GST touted as the biggest taxation reform since Independence, it has been nearly 4 months since new indirect taxation regime was implemented across the country. The Central and the State Government is considering to reduce the tax rates on 150- 200 items in the top slab- rate category of 28 percent. Additionally, the Indian government also permitting to large businesses to file GST returns quarterly instead of monthly.

A senior official told to media reporters, a panel of State- Finance Ministers are considering to revise the tax rates on several items and the majority of items belongs from the top category. The list of items includes daily routine household products, sanitary napkins, electrical fittings, construction-related products, furniture, and goods produced by the small-scale businesses.

According to TOI report on 9th October, several states have requested to GST council to reduce the tax rates. It is anticipated that the final decision will be announced at 23rd GST Council Meeting, scheduled to be conducted on 10th November 2017 at Guwahati, Assam. The main aim of the Central Government is monetary resources and committed to compensating the states for revenue while making plans to better align with fiscal equality.

Some of the goods and services in the list, many of the items will have to face 18 percent GST, will give the indication to the Central Government to transform into a three-tier rate structure.

Previously, Finance Minister Arun Jaitley has already discussed the single standard rate under GST, which is currently levying 12 percent and 18 percent.

In the midst of the review, it is perceived that the government has enhanced the tax rates on several items under GST, the businesses are requesting to customers that the payment can be made via cash instead of digital means.

Read Also: Will November Make GST Composition Scheme Brighter with Low GST Rates for Restaurants?

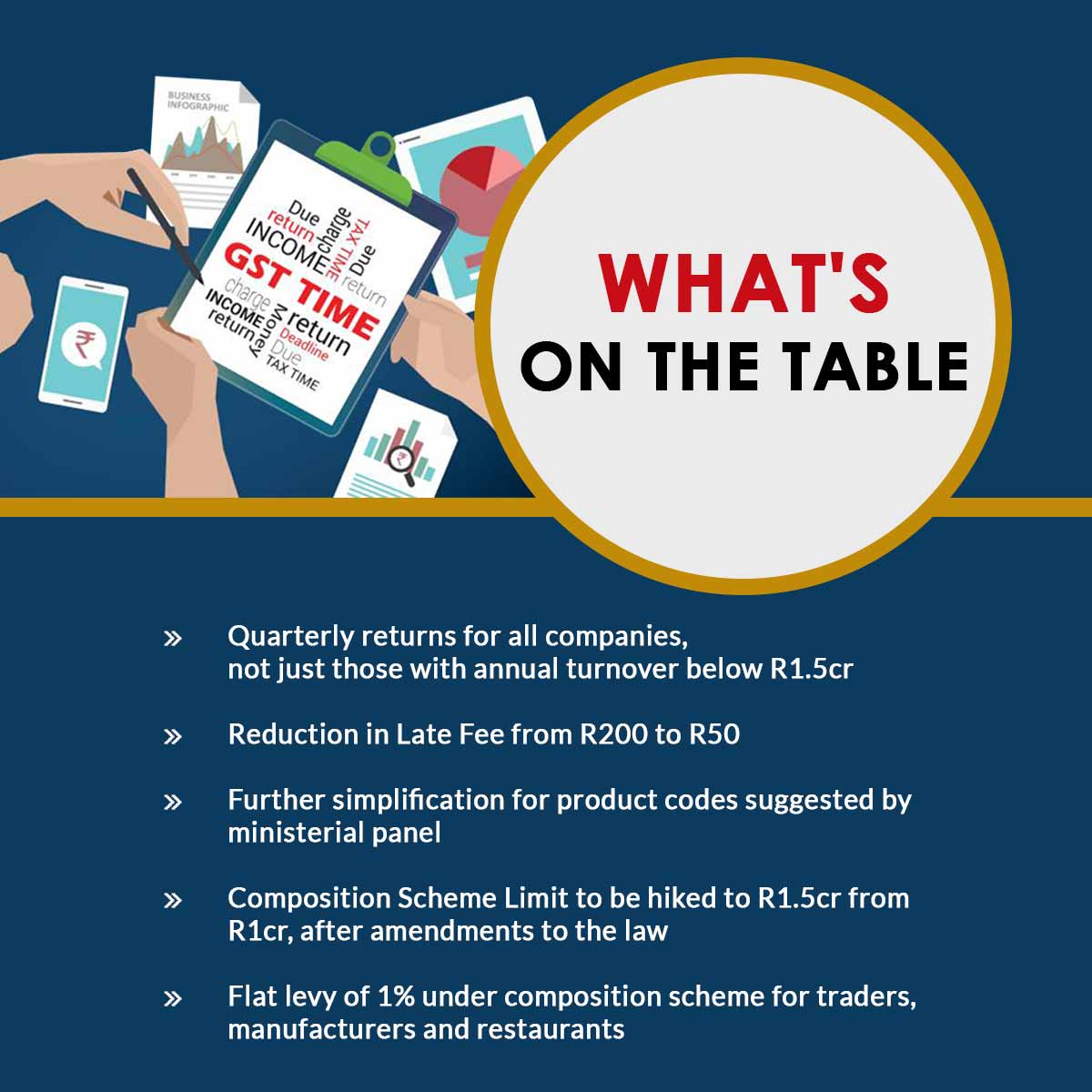

Additionally, a panel of five state finance ministers has also suggested that all larger companies are allowing to file returns quarterly basis instead of monthly. The GST council allowed quarterly filing returns to businesses only who have an annual turnover of up to Rs 1.5 crore. An official said, “This should be done for units with a turnover of Rs 5-10 crore, if not for everyone.”

The state finance ministers were also in the talks for making some changes in the detailed tax break up of bills and consolidating them making some better impression to the consumers. The government had express concerned that the 90 percent of users have paid less than 5 percent of the taxes. A Group of Ministers (GoM) have also reduced the late fee penalty from Rs 200 to Rs 50, those who have missed the last deadlines of filing returns.