PAN and State)

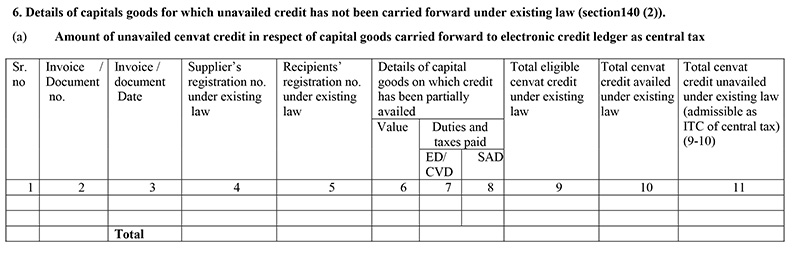

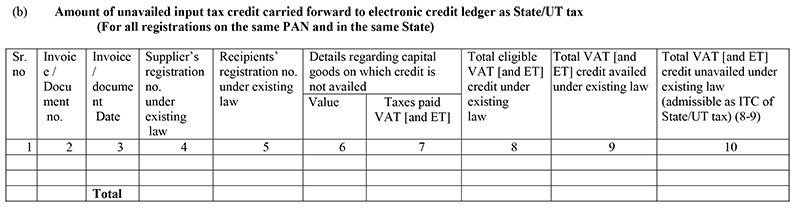

6. Details of capitals goods for which unavailed credit has not been carried forward under existing law (section140 (2))

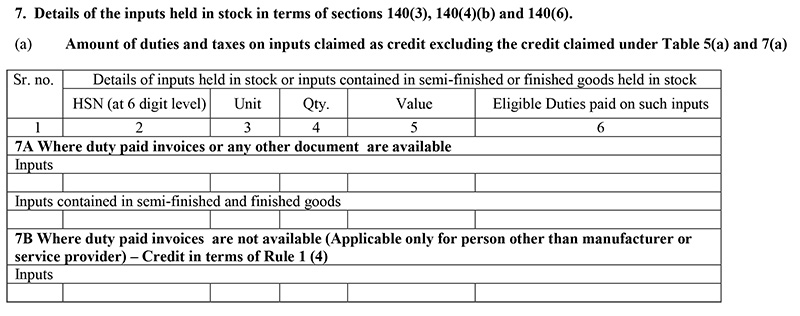

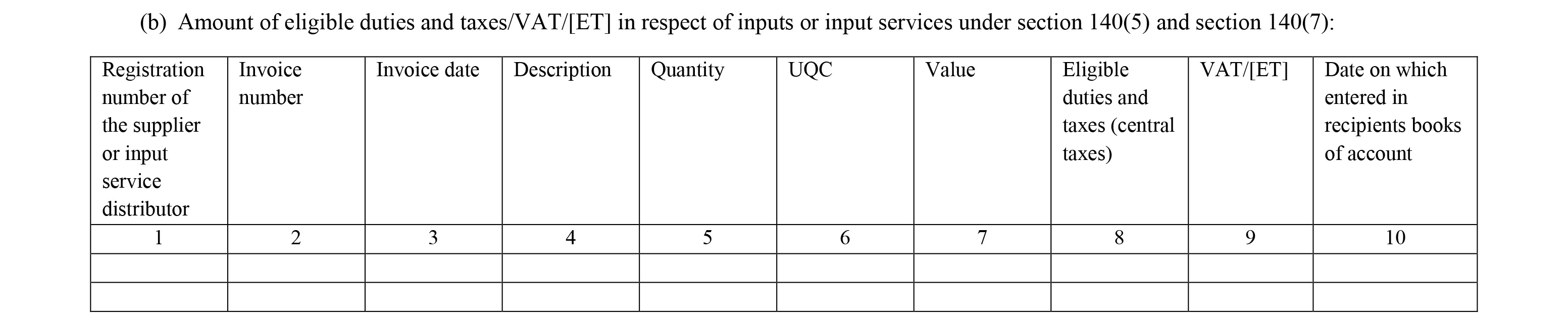

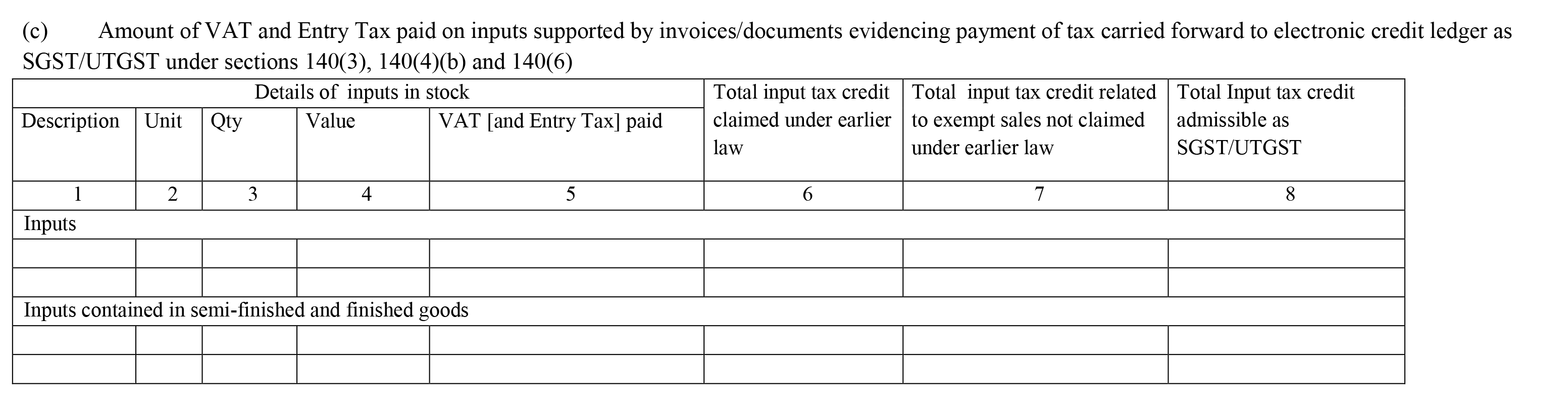

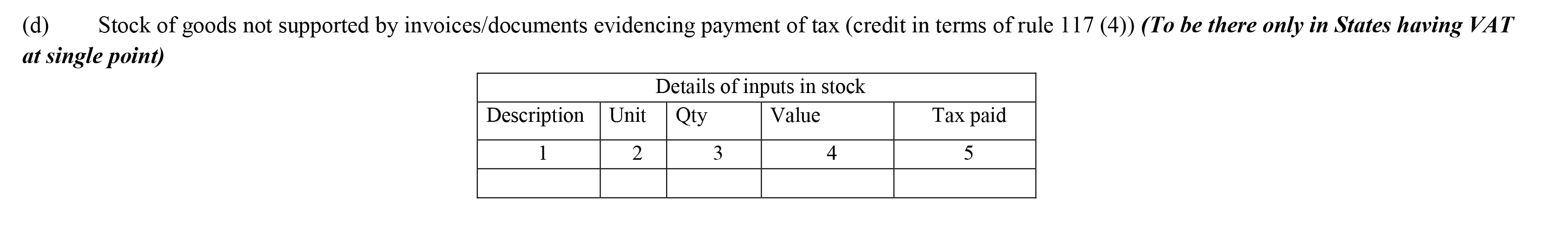

7. Details of the inputs held in stock in terms of sections 140(3), 140(4)(b), 140(5) and 140(6).

8. Declare the details of tax paid under earlier laws and credit admissible on inputs (goods), And services received in the time period of 30 days (60 days in a case of extension) of an appointed day in table 7(c)

