The applicability of DRC-03 in the payment done by the taxpayer is given in the article including the complete process and payment verification with DRC-03. Also, the article post will be showing the acknowledgement issuance of payment via DRC-04 or the proceeding of conclusion through DRC-05 with the payment clause in the GST-CBIC application.

The entire post will be able to offer knowledge on:

- Major points of DRC-03 payments by the taxpayers

- Major points of DRC-03 based verification

- Major points of issuing DRC-04 or DRC-05 in the DSR module

Basics of Voluntary Payment: DRC-03, DRC-04 & DRC-05

DRC-03 verification and in some cases the issue of SCN

Form GST DRC-03

Section 73(7) and Sec 74(7) states that the tax office will check the received payment, and if the amount falls short of the actual payable amount then they will issue a notice regarding the amount which falls short of the actually payable amount. Accordingly, the DRC 03 payment verification is based on this module.

FORM DRC-01 is a summary of the show cause notice, in the digital form, received by the taxpayer. By using DRC 03 on the common portal a taxpayer can pay against DRC 01. The verification of interest paid in such DRC 03 is made in the system as the tax is already prescribed in DRC 01.

Overview of DRC-03

Processing of voluntary payment by the taxpayer through DRC-03 before issuing of any notice:

- The DRC-03 will appear on the dashboard of the judicial range officer, who in turn verifies himself or reassigns the proper officer based on monetary limits as DRC-03 falls within the scope of verification. The Judicial Range Office should carefully scrutinize and verify the available details in the documents received with DRC-03 and then re-assign it to the proper officer any number of times connected with Judicial decision, Audit Commissionerate, Anti-Evasion Wing of Commissionerate, or DGGI, whatever is applicable.

- The DRC 03 verification process involves providing answers to some logical questions in the system to allow acceptance of payment or issue of show-cause notice (SCN). If payments are made voluntarily and the verification tests are successfully concluded, the appropriate officer may issue DRC-04, DRC-04 is an acknowledgment of acceptance of payments made voluntarily. However, if any deficiency is found, the tax officer will seek an offline explanation from the taxpayer in this regard, and records of such offline communication will be uploaded into the system.

- During the verification process, a set of questions or checklists will be visible on the user’s screen. Subsequent questions change based on validations. Further, If the officer believes/finds out that there is a fraud/willful misstatement/ suppression from the taxpayers and still, the DRC-03 payment is received from the taxpayer as per Section 73, then the revised section will be changed to 74 and it doesn’t allow the issue of DRC-04. In addition, the revised liability calculated by the tax officer is allowed to be captured in the system.

- If the proper officer believes that the amount paid is less than the amount voluntarily payable, he will proceed to issue a show-cause notice manually and then upload the same online to DRC-01, it will be in respect of the amount which actually falls short of the actual payable amount.

- The DRC 03 verification process made against show-cause notice (SCN) also involves verification of interest paid. If verification is approved, DRC-05 will be issued to conclude the proceedings. For issuing the DRC-05, the entire payment needs to be paid once within 30 days from the date when the show cause notice was issued. It is important to mention that Partial payment is not permitted on the common portal.

- Since the verification of DRC-03 is within the purview of the adjudication, the verification process has to be approved by the proper officer based on the monetary limit as stated in Circular no. 3/3/2017 released on 05.07.2017 and Circular no. 31/05/2018 released on 09.02.2018.

- Once the DRC-05 is issued, the officer will lose the option to issue another Order-in-Origin or DRC-07. Here, DRC-05 will be considered as the conclusion of proceedings and hence the appropriate officer will have to maintain the time limit of 3 years / five years according to Section 73/74 respectively.

Instructions for Taxpayers for Furnishing DRC-03 in the Common Portal

- Making Payment Voluntary on GST Portal: Portal provides the facility for taxpayers to make the payment on a voluntary basis, using Form GST DRC-03 (refer Rule 142(2) or 142(3) of the CGST Rules, 2017).

- Open GST Portal.

- Login using Login Credentials.

- Navigate to Services > User Services > My Applications.

- Here Check the Application Type drop-down list and Select the Intimation of Voluntary Payment DRC 03.

