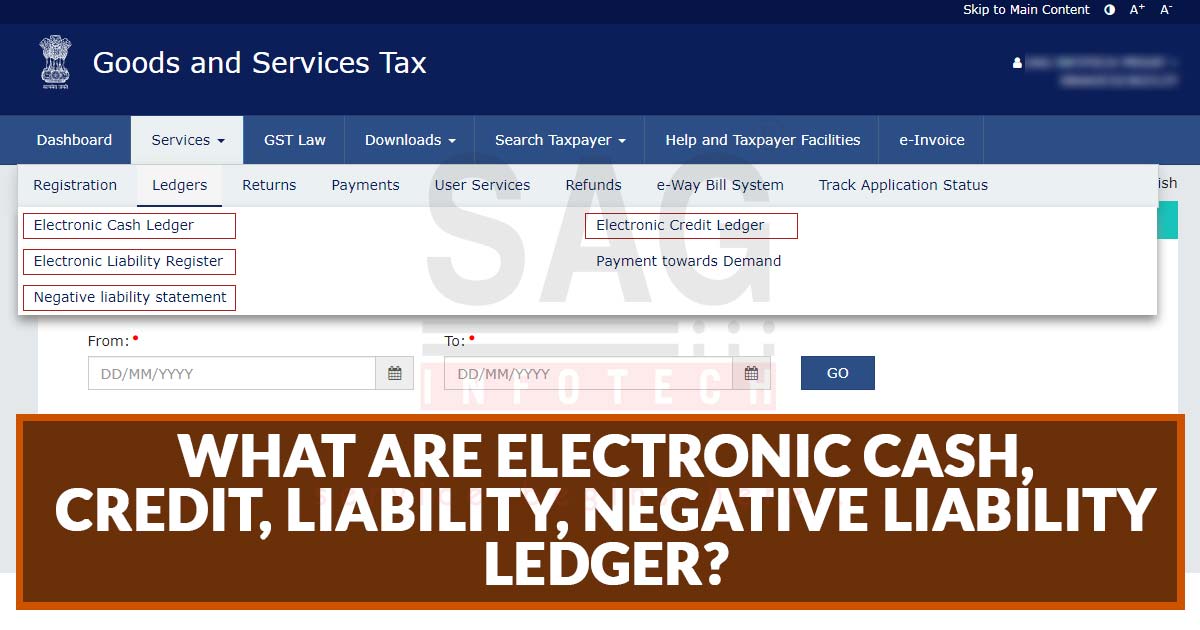

Towards GST the e-Ledger is an electronic form of passbook. These e-ledgers are present to all kinds of GST registrants upon the GST portal. The e-ledgers includes the information of the mentioned particulars:

- GST Amount deposited in cash towards the government liability in electronic cash ledger.

- Input Tax Credit available (ITC) balance in the electronic credit ledger.

- Setting off GST liability along with balance liability (if any) in electronic liability ledger.

Latest Update

07th July 2022

- The CBIC circular no 174/06/2022-GST regarding re-credit in the electronic credit ledger. Read More

29th March 2022

- The Gujarat High Court issued the judgment for Milap Scrap Traders Through Pro. Harshadbhai Manubhai Patel. The judgment said, the GST department to withdraw Rs.14,11,678 extent after the remained balance to the negative block of the electronic credit ledger. Read More

- The Madras High Court has ordered the GST department to refund INR 88,17,754 amount lying under the electronic liability register against the future supplier that can be utilized for discharging the tax liability.

18th January 2022

- The Gujarat high court has ruled that the electronic cash ledger will be unblocked after 1 year automatically and it can be blocked only for 1 year. Read Order

31st December 2021

- “Mechanism for filing of refund claim by the taxpayers registered in erstwhile Union Territory of Daman & Diu for the period prior to the merger with U.T. of Dadra & Nagar Haveli.” Read Circular

What do You Mean by Electronic Cash Ledger?

