On August 4, 2023, the Central Government vide notification no. 38/2023 has told the Central Goods and Services Tax (CGST), the rules of 2023. Certain rules would have been revised and also inserted new ones.

A new rule 88D would have been inserted into the CGST rules through the same revision which describes the way of dealing with the ITC difference available in Auto-Generated Statement having ITC information and that claimed in Return, that is GSTR-2B and GSTR-3B.

Fill Form for GST Compliance Software

Latest Update

- The Rajasthan High Court has published the order for M/s Sarna Marbles Private Limited. A final order was stayed by the high court about time-barred GST DRC-01 concerning input tax credit (ITC) requests in Form GST TRAN-1. Read pdf

- The CBIC has issued instructions to proper officers regarding the electronic service of GST DRC-01 and the upload of DRC-07 notices via the government portal. Read PDF

- Important Notice about Online Compliance for GST ITC Mismatch – DRC-01C. View more

- A compliance advisory regarding DRC-01C (difference between ITC claimed in GSTR-3B and ITC available in GSTR-2B) View More Read PDF

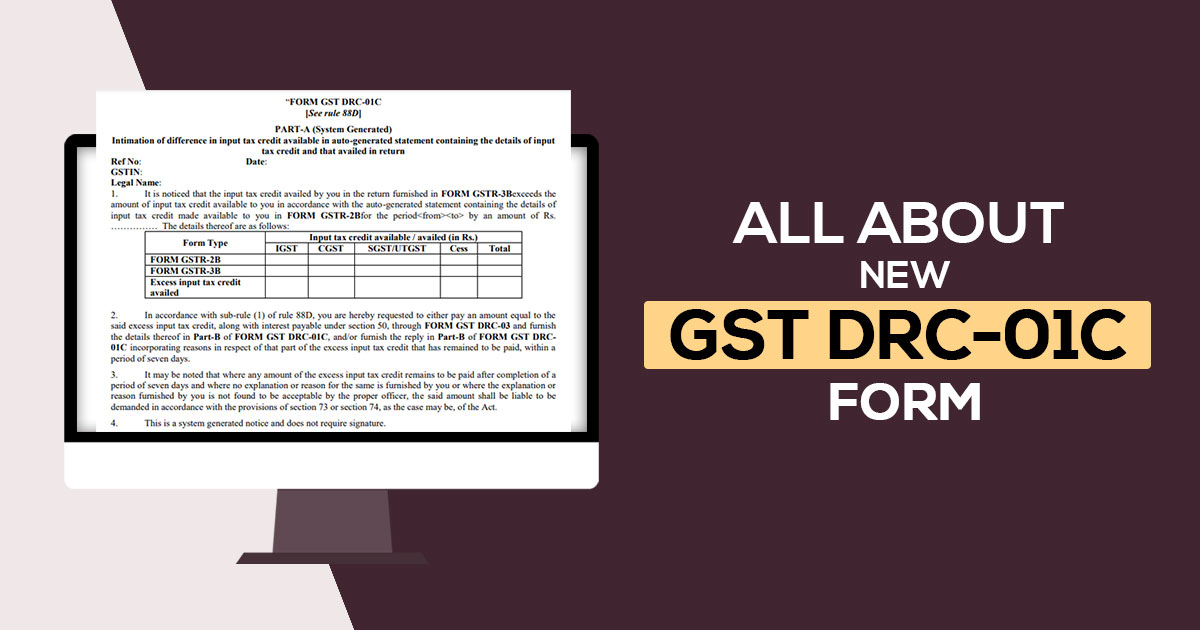

A new Form GST DRC-01C has been incorporated by the government, a system-generated form for the intimation of the difference in the available ITC in the auto-generated statement that has the ITC information and claimed in the return concerning the amended inserted Rule 88D. This functionality is now live to handle the ITC mismatches between GSTR-2B and GSTR-3B.

The Part A of Form GST DRC-01C comprises the Reference number, Date, GSTIN, and lawful name. The initiation of Part A of the form is with

- It is seen that the claimed ITC through you in the return filed in Form GSTR-3B is more than the ITC amount available to you as per the auto-generated statement that comprises the ITC information made available within you in FORM GSTR-2Bfor the period by an amount of Rs. …………… The information thereof is as follows:

- As per sub-rule (1) of rule 88D, you would be urged to either pay the amount identical to the stated excess ITC including with the interest liable to get paid under section 50, via FORM GST DRC-03 as well as file information in Part-B of FORM GST DRC-01C, and file an answer in Part-B of FORM GST DRC01C including reasons for that portion of the excess ITC that comprises of the left to get paid, under the duration of 7 days.

- It should be noted that if any amount of the excess input tax credit is still owed after seven days and neither you nor the appropriate officer has provided an explanation or justification for it, or if your explanation or justification is not accepted by the proper officer, the said amount may be demanded by section 73 or section 74, as applicable, of the Act.

- This notice was generated through the system, thus it doesn’t need to be signed.

