Online GST registration application is an essential step under the GST regime for every taxpayer or business owner whose annual turnover is above 20 lakh. A business owner receives a unique GSTIN number only after completing the online GST registration process

A taxpayer needs the GSTIN number at every stage of return filing, bill generation and invoice processing so it becomes a prominent part of GST filing.

For all this process one must go to the GST registration online on the government’s official website.

- Check GSTINs Associated with PAN

- Submission of Representative Details

- Withdrawal of Validation Unique Combo

- procedure for GST registration

- General Queries on GST Registration

Latest Updates in the GST Registration

- GSTN warns that taxpayers who do not update their bank account details by 2nd December, 2025, could automatically lose their GST registration. read more

- GSTN has issued a new advisory to simplify the GST registration scheme under Rule 14A, which became effective from 1st November 2025. View More

- On Thursday, Finance Minister Nirmala Sitharaman announced that, starting November 1, GST registration approvals for new applicants will be auto-granted within three working days.

- In the 56th GST Council meeting, the Finance Minister simplified the registration scheme for low-risk businesses and small suppliers. View More

- The CGST Delhi East Commissionerate successfully launched the GST Registration Campaign on March 21–22, 2025, to promote increased registration and compliance under the tax system. Read Press Release

- Taxpayers in Jammu & Kashmir and West Bengal must now undergo biometric-based Aadhaar authentication and document verification for GST registration. View More

- Minister of State for Finance, Shri Pankaj Chaudhary, said the tax administration takes an average of 12.82 days to approve GST registration.

As per the recent update, GST Registration of around 8602 merchants has been revoked recently but SGST Department said that traders whose GST Registration has been canceled don’t have to worry about. They will get the chance to restore the revoked registration of Goods and Services Tax (GST). The function for traders or merchants will remain open till 30 September on the GST portal. Registrations were canceled/ revoked under Section 29 of the GST Act.

Aadhar Authentication in GST Registration Provisions

Recently the GSTN portal has introduced the Aadhar authentication process for all the individuals applying for the GST registration including Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD)/ SEZ Developer/ SEZ Unit etc.

It would require authorized signatory and if in case the Aadhar authentication gets failed, the tax department may do a site verification. The Aadhar authentication will apply to all the Promoters/ Partners/ Authorized Signatories/ Karta etc. IT is to be noted that all the registered person may not require Aadhar registrations and also those who are not the resident of India. Read more

50th GST Council Meeting Update

Update on GST Registration Changes: GST 2.0

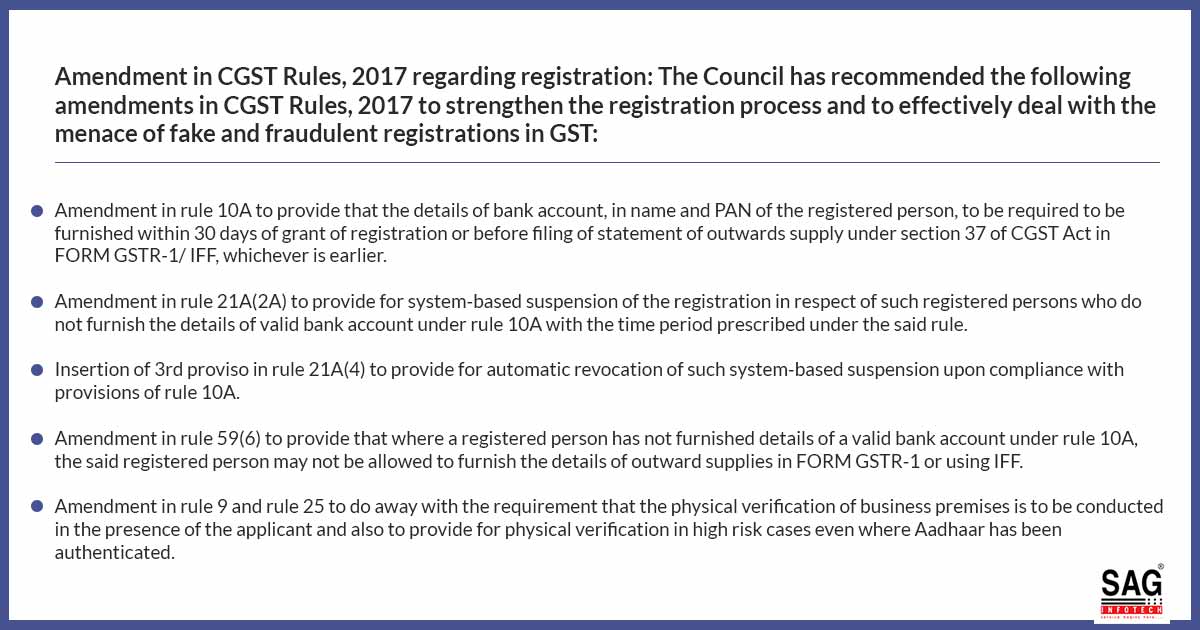

At the 56th GST Council Meeting in New Delhi, a new registration process was announced. The key updates are listed below:

