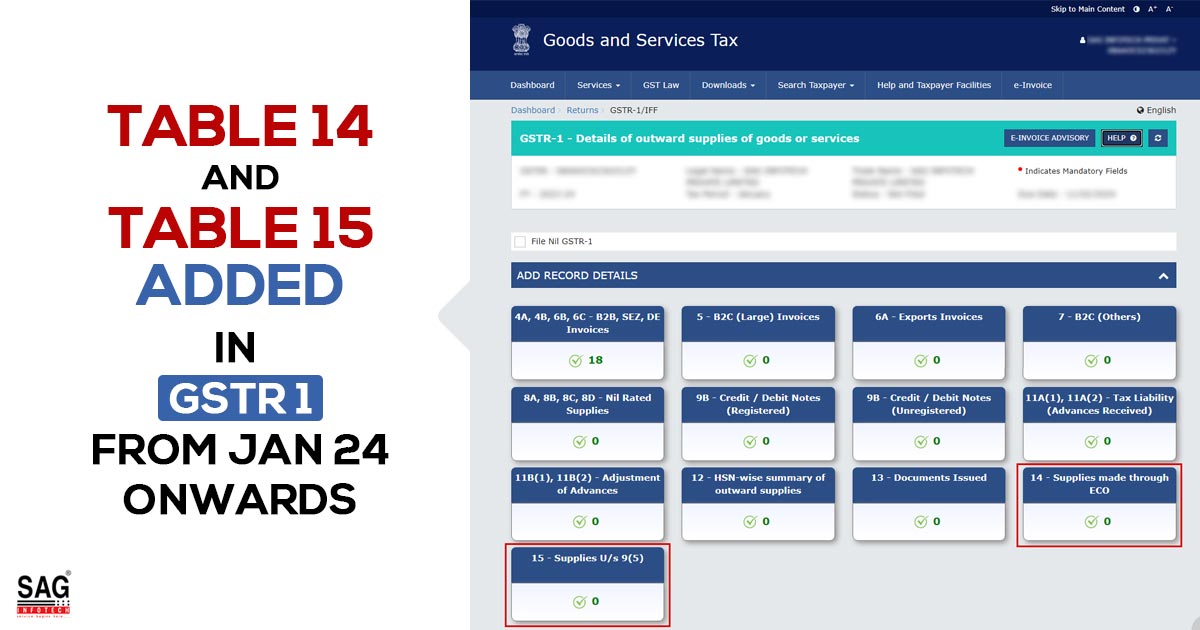

The CBIC department has made the most awaited filing changes in the GSTR 1 form from January 2024 onwards. The form has now fifteen tables including new tables 14 and 15. Table 14 is related to supplies made through e-commerce operators and Table 15 is related to supplies U/S 9(5). These changes are showing after clicking the e-filing option.

E-Commerce Operator Supplies in Table 14

A taxable outward supply made to an e-commerce operator can be entered in this table.

- ‘Liable to collect tax u/s 52 (TCS)’- You will see this tab by default.

TCS supplies made under section 52 should be reported here. - ‘Liable to pay tax u/s 9(5)’- By clicking on this tab, you can add records to Table 14.

You are requested to provide here a summary of the e-commerce supplies that are covered by section 9(5).

- ‘ADD RECORD’ – You can input e-commerce-related details using this tab.

- ‘PROCESSED RECORDS’ – Details of successfully added records can be found under the “Processed Records” table.

- ‘PENDING/ERRORED RECORDS’ – The following table shows the details that you added, but they are not processed successfully.

- ‘BACK’ – When you click on this button, it will take you back to the GSTR-1 dashboard page.

Note – The amounts and values can be either positive or negative.

Table 15 Supplies Under Section 9(5)

With this table, you can enter information about taxable outward supplies for which the e-commerce operator is responsible for paying tax u/s 9(5) of the Act.

The e-commerce operator can declare the supplies for which they are liable to pay tax under section 9(5) of the Act, based on the types of suppliers and recipients mentioned below:

