The migration of old existing Haryana VAT Dealers has been started. The time period for the migration was 16/12/2016 to 30/04/2017. In upcoming details, we divided Haryana migration process for VAT dealers. In the first step, we explain how to get the provisional Ids. In the second step, we explain that how to convert the provisional Id’s in the GST Id and password. In the last step, we explain what the mandatory requirements while filling GST registration form are.

Recommended: Free Download Gen GST Software for GST India

Here we are explaining the overall process of migration to the GST structure in easy to understand way.

Step 1: Steps to get Provisional ID – Haryana

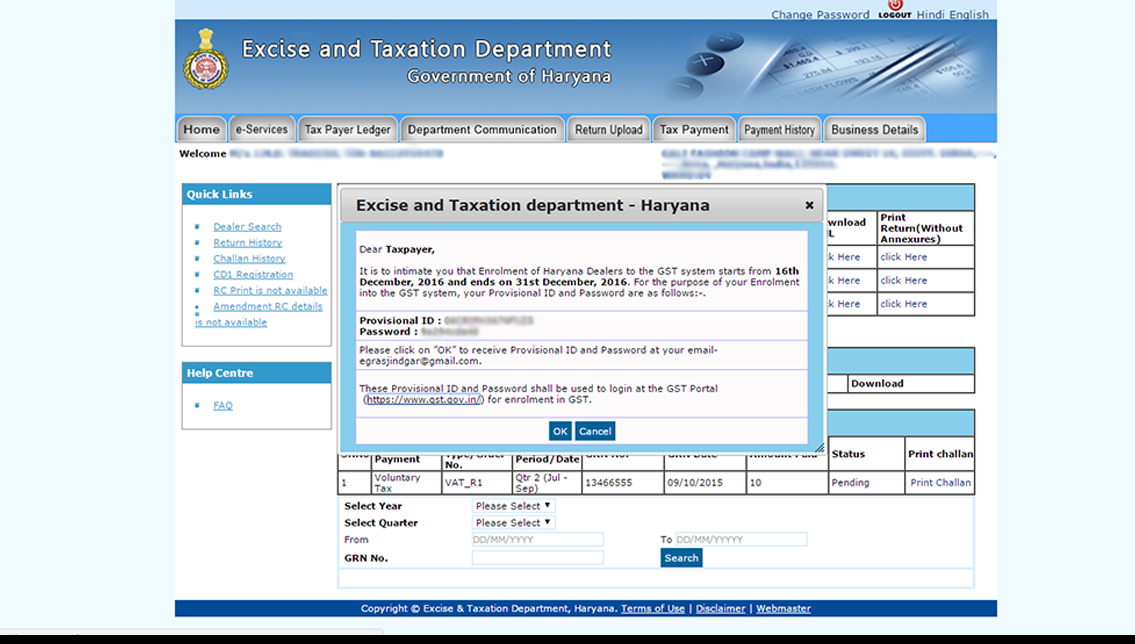

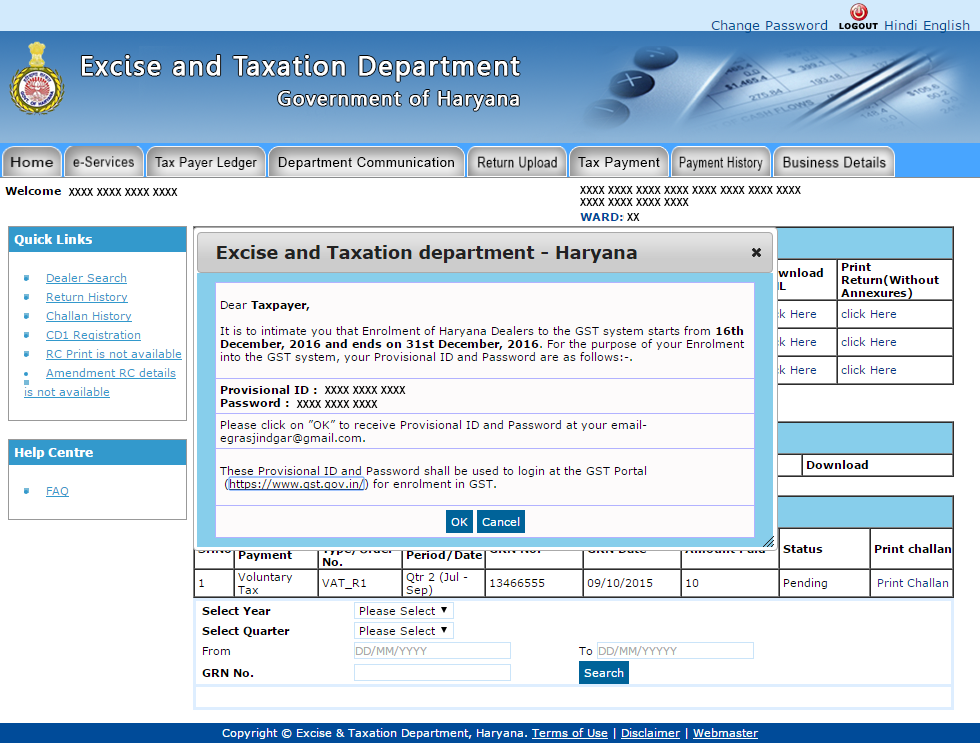

GST Migration starts From 16-December-2016 for Haryana State, Once Dealer will log in on Haryana Commercial Tax Department Portal i.e. https://haryanatax.gov.in/HEX/appmanager/HexPortal/HaryanaExcise and enter user id and password of the client using his Login Id (VAT TIN) and credentials.