- Fast Approval Within 72 Hours: If you apply for a new GST registration from November 1st, your application could be approved within three working days. This change is expected to benefit nearly 96% of new applicants.

- Who is Considered Low-Risk?: The low-risk applicants include small businesses and suppliers whose tax liabilities are less than ₹2.5 lakh per month. This technology will be used to conduct data checks and identify these applicants quickly

- Focus on Higher-Risk Cases: For applicants identified as high-risk, tax authorities will continue to conduct detailed manual verifications. This approach helps curb potential fraud while ensuring a smoother, hassle-free experience for genuine taxpayers.

New Functionalities While GST Registration on the Portal

The GST Network (GSTN) has also introduced additional features, called GST 2.0, on its registration portal to further assist applicants:

- Check Your GSTINs with PAN: With this functionality, applicants can check the GST numbers linked to their Permanent Account Number (PAN) across the country when filling out the registration application

- Authorised Representatives: If you’re applying to provide services online, you’ll need to provide details about your authorised representatives in India.

- Easier Second Registrations: Previously, applicants had to use a unique combination of their PAN, mobile number, and email address for each registration. This requirement has been lifted, allowing registered taxpayers to apply for additional registrations (like in different states) using the same information as before.

What to Do After Application Revocation of GST Registration Rejected?

One has to perform the steps if the application for GST registration has been rejected and the application for revocation has also been cancelled. On the official Twitter, the instructions have been given that the Goods and Services Tax Network (GSTN) for the people whose applications got rejected.

One can file the application for revocation if the reason for rejection is these as mentioned below:

- The registration for the revocation application is rejected by the tax officers before or till 12th June 2020

- If you have filed a revocation application for 30 days of cancellation for GST registration

- One has appealed in the online/offline platform for the revocation of GST but yet the order has not passed

To file the new application, one needs to log in to GST portal – www.gst.gov.in

For revocating, one has to log in to the portal and post-login go to the services registration application.

- One can visit the website https://reg.gst.gov.in/registration/. for new enrollment

- Fill the data as per the demands on the landing page

- One has to give the information regarding fields like ‘I am a’, ‘State/UT’, ‘District’, the judicial name of the business mentioned in the PAN card, mobile number and email address

- Post information proceeds with instructions

It is important for every company that is involved in the business to register under the Goods and Services Tax Act, of 2017. if the company’s turnover is 20 lakh (in all Indian states, other than north-eastern states) then they have to register with GSTN.

To help the taxpayers in India prepare the file returns to execute payments of indirect tax liabilities and do additional agreements. For the implementation of GST in India the IT infrastructure and services to the Central and State Governments, taxpayers, and other stakeholders have been provided by them.

In the 32nd GST council meeting, the members increased the GST threshold limit from 20 lakh to 40 lakh as suggested by GoM. The single condition is eligible for Kerala & Chattisgarh which limits to remain either 20 lakh or 40 lakh.

New Functionalities While GST Registration on the Portal

The GSTIN has enabled three new functionalities for taxpayers while registering on the GST portal. The new GST functionalities are described below:

Check GSTINs Associated with the Same PAN

Now, the taxpayers will be able to check all the GSTINs connected to the same Permanent Account Number (PAN) throughout India. A taxpayer can do so while filing Part A of the GST registration application form on the same PAN. The registration application form is the application form to apply for new registration.

Submission of Representative’s Details

Taxpayers filing registration applications using Online Information and Database Access or Retrieval (OIDAR) Services will now be able to furnish details of their representatives who are authorized and appointed in India. The authorized representative’s name, PAN, email address & mobile number are to be filled in Part A of the registration form GST REG 10.

Withdrawal of Validation of Unique Combo Having the Same PAN

The authentication of the unique combination of the same PAN, Mobile Number and Email has been withdrawn at the time of registration application submission when the application is filed by already registered taxpayers.

Now an already registered taxpayer can avail another registration by submitting the same unique combination of PAN, Mobile number and Email address. This facility is available for all already registered normal taxpayers, taxpayers registered under the composition scheme, taxpayers registered as casual taxpayers, TDS, GSTP and TCS.