Part B of Form GST DRC 01C is devoted to the Taxpayer’s Reply to the Intimation of Difference in input tax credit (ITC). It must include the intimation reference number and date.

The form begins with

A. I have paid the amount equivalent to the excess input tax credit, as defined in Part A of FORM GST DRC-01C, fully or partially, including with interest liable to get paid under section 50, via FORM GST DRC-03, and the information thereof is stated below:

| ARN for GST Form DRC-03 | Paid Under Head | Tax Period | IGST | CGST | SGST/UTGST | CESS | Interest |

|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

B. The reasons in respect of that part of the excess ITC that has remained to

be paid are as under:

| S. No | Brief Reasons for Difference | Details (Mandatory) |

|---|---|---|

| 1 | Input tax credit not availed in earlier tax period(s) due to non-receipt of inward supplies of goods or services in the said tax period (including in the case of receipt of goods in instalments). | |

| 2 | Input tax credit not availed in earlier tax period(s) due to non-receipt of inward supplies of goods or services in the said tax period (including in the case of receipt of goods in instalments). | |

| 3 | 3 ITC availed in respect of import of goods, which is not reflected in FORM GSTR-2B | |

| 4 | Input tax credit not availed in earlier tax period(s) inadvertently or due to a mistake or omission | |

| 5 | Excess reversal of ITC in previous tax periods which is being reclaimed in the current tax period | |

| 6 | Recredit of ITC on the filing of return by the supplier, in respect of ITC, reversed as per the rule 37A in the earlier tax period. | |

| 7 | Recredit of ITC on payment made to the supplier, in respect of ITC reversed as per rule 37 earlier tax period. | |

| 8 | FORM GSTR-3B was filed with incorrect details and will be amended in the next tax period (including typographical errors, wrong tax rates, etc.) | |

| 9 | Any other reasons (Please specify) |

Verification

“I __ hereby solemnly affirm and declare that the information given hereinabove is true and correct to the best of my knowledge and belief and nothing has been concealed therefrom.

When replying to the form, the assessee would need to affix their authorized signature along with their name, designation, place, and date.”

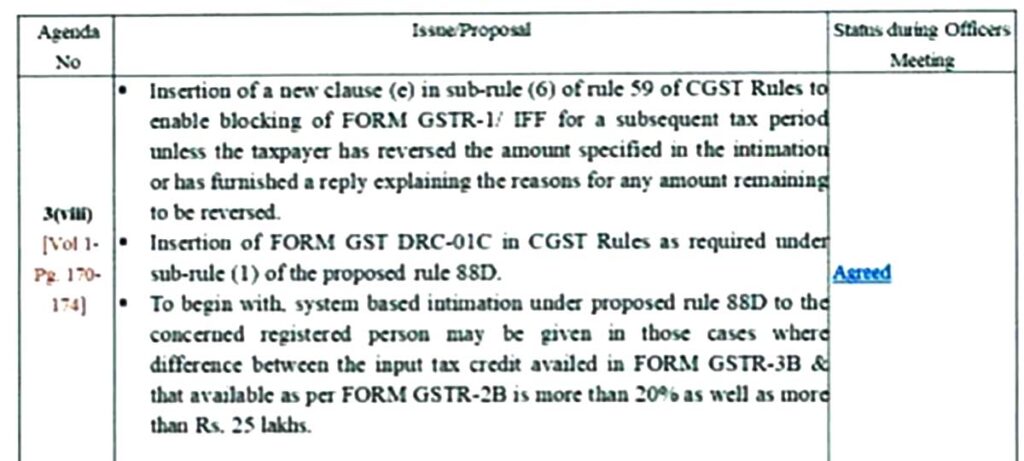

No DRC-01C Notice for GST ITC Mismatch Below 25L or 20%

Rule 88D for the manner is notified by the Central Board of Indirect Taxes and Customs (CBIC) that deals with the difference in the ITC available in the auto-generated statement that has the ITC information and that is claimed in the return via the Central Goods and Services Tax (Second Amendment) Rules, 2023, w.e.f. 4-8-2023.

According to the rule in which the amount of ITC is claimed via the registered individual in the return for the duration of tax or periods provided via him in form GSTR-3B is more than the ITC available to these individuals as per the auto-generated statement that has the information of the ITC in the form GSTR-2B about the stated tax period or the periods, as per the case through these amounts.

These percentage as per the suggestions of the department, the enrolled individual will be intimated of these differences in Part A of form GST DRC-01C, electronically on the common portal and a copy of these intimations will be provided on his email address during the registration or as revised over the time.

Amount and Percentage Decoding

The intimation based on the system under the proposed rule 88D to the related registered individual might be provided in such cases in which the difference between the ITC claimed in form GSTR-3B and that available as per form GSTR-2B exceeds 20% and more than Rs. 25 lakhs, According to the minute’s book of the 50th GST council meeting.

GST portal is indeed complying with the aforesaid specified limits. You are required to note that the word prescribed has not been utilized in Rule 88D which renders that the limits are not required to be notified via separate notification & a recommendation in the Council meeting would suffice.