Indirect taxes have always been contributing more than direct taxes to the Government’s Revenue. Services solely contribute a major part of the whole Gross Domestic Product (GDP), subsequently, it shows the major contribution of Services in taxes also. The service sector not only dominates the GDP contribution but attracts foreign investment towards the Indian Economy.

The service sector contributes significantly to exports as well as provides large-scale employment. India’s services sector covers a wide variety of activities such as trade, hotel and restaurants, transport, storage and communication, financing, insurance, real estate, business services, community, social and personal services, and services associated with construction.

Latest Update

- The Orissa High Court issued the order against M/s Mind Mart on Friday, for allegedly failing to pay wages to data entry operators and deducting too much service tax and GST. Read Order

- Authority for Advance Rulings of Maharashtra ruled that GST applicable on security services rendered regarding different municipal corporations’ sites. Read more

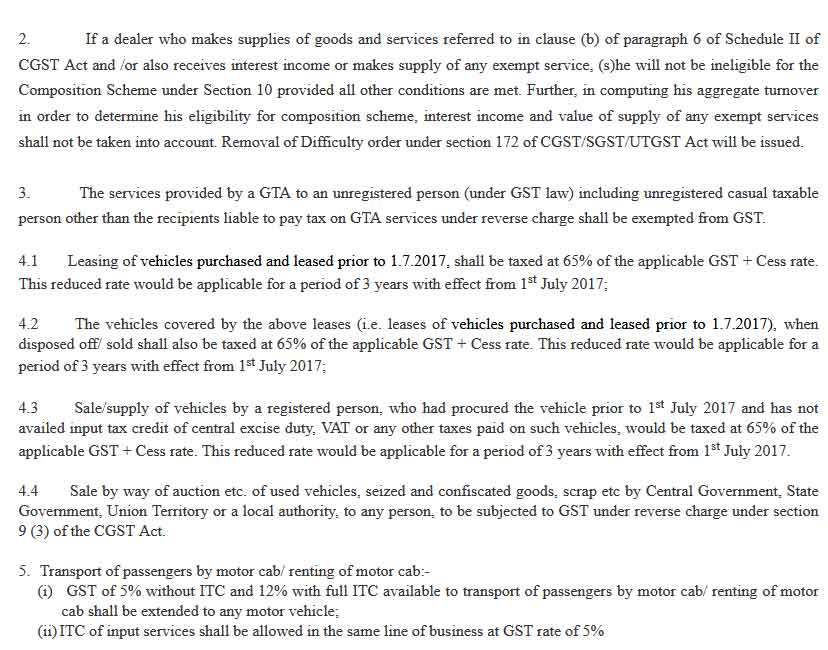

The GST council has decided in its 22nd meeting that Presently, anyone making inter-state taxable supplies, except inter-State job worker, is compulsorily required to register, irrespective of turnover. It has now been decided to exempt those service providers whose annual aggregate turnover is less than Rs. 20 lacs (Rs. 10 lacs in special category states except for J & K) from obtaining registration even if they are making inter-State taxable supplies of services. This measure is expected to significantly reduce the compliance cost of small service providers.

47th GST Council Meeting Updates

| Services | To | From |

|---|---|---|

| Services supplied by a foreman to chit fund | 12% | 18% |

| Job work in relation to the processing of hides, skins, etc | 5% | 12% |

| Job work in relation to the manufacture of goods and footwear | 5% | 12% |

| Job work in relation to the manufacture of clay bricks | 5% | 12% |

| Works contract for roads, bridges, railways, metro, effluent treatment plant, crematorium etc. | 12% | 18% |

| Works contract supplied to central and state governments, local authorities for historical monuments, canals, dams, pipelines, plants for water supply, educational institutions, hospitals etc. & sub- contractor thereof | 12% | 18% |

| Works contract supplied to central and state governments, union territories & local authorities involving predominantly earthwork and sub-contracts thereof | 5% | 12% |

| Transport of goods and passengers by ropeways. | 18% | 5% (with ITC of services) |

| Renting of truck/goods carriage where the cost of fuel is included | 18% | 12% |