Here is the simplified step-by-step procedure for GST registration:

We have divided the whole procedure of GST registration online into four sub-parts in order to make an easy understanding of the complex procedure of GST registration online process.

Part 1 in GST Registration Process

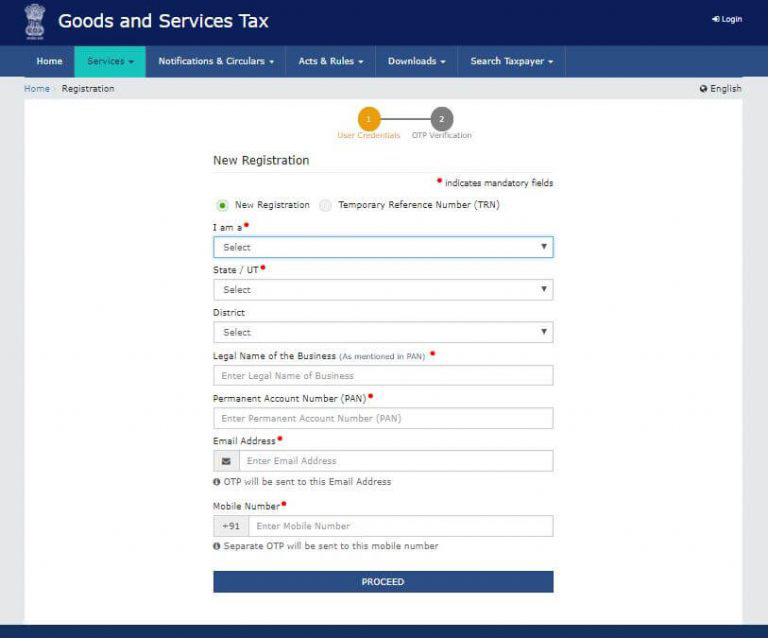

Step 1: Enter the GST official website link in the URL. Click here https://reg.gst.gov.in/registration/.

Step 2: Click on the ‘Services’ tab provided in the main menu. Three options will open in the drop-down list such as “Registration”, “Payments”, and “User Services”.

Step 3: By hovering the mouse on “Registration” will open more options.

Step 4: Click on the first option which is “New Registration”. It will open the new form in the same window.

Step 5: Now, enter the details regarding whether you are a

- Taxpayer

- Tax Deductor

- Tax Collector (e-Commerce)

- GST Practitioner

- Non-Resident Taxable Person

- United Nations Body

- Consulate or Embassy of Foreign Country

- Other Notified Person

the State/UT and District you belong to, Name of the taxpayer or tax practitioner as mentioned in the PAN card, PAN number, Email ID, and Mobile Number. At the end of the form, enter characters as displayed in the CAPTCHA image and click on “PROCEED”.

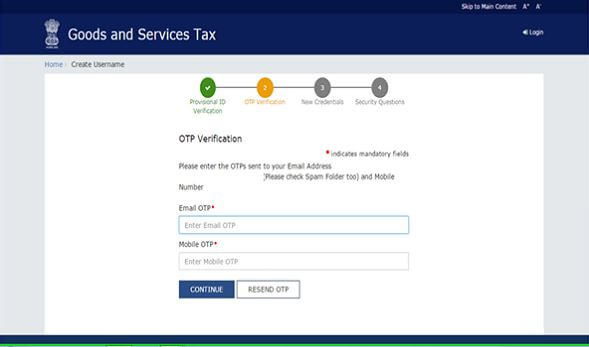

Step 6: An OTP will be sent to the provided mobile number and email ID in Step 5. Enter the OTP received and click on the “Continue” button.

