The GST regime in India is a faster system with the tax rates within the amendment by the Government. In finding the applicable tax rate for the supplies made at the time of these rate revisions, Section 14 of the Central Goods and Services Tax (CGST) Act, 2017, plays a vital role. This blog facilitates a detailed examination of section 14 and its implications for businesses.

Main Function of GST – Section 14:

The main function of section 14 is to make the precise point of time of supply in the matter of revision in the tax rate of goods or services of both for the objective of imposing the GST at a new or old rate.

As per the Goods and Services Tax, the time of supply is an important concept. It shows the tax duration in which a supply is deemed to have been incurred and the subjected tax rate. The supply time is earlier of the below-stated three events-

- The date of the invoice issued by the supplier;

- The date on which the goods are delivered or the services are rendered; or

- The date on which payment is received for the supply.

Section 14 does not directly express “supply” itself. But, it clarifies when a supply is deemed to have emerged based on the timing of payment, issuance of Invoice, and Supply of Goods/Services or Both.

The same indirectly impacts the obligation of tax related to the supply. The same is related when the tax rate is subjected to get applied on a specific supply experience a change. The same section signifies whether the tax rate enduring in the course of supply or amended rate applies.

It should be cited that Under Section 14, overrules section 12 (time of supply of goods) and section 13 (time of supply of services). In other terms, if a change in the rate of tax, only Section 14 is to be referred to for determining the Time of Supply of Goods or services of Both.

Provisions of GST – Section 14: The section is Divided into Two Main Parts –

- When goods or services or both have been supplied before the change in the rate of tax (i.e. supply affected before the change in rate);

And

- When goods or services or both have been supplied post revision in the rate of tax (i.e. supply affected after the change in rate):

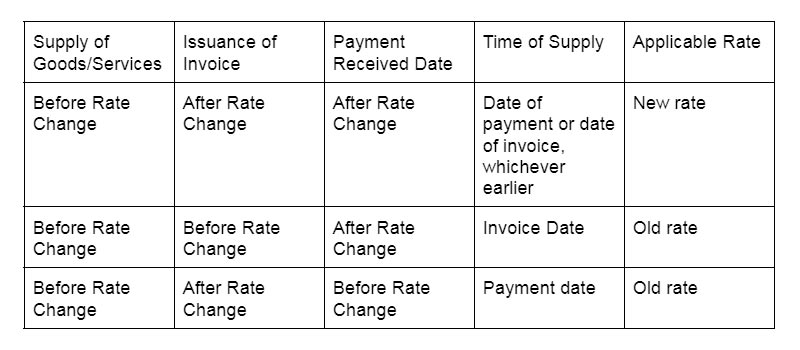

Examining the first part i.e supply being affected before the revision in the rate with the table furnished below:

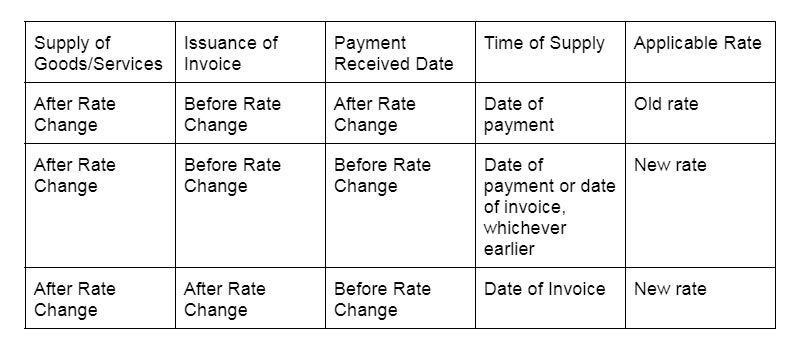

Let us examine the second part i.e. supply being affected post the change in rate with the table provided below:

Paying by the Following Date:

Section 14 furnishes an explanation for specifying the date of receipt of payment. The same date acts as a benchmark for establishing the applicable tax rate. There are two options-

- The date the payment is recorded in the supplier’s books of account.

- The date the payment is credited to the supplier’s bank account.

The earlier of these two dates is regarded as the date of receipt of payment for the objective of section 14.

Closure

Section 14 of the CGST Act plays a crucial role in ensuring transparency and consistency in applying the GST at the time of the revisions of the tax rate. Businesses while getting the insights of time of supply and its link to the payment date, could ensure that they adhere to the related tax statutes and prevent any potential differences in their GST filings.