It is just similar to the e-wallet. In the form of cash or within a bank the GST payment filed shows in the Electronic Cash Ledger. Post to the deduction of the Input Tax Credit (ITC) any balance tax liability ought to be filed through the balance in the Electronic Cash Ledger. For instance- Mr A has a GST on sales of Rs 50,000. He also has an Input Tax Credit (ITC) upon buyings of Rs 35,000. Electronic Cash Ledger balance here is Nil.

| Particulars | Amount |

| GST on Sales | 50,000 |

| Input Tax Credit (ITC) | 35,000 |

| GST Liability to be paid | 15,000 |

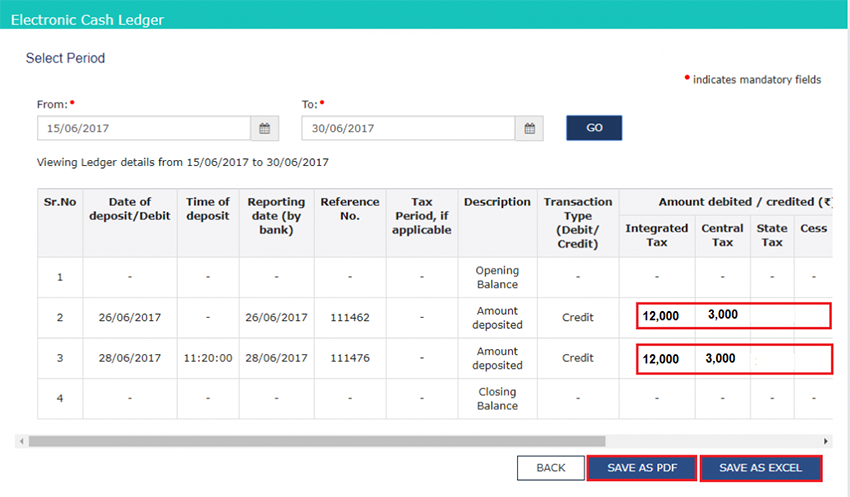

GST liability constituting Rs 15,000 needs to get furnished in the form of cash/bank payment. Mr A will deposit Rs 15,000. It is to be displayed in the Electronic Cash Ledger of Mr.A. The balance of the ledger shall be used for the GST payment. This amount will be shown in Mr A’s Electronic Cash Ledger which is listed in the picture.

Towards filing of the GST liability, the balance inside the electronic Cash Ledger shall get practiced. When the GST liability gets offset then on the GST portal the GST liability gives such a look as given in the picture.

What do You Understand With the Term Electronic Credit Ledger?

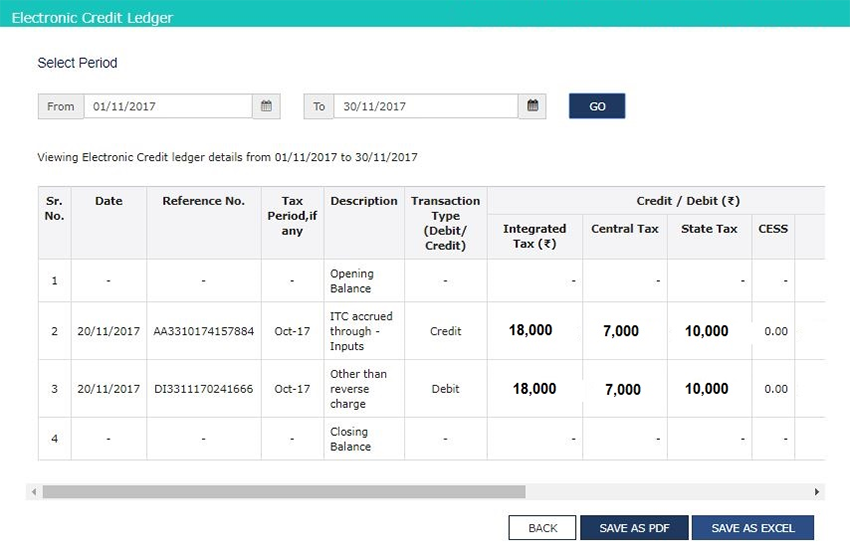

The subjected input tax credit (ITC) claimed through the enrolled dealer in the GST returns (GSTR-2 or GSTR-3B) shows in Electronic Cash Ledger. Towards filing of the tax, the credit in Electronic Cash Ledger could be practiced. It reveals that the balance of the electronic credit ledger shall not be practiced for the interest payment, penalty, or late fees. Interest and Penalty shall be furnished via real cash payment. Below are the particular order and limitations to using the ITC (IGST, CGST, SGST) for payment of GST liability:

- The credit of IGST can be used with respect to any tax liability in this order – IGST, CGST, or SGST/UTGST.

- The credit of CGST will not be practiced for payment of SGST. It can be set off in the following order – CGST, IGST.

- The credit of SGST/UTGST shall not be used for payment of CGST. SGST can be set off in the following order – SGST/UTGST, IGST.

