To prevent tax evasion and to motivate the traders to duly & timely pay Goods and Services Tax (GST), the Uttar Pradesh government is thinking of providing free accidental insurance and pension facilities to traders registered under GST.

The meeting held among the top officials of the Commerce Tax Department under the chairmanship of Chief Minister Yogi Adityanath indicates such measures to be taken by the Government of UP.

UP Chief Minister Yogi Adityanath asked the officials of Commercial Tax Department to accelerate the process of GST and VAT collection so that the target of Rs 77,640 crore can be met in the current financial year.

Besides, the CM also suggested the Merchant Welfare Board and the Commercial Tax Department organise awareness drives about the benefits of GST & to enable traders file GST returns

“It should carry out awareness drives for traders by taking the help of the Traders Welfare Board. Tell them that it is the government’s right to receive and it is their duty to hand over the tax money that they are taking from customers. The money is utilised in development work,” said CM of UP.

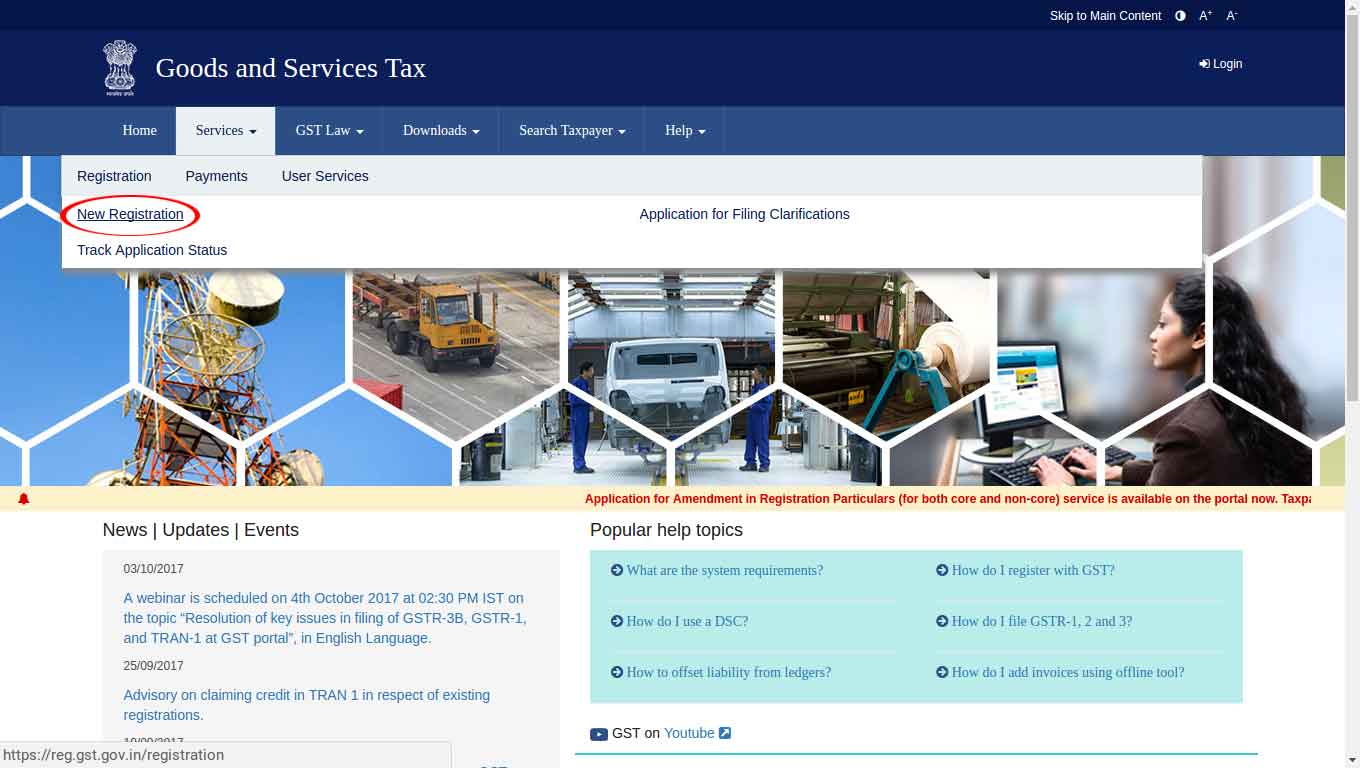

CM told them that the annual revenue target of Rs 77640.10 crore for the financial year 2019-20 should be met at any cost. He also instructed to review the works of officers posted in the mobile team every 15 days. Chief Minister said that a large number of traders will still require GST registration

He said that accidental insurance of Rs 10 lakh would be given to the merchants registered under GST, which would greatly benefit them. Also, it will be contemplated to ensure the system of providing pensions to the GST registered traders. He instructed the officials to give complete information about the benefits of GST registration as well as its return filing to the traders so that they can easily file their returns.

The Chief Minister said that the officials of the Commercial Tax Department should help the traders in the return filing. He also instructed to continuously monitor the return filing and provide refunds to traders on time. Also, the refund process should be simplified.

He said that the revenue from GST plays an important role in the progress and development of the country as well as the state. He instructed the Commercial Tax Department officials that this work should be carried out with utmost sincerity and that by expediting the tax collection process, the revenue target to be collected under GST & VAT should be achieved at all costs. There should not be unnecessary harassment of traders in GST collection because taxpayers are not afraid of paying taxes, instead, they are afraid of harassment.

“We have to end this fear through our behaviour and also simplify the process of filing returns and refunds. For this, provide training to traders,” he said.

The Chief Minister instructed the officials of the Commercial Tax Department to carry out an inspection of the annual turnover of traders and ensure to register the traders whose turnover exceeds the prescribed limit under GST. This will enable large scale merchants to get registered under GST and this will increase the revenue of the government under GST. With this measure, Uttar Pradesh can achieve the target of revenue collection of one trillion rupees under GST in the next fiscal year.

“Considering the population and number of cities and towns in the state, this target would be easily achieved,” he said.

Additionally, he also ordered the officials to figure out the measures to assess the GST collected at the district level.

“If you decentralise the system, the administration will also help you. Besides, felicitate 10 traders from each district who pay the highest GST. Also, felicitate the highest tax-paying traders in the state on GST Day,” said Adityanath.

In the same meeting, he expressed disappointment over the small number of GST registration i.e. 14 lakh in the state. According to him, the number of traders for GST registration should reach up to 25 lakh.