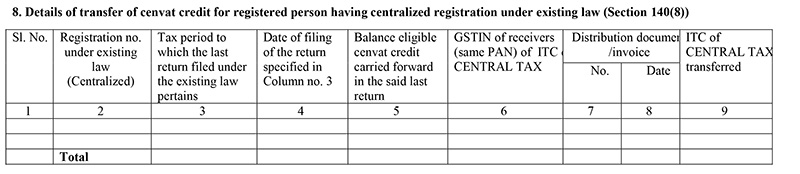

9. Announce details of transfer/distribution of Central tax credit claimed in Table 5 (a) on account of CENVAT credit carried forward in last return for registered person centralized registration under service tax by clicking on the tile 8.

A – In tile 8, you are allowed to enter only GSTIN of receivers that have the same PAN as the taxpayer furnishing details in TRAN 1. The transferred central tax ITC will be posted to the ITC ledger of the recipients.

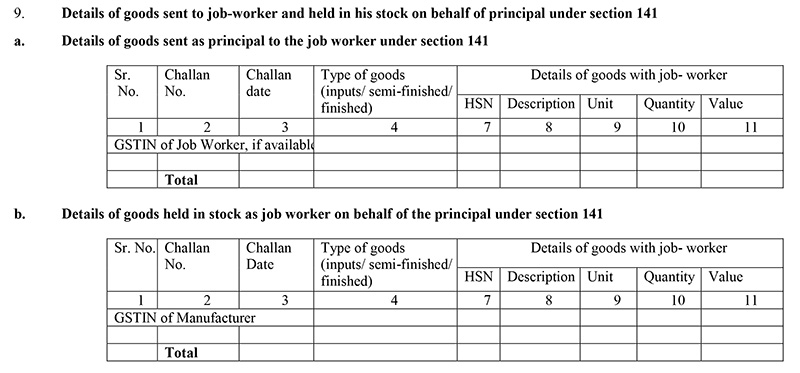

10. Declare details of goods sent to job worker and held in his stock on behalf of the principal (by both job worker and the principal) by clicking on the tile 9(a) & 9(b).