- When to make a voluntary payment: Taxpayers can make Payment voluntarily for a self-ascertained liability or due to the received SCN issued by the tax authorities, with respect to Section 73 or 74 of the CGST Act, 2017, within 30 days from the date of issuance of show-cause notice (SCN) or even before issuance of the such SCN.

- Partial Payment not permitted: Making Partial payments of the amount stated in the show-cause notice (SCN) is not allowed on the GST Portal.

- Cause of Payment: Making Payment through the Form GST DRC 03 is allowed for any reason such as audit, SCN, investigation, voluntary payment, annual return, reconciliation statement, or any other.

- Saving Draft DRC 03 Application: The draft application for a notice of voluntary payment can be kept saved on the portal for a maximum of 15 days. If the taxpayer failed to file the same within 15 days, then it will be cleaned. A taxpayer can see the saved application by

- After Login on to the portal

- Navigate to the Services

- Then click on User Services

- And then find and click on the My Saved Applications option.

- Using Payment Reference Number: in the case where payment has been done and the Payment Reference Number (PRN) has been generated but has not been applied in Form GST DRC-03, then here, it can be furnished by selecting an application available in ‘My Savings Application’ and using PRN that is already generated. But, in the case where the period of 15 days has passed, the details in the form need to be refilled and already prepared PRNs can be used to furnish the applications.

- Filing Form GST DRC 03: Taxpayers have to file Form GST DRC-03 using either DSC or EVC depending on the case may be after making payment. With it, the status will be changed to “Pending for approval by Tax officer”. However, it needs to be mentioned here that no approval of the tax officer is required during making another voluntary payment through FORM GST DRC 03 on the earlier application.

- Acknowledgment by Tax Official: After furnishing of Form GST DRC-03, the Tax Office will issue an acknowledgment in Form GST DRC-04 for Acceptance of Voluntary Payment. There is no restriction on making another voluntary basis payment from the taxpayer side issuance of acknowledgment by the tax officer, another payment by the taxpayer on a voluntary basis, or due to pending issuance of acknowledgement from the tax officer side.

Explanation of Application of receiving DRC-03

Intimation of payment DRC-03 (voluntary) and verification of payment of DRC-04:

Here DRC-03 which is paid before issuing show-cause notice (SCN) is transmitted by Range Superintendent to Directorate General of GST Intelligence(DGGI) vertically – after reaching DGGI, Superintendent will assign verification work to Inspector, and after proper verification, DGGI Superintendent will issue DRC -04.

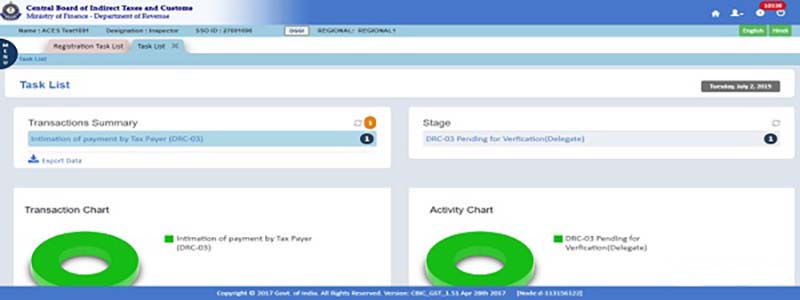

Superintendent’s Task: DRC-03 Pending for Verification

Step:> Using SSOID Superintendent have to log in and then select the task

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Verification of DRC-03 Pending

Step:> Superintendent will select CRN link from the list

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Verification of DRC-03 Pending

Step:> DRC-03 will be visible, Superintendent have to verify the details

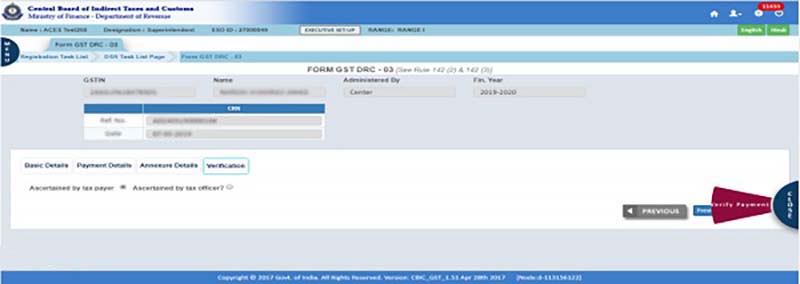

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Verification of DRC-03 Pending

Step:> There will be two verification options i.e. “Ascertained by Tax Payer” or “Ascertained by tax officer”, the system allows Superintendent to take “Verify Payment” actions for either option.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Verification of DRC-03 Pending

Step:> System will allow a “Re-assign” action only if “Ascertained by your formation” is set to “No” (this is the case of other formations check below).