From the mentioned example. Mr A has an ITC of Rs 35000. The breakup of ITC is-

- IGST – Rs. 18,000

- CGST – Rs. 7,000

- SGST – Rs. 10,000

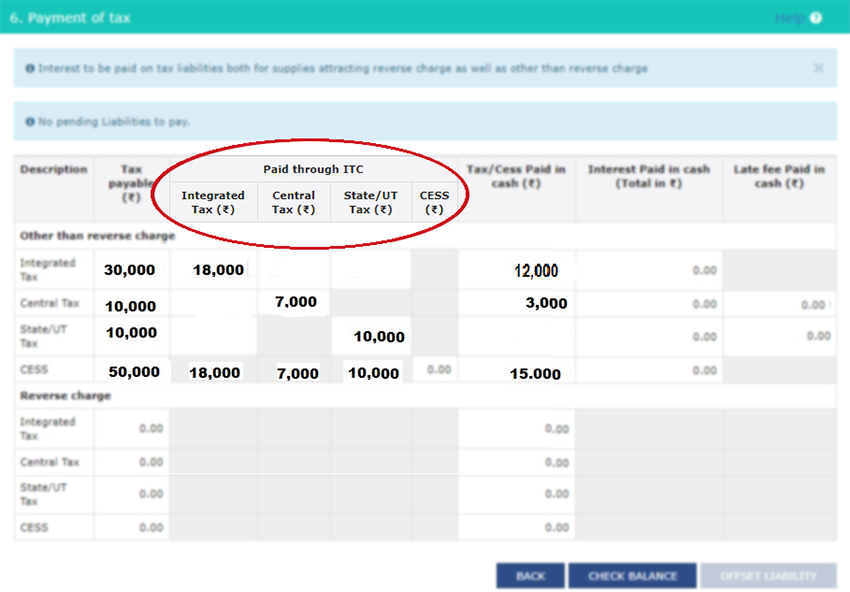

The IGST Liability is Rs 30,000. The IGST credit of Rs 18,000 shall be wholly practiced to set off such liability. The balance IGST gets furnished in cash of Rs 12,000 that shows in the Electronic Cash Ledger.

Towards the concern of CGST, the credit of Rs 7000 shall be set off with respect to the liability of Rs. 10,000 and CGST of Rs. 3,000 needs to get furnished. The applicable SGST needed to pay is equivalent to the credit of SGST available. This indicates there is no SGST that has to be paid by Mr A.

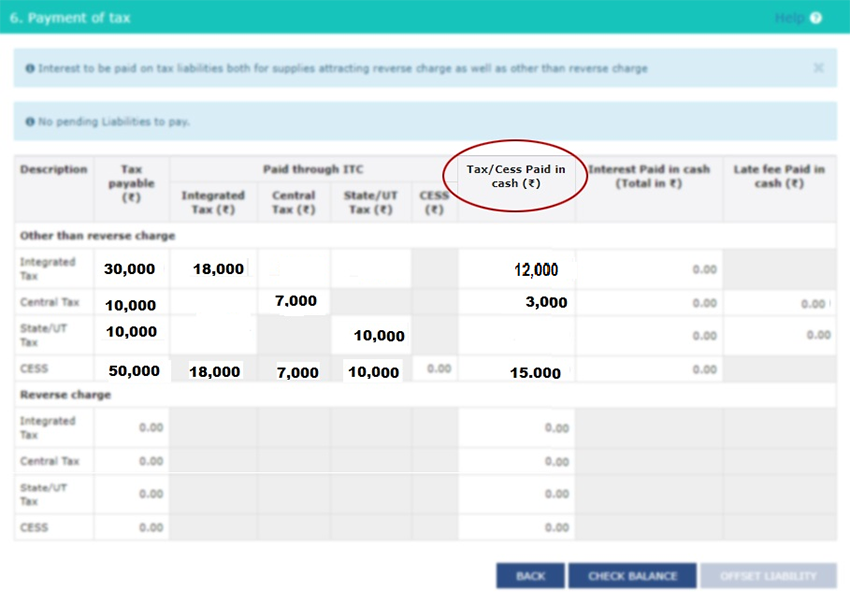

Executing offsetting credit here is the method of adjustments that shows upon the GST Portal-

What does the Term Electronic Liability Ledger Suggest?

