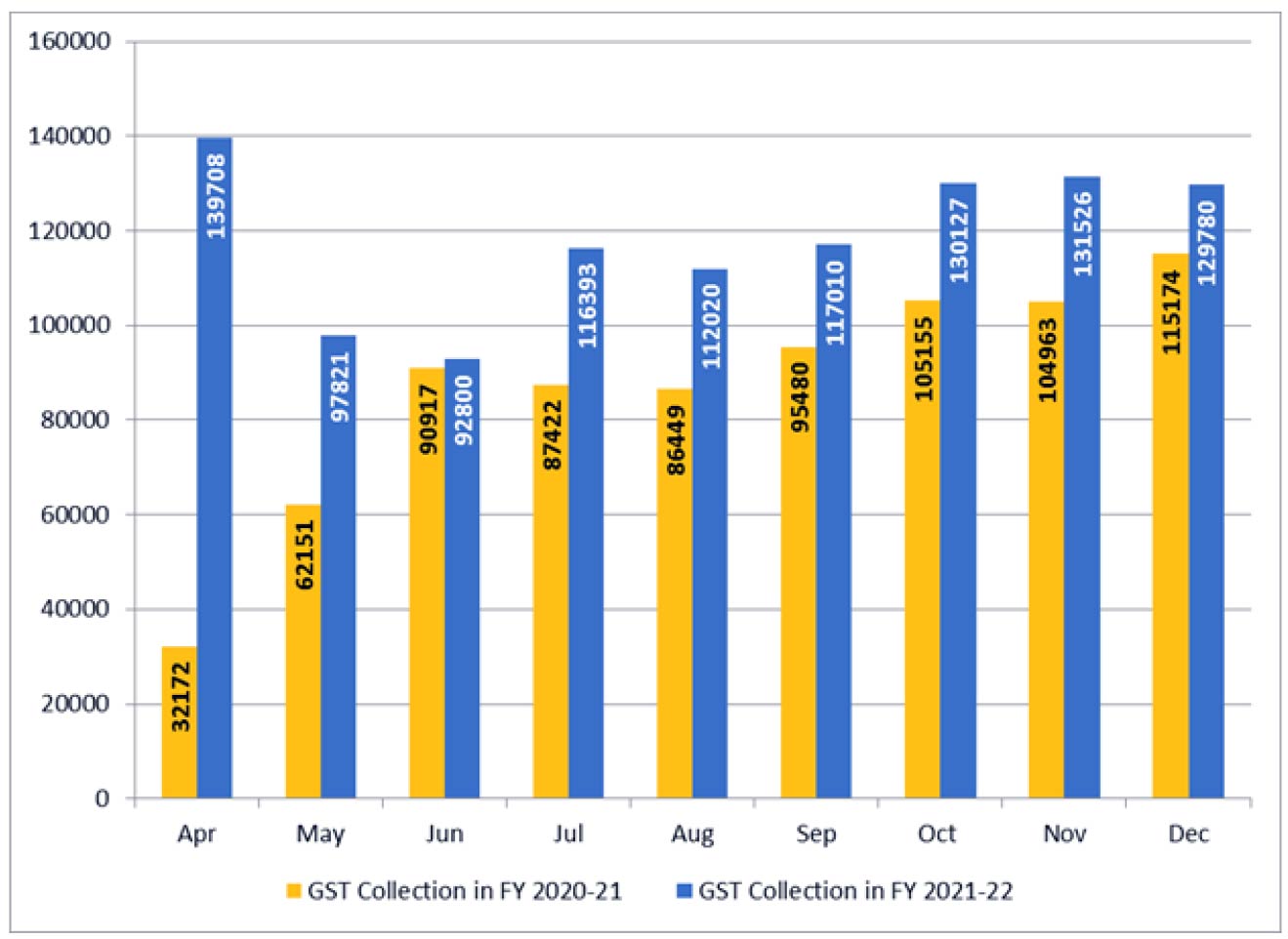

In the month of Dec quarter GST collection place with an extraordinary number concerned to the receipts from the tax given people of the country for center and states. Towards the Centre and states with an average monthly gross collection of Rs 1.3 trillion, the October-December quarter of 2021-22 (FY22) was the most promising since GST was begun (July 1, 2017), which shows the speedy recovery of the economy.

Excluding the May and June months on which the economy of the country gets lowered because of the coronavirus, In the first 9 months of FY 2021-22 seen motivating GST receipts of exceeding Rs 1 trillion.

In between that Omicron variant still seems to be an unknown factor for the economy. GST collections in the February and March 2022 has seems to get affected as relied on the rate of spread of 3rd wave and the restrictions on businesses along with that.

“What happens in the months to come depends upon the severity of the third wave. The restrictions we are seeing so far are in certain states and for certain activities. So far, no state has imposed mass restrictions the way we saw in the second wave,” said a tax expert.

Tax expert added that no clarity is seen on the severity of the Omicron wave and the kind of restrictions needed “Whether there will be restrictions in the interstate movement of goods is what needs to be keenly watched,”

From the 2nd covid wave these two months in FY 2021-22 that stood with the collection of Rs 1 trillion where the Gross GST collections for May 2021 which would show the economic activity in April stood at Rs 97,821 crore, towards June (a barometer for May’s economic activity) was the year’s lowest at Rs 92,800 crore.

“I don’t see a complete lockdown like we saw at the peak of the second wave. But economic activity will definitely get impacted. Yes, the collections could be lower than what we have seen in the past two to three months. However, it may not be as bad as what we saw in May-June,” a tax expert commented.

The state of West Bengal has become the first one to levy restrictions on the businesses establishments, with shopping malls, market complexes, restaurants and bars, government and private offices, and local trains ordered to function at 50% capacity from Monday. Gyms, salons, tourist spots would be completely shut till another circulation from the council

Delhi, parts of Haryana, Uttar Pradesh, Maharashtra, and other states are already following similar restrictions. Keeping the uncertainty aside experts mentioned that the recovery in the economy would be at the same rate as it was undergone over the past few months.

“The economic performance, as demonstrated in the GST collections, has recovered faster than it was expected to. When we were hit by the second wave, we did not expect recovery to happen so quickly. The Rs 1.3 trillion per month seems to be the new normal,”

Economists and policymakers under government recognize GST as an effective parameter of how the economy is going apart from that it mentioned that it captures the consumption and demand in goods, services, trade, and interstate movement across sectors.

“Whenever the economy is on a rebound, there is pent-up demand and spending tends to be much more. That is what happened, especially in the festival season,” a tax expert said.

The finance ministry expressed the average monthly gross GST collection for the October-December quarter was Rs 1.3 trillion, corresponding with Rs 1.1 trillion in April-June and Rs 1.15 trillion in July-September.

“Coupled with economic recovery, anti-evasion activities, especially action against fake billers, have been contributing to the enhanced GST. The improvement in revenue has also been due to various rate rationalization measures undertaken by the GST Council to correct an inverted duty structure. It is expected that the positive trend in revenue will continue into the last quarter as well,”