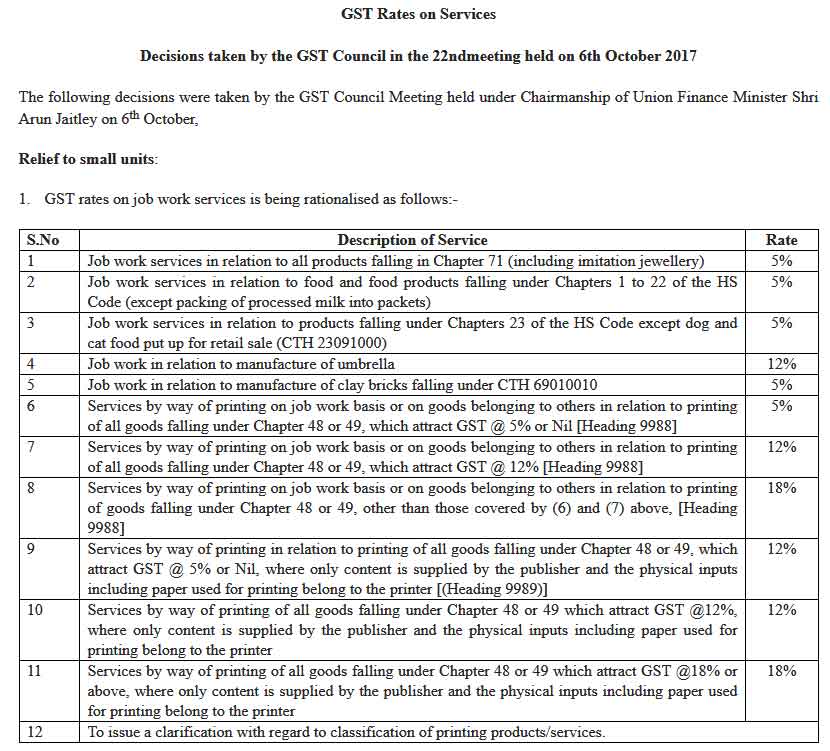

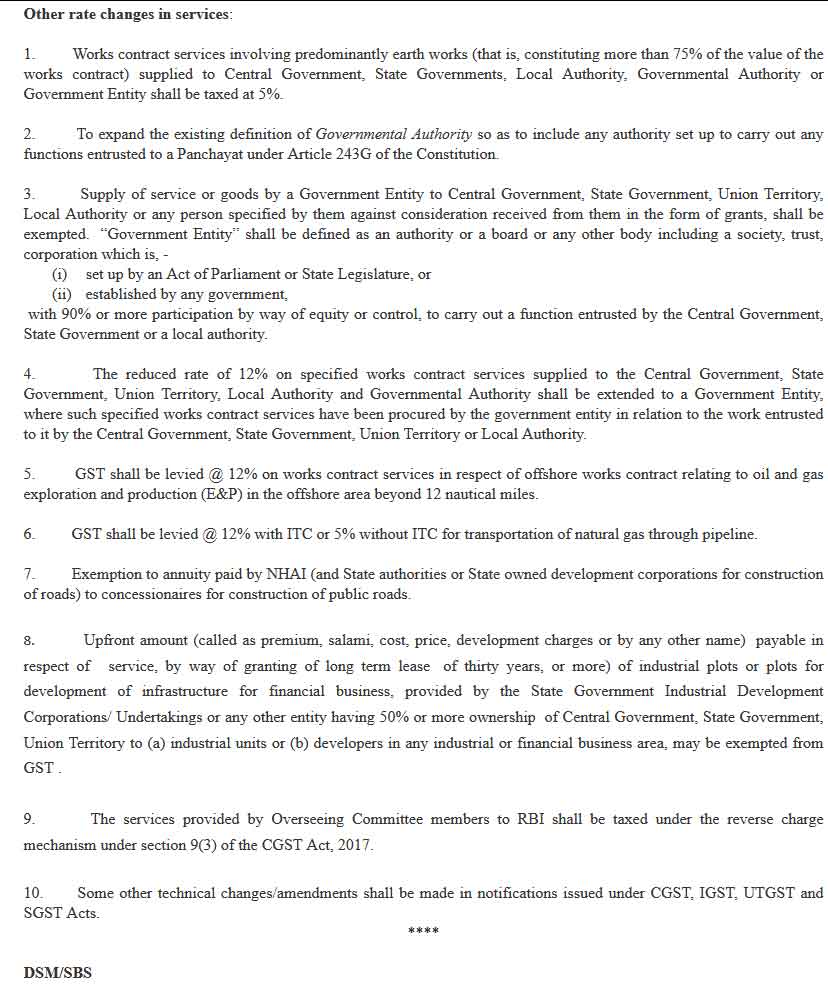

As GST Council changed the rates on services in the 22nd meeting held on 6th October 2017. We have included the infographics of the rate change on services below:

Some of the Important Areas where the GST Impact is Visible:

GST Impact on the Aviation Sector

Under the recent update from the aviation industry, the GST council has reduced the GST rate on MRO to 5%. This reduction has been done in the wake of the heavy stress that the aviation industry is going through.

