One of the outcomes of cancelling the registration of the taxpayer with retrospective effect is that the taxpayer’s customers are refused the claim of the input tax credit for the supplies made by the taxpayer, the Delhi High Court ruled.

The bench of Justice Sanjeev Sachdeva and Justice Ravinder Dudeja witnessed that simply due to the reason that the assessee has not furnished the returns for the specific duration the same does not direct that the registration of the taxpayer needs to be cancelled with the retrospective date and indeed covering the duration when the returns were get furnished and the taxpayer was the complaint.

The applicant is in the business of TMT bars and secures the GST registration under the Central Goods and Services Act, 2017.

Before the applicant, an SCN was issued asking for the cancellation of its registration. But the notice did not cite any reason it just quotes that any taxpayer other than a composition taxpayer does not have furnished the returns for the continuous duration of 6 months.

As per SCN, the applicant is needed to appear before the undersigned. i.e., the authority issuing the notice. However, the notice does not cite the time and date for which the applicant ought to appear for a personal hearing.

No cancellation reason is being provided under the order passed on SCN. it cited that the registration is obligated to be cancelled for the cited reason- while no response to the notice to show cause has been furnished.

The order itself is the opposite. As per the order it cited that the reference to your response on 5th April 2023 in reply to the notice to show cause on 18th August 2021, and the cause cited for the GST cancellation is “Whereas no reply to the notice to show cause has been submitted.” The order remarks that the cancellation effective date of the registration is July 1, 2017, i.e., a retrospective date.

No material on record is there to show the cause for why the registration is asked to get cancelled.

The taxpayer argued that according to the order the registration is obligated to get cancelled and in the column at the last there are no dues cited to be due against the applicant and the table depicted the nil demand.

As per Section 29(2) of the Act, the proper officer may cancel the GST registration of a person from such date, along with any retrospective date, as he may consider fit if the possibilities set out in the subsection are fulfilled.

Mechanically registration cannot be canceled with retrospective effect. It can be cancelled just when the proper officer considers the same to be fit to do the same. This satisfaction cannot be subjective but should be on the grounds of certain objective criteria.

The court witnessed that the SCN along with the impugned order as indeed devoid of any information. Neither the SCN nor the order states any cause for the retrospective cancellation. As per that the same could not be sustained.

As per the court, the applicant is not asked to continue the business or registration; to a restricted extent, the impugned order dated is amended so that the registration will be deemed as cancelled w.e.f 18th August 2021 i.e. the SCN issuance date. The applicant will perform the required complaints as needed under section 29 of the Central Goods and Services Tax Act 2017.

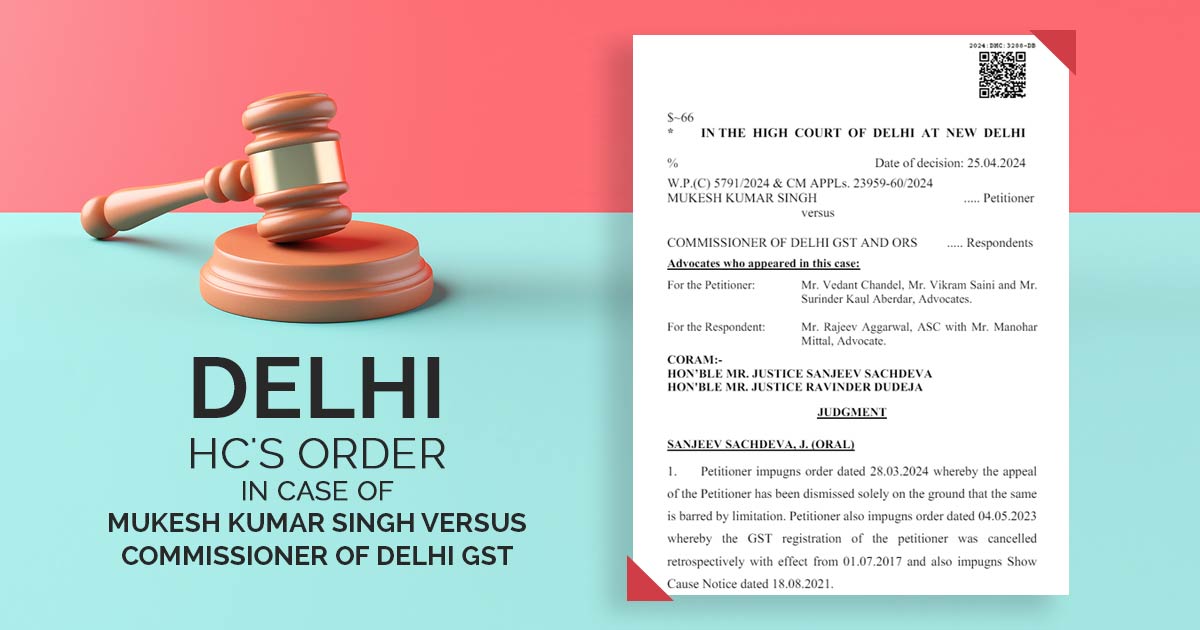

| Case Title | Mukesh Kumar Singh Versus Commissioner Of Delhi GST |

| Case No.: | W.P.(C) 5791/2024 & CM APPLs. 23959-60/2024 |

| Date | 25.04.2024 |

| Counsel For Petitioner: | Mr. Vedant Chandel, Mr. Vikram Saini and Mr. Surinder Kaul Aberdar, Advocates. |

| Counsel For Respondent | Mr Rajeev Aggarwal, ASC with Mr Manohar Mittal, Advocate. |

| Mr Rajeev Aggarwal, ASC with Mr. Manohar Mittal, Advocate. | Read Order |