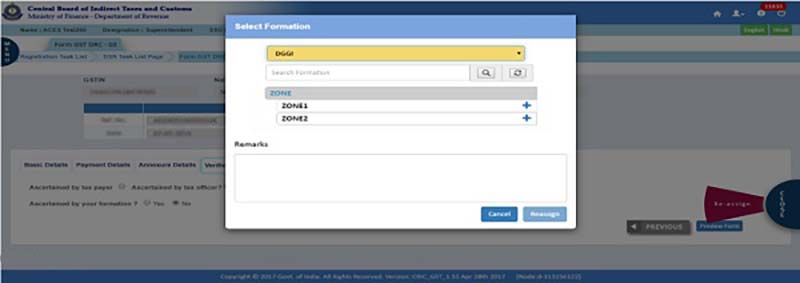

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Verification of DRC-03 Pending

Step:>With the “Re-assign” action allowed, Superintendent can re-assign DRC-03 Record to another vertical process such as Audit, DGGI, Investigation. Just by clicking the ‘Re-assign’ button. Superintendent can also select bottom level formation for DGGI vertical.

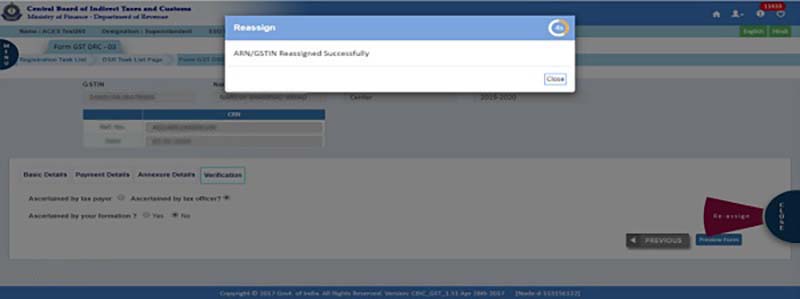

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Verification of DRC-03 Pending

Step:>After Re-assign, a ‘Success Message’ will be displayed.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04: Workflow at other formation (DGGI)

Superintendent’s Task: Verification of DRC-03 Pending

Step:>DGGI Superintendent will log in using SSO ID. The reassigned DRC-03 form will be visible under the task list.

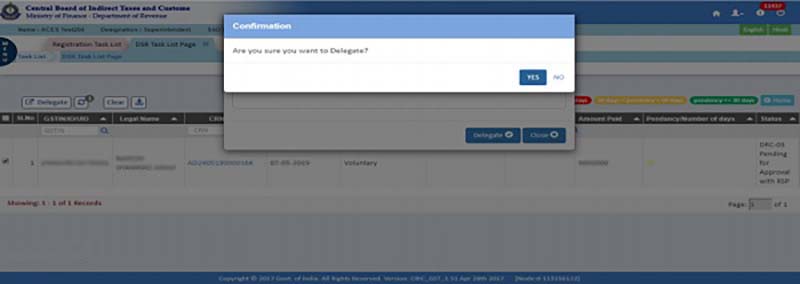

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04: Workflow at other formation (DGGI)

Superintendent’s Task: Verification of DRC-03 Pending

Step:>Need to select a specific record and then they need to click on the “Delegate” option for delegating the re-assigned task to the Inspector.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:Workflow at other formation (DGGI)

Superintendent’s Task: Verification of DRC-03 Pending

Step:>They have to Confirm the delegation by clicking on the YES button appeared in the popped-up confirmation window.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

Step:> DGGI Inspector has to Login with SSO ID of and the delegated task will appear under the Task List.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