Costlier Services

In the previous tax regime, service tax was applicable at the rate of 15% on Services rendered which includes 0.5% for Swachh Bharat Cess and 0.5% for Krishi Kalyan Cess but in the goods and service tax regime, it has been extended to 18% making the services and works contracts costlier. The revenue secretary also mentioned the level of taxation which has been increased in the latest implemented GST structure as the minister was sure and told that the service sector is under the higher taxation of 18 per cent from the previous 15 per cent in the Goods and Services tax framework.

Notices from Taxation Authorities

In the previous tax system, both Central and State Govt. had the right to collect the tax according to the rights given in lists I, II and III in the Constitution and because of that sometimes it became so confusing to find out to pay taxes to which department in regards to goods and services like software, works contract etc. having disputes between Central and State Government and what happened was that the person paying tax to service tax department getting notices from the VAT/CST department and the person paying the VAT/CST liability gets the notifications from the Services tax department.

Read Also: GST vs VAT: Simple Way to Describe the Differences

But with the introduction of a single tax GST regime, the double taxation effect due to disputed goods and services in the previous tax system has been eliminated. In the GST tax structure, both supplies of goods and services are treated once with a unique rate of tax respectively.

Registration of Place of Business

GST registration rules are rather simple for service providers with operations in one state. They are actually liable to get more input tax credits (ITC) with less GST compliance burden. But the service providers with operations in more than one state have some major GST compliance rules to go through.

Most of the service providers with operations in multiple states will now have to register in different states to be assessed separately in each state. There are, however, certain conditions and rules that need to be fulfilled for a service provider to register across multiple states. If you are also wondering when and how you get a multi-state GST registration, this article is to provide information regarding that.

Challenges as Explained by the Chairperson of SBI

Arundhati Bhattacharya, Chairman of SBI mentioned that “In respect of GST, the fact of the matter is, we are dealing in services, to that extent there are certain challenges. First of all, there is no centralized registration. If you look at the other jurisdictions where GST has been rolled out, services always have centralized registration. Here we will need to have 36 registrations for all the 36 states (including Union Territories).”

Impact on the Software Service Industry

There are numerous software service companies that are now tackling the goods and service tax scheme now. Among them, there are some industrial companies that state a different point of view regarding the regime. Nikhil Rungta, Managing Director of Intuit India, mentioned that “In the GST regime, it is imperative for every stakeholder in the ecosystem to upload tax. If one does not, the party that has sold the goods forces the receiving party to do so immediately or else faces the burden of not getting an input tax credit.” There is a lesser if not fully impact on the software industry with the tax scenario being lower than previous.

GST Impacts On CBLO (Collateralised Borrowing And Lending Obligation)

Under the model GST, Services are defined that everything other than Goods. So CBLO also comes under services and all the rules and regulations are applied to it.

CBLO benefits from two factors fee-based activities and fund-based activities. Fee-based activities including transaction fees, processing fees, and locker charges are liable to be considered in service tax under GST. The fund-based services such as interest, investment, asset financing, and proprietary trading are exempted from the service tax.

Benefits to Healthcare Services:

Finance minister while drafting GST, ensured to make healthcare services affordable for all the people. There are no taxes on health care services to make them cheap and easily available to all. Healthcare services include care and treatment for illness, injury, deformity, pregnancy, and abnormality along with diagnosis service, patient transportation services, also clinical establishment by the hospital, nursing, clinic, and sanatorium.

Read Also: GST Impact on Healthcare Industry in India

Due to healthcare services being exempted from GST, the input tax credits are not available for healthcare service providers. This increased the input tax cost and affected the burden of tax on healthcare services on end-users or patients.

Increase in Service Sector Growth Rate

The Service Sector has registered a small increase in its growth rate for the month of December. Despite the recovery, the service sector has been unable to expedite the acquisition of new projects. After GST implementation, customer demand has been low and stagnant considering the business outcome. Hence, new projects have been hard to come by. However, the business activity index has increased from 48.5 in November to 50.9 in December.

Signs of Recovery in the Service Sector

A PMI index greater than 50 indicates that there has been an expansion in the activities of the Service Sector. As per reports by IHS, Indian Service Sector is showing signs of recovery which is largely facilitated by manufacturing companies.

Manufacturing Sector Boasts Highest Growth Rate in Five Years

The production growth rate for the month of December has been the highest for the last five years. The Nikkei India Composite PMI output index increased to 53.0 in December as compared to 50.3 in November 2017. Output growth has been the highest for manufacturing since 2012. These are good signs and maybe a small indicator that the economy is now slowly recovering. The slowdown days after the double jolts of Demonetisation and GST may just be over.