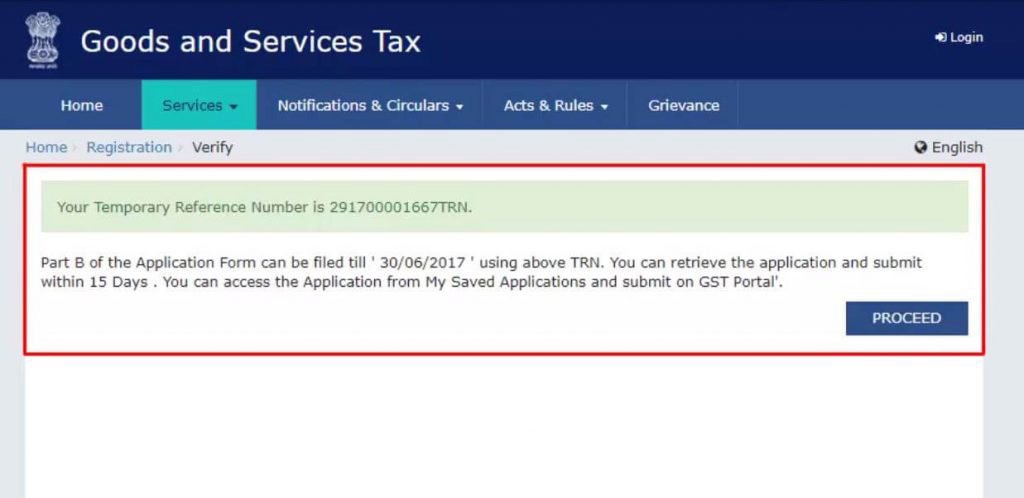

Step 7: A TRN (Temporary Reference Number) will be shown on your screen and the same TRN number will also be sent to your provided email ID and Mobile Number. Save the TRN number for future requirements.

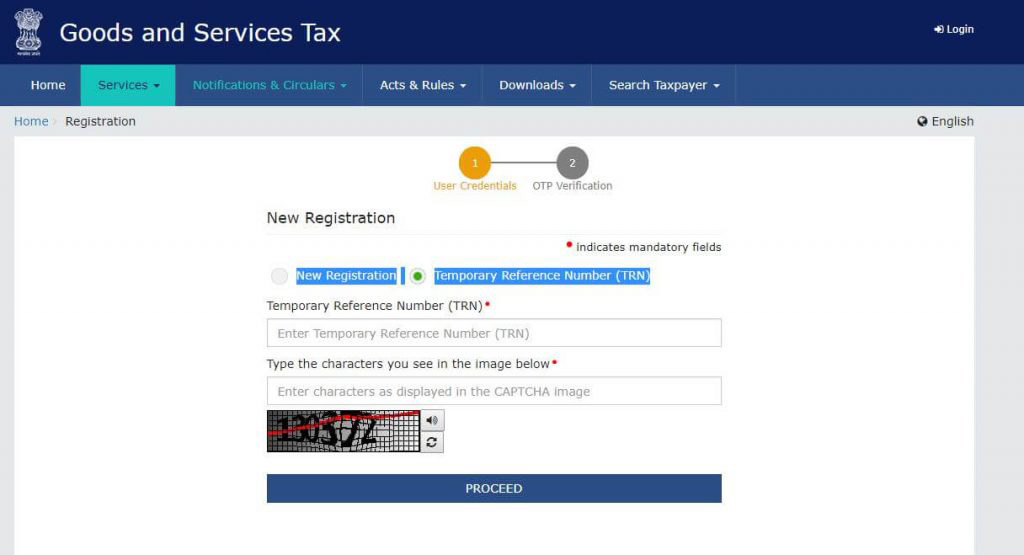

Part 2 for Finding Tracking Temporary Reference Number

Step 1: Go back to the GST official website.

Step 2: Again select the “Services” tab.

Step 3: Select “Registration” from the drop-down menu under the “Services” tab and click on “New Registration”.

Step 4: Choose the option “Temporary Reference Number (TRN)” and after selecting it the dot will be filled with green colour and a new page will open.

Step 5: Enter the TRN number provided in Part 1 and give Captcha characters.

Step 6: Click on the “PROCEED” button.