Step:> Then click on hyperlink visible in CRN Tab

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

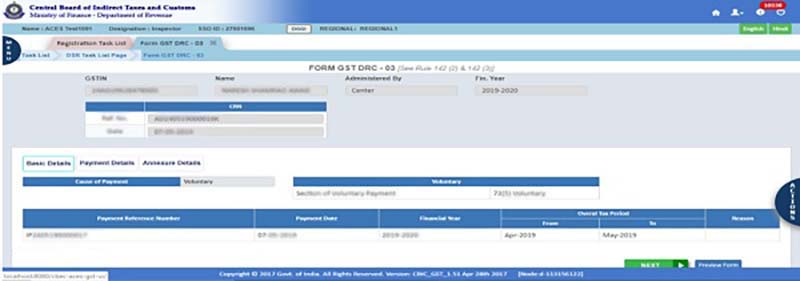

Step:> DRC-03 will be displayed Here, the taxpayer declares that the case is voluntary payment before issuing SCN (case of Sec.73 (5)).

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

Step:> “Verify payment” option will be available for the inspector he can select it from Actions

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

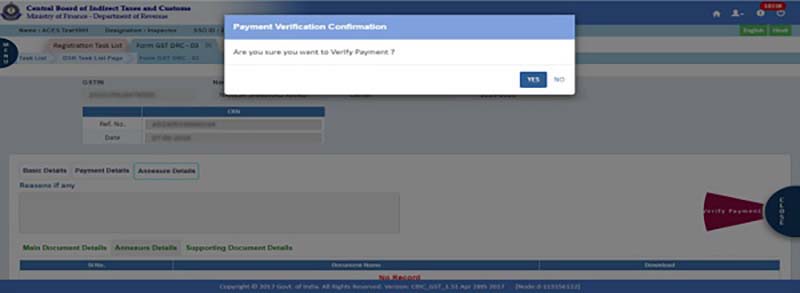

Step:> Need to be Confirmed by clicking on Yes.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

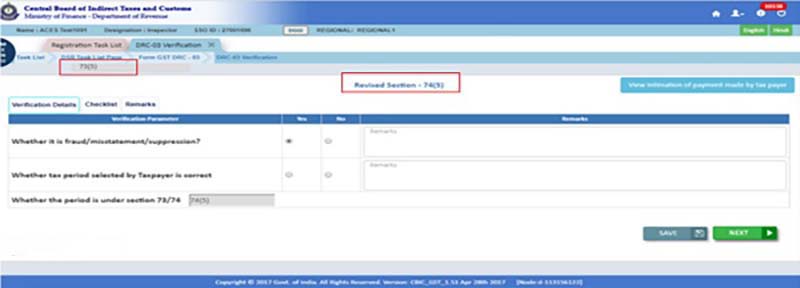

Step:> Respond to verification parameters. Here in the process, the tax officer observed that the matter was suppressed and has confirmed it. The system will automatically validate the case as per section 74 (5).

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

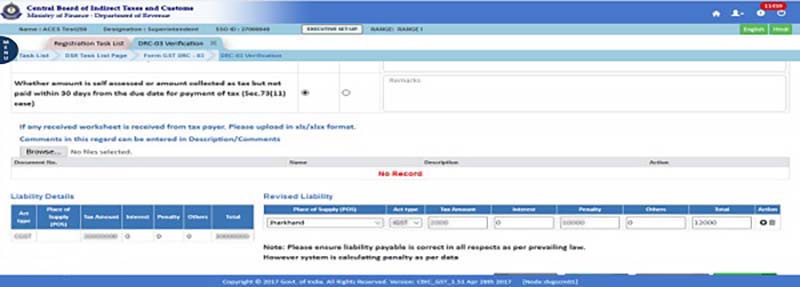

Step:> if the payment is Under Sec.73 (11), the system displays the ‘Verification Details’. Here, the validation of parameters is discussed. If the tax period is not correct, the officer is allowed to change the period.

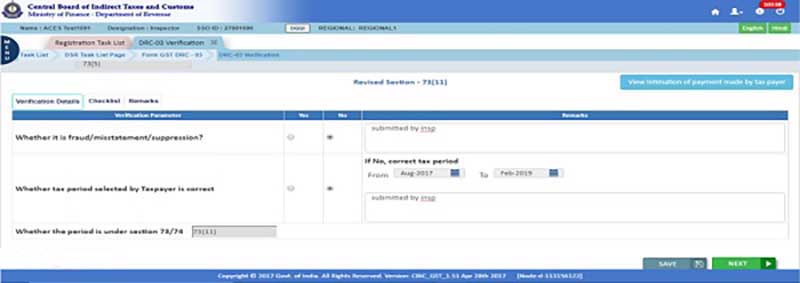

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

Step:> See Checklist – Sl. Number 3, here the taxpayer has not complied (not made payment within 30 days), the system will display ‘liability details’ and ‘revised liability’. . ‘Liability Details’ will be fetched from the form. Revised Liability represents the prescribed liability and it assists the user to do corrections in the liability details.