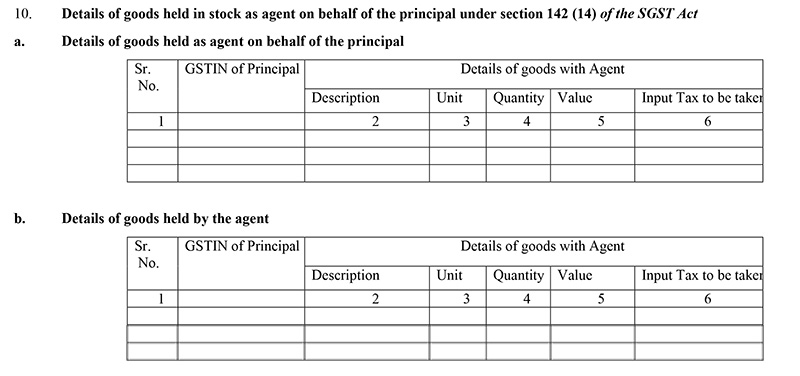

11. Declaration of details ( by both the agents and the principals) of goods were held in stock by agents on behalf of the principle and its admissible ITC agents by clicking on the tile 10(a), 10(b).

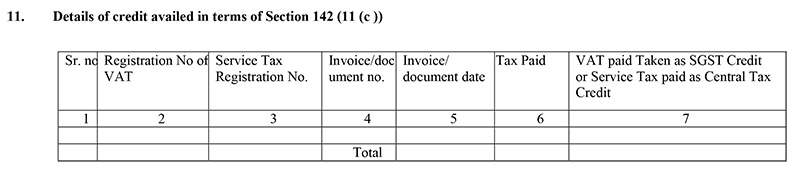

12. Declare details of transition credit availed on transaction subject to both service tax and VAT on which tax has been paid under earlier laws and are also taxable under GST by clicking on the tile 11.

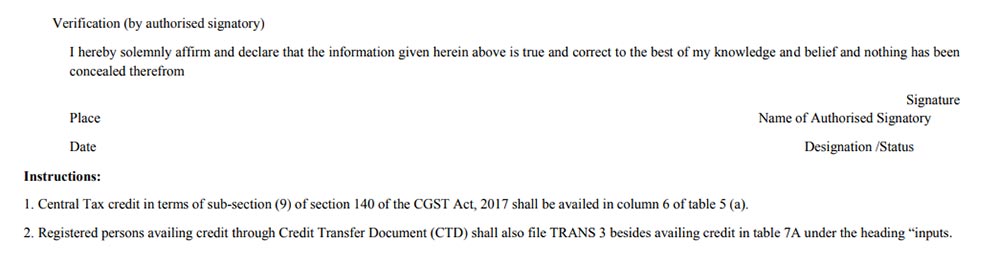

Verification

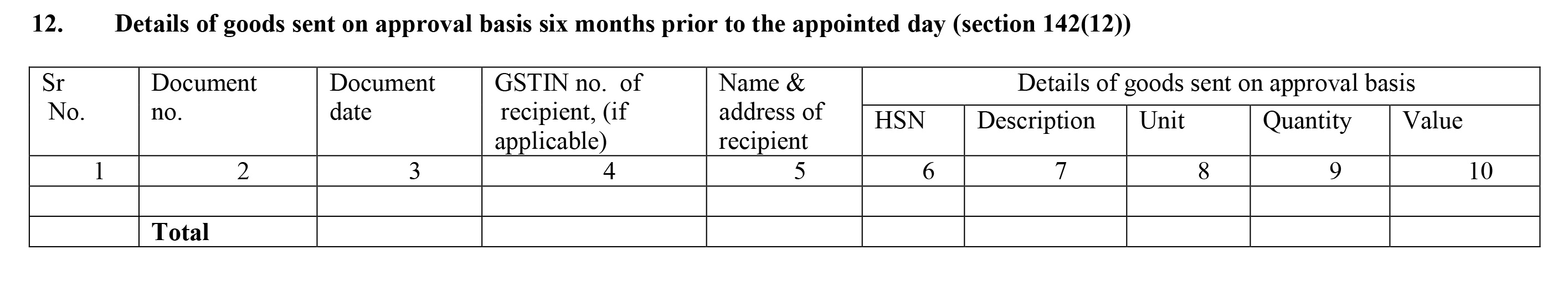

13. Declare details of goods sent on approval basis six months prior to the appointed Day by clicking on the tile 12.

14. Click on Submit button to freeze the TRAN 1

- Please note that after submission, no modification is possible Hence ensure that details are filled accordingly and correctly before clicking on submit button.

15. On successful submit of TRAN 1 the transition credit claimed in the details provided would be posted to Electronic credit ledger however it can be utilized only after filing of TRAN 1 by signing it.

16. Click on file button using DSC or EVC.

17. Message regarding successful filing will be displayed and an acknowledgment will be generated.

18. The ITC posted in electronic credit ledger post successful filing can be used to offset liabilities of GSTR 3B (July 2017) or any other subsequent Returns.

Note:- All the entries must be filled with either Zero or Nil, No single entry must be sent blank.