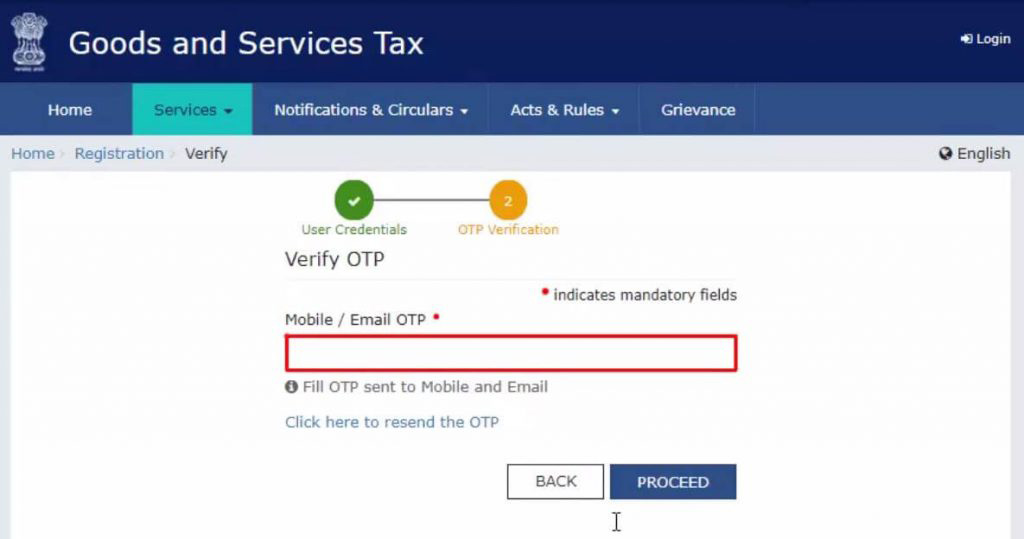

Step 7: You will get an OTP on the registered mobile number and email ID. Enter the OTP in the prescribed field and again click on “PROCEED”.

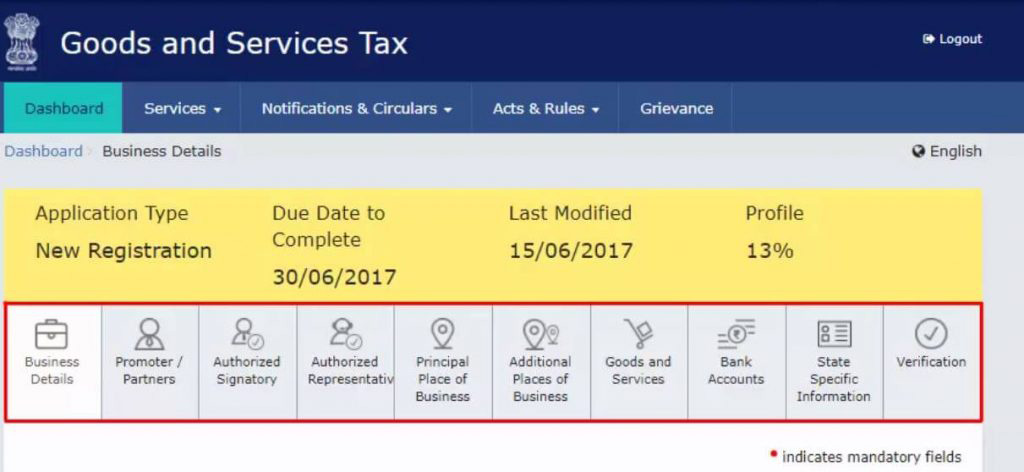

Step 8: The draft format of the application will be shown on your screen. Now click on the Edit icon.

Part 3 for ARN Status Verification

Step 9: The new page will be displayed on your screen. There are 10 sections to fill in the required details and upload the requested documents for this particular section.

You will need the following GST registration documents to keep handy you in the scanned format:

- Photographs

- Constitution of the business owner

- Identity proof of the place of business

- Bank account details

- Authorization form

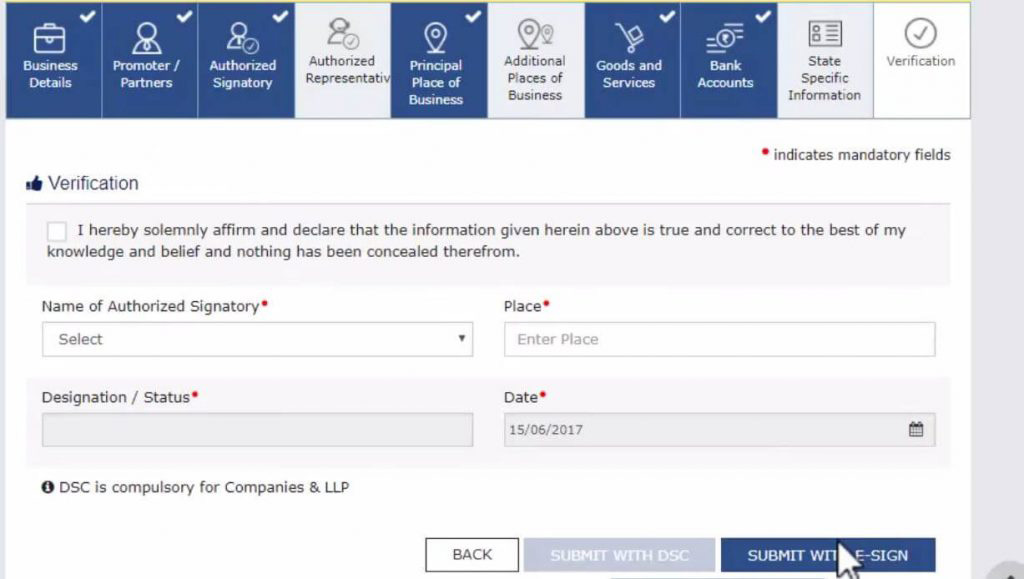

Step 10: After uploading all the details, go to the Verification page

Step 11: Select the Declaration stated and mark the tick

Step 12: Submit the application using DSC, e-Sign (OTP will be sent to Aadhaar-linked mobile number) and EVC (OTP will be sent to registered mobile number)

