What is GST PMT 09?

Earlier launched by CBIC via notification no. 31/2019 CT on 28th June 2019, PMT 09 is the prescribed challan for relocating the falsely or erroneously paid ITC. For example, if you have paid CGST instead of SGST, you can rectify it by using this challan which is known as GST PMT 09.

GST PMT 09 is Live on the GST Portal

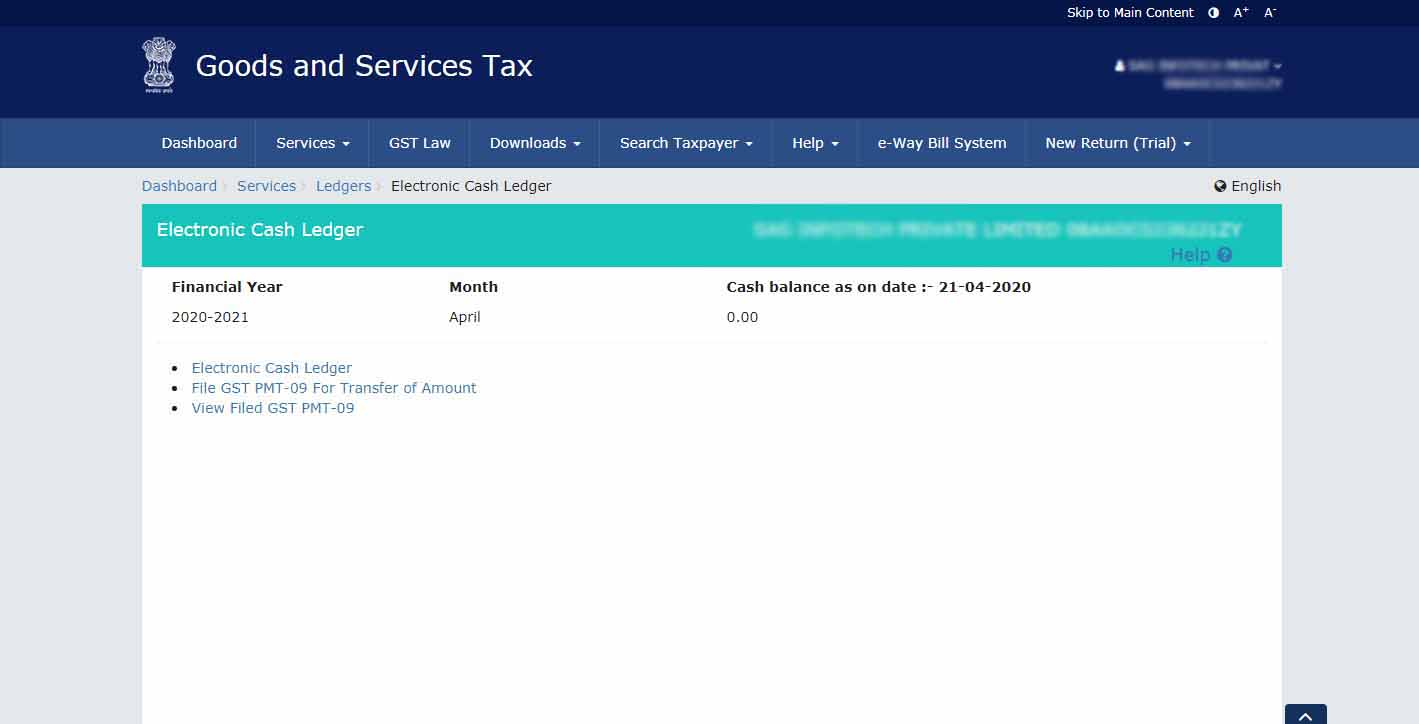

Now the GST PMT 09 form is on the portal and the taxpayers can transfer the available electronic cash balance to other tax heads, for example, SGST to CGST or penalty to interest, etc. To that, the taxpayer will have to log in first then go to Services –>Ledgers–>Electronic Cash Ledger—> File GST PMT-09 For Transfer of Amount.