If “No” is chosen for the 1st question, “Revised Liability” will be displayed by the system and it is helpful for the user to determine the liability.

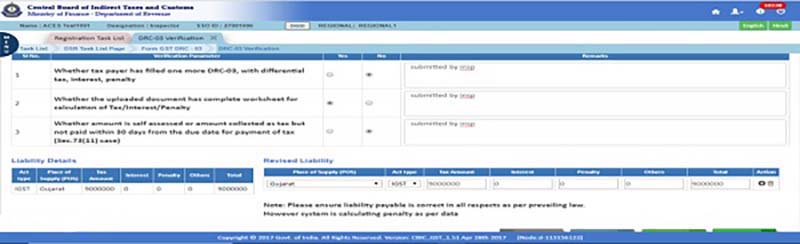

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

Step:> If “No” is also chosen for the second question (documents not uploaded), the system will provide an option to upload the revised worksheet.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

Step:> It needs to be mentioned here that verification is done for punishments.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Inspector’s Task: Verification of DRC-03 Pending

Step:> When all the options are selected, Fill remarks and click on the Submit button. The system will transfer the task for approval to Superintendent.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

The task has been transferred back to the superintendent Superintendent’s Task: Returned or Verified DRC-03

Step:> Login back to the system using Superintendent SSOID.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Returned or Verified DRC-03

Step:> On the Task List page Click on the available hyperlink under the CRN tab

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Returned or Verified DRC-03

Step:> Form DRC-03 will appear in editable form

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Returned or Verified DRC-03

Step:> According to the response to the question, DRC-04 will be available, Superintendent has to click on it.

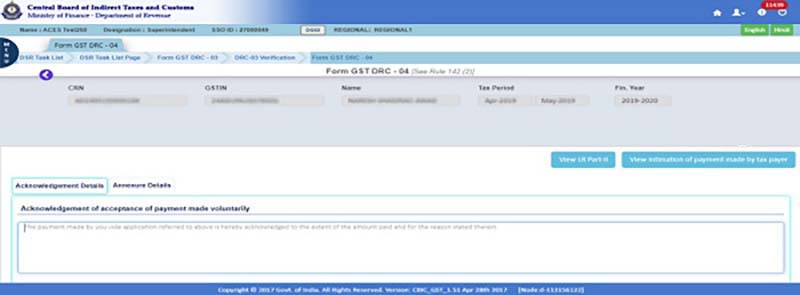

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Returned or Verified DRC-03

Step:> User will receive editable FORM DRC-04

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Returned or Verified DRC-03

Step:> User has to fill it and then click on the Submit button.

Voluntary Payment DRC-03 Intimated -Verification of payment Issue of DRC-04:

Superintendent’s Task: Returned or Verified DRC-03

Step:> If the Form is successfully submitted, the User will see a confirmation message on the screen and on Mail and Mobile Number registered.

Voluntary Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05:

The case given is one where the Superintendent himself confirms the payment made against the SCN, which is within its monetary limit and also issues DRC-05.