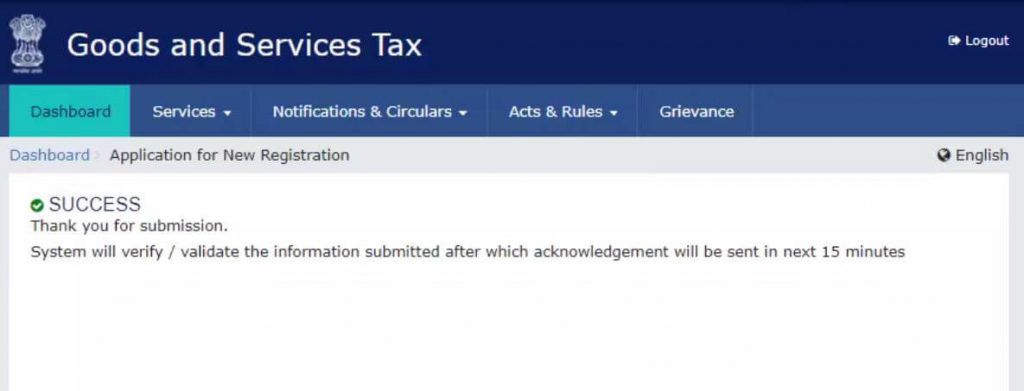

The message of successful completion of registration will be shown on the screen and an ARN (Application Reference Number) will be sent to the registered mobile number and email ID.

