GSTN would have been initiated to permit the revision concerned with the FY 2021-22 in October 2022 return period. The same is within the recent revision in the GST Law in which the revision could be performed up to 30th Nov. of the subsequent fiscal year.

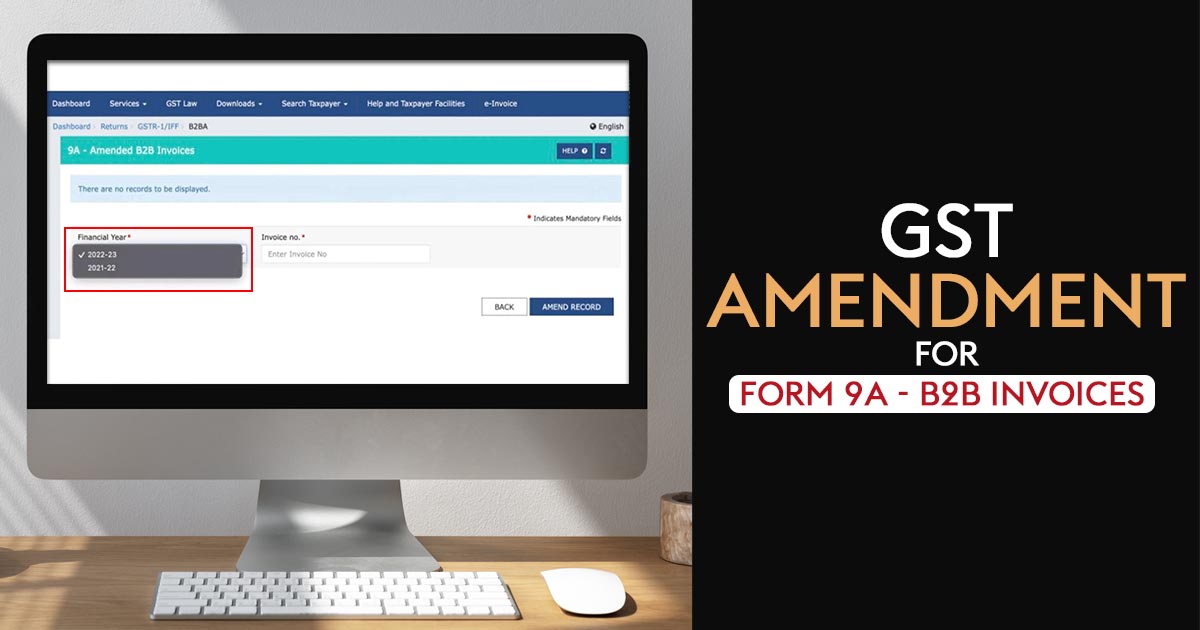

The information of the taxable outward supplies could get revised by the assessee which has been made to the registered person which has already notified in table 4A, 4B, 6B, 6C – B2B Invoices. The assessee would have the facility to furnish the invoice number for the fiscal year and tap on the revised record to search for the invoice.

The government would extend over the time, 30th Nov would be the last date to make the GSTR-1 revisions and claim the due ITC for FY 2021-22. But, the actual due date relies on November’s GSTR-1 or GSTR-3B filing last datcee (i.e. related to October’s return period). When the assessee misses the concerned last date, the GSTR-1/3B could not get amended. Pending ITC for FY 2021-22, if any, shall get relinquished.

The Invoice Furnishing Facility (IFF) is called a utility beneath the QRMP scheme for small assessees, who proceed to upload their B2B outward supply invoices each month, for the first two months of the quarter. The invoices concerned with the former month of the quarter would be needed to be uploaded in the online GSTR-1 return.