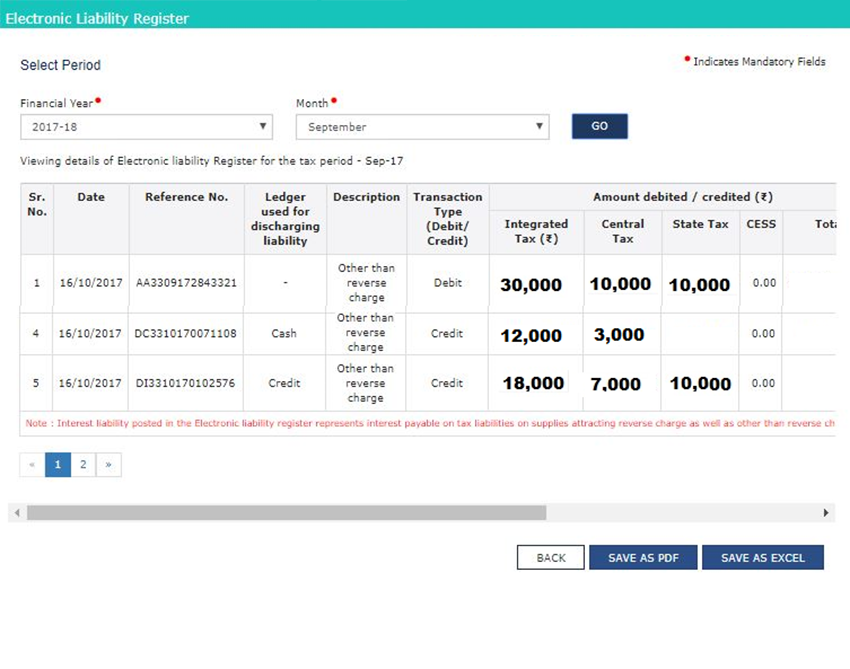

The ledger poses the information about the GST liability. The ledger includes that the sum of GST liability along with the way it had furnished in cash or via credit. In the above example, the way GST liability is set off will be revealed inside the Electronic Liability Register. Below is the Electronic Liability Ledger look inside the GST Portal:

Basic knowledge of the mentioned e-ledger is essential. An individual can access e-ledgers via the GST portal.

What do You Mean by Negative Liability Statement?

When if a negative liability arises within the tax tenure and the tax payable is still nill from the taxpayer, then the GST portal will account for the negative liability in the negative liability statement. While the balance will be further adjusted automatically in the liability of subsequent tax period(s). The taxpayer can only view the statement and is maintained by the portal under the composition scheme currently. Also, the negative statement is open to adjusted in other liability returns also.

“For E.g.: If Tax Amount of Outward Supplies (CGST+SGST/IGST) = Rs 2,00,000 and Tax Amount of credit notes (CGST+SGST/IGST) issued = Rs 2,50,000, then negative liability = -50000″

| Description | IGST | CGST | SGST | Total |

|---|---|---|---|---|

| “Tax component on Outward supplies during a tax period say Q1” | 1,00,000 | 50,000 | 50,000 | 2,00,000 |

| “Tax component of credit notes issued during the tax period Q1” | 1,00,000 | 70,000 | 70,000 | 2,50,000 |

| “Negative Liability (available for utilization towards supplies in future tax periods)” | -10,000 | -20,000 | -20,000 | -50,000 |

| “Tax component on Outward supplies made during next tax period say Q2” | 10,000 | 15,000 | 15,000 | 40,000 |

| “Tax amount adjusted against the Negative Liability” | 10,000 | 15,000 | 15,000 | 40,000 |

| “Negative Liability (available for utilization in future tax periods) say Q3” | 0 | -5,000 | -5,000 | -10,000 |

“In above example, Rs 50000 will be posted as a credit entry in the Negative Liability Statement.

In the next tax period if the total liability is Rs 40,000, then out of Rs 50,000, Rs 40,000 will be utilized. Then, there will be a debit entry posted in the Negative Liability Statement for Rs 40,000.”

Step to View Negative Liability Statement

Step 1: “Access the https://www.gst.gov.in/ URL. The GST Home page is displayed. Login to the GST Portal with valid credentials. Click the Services > Ledgers > Negative Liability Statement option.”

Step 2: “The Negative Liability Statement page is displayed. Select the ‘From’ and ‘To’ date using the calendar to select the period for which you want to view the Negative Liability Statement. Click the SEARCH button.”

Note: “You can view the Negative Liability Statement for a maximum period of 12 months at a time.”

Step 3:” The negative liability statement details are displayed.”

Step 4: “Click the DOWNLOAD AS CSV button to download and view the negative liability statement in an excel format.”

Step 5: ” The details are displayed in CSV format as shown below. “