In sharp contrast to underlying industry doubts, all National Anti-Profiteering Authority orders under the goods and services tax (GST) have gone against the complainants. Reportedly, The NAA was set up to ensure that benefits from the GST were passed on to the consumers and the common taxpayers.

The recent order passed by the NAA was a one of a kind case where elevator manufacturer Schindler India had charged both VAT and GST on invoices against elevators purchased before GST was introduced but installed post-July 1, 2017.

The Complaint

The complaint was filed by a Delhi based Business owner. The plaintiff said that the company charged excise duty (pre-GST) and installation charges (GST rates) on the invoices of two elevators. The installation of the second elevator was completed post-GST introduction.

Read Also: GST After 1st Year: What We Expect and What Actually Got from New Tax Regime?

Reportedly, the elevator was purchased before July 1st and accordingly service tax had been charged. However, post-installation full GST was charged on the value of the total material used during installation. The complainant accused Schindler India of double taxation. The pre-GST tax was not excluded in the invoices.

The Confusion

Reportedly, the complainant wanted to withdraw his application even before NAA summoned a hearing. The complainant cited inadequate understanding of GST provision as a reason for the confusion. However, The NAA upon considering the investigative report submitted by the Directorate General of Safeguard (DGS) dismissed the petition.

The three-member hearing body of the NAA stated that the installation of the second lift had been completed after coming into force of the CGST Act, 2017, he was liable to be charged GST at the rate prevalent on July 27, 2017. The two invoices were dated July 27, 2017. Mr BN Sharma, the Chairman of the NAA was also part of the three-member body.

Recommended: How to Fill Anti-Profiteering Complaint Form Under GST?

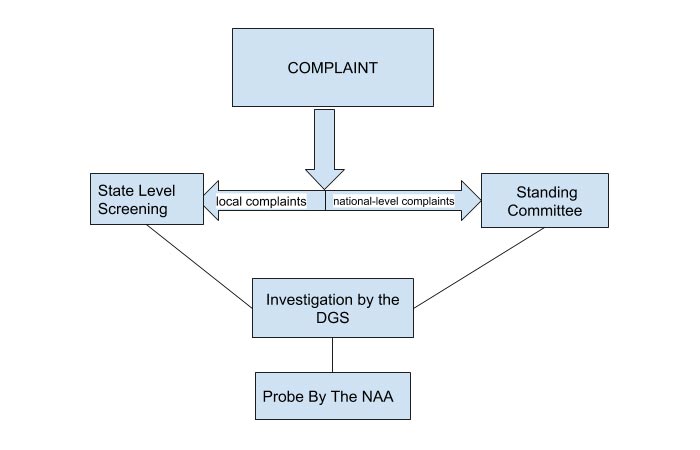

The Anti-Profiteering Mechanism

The three stages of the Anti-Profiteering Mechanism has been shown below. The case reported was in the third stage of the hearing process. At the moment, there are around 50 registered complaints that await the NAA orders. Since its inception, the NAA had passed two orders before this and all the orders (including the present one ) were in favour of the industry. The two previous orders were against complains pertaining to Basmati rice-exporting firm KRBL and a Bareilly-based Honda car dealer.

Pratik Jain, National Leader, Indirect tax, PwC India said that the approach of the NAA has been selective and methodical. Pricing doesn’t depend only on rates.