- B2B

- B2C

- URP2B

- URP2C

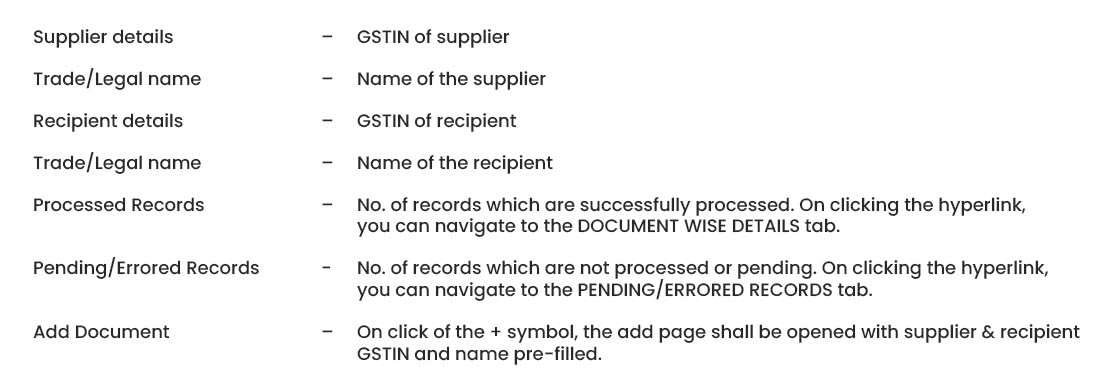

‘B2B’ – By default, this tab will display records added to the Record Details table based on recipient and supplier. The table will show the following information:

- ‘DOCUMENT WISE DETAILS’- You can access a list of processed records by supplier/recipient GSTIN, and edit or delete them before submitting GSTR-1.

- ‘ACTION’ – The icon with the trash will delete the document, while the pencil icon will allow you to edit document details.

- ‘PENDING/ERRORED RECORDS’- You can view all pending records for a specific supplier/recipient GSTIN.

- ‘ADD RECORD’ – You can now provide document details for taxable outward supplies, for which an e-commerce operator is liable to pay tax under section 9(5) of the Act, on behalf of registered suppliers and recipients.

- ‘BACK’ – By clicking on this button, you can easily navigate back to the GSTR-1 dashboard page.

‘B2C’ – By clicking on this tab, you can add details of taxable outward supplies that e-commerce operators are liable to pay tax for, under section 9(5) of the Act, related to registered suppliers and unregistered recipients.

- ‘ADD RECORD’- To add specific details based on the POS or supplier, please use the designated tab.

- ‘PROCESSED RECORDS’ – The details that have been added successfully will be accessible under the “Processed Records” table.

- ‘PENDING RECORDS’ – This table shows the details that you added, but they were not processed successfully.

- ‘BACK’ – By clicking this button, you will be redirected to the GSTR-1 dashboard page.

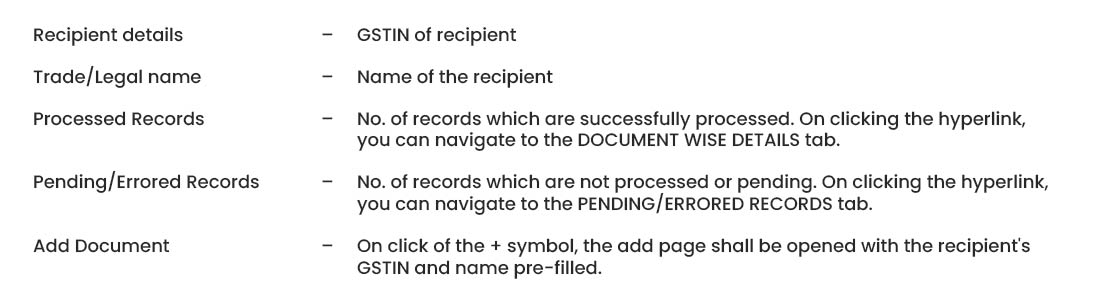

‘URP2B’ – Upon clicking this tab, you can input information regarding taxable outward supplies for which an e-commerce operator is responsible for paying tax under section 9(5) of the Act. These supplies are related to unregistered suppliers and registered recipients. The records you add will be displayed in the Record Details table, organised by recipient. This table will provide the following details:

- ‘DOCUMENT WISE DETAILS’ – You can access all processed records for a specific recipient GSTIN, and make changes or deletions before submitting GSTR-1.

- ‘ACTION’ – The icons on the screen have different functions. The delete icon removes the document, while the edit icon allows you to modify document details.

- ‘PENDING/ERRORED RECORDS’ – You can view all pending or errored records associated with a specific recipient’s GSTIN.

- ‘ADD RECORD’ – You can now add document details for taxable outward supplies where the e-commerce operator is liable to pay tax under section 9(5) of the Act for both unregistered suppliers and registered recipients.

- ‘BACK’ – When you click on this button, it will take you back to the dashboard of the GSTR-1 page.

‘URP2C’ – Click this tab to add details of taxable outward supplies for which an e-commerce operator is liable to pay tax under section 9(5) of the Act, related to unregistered suppliers and unregistered recipients.

- ‘ADD RECORD’ – To provide specific details based on the point of sale, you can utilize this tab.

- ‘PROCESSED RECORDS’ – The details that have been successfully added will be available in the processed records table.

- ‘PENDING RECORDS’ – This table shows the details you added, but that could not be processed successfully.

- ‘BACK’ – By clicking on this button, redirected to the GSTR-1 page.