The Finance Minister’s recent statement has provided insights into the GST rates for stationery items, specifically those commonly used by students, and the tax treatment of online education services. This article aims to examine the factors influencing GST rates and explore the possibility of any contemplated revisions.

GST Rates Applicable on Stationery Items

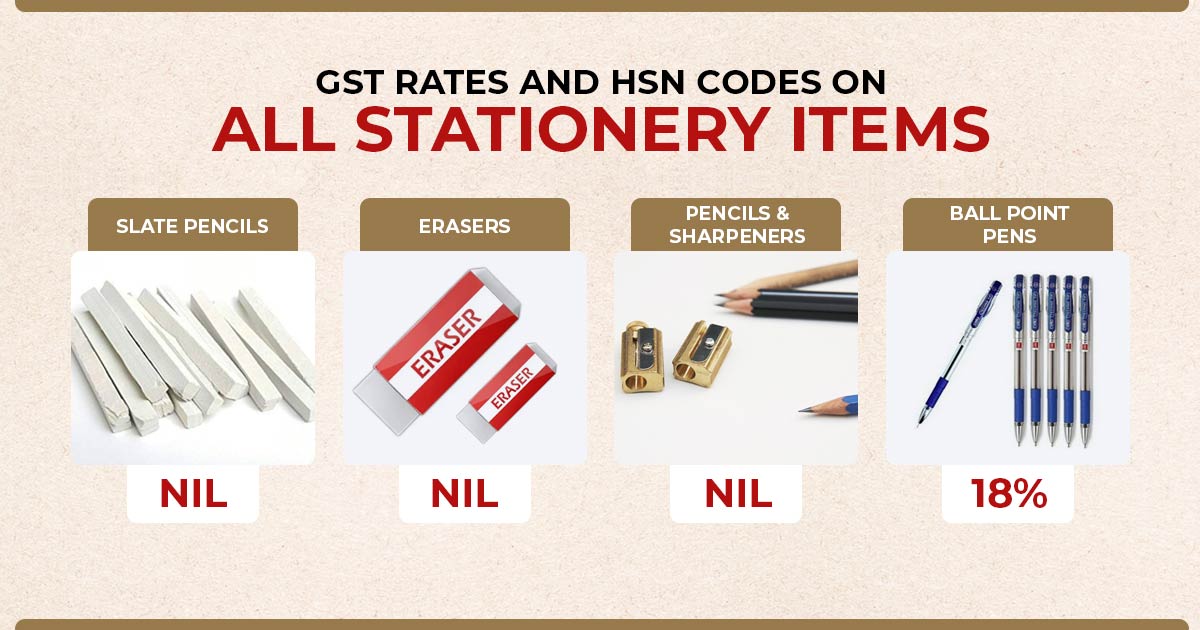

After the recent 56th GST Council meeting updates, many school stores that students commonly use, like sharpeners, pencils, notebooks, erasers, and geometry kits, are either exempt from taxes or have had their GST tax rates reduced to 5%. However, pens, including ballpoint, still have a higher tax rate of 18%.

Rationale Behind Separate GST Rates on Stationery Items

The differential rates for stationery items are based on their categorisation and usage. Essential items like slate pencils and erasers attract GST rates ranging from 5% to NIL, while a higher GST rate of 18% is applicable on non-essential items like ballpoint pens.

GST Applicable on Online Education

Online learning services offered by educational institutions, involving preschool to high school education, vocational courses, and recognised certifications, are not subject to GST. This exemption corresponds to the government’s goal of democratizing education in India.

Reasons Behind GST Exemption on Online Education

The exemption indicates the government’s view of the transformative impact of digital education and its vision to make education accessible to all. It seeks to facilitate online learning without imposing an extra financial burden.

Government’s Position on GST Revision

In response to inquiries about reducing GST rates on stationery items and online education, the government has stated that there are currently no plans for such changes. Any adjustments to GST rates and exemptions will be based on recommendations from the GST Council, a constitutional body comprising representatives from the Central and State Governments.

Summary of GST Rates on Stationery Items with HSN Codes

The article also includes an annexure that outlines specific stationery items and their corresponding GST rates, ranging from NIL to 18%. This comprehensive overview helps us understand the tax implications of different stationery items.

| Product Name | HSN Code | New GST Rate from 22nd September 2025 |

|---|---|---|

| Slate Pencils and Chalk Sticks | 9609 | Nil |

| Erasers | 4016 | Nil |

| Pencils (Including Propelling or Sliding Pencils), Crayons, Pastels, Drawing Charcoals and Tailor’s Chalk | 9608 or 9609 | Nil |

| Pencil Sharpeners | 8214 | Nil |

| Mathematical Boxes, Geometry Boxes and Colour Boxes | 7310 or 7326 | 5% |

| Exercise book, Graph Book, Laboratory Notebook and notebook | 4820 | NIL |

| Newsprint (rolls or sheets) | 4801 | 5% |

| Uncoated paper and paperboard used for an exercise book, graph book, laboratory notebook and notebooks | 4802 | NIL |

| Toilet/facial tissue stock, towels, cellulose wadding, similar sanitary papers | 4803 | 18% |

| Pencils (including propelling or sliding pencils), crayons, pastels, drawing charcoals and tailor’s chalk | 9608 or 9609 | NIL |

Conclusion: Gaining an understanding of GST rates for stationery items and online education is of the utmost importance for students, educational institutions, and businesses. The differential approach by the government in determining stationery GST rates aims to strike a balance between revenue generation and affordability for students.

Read Also: GST Impact on Education Sector in India

Likewise, the GST exemption for online education aligns with the broader vision of inclusive and accessible learning. While there are no immediate plans for GST revisions, stakeholders in the education sector need to stay informed about these rates.

What would be the rates for GST 2.0 (after 22 September 2025) on printing charges for books, and for paper used for the same? What is the correct HSN code ? Please let me know

What would be the current rates for GST on printing charges for books, and for paper used for the same? What is the correct HSN code for these please?

GST Rate 5% and HSN code 49011010

What is the gst charges for school report card. HSNcode

HSN code 4901, rate 5%

i want only 2percent gst rate that is applicable for school iteams