What is GST Rule 88C?

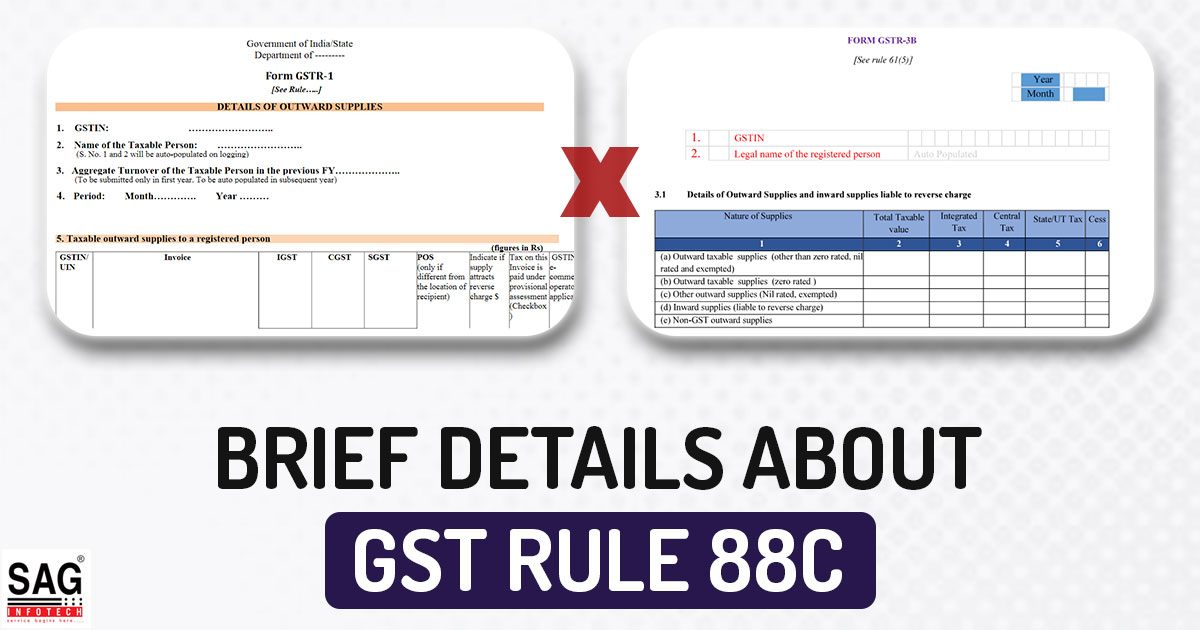

The Achilles’ heel of GST has always been the mismatch in GSTR-1 and 3B. There have been several cases when ITC was transferred by the supplier via GSTR-1 even though taxes had not yet been refunded via GSTR-3B. While some of the discrepancies in GSTR-1 and 3B relate to tax payments, others may be the consequence of true errors that result in tax payments not being made. The registered individual must provide an explanation, and the Department personnel must use their judgment to effectively differentiate the two.

Through suggestions of the 48th GST Council meeting dated 17th December 2022, Rule 88C was inserted to furnish a process for dealing with the difference that comes from taxpayer’s liability as noted in GSTR-1 v/s GSTR-3B.

Insertion of GST Rule 88C

Section 75(12) of the CGST Act, 2017 permits tax recovery without the issuance of a Show Cause Notice under Section 73/74 of the CGST Act, 2017 in which any tax amount is self-assessed as per the return filed under Section 39 of the CGST Act, 2017.

To the said sub-section of Finance Act, 2021 an explanation was counted in which the expression “self-assessed tax” comprises the tax subjected to be paid in relation to the information of outward supplies furnished under section 37 (GSTR-1), however, excluded in the return filed under section 39 (GSTR-3B). The stated explanation came into force on 01st January 2022.

Trade and field formations expressed a great lot of uncertainty over how the Tax Authorities would handle the recovery due to the mismatches between GSTR-1 and GSTR-3B. Under the provisions of Section 79 of the CGST Act, 2017, CBIC issued policies for recovery proceedings, on the date of 7th January 2022. Before taking any action under Section 79 of the CGST Act of 2017, it was advised to provide the concerned taxpayer with the chance to clarify the discrepancies between GSTR-1 and GSTR-3B by writing a letter.

Rule 88C – Pay or Describe

The same furnishes that It states that the registered person shall be informed of the discrepancy in Part A of form GST DRC-01B if the tax due as per GSTR-1 / IFF exceeds tax paid in GSTR-3B by the amount and the percentage that may be specified by the council.

A copy of this notification, along with the form GST DRC-01B, will be posted to the common portal and forwarded to the person’s registered email address.

The aforementioned form would demonstrate the distinction between GSTR-1 and GSTR-3B. Both of the two choices are available to the taxpayer when dealing with FORM GST DRC-01B.