It will show pop-up window which will show details of GSTN Provisional Id and Temporary password on screen to enroll on GSTN Portal

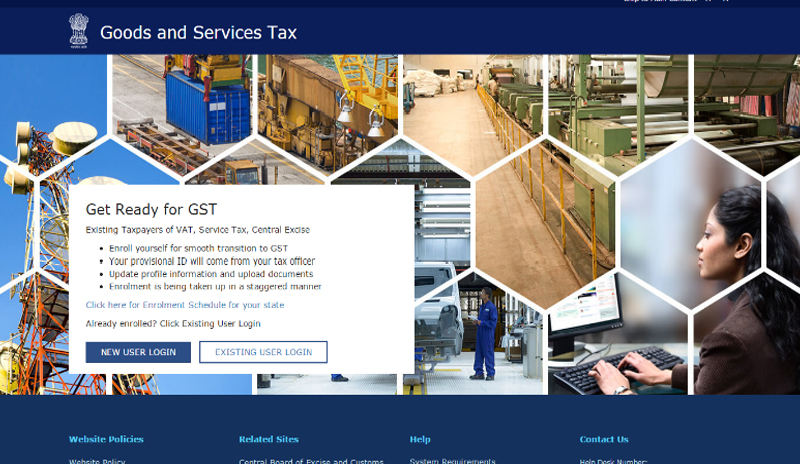

Step 2: How to Convert Provisional ID into GST User ID and Password

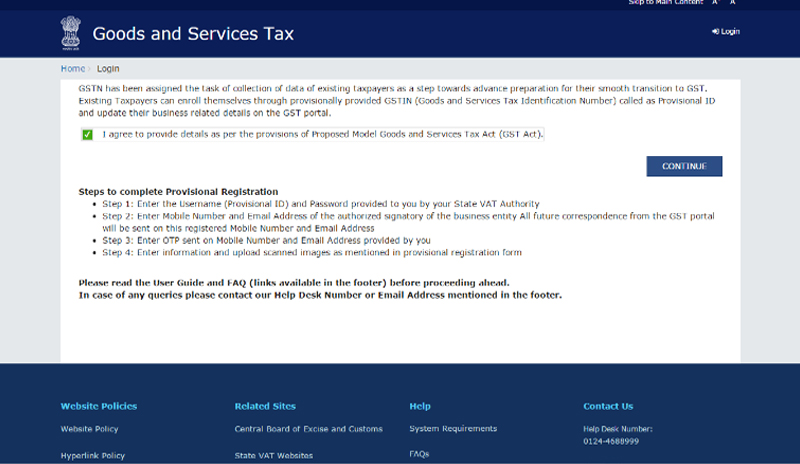

Go to www.gst.gov.in site

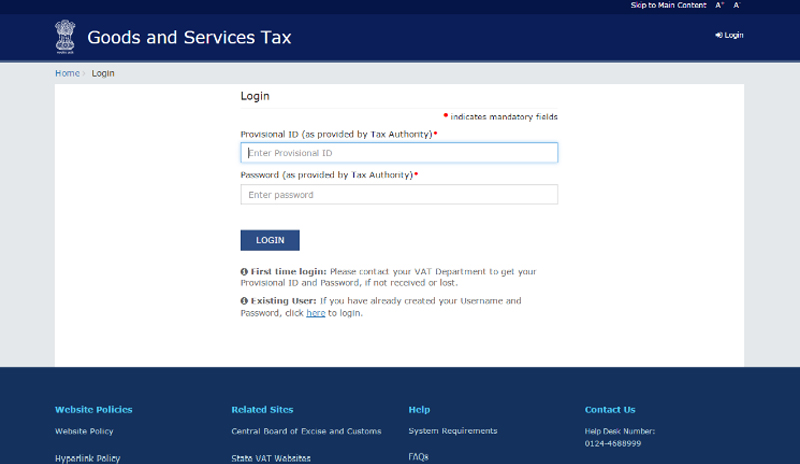

After Clicking on Continue button, enter provisional ID, and password:

After entering the details, enter mobile no. and email address

An OTP will generate and enter the same.

After that make a user id and password of your choice for the GST.

Step 3: Mandatory Requirements for Filling GST Registration Form

- Have your PAN card, Name, Address, Passport Number, Aadhar No available for updating them on the portal for the owner, authorized signatory, partners, proprietors, Karta of HUF, directors or partners of LLP.

- Keep handy of bank account number, IFSC code and bank address ready as well.

- Pick out all your required documents in soft copies as pdf / jpeg with each file size up to maximum 100 kb, ready for the quick migration process.

- Fill up the required details W.R.T. each page for registration. On successful updating of details, each page will show a right click mark

- Get the DSC of the applicant verified / registered beforehand on the GSTN portal.

- On complete updating of all required pages, the application shall be verified using the DCS of applicant or E-signature. As of date, there is no clarity on e-signature.

Recommended: Gen GST Registration Utility: Easy Way for GST Migration & Registration