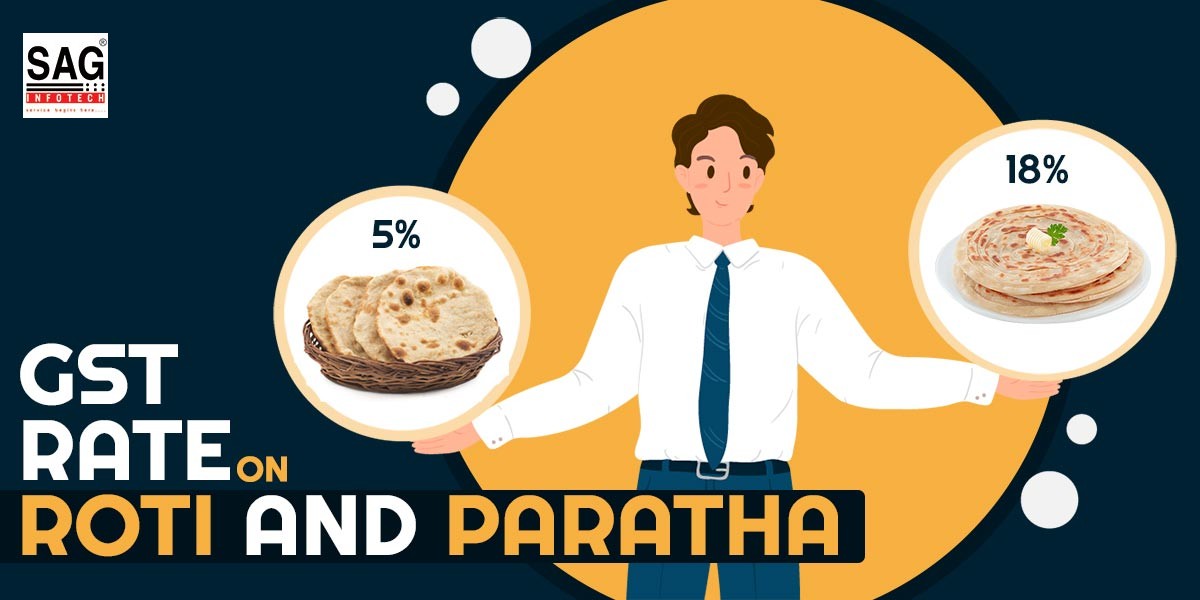

The GST on paratha has been a hotly debated topic for Indian customers. Due to their varied compositions, roti and paratha are subject to various GST rates. In this post, let’s examine the specifics of the CBIC GST rate and the GST on the paratha.

Why is the 18% GST Rate on Paratha While Roti is 5%?

Understanding the nature of the item is necessary to determine what the GST on paratha is. On this subject, an advance ruling was also submitted. In M/s Vadilal Industries Ltd., the Gujarat AAR issued an advance ruling in 2021, and the Gujarat AAAR heard an additional appeal in 2022.

The AAR applicant/appellant runs a business selling packaged kinds of parathas, which are processed foods. Parathas consist of plain, Onion, mixed vegetables, Mooli, Aloo, Methi, Laccha, and Malabar paratha. All types of wheat flour are the main component. Others include water, salt, vegetable oil, antioxidants, etc.

The appellant challenged the 18% GST on paratha, arguing that toasted bread, pizza bread, and rusks only incurred 5% GST. According to AAR in Gujarat, parathas include more components than bread or roti, which is why the GST rate is higher. Finally, after an appeal, the Gujarat AAAR confirmed the AAR’s position and determined that the GST on paratha was 18%.

GST HSN Code for Paratha

The GST HSN code assigned to “Paratha” is 21069099. Different varieties of “Khakra” and “plain roti” are known as parathas. Because they need to be cooked before eating, parathas cannot be categorized as simple chapati or roti.

The directions on the packaging also state that a paratha must be heated for 3–4 minutes before its colour changes and it becomes safe for ingestion. The HSN chapter heading 1905, on the other hand, applies to roti or chapati, which is prepared for consumption when purchased. Roti and chapati are subject to 5% GST (2.5% CGST + 2.5% SGST).

Important: Can One GST Rate Make Product Classification Easier, Check

The first listing of the paratha was at Entry No.453 in Schedule-III of the CGST Rate Notification No.01/2017, which was published on June 28, 2017. There is an 18% GST on paratha (9% SGST + 9% CGST). This designation was in use until November 14, 2017.

It was reclassified as of November 15th, 2017 under Entry No.23 of Schedule-III of the CGST Rate Notification No.01/2017, which was released on June 28, 2017, as a result of a GST change.

The paratha’s GST rate (9% SGST + 9% CGST) was kept at 18% without ITC claims.

GST FAQs on Paratha

Q.1 – Does GST Apply to Papad?

According to CGST Rate Notification No. 2/2017 under Entry No. 96, GST on papad or pappad of any shape is exempt or nil rated.

Q.2 – Does GST Apply to Cooked Food?

Yes, the GST on cooked food varies depending on where it is sold. Consider that it is a takeout-only restaurant, an AC or non-AC restaurant that is not connected to a hotel. In that situation, the restaurant with the HSN code 9963 is subject to a 5% GST on prepared meals without ITC claims. GST on cooked food is 18% if the restaurant is a part of a hotel with rooms priced at Rs. 7,500 per day, plus ITC claims.