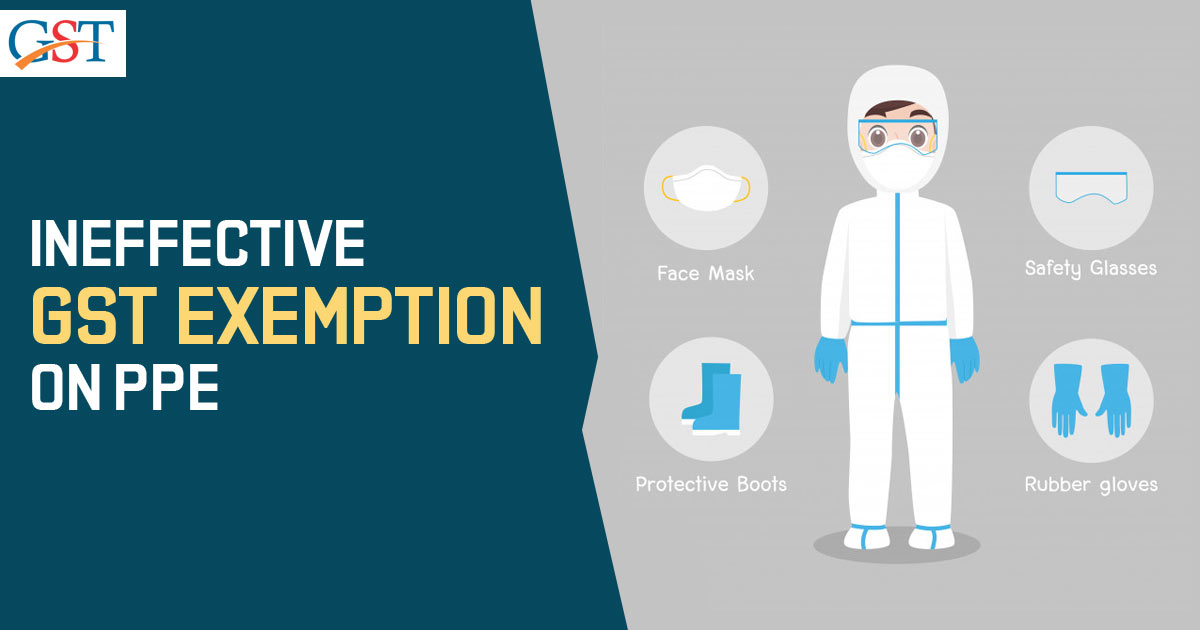

The government sources informed the media that the exemption of GST (Goods and Services Tax) on personal protection equipment like medical test kits, masks, sanitizers, and ventilators will neither benefit the manufacturers nor the customers. Presently, the GST is charged on masks at the rate of 5%, on ventilators and medical testing kits at the rate of 12% each and that on sanitizers at the GST rate of 18%

Tax officials have explained that the GST, being a type of value-added tax, would not benefit the manufacturers or customers if removed. They said that even if the government decides to remove GST from the personal protective equipment, still the cost of the equipment will remain unchanged as the GST is already charged on the previous inputs before it comes in the hand of the producers. If GST is exempted, then Input Tax Credit (ITC)

The cost of the equipment will increase that will not be beneficial for the customers and the producers too will have to suffer as they will have to maintain separate accounts for the inputs and the items exempted from GST. The need to maintain separate accounts will increase the compliance burden of the producer. Additionally, the importers will get the equipment at cheaper prices as the government has removed custom duty and cess on the essential items, so the domestic producers will have to face more problems as their products will be more expensive than the imported products.