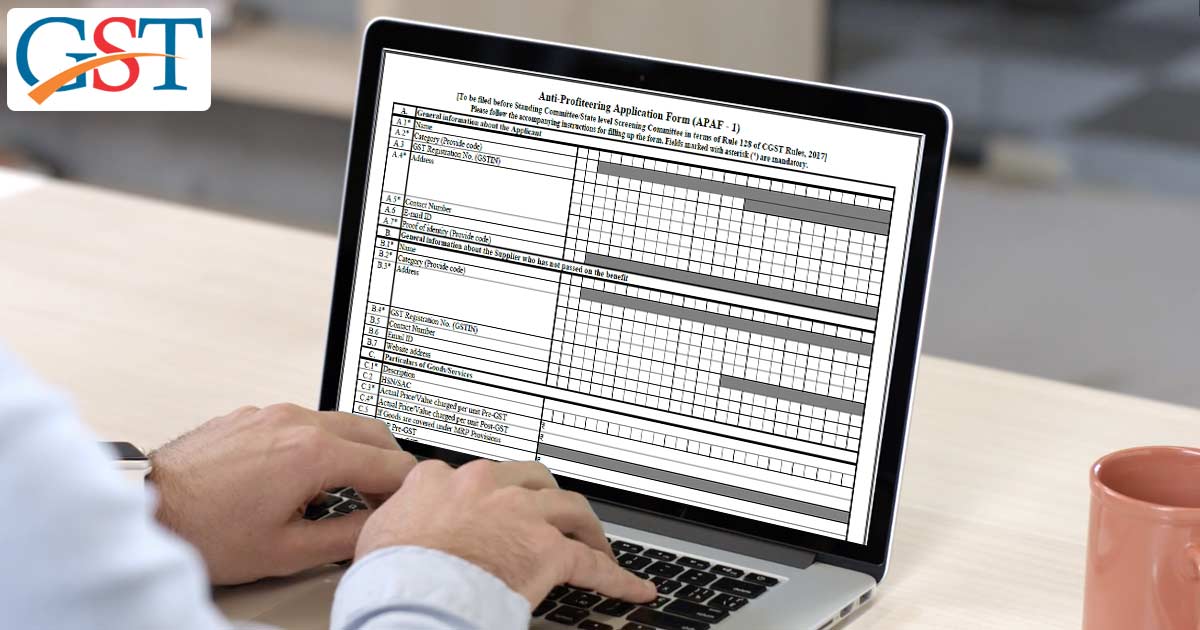

The Finance Ministry has made the complaint procedure against profiteering schemes used by traders/business owners post GST rollout. Consumers will now have to fill a simplified version of the complaint form with less number of columns.

Compared to the original 44 columns, people will now have to fill only 16 fields in the profiteering complaint form. Out of these only 12 fields are mandatory. People will now have to provide following personal details while filling the anti-profiteering complaint form:

- Name and Address

- Contact Details

- Proof of Identity

In addition to above personal information, the applicant will have to provide following details of the supplier in question:

- Name and Address of the Supplier.

- Goods or Service for which the application is being filed.

- Price value per unit of the Goods and Services.

- The pre and post-GST MRP of the Goods and Services.

Further, the applicant will also have to attach copies of invoice or price list as evidence. The hard copy is a proof against the supplier for the tax reduction or the input tax credit gobbled by him in place of the consumer.

Anti-Profiteering Mechanism

Complaints subjected to local or state nature fall within the scope of the state-level screening committee, whereas national level complaints are attended by the Standing Committee.

The Standing Committees (state or national) review the complaints. Based on their findings and merits of the complaint, the cases are forwarded to the Directorate General of Safeguards (DGS) for further investigation.

Anti-profiteering Unit than further investigates the case. If found guilty, the convict stands to face extreme capital punishment as well as cancellation of Goods and Services Tax registration.

The tally for Anti-profiteering complaints stands at 170 since the launch of GST in July last year.

Earlier Complaint Form

The earlier form it seemed was aimed at creating a case history of the trader or business person. The complainant had to do a lot of background work to fill the profiteering complaint form. Some of the mandatory details required by the earlier form were:

- Details of pre-GST rates of excise duty, VAT, service tax, the luxury tax charged by the businesses.

- Actual price or value charged per unit pre-GST and the same post-GST

- Self-attested copies of all documentary evidence like proof of identity, invoice, price list and detailed working sheet

- Total tax per unit and the reduction in tax amount post-GST

The move from the Ministry of finance comes in response to the suggestions by the standing committee which felt that the earlier form was to complicated. As per claims made by the committee, even a common man can now file a complaint without the guidance or help of an accountant. This is power in the hands of the common man. We Guess… Its a form of Swaraj!!.