Superintendent’s Task: Verification of DRC-03 Pending

Step:> Superintendent have to log in using SSO-ID of RSP

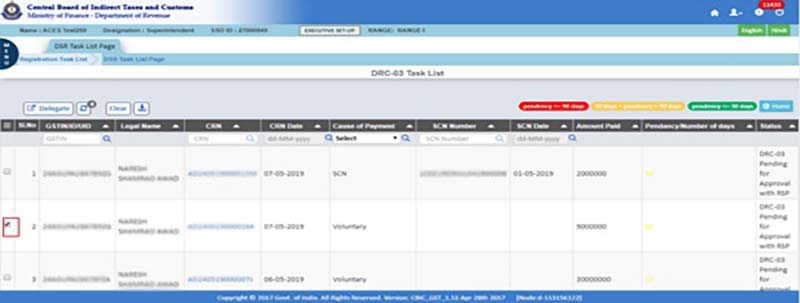

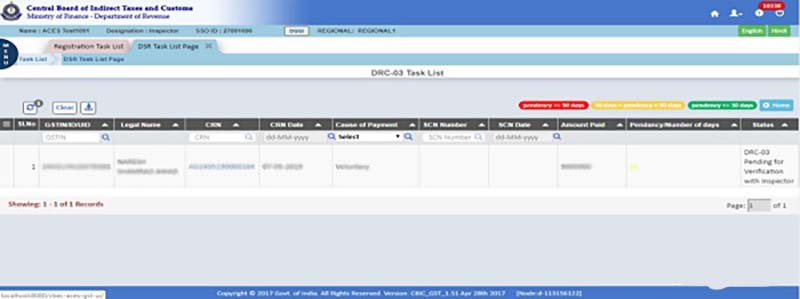

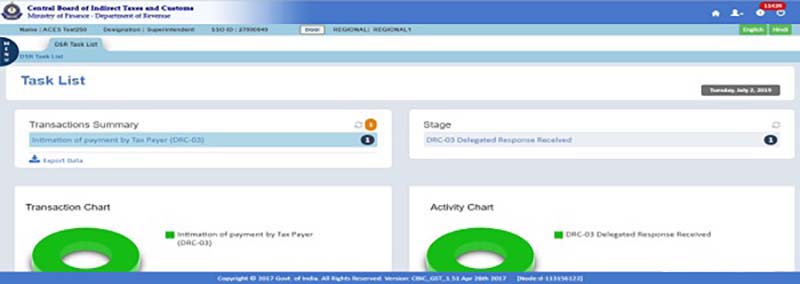

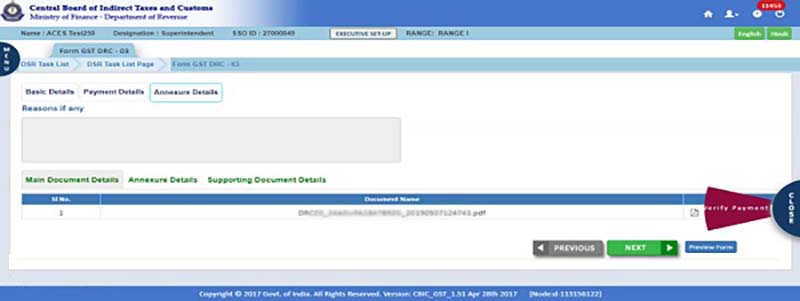

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05: Superintendent’s Task: Returned or Verified DRC-03

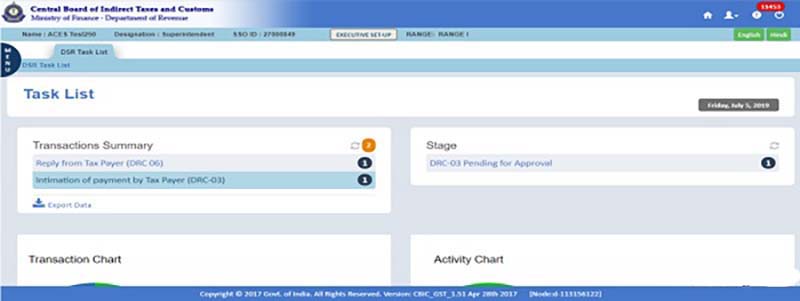

Step:> Navigate to Task List then DSR SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05:

Superintendent’s Task: Verification of DRC-03 Pending

Step:> Go to Task List and then click on Intimation of payment by Tax Payer (DRC-03) then click on DRC-03 Pending for Approval