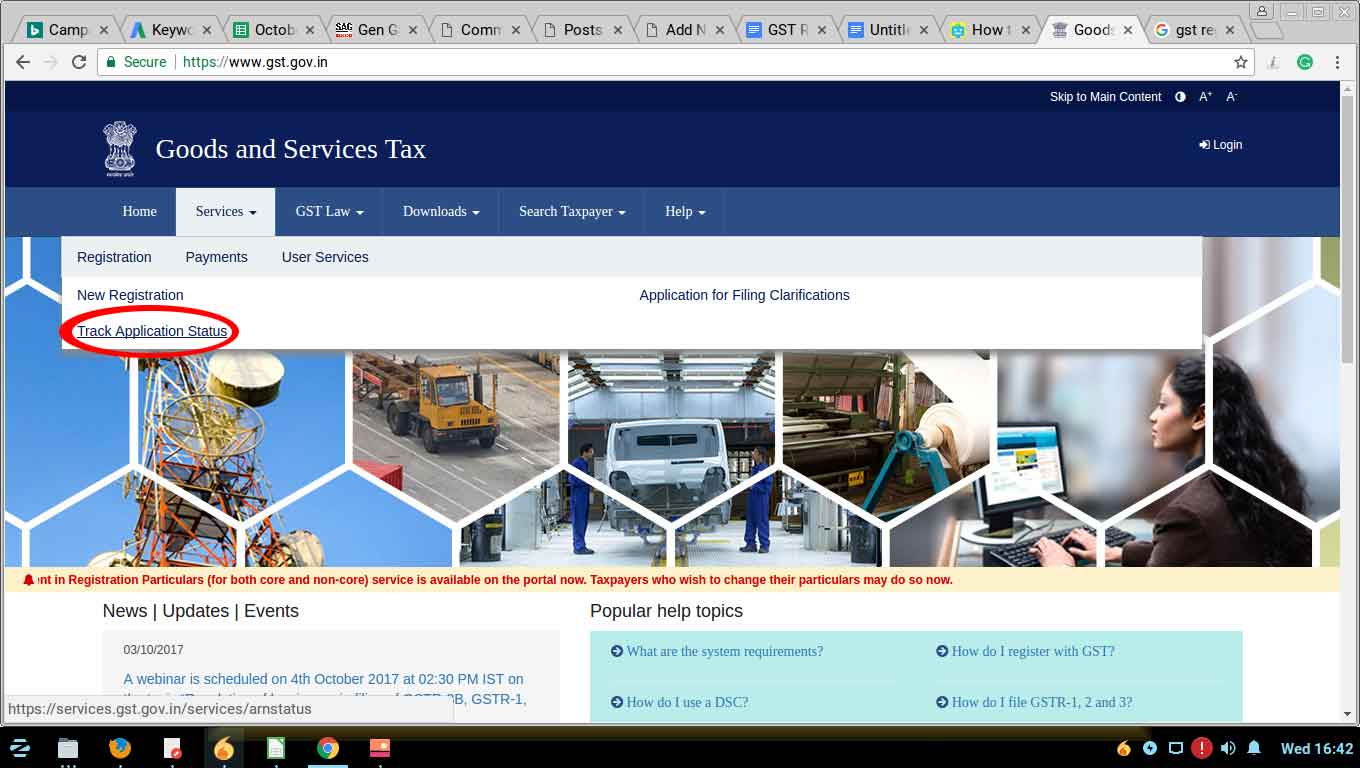

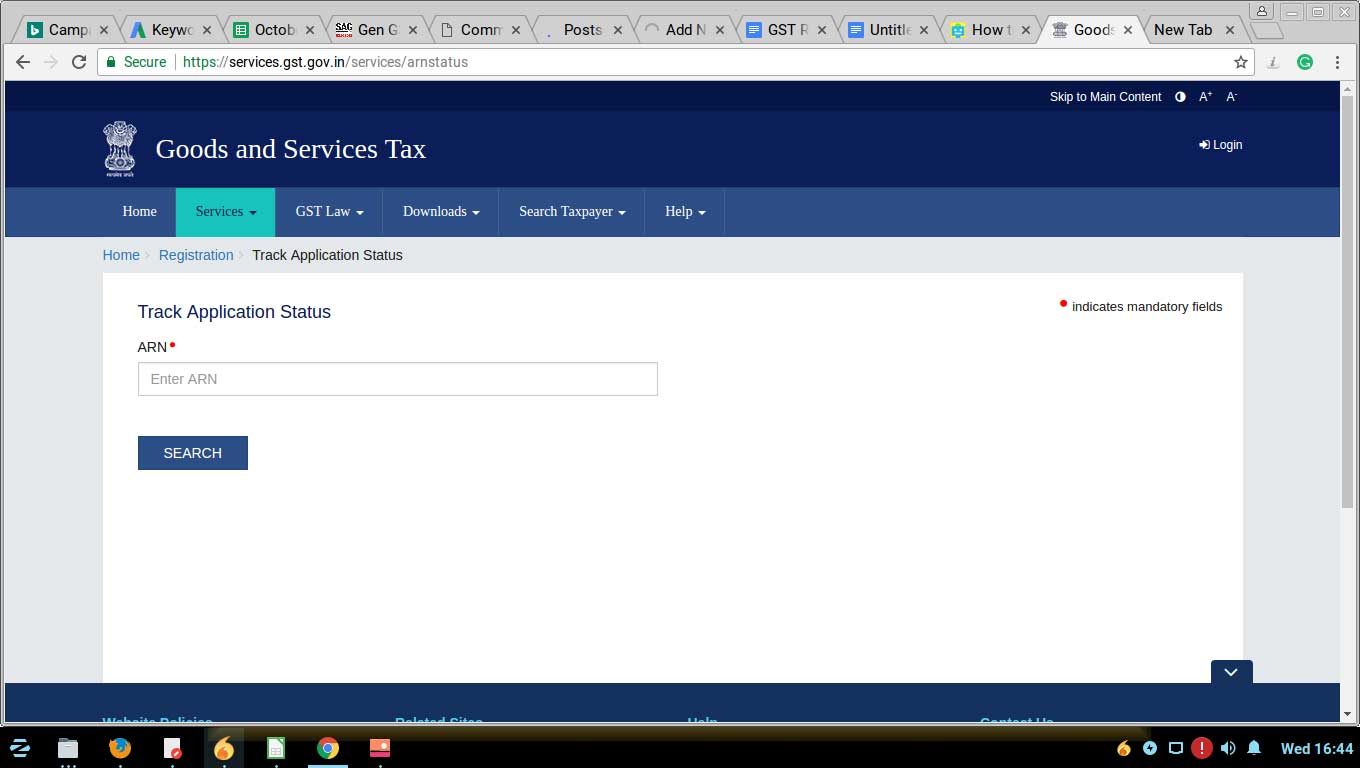

Part 4 for Checking The Status Online of GST Registration by ARN

The applicant can check the status of an application for registration by entering the ARN, for this:

Go on GST Portal> Click on Services tab> Select “Track Application Status” under Registration option

Now Enter the ARN number >Click on the “Search” button

The status will be displayed along with department remarks

The Government is working in the direction of making the GST a more comprehensive and efficient system of taxation. It is very important to understand that India is having a taxation system as VAT/ Sales Tax, which was highly faultyand very misleading. The Modi Government introduced a system of taxation that was uniform in its content and practices. The new GST system has been built with the aim of promoting transparency, avoiding corruption in the taxation system which was eating up the revenue growth and Government treasury. Keeping in view this end, there have been changes improvised bybetter and more transparent. As and when there is a missing link found, the Government plugs it with the reforms aimed at improving the scheme of things.