Pay the differential tax liability mentioned in Part A of form GST DRC-01B, fully or partially including interest under section 50, via form GST DRC-03 and file information thereof in Part B of form GST DRC-01B electronically on the common portal; or

Within seven days of the DRC-01B’s issue, submit a reply electronically via the common portal that includes justifications for any outstanding portions of the differential tax due in Part B of form GST DRC-01B.

Recovery procedures would be started in accordance with Section 79 of the CGST Act, 2017, in the event that the sum mentioned in DRC-01B is still outstanding, no reply was provided, or the proper officer deemed the response provided to be unsatisfactory.

GST Rule 88C Effective Date

Rule 88C is not currently in effect. Only when the difference between GSTR-1 and GSTR-3B form would surpass a specific amount and percentage as may be stipulated would the aforementioned regulation is activated. The regulation cannot be put into effect until the amount and percentage are notified since they have not yet done so.

Stoppage of Next GSTR-1 Filing

Rule 59(6) of the CGST Act, 2017 also got inserted vide Notification No. 26/2022 -Central Tax dated 26th December 2022. The aforementioned regulation prohibits the filing of GSTR-1/IFF for a future tax period when the taxpayer does nothing after the issuance of DRC-01B. Here, neither the taxpayer nor

(i) Pays the sum due in accordance with DRC-01B nor

(ii) Submits any answer for any amount remaining unpaid in Part B of FORM GST DRC-01B

The regulation does not call for blockage of GSTR-1 or IFF where the provided response was deemed unsatisfactory by the tax authorities. Only recovery actions under Section 79 of the CGST Act, 2017 will be initiated in cases where the reply was provided but later judged to be unsatisfactory. The blockage of GSTR-1/IFF and the beginning of recovery proceedings under Section 79 of the CGST Act, 2017 would occur in cases where no measure was taken to stop issuing DRC-01B.

7 Days – Very Short Time to Respond

The taxpayer has just seven days to respond to DRC-01B, which is the allotted amount of time. In the event of failure, legal action would be taken against the taxpayer. A 7 days time limit is a very short window provided to an aggrieved assessee. Even if a taxpayer has received a Show Cause Notice, he has 30 days to respond at the very least.

Our recommendations for this seven-day time constraint are as follows:

The time frame for a response should be extended by at least 30 days by the government. If not, at least read “7 days” as “7 working days.”

There isn’t a clause in place right now that would allow the time restriction to be extended. The taxpayer should be given the chance to request an extension if for whatever reason he is unable to submit his response within the allotted seven days. The proper officer is free to grant an extension. Before taking any action against a taxpayer, at least three reminder notifications must be sent to him.

Amount Recovery Proceedings

In cases when the taxpayer’s response is deemed to be unsatisfactory, direct recovery proceedings under Section 79 of the CGST Act, 2017 are to be executed against the assessee without any additional chance of being heard.

Section 79 of the CGST Act, 2017 permits merely for the recovery of the amount liable to be paid by the individual. ” The words any amount payable” would be interpreted in context, where the same would be utilised and the liable amount to be paid (until considered) could merely reveal via executing the adjudication procedure as mentioned under Section 73 or 74 of the CGST Act 2017.

Additionally, Section 75(5) guarantees that an opportunity will be needed if a written request is made or whenever a negative decision is anticipated for the individual in question. Any demand or recovery that is raised because of a mismatch between GSTR-1 and 3B falls under this category.

Therefore, it is important that the taxpayer get a personal hearing before any negative action is taken against him in the event that he contests the responsibility calculated for whatever reason. Additionally, he should be given a good chance to defend his position. No recovery action should be brought against him prior to the principle of natural justice principle.

Therefore, in our opinion, one should only begin recovery against the registered person if the taxpayer in his reply admits the tax duty but still fails to pay or is unable to make any answer within the appropriate timetable.

Judgment and Scrutiny

The tax council would have the potential to execute the recovery proceedings in which the answer would not be treated to be accepted via the tax council. However, what is permissible requires careful judicial analysis and examination. For every case in which the assessee does not agree to the liability levied, the same could not be said to be unacceptable directing to recovery proceedings.

The judicial review system of the country needs a thorough and separate analysis of the problem at various seniority levels prior to any case arrived at conclusion. An effective procedure of the judicious review of the answer of the enrolled individual by the senior ranked officers and the quasi-judicial authority prior to coming to a closure that the demand/recovery is explained.

Need for Rules and Laws

Additionally, it should be made clear that recovery proceedings under Section 79 of the CGST Act, 2017 should not be started while the taxpayer challenges the responsibility in DRC-01B since it is impossible to determine if tax is due when it is in dispute. If the proper officer determines that the tax is still due and owing, he may proceed to issue a show-cause notice in accordance with Sections 73 / 74 of the CGST Act, 2017.

It is advised that the board release a Circular that addresses a number of concerns about Rule 88C of the CGST Rules, 2017. In any instance where his perspective varies from that of the taxpayers, tax authorities may begin recovery actions if no explanation is provided. Due to the time, expense, and exposure involved, the taxpayer would have no choice but to knock on the High Court’s doors, which may not be an option for all taxpayers.