The Economic Advisory Council of the Fifteenth Finance Commission got heads together to resolve the issues concerned with GST stabilization and methods to lift the tax collection for the mobilization of increased resources.

This was the fifth meeting of the Fifteenth Finance Commission and was held under the chairmanship of N K Singh. M Govinda Rao, Sudipto Mundle, Arvind Virmani, Surjit Bhalla, Prachi Mishra, Omkar Goswami, Indira Rajaraman are some of the council members who took active participation in the meeting.

“Advisory Council was informed about the submission of the 2020-21 report and now the Commission is on its next task of preparing the report for 2021-26 period,” stated by an official after the meeting of the Fifteenth Finance Commission got over.

While interacting with the reporters, Chairman of the Finance Commission, N K Singh told that the Fin Commission is designing the proposals on Goods and Services Tax (GST), which will be thought-through by the GST council meeting

Stabilization of Goods and Services Tax (GST), GST compensation being given to states and the connection among GST Council and Fin Commission were the subject matters to be conferred upon by the Economic Advisory Council of the Fifteenth Finance Commission.

Also, topics like the structural change in inflation, the connection between inflation in consumer price and Growth Domestic Product (GDP) deflator and probable curves of movements in real activity; were also part of the deliberation. The Council also discussed the practical macro assumptions for the award period of the Commission, concerning real growth, inflation, etc.

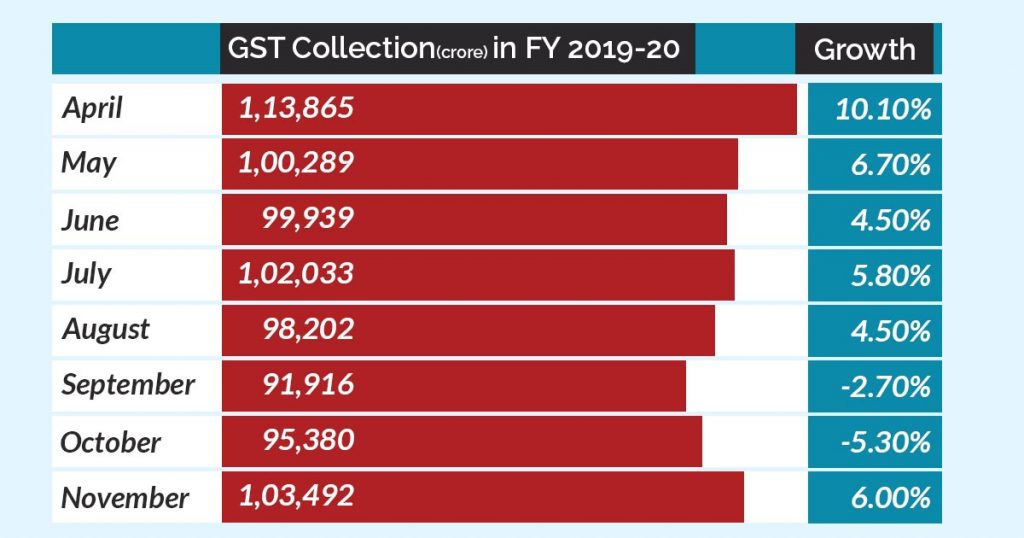

“Tax revenues and expenditure patterns emerging both at the Union and the States level. A possible way to improve tax collection for additional resource mobilization,” said an official release after the meeting.

Patterns of tax revenues and expenditure arising at the Union & the state level was also a matter of contention of the meeting where the feasible methods to increase GST tax collection

The meeting also sheds light on the need for yielding financial transparency and the issues concerned with conformity and adherence to Fiscal responsibility legislations (FRLs) enforced by relevant governments.

The Commission also notified the Advisory Council members about the new terms of reference stretching the time-frame of the Fifteenth Finance Commission till October 2020.

According to the additional terms of reference, two reports will be submitted by the Commission. One report will be for a year i.e. 2020-21 and the second report will be for the period of five years i.e. from 2021-22 to 2025-26.