But making changes every now and then has created much confusion among taxpayers and businesses alike. To resolve these confusions some of the issues are addressed as under:

General Queries on GST Registration

Q.1 – I am a small trader engaged in intrastate business in 4 states and my aggregate turnover on the same PAN from 4 states is less than the threshold limit as stated under the GST Act. Whether I am liable for GST Registration?

According to Section 2 (6) of the CGST Act, 2017, the calculation of aggregate turnover of a business is based on the same PAN and if the aggregate turnover is less than the threshold limit then the GST registration is not required mandatorily. Since your aggregate turnover on the same PAN is below the threshold limit, registration under GST is not compulsory for you.

Q.2 – I am a small trader dealing in Fabrics and my turnover is below INR 10 lakhs. Is it mandatory for me to register under GST?

Section 22 of the CGST Act 2017, states the conditions under which GST registration is mandatory. These conditions constitute a threshold limit for which GST registration has been prescribed. However, section 24 of the CGST Act, 2017 supersedes Section 22 and states the conditions under which GST Registration is mandatory irrespective of the threshold. As per Section 24, if an individual is carrying out any inter-state taxable supply then, it is compulsory for him to get registered under GST, irrespective of the turnover threshold prescribed for the mandatory registration. Therefore, in this case, GST registration is mandatory.

Q.3 – I want to start my online business of selling products on E-Commerce platforms such as Amazon, Flipkart, etc. Do I need to get GST registration?

Yes, it is mandatory for you to get GST registration. Section 24 (ix) of the CGST Act, 2017 prescribes the compulsion of GST registration to sell the goods via E-Commerce portals, irrespective of the threshold limit. So, you want to sell your products online, it is mandatory for you to get registered under GST, no matter what your aggregate turnover is.

Q.4 – I want to get registered under GST and sell my goods across India. Get I get registered under Composition Scheme and sell my goods throughout India?

Section 10 (2) (c)’ of CGST Act 2017 prescribes with the norms that prohibit Interstate outward supplies of Goods. According to this section, an individual registered under the Composition scheme is eligible for the Intrastate Sale only. Therefore, if you get registered under Composition Scheme, you will not be allowed to sell your goods throughout India.

Q.5 – Two months back, I got a new GST Registration but I have not made any sale-purchase transaction under this new GST registration. Do I still need to file Monthly GSTRs?

Yes, you still need to file a Nil GST return even if no Sale Purchase transaction has taken place. According to the rules prevailing, all the dealers who are registered under GST need to file monthly GSTR-3B and Monthly/ Quarterly GSTR-1, based on the turnover limit.

Q.6 – Which are the necessary documents needed for GST Registration for starting a new business under proprietorship?

The necessary documents needed for GST Registration for starting a new business under the proprietorship are as follows:

- PAN Card

- Aadhar Card (Optional as of now, may become mandatory)

- Proprietor’s photo

- Mobile Number and Mail ID

- Trade Name

- Address Proof – Electricity Bill or Rent Agreement/ Lease Deed/ Property Paper, etc. of the address for which you need GST registration.

Q.7 – What are the consequences of not filing GSTR when the non-filer is registered under GST?

When an individual registered under GST fails to file GST Returns for two subsequent months, E-Way Generation facility for him gets terminated and when he fails to file returns continuously for 6 Months, his GST Registration may get revoked by GST authorities. Apart from this, interest and penalty liability may also be charged from him.

Q.8 – I made a purchase of raw material from a person who files his GSTR-1 on a quarterly basis but his GST credit is not reflecting in my GSTR-2A. Am I eligible to claim the GST credit which my GSTR-2A is not showing?

No, you are not eligible to claim the GST credit which is not shown in GSTR-2A. According to the latest GST guidelines, an individual can now avail a maximum of 20% (10% Revised rate) of eligible credit reflecting in his GSTR-2A. You become ineligible to claim any credit if your GSTR-2A is not reflecting any.