After GST PMT-09 Form is Filed:

- ARN will be generated

- A message and an email will be sent to the taxpayer’s registered email and mobile number.

- The electronic cash ledger will be updated

- Taxpayers can view or download the filed GST PMT 09 form in PDF format

GST PMT 09 Filing and FAQS

Read Also: Complete Guide of GST PMT 06 and GST PMT-07 Form

How Would You Describe the Format of GST PMT 09?

PMT 09 consists of minor and major heads. You can mention the amount of tax you wish to shift as in the details of the amount to be transferred from one account head to another. The reallocation of tax can be from major head to minor head and vice versa. The provision was brought in under the Fourth Amendment Act of CGST norms and Clause 13 was introduced to CGST Rules as in rule 87.

What is the Eligibility to File a GST PMT 09 Online?

Every taxpayer is eligible to file GST PMT 09 online which can be accessed on the GSTN portal. When GST PMT 09 is live on the portal, we are able to execute it. Thus you can rectify the mistakenly wrongly paid tax readily and effortlessly.

A few Points to Remember About GST PMT 09

- This challan is not helpful when a wrongly paid challan has been utilised (in GSTR 3b).

- It’s impossible to edit GSTR 3b.

- The challan can shift only the amount of tax present in the cash ledger.

- The amount once utilised and removed from the cash ledger cannot be reallocated.

- Challan is useful when payment is done under the wrong head but not utilised.

- Such situations arise only in case of penalties.

- When the data in return is wrong then the data in challan will also be wrong but in this situation too, it can be adjusted.

General Queries GST PMT 09

Q.1 What is Form GST PMT-09?

