The government came up with the conclusion of extending the deadlines for the GST e-way bill validation until 30 April 2020. Amid corona crises due to which the entire market is stagnant, this is a sigh of relief for all the businesses that were struggling with the issues of goods supplies stuck in between the two ports.

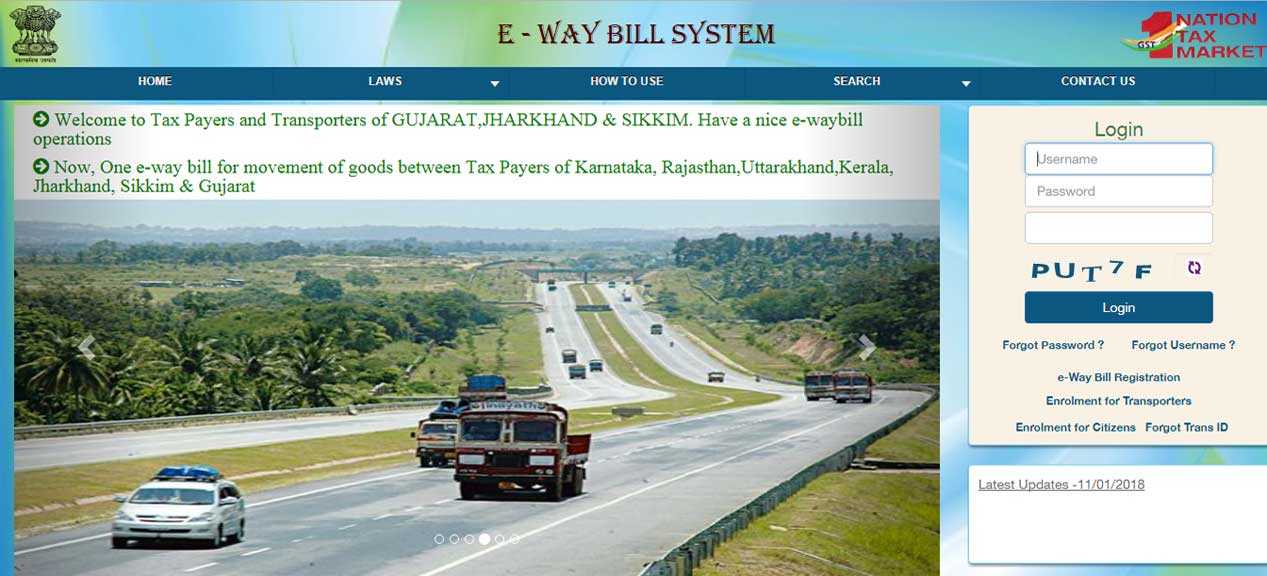

The entire accumulation of GST e-way bills generated

Adding on to the extension in e-way bill validity till 30 April, Finance Ministry has also called off the application of 10% restriction on availment of the input tax credit from February to Augst 2020. The 10% restriction on ITC availment will resume from September 2020, that will give enough time for the cash flow in the market, said tax experts.

By deferring 10% restrictions on GST Input Tax Credit (ITC) availment

The aforesaid provisions came into existence via the notification released by the government on Friday. Along with the said reliefs, the notification also confirmed relaxations in indirect tax compliances given by the government last week. Download and view official notification No. 35/2020 in PDF.