Every business registered under Goods & Services Tax receives a unique identification number called GSTIN or GST Identification Number from the CBIC department. The major focus of providing a single GSTIN number is to ensure a smooth administrative process with better compliance and overall growth in the tax collection base.

Under the GST tax scheme, all the business entities come under one single taxation authority and all the multiple identification numbers will be replaced by a single registration number referred to as (GSTIN).

GST Identification Number in Brief:

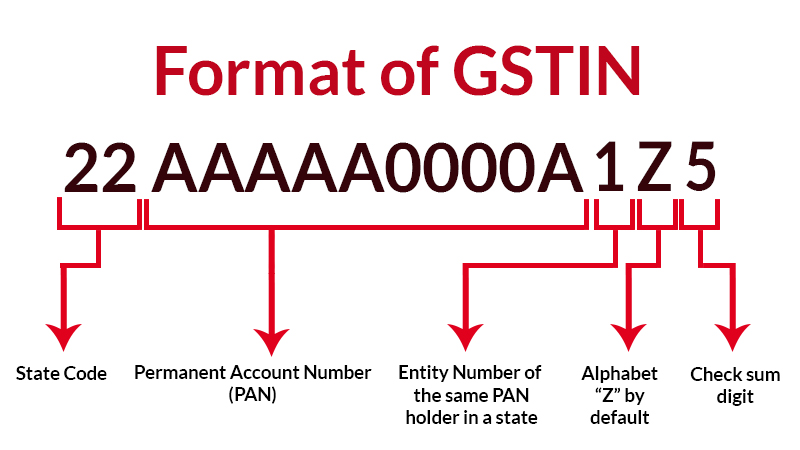

- Each taxpayer assigns a 15-digit state-specific GSTIN based on their PAN.

- First, two digits of the GSTIN represent the state code according to the Indian Census 2011. Which says that every state will have a unique two-digit code for example “27” for Maharashtra and “10” for Bihar

- The next ten digits of GSTIN are the PAN number of the taxpayer

- The 13th digit indicates the number of registrations an entity has within a state for the same PAN

- It is an alpha-numeric number (first 1-9 and then A-Z) and is assigned on the basis of the number of registrations a legal entity (having the same PAN) has within one state

- The fourteenth digit at present has no use and therefore will be “Z” by default

- The last digit is a checksum code which is used for the identification of errors by means of summing up

GST Identification Number Detailed Break-up

Will new registration under GST be required for existing taxpayers under Central Excise or Service Tax or State VAT

No, the assessee with PAN validated from CBDT’s database is not required to apply for any fresh registration under GST. However, they can get provisional GSTIN from the GST portal having a validity of 6 months for the purpose of providing required data according to the GST registration form.

After the completion of the data filing procedure, their provisional registration will get transferred into normal registration. All future notifications from the tax department will then be processed for any further guidelines.

However, the service tax assessees having centralized registration will have to apply for a new registration in the designated states wherever they perform their business operations. Apart from this, there is no fee applicable to obtain GSTIN and register under the GST.

How Does a GSTIN Get Verified?

Various businesses that do not register technically charge GST through the use of what emerges to be legal GSTIN to prevent filing taxes and increase profits. As issuing the bogus GSTIN would be identical to theft, it is important to verify the legality of the GSTIN.

It is simple and fast to validate the legitimacy of the GST number. Just search for the GST number on its website. For the purpose of tax, each invoice comprises the GSTIN of the company.

After you find it once then double check by performing the following-

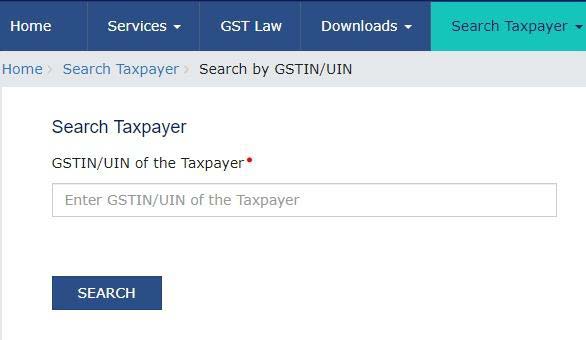

- Go to the GST website at https://services.gst.gov.in/services/searchtp

- On the next page, the entity’s GSTIN shall be needed upon tapping the link. Type in the GSTIN and click on the search button.

- Insert the valid captcha code and click on the search button.

- You shall get directed to the page that comprises the company’s statutory details. When provoked to enter the legal GSTIN you are concerned with the bogus GSTIN. The inaccurate entities contain those whose “Taxpayer Type” denotes “Composition.” Otherwise, the GSTIN is legitimate and can be utilized.