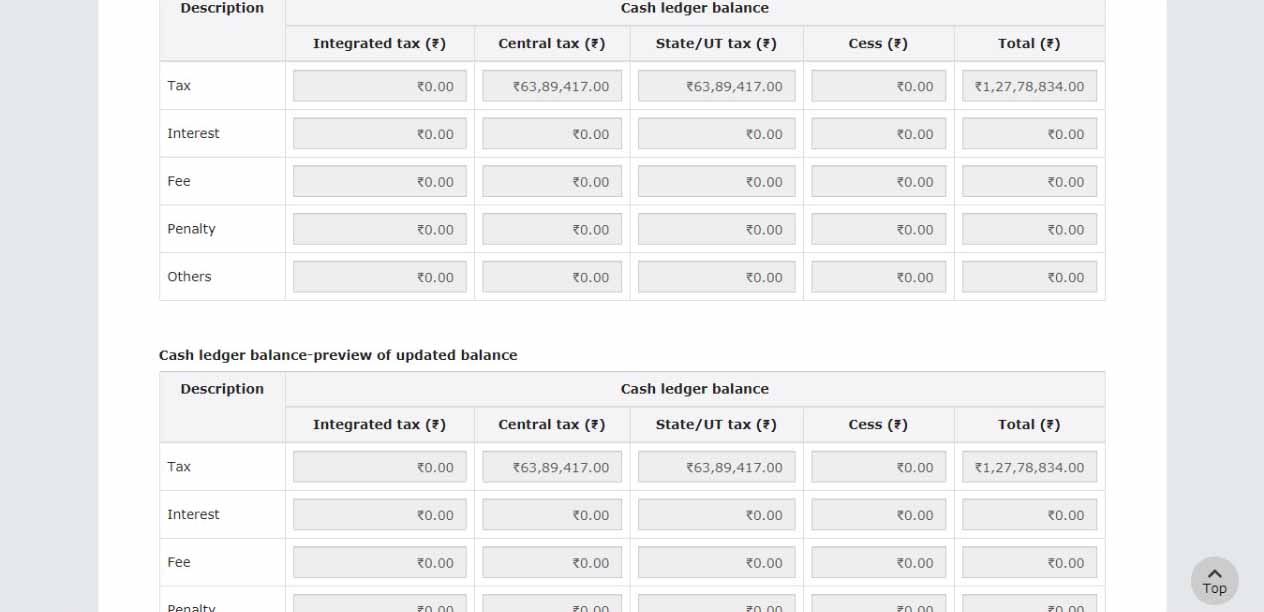

The enrolled assessee through the Form GST PMT-09 can undergo intra-head or inter-head transfer if the amount is present in the Electronic cash ledger. Hence the enrolled assessee can fill any amount of tax, interest, fee, penalty via Form GST PMT-09 in major or minor head to other major or minor authority as present in electronic cash record.

Q.2 – What is the advantage of Form GST PMT-09?

Under minor head (Tax, Interest, Penalty, Fee and Others) OR a major head (Integrated tax, Central tax, State or UT Tax, and Cess) If the assessee provides the amount then they use it to leave their obligations under the major and minor head. Thus they intend to give the amount beneath the specific head to encounter their liabilities.

The assessee is permitted to build Intra-head and Inter- Head transfer of funds, as available in their electronic cash record under the Form GST PMT-09 on the GST portal. Hence this function shall be invented to transfer the amount present in electronic cash record as declared below:

- Under the major head, cess to minor head interest under major head CGST or to transfer the amount from minor head tax.

- Under major head IGST for transfer amount from minor head Interest to minor head Tax under identical major head IGST.

Q.3 – Where can I furnish Form GST PMT-09?

Click on Services > Ledgers > Electronic Cash Ledger > File GST PMT-09 For Transfer of Amount option

Q.4 Do I opt for more than one major or minor head during furnishing of Form GST PMT-09?

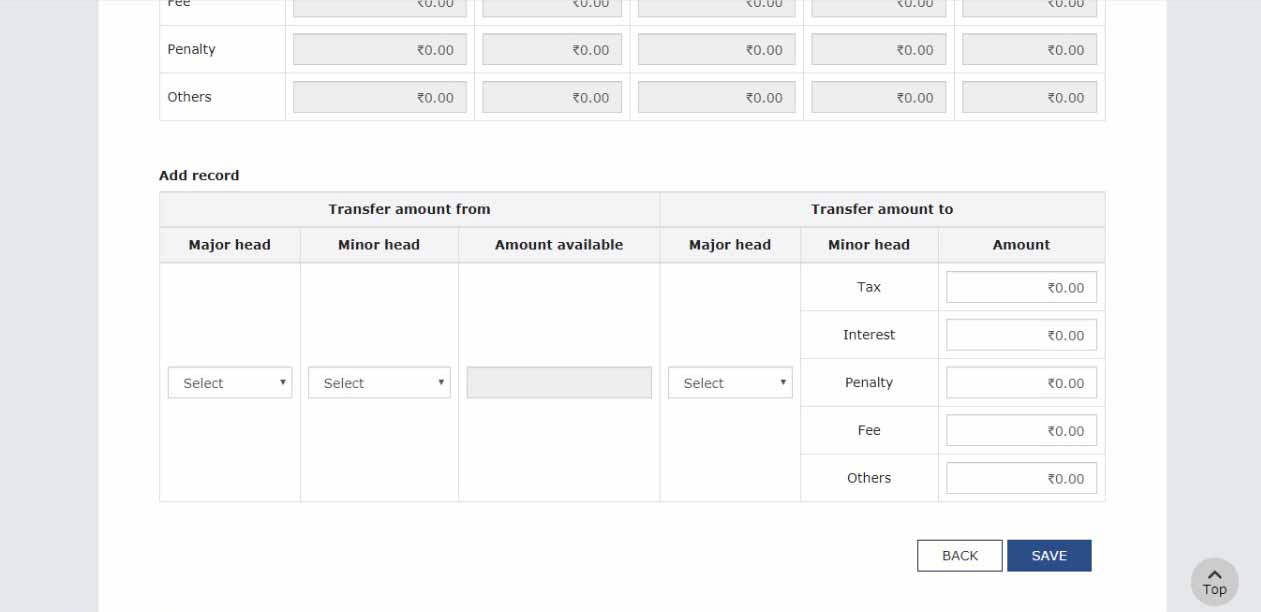

Surely, you can choose more than one major or minor heads during the supplying of amount from 1 head to another at one time on filing Form GST PMT-09.