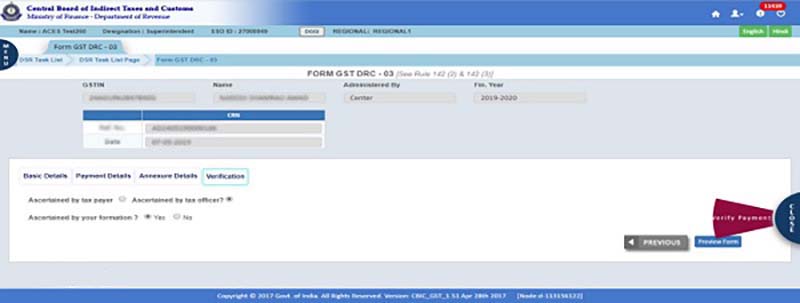

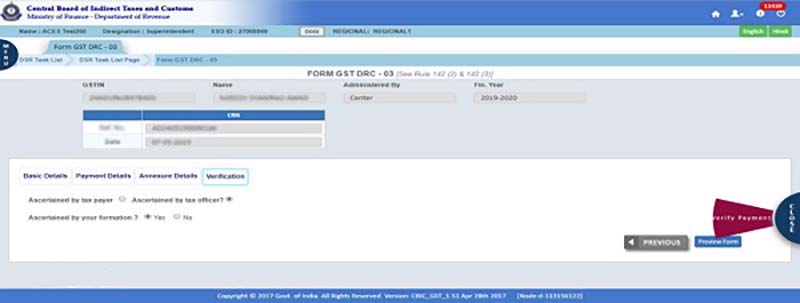

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05: Superintendent’s Task: Verification of DRC-03 Pending

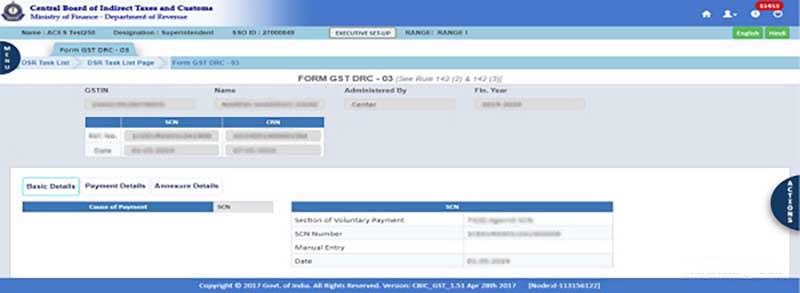

Step:>Select the CRN of the specific DRC-03 record. Here the periodicity of the pendency will be defined with a colored band.

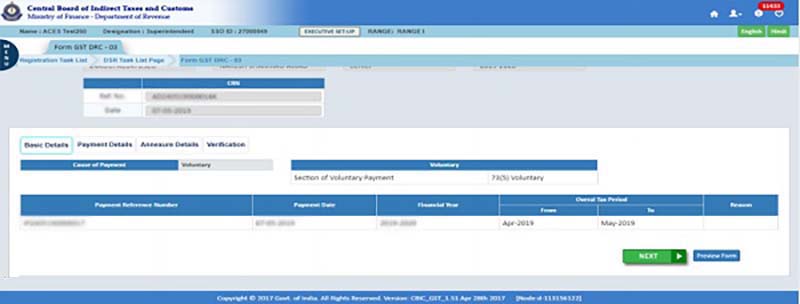

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05: Superintendent’s Task: Verification of DRC-03 Pending

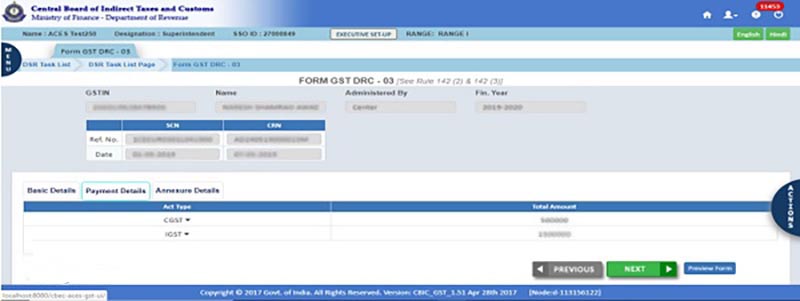

Step:> Check DRC-03 details

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05: Superintendent’s Task: Verification of DRC-03 Pending

Step:> Superintendent will click on ‘Verify Payment’

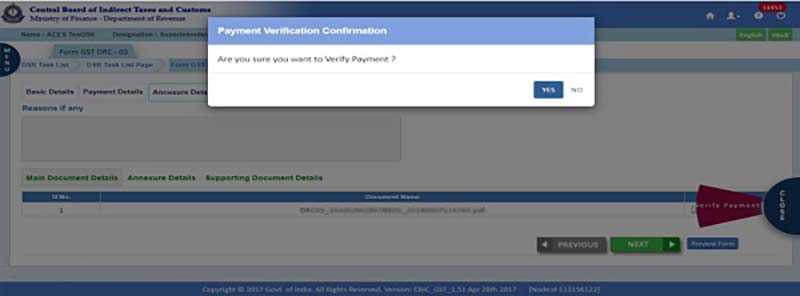

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05: Superintendent’s Task: Verification of DRC-03 Pending

