The next 28th GST Council meeting is all set to be held on July 21, 2018. Among many issues to be discussed in the meeting, one is related to the reduction of GST rate on various products and services, especially the ones which do not add much in terms of revenue to the government.

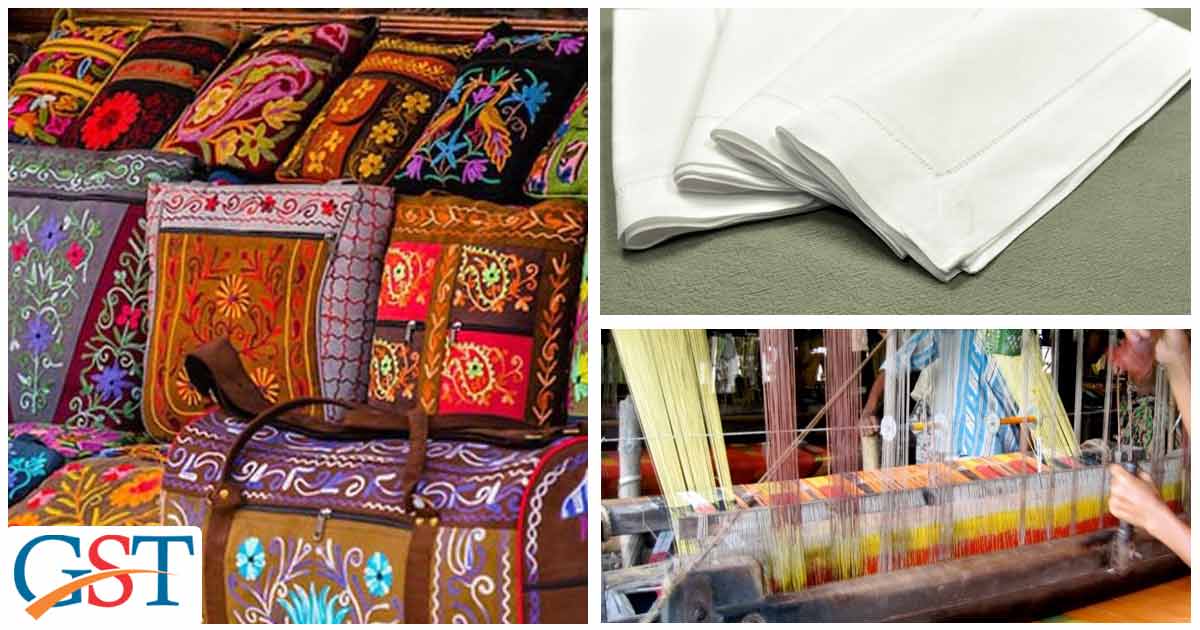

According to sources, the Council might consider reducing GST rates on items like napkins, handloom and handicraft products. As of now, the GST rate on sanitary napkins and most handicraft items is 12%, which could be reduced to 5%. As for service industry, the Council might discuss GST rates on services related to the health and employment industries, which have continuously been demanding for a lower tax rate.

This is not the first time when GST rates may be revised on products and services. In January 2018, the Council had revised (reduced) the tax rate of 54 services and 29 goods. Before that, in November 2017, over 178 items were removed from the 28% GST slab and adjusted in lower rate slabs. Also, the GST rate on hotels, except for 5-star hotel restaurants, was reduced from 18% to 5%.

Handicrafts business is mostly run by small manufacturers and dealers who find the GST system too complex and confusing. Therefore, the industry is seeking a relaxation in the current GST rates on handicraft items. Also, there is a demand to remove the tax on napkins completely.

Any decision would be made by the Council keeping the tax revenue in mind. While the government managed to get Rs 7.41 lakh crore in GST revenue in 2017-18, with an average monthly collection of Rs 89,885 crores, the GST collection in April 2018 reached to an all-time high of Rs 1.03 lakh crore. However, the collections in May and June have been disappointing. In any way, the Council would want to maintain the collection rate, if not increase it.

Read Also: Three GST Rates Instead of One: CEA Arvind Subramanian