Q.5 During the time of filing of Form GST PMT-09, how come, I add more than 1 major or minor head?

You can add up with more than one major or minor head utilising Add Record choice prior to clicking PROCEED TO FILE.

Q.6 – Do I see Form GST PMT-09 prior to filing?

The PDF format prior to filing the identical on the GST Portal can surely be seen and download the Form GST PMT- 09.

Q.7 – Can I find the ways to inscribe Form GST PMT-09?

Form GST PMT-09 can be furnished by seeking DSC or EVC.

Q.8 – What will be the result if once Form GST PMT-09 is furnished?

Post filing of Form GST PMT-09

- ARN gets generated on the successful furnishing of Form GST PMT-09

- An SMS or email is provided to the assessee to his mobile number as well as email id enrolled with it

- Post successful furnishing of Form GST PMT-09 the electronic cash record shall get updated

- To view or download in PDF format which is already furnished in Form GST PMT-09

Q.9 – Post filing the Form GST PMT-09 do I get any intimation?

On the enrolled mobile number as well as on the email address you can receive the SMS and e-mail id as soon as you file Form GST PMT-09 is filed.

Q.10 – Where should I observe filed Form GST PMT-09?

Checkout the filed Form GST PMT-09 by clicking on Services > Ledgers > Electronic Cash Ledger > View Filed GST PMT-09 option.

Q.11 – How to download the filed Form GST PMT-09?

Download filed Form GST PMT-09, Services > Ledgers > Electronic Cash Ledger > View Filed GST PMT-09 > DOWNLOAD GST PMT-09(PDF)

B. Manually Furnishing & Observing the Form GST PMT-09

How come I furnish and see the Form GST PMT-09?

For filing and observing the Form GST PMT-09 do the particular steps given below:

- Visit the https://www.gst.gov.in/ URL. The GST Home page is displayed. Login to the GST Portal with valid particulars

- Click to Services> Ledgers> Electronic Cash Ledger option

- For Transferal of Amount option access file GST PMT-09

- In the CASH LEDGER BALANCE, the electronic cash records page is mentioned. Electronic Cash record balance is present for transfer and previews the updated Electronic Cash Ledger balance is illustrated

- Through IGST, CGST, SGST/UTGST as well as Cess one can transfer the amount of tax, fee, penalty, interest etc. put the amount you want to transfer from along with the address and amount to then click SAVE to progress

- Tap YES to further proceed the transfer of the amount

- Observe the information which is add-in “Processed Records” section along with a table for the cash records, current balance to transfer and the cash records under the ADD RECORD option prior to choosing the PROCEED TO FILE

- Tap PROCEED TO FILE

- Choose the verified checkbox and opt the authorised signatory. Tap FILE GST PMT-09

- Tap yes

- Tap the FILE WITH DSC or FILE WITH EVC button

- Tap PROCEED

- A confirmation message is a mention which denotes that the filing has been successful and ARN has been provided on the screen. TAP OK

- TAP the SOLUTIONS> Ledgers > Electronic Cash Ledger > View Filed GST PMT-09 to view filed Form GST PMT-09

- You will find out the information via providing the ARN number or the date

- The information will be mentioned. One can click ARN hyperlink to preview the ARN information

- Press the DOWNLOAD GST PMT-09(PDF) for downloading the filed Form GST PMT-09