Step:>On the Payment Verification Confirmation popup Click on the “Yes” button to confirm

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05: Superintendent’s Task: Verification of DRC-03 Pending

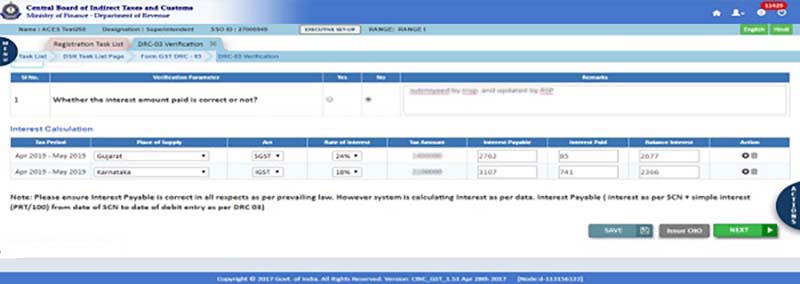

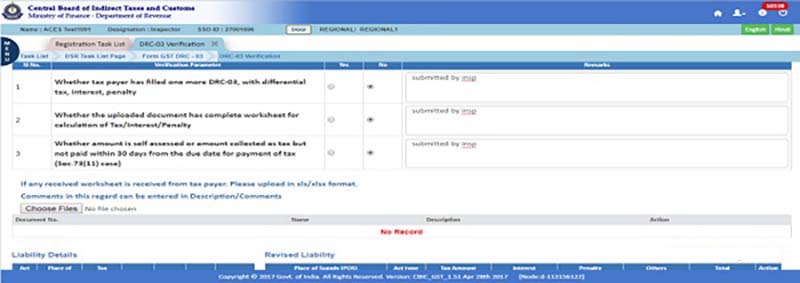

Step:> System will present ‘DRC-03 Verification’ in editable format

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05:

Superintendent’s Task: Verification of DRC-03 Pending

Step:> Respond to verification parameters using the available options. Comment (Remark) when needed

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05: Superintendent’s Task: Verification of DRC-03 Pending

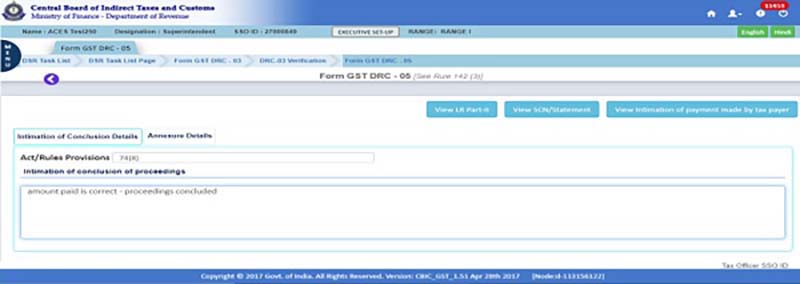

Step:> If the verification criteria are met and the outstanding balance is paid, then the proceedings can be stopped. The system will display “Issue DRC-05” button. Now click on this button, the DRC-05 will appear.

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05: Superintendent’s Task: Verification of DRC-03 Pending

Step:> Fill the details in “Form DRC-05” in all the visible tabs

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05: Superintendent’s Task: Verification of DRC-03 Pending

Step:> Tap on the “Submit” button and confirm the issue of DRC-05.

Taxpayers will receive access to the DRC-05 form. And he/she will be informed by SMS/mail.

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05:

Superintendent’s Task: Verification of DRC-03 Pending

Step:> Officers are empowered to view and download the filled DRC-05 Form

SCN Payment DRC-03 Intimated -Payment Verification and Issue of DRC-05:

If the payment amount falls short the “Issue OIO” button will be available (however issuing of DRC-05 restricted by the system).

Superintendent’s Task: Verification of DRC-03 Pending

Step:> Superintendent will Issue OIO