- The mentioned procedure would be used to validate the preciseness of the shown rates. A business might levy a charge to you exceeding the legal GST amount. If you do not learn about its rates, you can see an assured list of GST rates on the link https://cbic-gst.gov.in/.

You can contact helpdesk@gst.gov.in or call the support desk at 011-21400643 if you have any queries concerning GST.

How to Check the GST Identification Number of Any Business You Need?

GST implementation aroused many doubts and queries within the general trading units across the nation. The government has provided a GSTIN finder tool, which acts as an investigator tool for common people to find out whether a business, small or big is registered with the GST ambit.

The necessity to find out this important piece of information is considered in the light of the fact, that certain local business units have started taking undue benefits of this must-registration scheme. To understand this activity, one must also learn that there is certainly no impact of GST on everyday normal items. Daal pulses, Milk, Toothpaste and items similar to it are in no touch with the changes by the GST.

Traders across the nation might have started to charge CGST and SGST without coming into the tax bracket for registration and to further charge this tax from the consumers. The activity is suspicious and will be hampering the economy as well as the consumer’s pockets if it goes unnoticed. It is suspected that even the slight effect accounting to one or two rupees in the product may miss the chance to get clarification and this fact makes the traders go more illegal.

Comparison Between GSTIN and GSTN

GSTIN and GSTN are both related to GST so confusion often occurs. GSTIN stands for the taxpayer identification number.

While, the “Goods and Services Tax Network,” or GSTN, is a computerized system that manages the GST portal. It helps to successfully synchronize all parties engaged in GST, such as taxpayers, state and central government, etc. The GSTN assists the government in keeping track of domestic financial transactions.

Depending on the region of operation, business owners whose yearly turnover exceeds INR 10 lakh, INR 20 lakh, or INR 40 lakh should register their business under the GST system. After registering, you’ll receive a 15-digit GSTIN that needs to be written down on all GST bills. You can report the correct amount of input tax to the government using this number. Additionally, your GSTIN acts as an essential firm identifier.

GST Seva Kendra Services

GST Seva Kendra is also an alternative option to register for a GSTIN. You can visit the nearby GST Seva Kendra. The government has established “Seva Kendra” throughout the country to provide all the GST-related services for everyone. Taxpayers can also visit the centre in need.

This move has been taken by the government to help the transition of many taxpayers to the GST regime. This service is provided in the view that there are so many taxpayers who are not aware or don’t have basic knowledge or don’t have access to the online service.

General Queries Related to GSTIN

Q.1 – What is the method to file a complaint for a forged GSTIN?

On the official government portal, you can verify the GSTIN. If you notice any difference from a supplier then you can report them via the portal or by contacting the government through an email at helpdesk@gst.gov.in, or by calling the helpline numbers 011-23370115, 0124-4688999, or 0120-4888999.

Q.2 – What should I do after geeting my GSTIN?

It is important to promptly make GST-compliant invoices, regular GST return filing, and settle any owed GST amounts punctually, post-securing GSTIN.

Q.3 – Is there any fee for receiving GSTIN?

No there is no fee relevant to registering under the GST Act and receiving the GSTIN, no cost is there for the said process.

Q.4 – What is the need for GSTIN?

It has absorbed multiple indirect taxes, facilitating the process for individuals and businesses to meet their tax obligations. Certain businesses are bound to enroll under the GST system and obtain a GSTIN.

Q.5 – What does the GSTIN number stand for?

A GSTIN number is said to be a 15-digit code from which a GST-registered business in India can be determined. It is based on the state code, PAN, entity code, and check digit. For different GST-related procedures like filing returns and claiming input tax credits, the same is been used.

Q.6 – In what way do I obtain a 15-digit GST number?

You need to apply for GST registration online or offline to get a 15-digit GST number. You are required to furnsih your PAN, business details, bank account, and supporting documents. You will receive a GSTIN and a temporary password once your application is approved.

Q.7 – Is GSTIN linked to PAN?

GSTIN is linked to PAN, as the 10 digits of GSTIN are the PAN of the taxpayer. It assists to avoid duplication and assure uniformity across states. However, an assessee can have multiple GSTINs in diverse states or for different business verticals under the identical PAN.

Q.8 – What is the method to discover my GST number by name or PAN?

Via the GST search tool on the GST portal or other websites, you can find your GST number by name or PAN. You are required to enter the name or PAN of the business and tap on search. You could indeed add the name of the state to improve your search results.